#XRP/USDT#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.53, and the price has bounced from this level several times. Another bounce is expected.

The indicator shows a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.60

Target 1: 1.63

Target 2: 1.67

Target 3: 1.72

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Xrpusdbuy

#XRP/USDT (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.36, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.44

Target 1: 1.47

Target 2: 1.52

Target 3: 1.58

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#XRP/USDT (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.90, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.93

First Target: 1.94

Second Target: 1.97

Third Target: 2.00

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

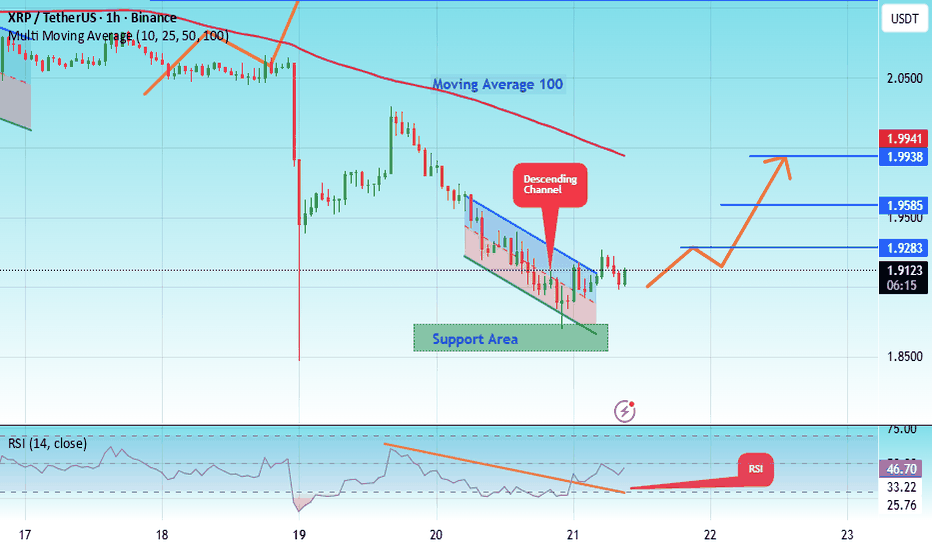

#XRP/USDT XRP (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.86, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.91

First Target: 1.92

Second Target: 1.95

Third Target: 1.99

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

XRP/USD Swing Trade Playbook — Bullish Breakout Profit Pathway📌 Asset:

XRP/USD – “Ripple vs U.S. Dollar” | Crypto Market Profit Pathway Setup (Swing Trade)

📈 Trade Plan (Bullish Bias)

Waiting for a HULL Moving Average breakout above 2.2500 to confirm bullish continuation momentum.

Once price breaks decisively, the structure opens room for a strong push toward the next liquidity zone.

🎯 Entry

Enter any price level AFTER a clean Hull MA breakout with candle body confirmation + volume uptick.

No breakout → No trade.

🛡️ Stop-Loss (Risk Protocol)

SL: 2.0500 — This is the Thief SL, designed to protect capital once breakout is confirmed.

Dear Ladies & Gentlemen (Thief OG’s), adjust your SL according to:

Your personal risk tolerance

Your system’s volatility rules

Timeframe-based noise filtering

You’re not required to follow my SL — trade safe, protect your bag. 🛡️

💰 Target (Exit Strategy)

Our next potential trouble zone — where the police (sellers) are waiting — stands near:

TP: 2.5500

This zone aligns with:

Overbought conditions

Previous liquidity sweep

Correlation pressure from broader crypto sentiment

Dear Ladies & Gentlemen (Thief OG’s), take profits based on your own system. Take money → Leave the market → Stay safe. 💸

🔍 Related Pairs to Watch (Correlation & Confirmation Signals)

1️⃣ BITSTAMP:BTCUSD – Bitcoin

Why watch it?

XRP often follows BTC’s trend.

A BTC breakout boosts liquidity across altcoins.

BTC above key moving averages = XRP tailwind.

2️⃣ BITSTAMP:ETHUSD – Ethereum

Why watch it?

Strong indicator of altcoin strength.

ETH momentum = altcoins tend to expand.

If ETH stalls while XRP breaks → caution (divergence).

3️⃣ COINBASE:XLMUSD – Stellar

Why watch it?

XRP & XLM share similar utility narratives.

High correlation during liquidity rotations.

XLM breakout → XRP often lags then follows.

4️⃣ BITSTAMP:XRPBTC Pair

Why watch it?

Shows whether XRP is outperforming BTC.

Rising XRP/BTC ratio = stronger XRP pump potential.

Falling ratio = breakout may fake out.

🧭 Key Correlation Notes

BTC strength = XRP stability + possible breakout fuel

ALT dominance rising → higher probability XRP joins the move

USD weakness boosts all crypto pairs priced in USD

Watch volatility cycles: XRP typically pumps after Bitcoin’s volatility cools

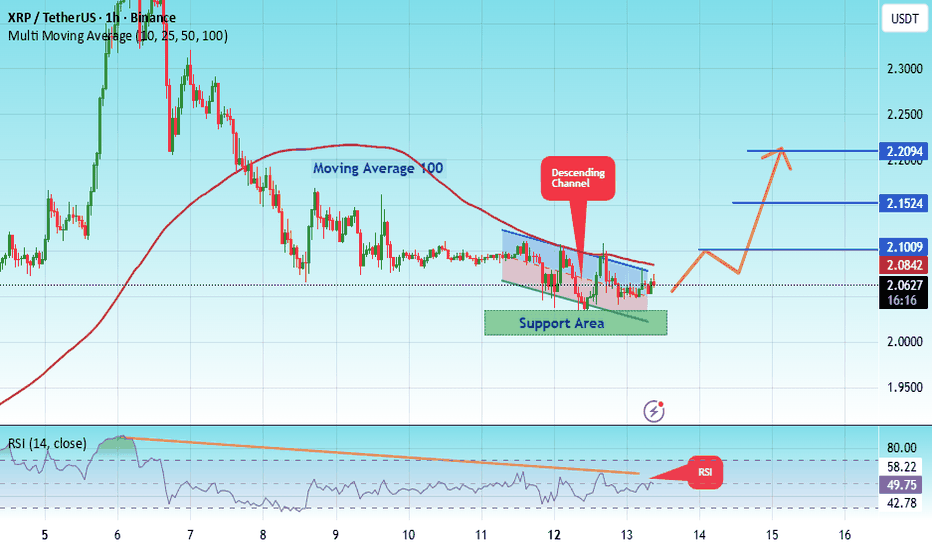

#XRP/USDT XRP (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 2.02, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 2.06

First Target: 2.10

Second Target: 2.15

Third Target: 2.21

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

#XRP/USDT XRP (1h) (spot)#XRP

The price is moving within an ascending channel on the 1-hour timeframe and is holding well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the price of 2.14, representing a strong support point.

We have a trend to stabilize above the 100-period moving average.

Entry price: 2.18

First target: 2.21

Second target: 2.28

Third target: 2.35

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#XRP/USDT (1H) chart, here’s a full technical read #XRP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 1.86. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 1.88

First target: 1.90

Second target: 1.93

Third target: 1.98

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

Is This the Start of a New XRP/USD Uptrend?🔥 XRP/USD Bullish Breakout Plan | HULL MA Confirmation Setup

📌 ASSET OVERVIEW

XRP/USD – Ripple vs U.S. Dollar

Market Type: Crypto

Trade Style: Swing Trade

📈 TRADE PLAN – BULLISH BIAS

🟢 Market Bias: Bullish (Conditional)

🟢 Strategy: Pending execution after HULL Moving Average breakout confirmation

This setup activates only after momentum confirms. No prediction — only reaction.

🎯 ENTRY STRATEGY

✅ Entry Rule:

AFTER HULL MA BREAKOUT ABOVE 1.91000

Once breakout is confirmed, ANY PRICE LEVEL ENTRY is acceptable based on your execution model

📌 Momentum confirmation is mandatory — patience is the edge.

🛑 RISK MANAGEMENT

🔻 Stop Loss: 1.80000

📍 Place SL only after the HULL MA breakout is confirmed

⚠️ Risk Note:

Dear Ladies & Gentlemen (Thief OG’s), this SL is not mandatory.

You are responsible for adjusting risk based on your capital, leverage, and strategy.

🎯 PROFIT MANAGEMENT

🎯 Target Zone: 2.10000

🧠 Why this level matters:

Triangular Moving Average acts as a profit barricade

Strong support + oversold reaction zone

Potential bull trap / liquidity sweep near higher levels

High probability area to secure gains, not chase price

⚠️ TP Disclaimer:

You are not required to use this TP. Scale out, trail, or exit based on your own plan.

🔗 RELATED PAIRS TO WATCH (CORRELATION EDGE)

Keep these on your watchlist for confirmation or divergence signals:

XRP/BTC → Strength here supports XRP dominance 📊

BTC/USD → Overall crypto market direction & risk sentiment 🧭

ETH/USD → Smart-money flow proxy in altcoin space ⚡

TOTAL2 / TOTAL3 → Altcoin market capitalization health 🌐

📌 If BTC holds structure and XRP/BTC trends up → XRP/USD breakout probability increases.

🧠 KEY TECHNICAL INSIGHTS

HULL MA breakout = trend acceleration trigger

Price acceptance above 1.91000 confirms buyer control

Failure to hold above HULL MA invalidates bullish thesis

Best execution comes from reaction, not anticipation

🌍 FUNDAMENTAL & MACRO FACTORS TO MONITOR

📢 Crypto-Specific Drivers

Ongoing regulatory clarity surrounding Ripple

Institutional adoption trends in cross-border payment solutions

On-chain activity & network usage metrics

📊 Macro & Economic Factors

USD strength/weakness (risk-on favors crypto)

Global liquidity conditions

Risk sentiment across equities & digital assets

🗞️ Upcoming Market Sensitivities

Major U.S. macro data releases (volatility catalyst)

Regulatory headlines impacting crypto sentiment

Large-cap crypto flows influencing altcoin momentum

✅ FINAL TRADER NOTES

✔️ Wait for confirmation

✔️ Trade with structure

✔️ Respect risk

✔️ Protect profits

💡 Discipline pays more than prediction.

XRP/USDT Professional Analysis – SMA Breakout Validated🌐 Professional XRP/USDT Trade Map — Breakout, Targets, Risk Controls

Asset: XRP/USDT – “RIPPLE VS TETHER”

Crypto Market Opportunity Blueprint (DAY/SWING Trade) 🚀📊

🔥 TRADE PLAN OVERVIEW

Plan: Bullish plan confirmed with Simple Moving Average breakout 📈✨

Entry: YOU CAN ENTRY ANY PRICE LEVEL 🟩🟢

This structure is built on momentum continuation + clean SMA upside confirmation.

🛡️ STOP LOSS GUIDANCE

Stop Loss: This is thief SL @ 2.0000

Dear Ladies & Gentleman (Thief OG's) — adjust your SL based on your strategy & your own risk.

⚠️ Note: I am not recommending you to set only my SL. It's your own choice; you can make money then take money at your own risk.

🎯 TARGET LEVEL – PROFIT MANAGEMENT

Target: TRIANGULAR Moving Average acts as a strong resistance + overbought zone + trap region.

📌 OUR target @ 2.3000 — kindly escape with profits before the trap activates.

⚠️ Note: Dear Ladies & Gentleman (Thief OG's), I am not recommending you to set only my TP. It's your own choice; you can make money then take money at your own risk.

🌍 RELATED PAIRS TO WATCH — CORRELATIONS & KEY POINTS

Monitoring correlated assets gives extra confirmation of trend strength, liquidity flow, and momentum shifts. Here are the pairs to keep an eye on:

💠 1. BINANCE:BTCUSDT – Bitcoin Controls Crypto Liquidity

Why watch it:

BTC is the macro driver of overall crypto momentum.

A bullish BTC → stronger inflow into alts like XRP.

If BTC rejects from key levels, XRP often slows or traps.

Key correlation:

Rising BTC dominance can limit XRP upside.

Falling dominance supports large-cap alt breakouts.

💠 2. BINANCE:ETHUSDT – Ethereum Trend Confirms Alt-Market Strength

Why watch it:

ETH often leads altcoin rotations; when ETH trends strong, major alts follow.

ETH breaking resistance = broader bullish environment for XRP.

Key correlation:

Strong ETH liquidity → better confidence for XRP swing trades.

💠 3. BINANCE:XLMUSDT – Directly Related Utility Sector Coin

Why watch it:

XLM and XRP often move with similar cross-border payment narratives.

When XLM surges first, XRP commonly follows with a delayed reaction.

Key correlation:

Positive XLM momentum strengthens confidence in XRP bullish setups.

💠 4. BINANCE:ADAUSDT – Risk-On Altcoin Indicator

Why watch it:

ADA rallies typically signal strong retail participation in altcoins.

Helps confirm whether the market is in alt season rotation mode.

Key correlation:

ADA strength → XRP follow-through probability increases.

💠 5. BINANCE:XRPBTC – Relative Strength Indicator

Why watch it:

If XRP/BTC is rising, XRP is outperforming Bitcoin → strong signal.

If XRP/BTC is dropping, XRP bullish trades may weaken or get trapped.

Key correlation:

XRP/BTC breakout = highest-quality long confirmation.

📌 SUMMARY FOR TRADINGVIEW READERS

This XRP blueprint delivers a clear bullish continuation setup powered by SMA breakout momentum, structured risk guidance, and a realistic trap-aware profit target. Monitoring correlated pairs amplifies your confidence, especially during critical breakout or overbought zones.

XRP Approaching Key Supply Zone: Break or Reject?Hi!

Bullish Scenario

A bullish continuation becomes likely only if price breaks and closes above the $2.12–$2.18 S&D zone.

If that happens:

Buyers regain control

A retest could confirm support

Next target -> descending trendline at $2.35–$2.45

Conclusion:

Break S&D -> Long toward the descending trendline.

Bearish Scenario

If price rejects from the S&D zone and fails to reclaim $2.12–$2.18:

Momentum shifts back to the downside

Price may retest the $1.90–$1.92 zone, the most recent low

Further breakdown could lead to new cycle weakness

Breaking; It is Time to Sell $XRPThe price of the notable altcoin Ripple ( CRYPTOCAP:XRP ), saw its value nosedived tanking to the $1.9 support enroute to breaking the $1.8 support point.

With the RSI at 30, if CRYPTOCAP:XRP breaks the $1.8 bottom, we will expect a selling spree to the $0.60 support offering a buy opportunity for traders and investors. Hence the statement "It is time to sale CRYPTOCAP:XRP ".

A bearish symmetrical triangle is already forming as the asset breaks the $1.9 support point.

However, in a bullish thesis, if the asset makes a bounce from the current support point to the $2.5 resistant there might be hope for Ripple.

In another news, XRP has fallen 12% this week as its ongoing decline continues despite growing institutional interest. The altcoin is struggling to recover, even with two XRP ETFs already live and two more scheduled to launch next week.

What Is XRP / XRP Ledger?

Launched in 2012, the XRP Ledger (XRPL) is an open-source, permissionless and decentralized technology. Benefits of the XRP Ledger include its low-cost ($0.0002 to transact), speed (settling transactions in 3-5 seconds), scalability (1,500 transactions per second) and inherently green attributes (carbon-neutral and energy-efficient). The XRP Ledger also features the first decentralized exchange (DEX) and custom tokenization capabilities built into the protocol. Since 2012, the XRP Ledger has been operating reliably, having closed 70 million ledgers.

How Can XRP ETFs Prevent Price Crash To $2 This Month?XRP trades at $2.14 and currently rests on key support at the same level. The asset has been locked in a downtrend for nearly a month, struggling to break out despite periodic attempts. Without external catalysts, XRP risks drifting lower as bearish momentum persists.

However, XRP may avoid a deeper decline as the likelihood of ETF approval increases. Bloomberg ETF analyst Eric Balchunas noted that the SEC released guidance allowing issuers to speed up filing effectiveness, likely to clear regulatory backlog. Bitwise’s XRP ETF is reportedly next in line, and any progress could improve market sentiment instantly.

If bullish momentum continues and ETF expectations strengthen, XRP could climb to $2.28 and then $2.36, breaking free from its downtrend. If momentum weakens or ETF decisions face delays, XRP may resume its slide and potentially drop 6.8% to reach $2.00. This would invalidating the bullish thesis.

Will XRP Form a Death Cross or Repeat July 2025 Rally?At the time of writing, XRP trades at $2.55, holding slightly above the crucial $2.54 support level. The altcoin needs renewed bullish activity to break through resistance at $2.64, which would confirm upward momentum.

If the Death Cross materializes, XRP could face a short-term correction, possibly dropping toward $2.35 or lower. Such a decline might trigger short-lived selling as traders react to the technical setup.

Conversely, if investor maturity continues to grow, XRP could replicate its July 2025 breakout. A successful push above $2.64 could propel the token toward $2.75 and potentially $2.85. This would invalidate the bearish outlook and reigniting bullish sentiment

XRP Chasing New Highs - {26/10/2025}Educational Analysis says that XRPUSD or XRPUSDT (Crypto Pair) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - Bitstamp

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Crypto Pair brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS,

Happy Trading,

FX Pairs & Crypto Curreny Trade Analysis.

My Analysis is:-

Short term trend may be go to the external demand zone.

Long term trend breaks the new high after going from discount zone.

#XRP/USDT (1H) chart, here’s a full technical read:#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 2.36, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 2.38

First target: 2.41

Second target: 2.47

Third target: 2.53

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Is XRP Building for a Major Move? | Capital Flow Analysis🎯 XRP/USD: The Great Heist Setup | Swing Trade Blueprint 💰

📊 ASSET OVERVIEW

Pair: XRP/USD (Ripple vs. U.S. Dollar)

Market: Cryptocurrency

Trade Type: Swing Trade (Bullish Accumulation Play)

Chart Style: Capital Flow Blueprint with Triangular Moving Average Confirmation

🎭 THE HEIST PLAN

Ladies & Gentlemen, welcome to the ultimate Thief's Playbook! 🕵️

We've spotted a bullish accumulation pattern confirmed by our trusty Triangular Moving Average showing strong pullback support. The vault door is creaking open, and it's time to execute the perfect heist! 💎

Market Structure: XRP has been consolidating beautifully, building up energy like a coiled spring. The triangular MA convergence suggests institutional accumulation is underway. Translation? The big players are loading their bags while retail panics. Classic.

🎯 ENTRY STRATEGY: THE LAYERED HEIST

Here's where the "Thief Strategy" comes into play—we're not going all-in at once like amateurs. We're professionals. We layer our entries like a mastermind planning multiple escape routes! 🎪

Entry Method: Multiple Buy Limit Orders (Layering Strategy)

Recommended Entry Layers:

🎯 Layer 1: $2.3000 (First probe)

🎯 Layer 2: $2.4000 (Main accumulation zone)

🎯 Layer 3: $2.5000 (Final entry before liftoff)

Note: You can add more layers based on your bag size and risk appetite. The beauty of this strategy is flexibility—if price dips, you average down; if it rips, you're already in! Feel free to adjust these levels to suit your own master plan.

🛡️ STOP LOSS: THE EMERGENCY EXIT

Thief's SL: $2.2000

Listen up, OG Thieves! 👑 This is my stop loss based on technical invalidation below the accumulation zone. However, I'm NOT your financial advisor (I'm just a dude with charts and dreams). You set your own risk management. If you want to be more conservative or aggressive, that's YOUR heist to plan. Remember: scared money don't make money, but reckless money don't KEEP money! 💯

Why $2.2000? Breaking below this level invalidates the bullish structure and triangular MA support. At that point, we abort mission and live to steal another day! 🚪

💰 TAKE PROFIT: THE ESCAPE ROUTE

Primary Target: $3.1000 🚨

Here's the deal: At $3.1000, we hit what I call the "Police Barricade Zone"—a confluence of:

⚠️ Strong historical resistance

⚠️ Overbought conditions on multiple timeframes

⚠️ Potential bull trap territory

Exit Strategy: Scale out as you approach the target. Take some profits along the way! Maybe 33% at $2.8000, another 33% at $2.9500, and let the rest ride to $3.1000 with a trailing stop.

Note to Thief OG's: Again, this is my target based on technical analysis and risk/reward. You're the mastermind of your own operation! If you want to take profits earlier or swing for higher targets, that's your prerogative. Your money, your rules, your risk! 🎲

🔗 RELATED PAIRS TO WATCH (Correlation Analysis)

Keep your eyes on these accomplices—they often move together! 🕵️♂️

1. BITSTAMP:BTCUSD (Bitcoin) 📈

The godfather of crypto. When BTC pumps, altcoins like XRP usually follow. Currently hovering around all-time high zones—if BTC consolidates healthily, expect altseason momentum.

2. BITSTAMP:ETHUSD (Ethereum) ⚡

The second-in-command. ETH's strength or weakness often dictates altcoin sentiment. Watch the $2,500-$2,700 zone for continuation signals.

3. BINANCE:XRPBTC (XRP vs. Bitcoin Pair) 🔄

This tells us if XRP is outperforming or underperforming BTC. Currently showing relative strength—a bullish sign for XRP/USD longs.

4. TVC:DXY (U.S. Dollar Index) 💵

Inverse correlation alert! When DXY weakens, crypto typically strengthens. Keep an eye on the 104-106 resistance zone on DXY.

Key Correlation Point: If BTC holds structure and DXY rolls over, XRP could see explosive upside as capital rotates into high-beta altcoins. The macro backdrop matters! 🌍

🧠 KEY TECHNICAL HIGHLIGHTS

✅ Triangular MA Convergence: Bullish alignment across multiple timeframes

✅ Accumulation Zone: Smart money quietly loading between $2.30-$2.50

✅ Volume Profile: Strong support cluster in our entry zone

✅ Market Structure: Higher lows forming—textbook bullish continuation

✅ Risk/Reward: Approximately 3:1 RR ratio (solid!)

🎬 FINAL WORDS

The setup is clean, the plan is laid out, and the vault is waiting. Will XRP execute the perfect heist to $3.10? Only time will tell! Remember: patience beats panic, and risk management beats revenge trading!

Stay sharp, stay disciplined, and may the charts be ever in your favor! 🎰

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#XRP #XRPUSD #Ripple #CryptoTrading #SwingTrade #TechnicalAnalysis #CryptoSetup #Altcoins #BullishSetup #ThiefStrategy #LayeredEntry #RiskManagement #CryptoSignals #TradingView #ChartAnalysis #XRPArmy #CryptoTA #SwingTrading #PriceAction #SupportAndResistance

You will ask yourself, "how did he know Xrp would do that"?On Sept 5th I wrote, "Based on my statistical analysis of the "3 week down rule", I anticipate Xrp retracing from one of these 3 targets to form a lower low". Congrats to all who rode the gains up to the 3rd target and shorted the top. Also, as expected, Xrp got the lower low for all the doubters of the "3 Red Week Down Rule".

#XRP/USDT long idea/classic pattern#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 2.30, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 2.41

First target: 2.46

Second target: 2.54

Third target: 2.63

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#XRP/USDT looking extremely bullish#XRP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 2.93, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 2.96

First target: 3.02

Second target: 3.06

Third target: 3.10

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.