#XRP/USDT (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.36, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.44

Target 1: 1.47

Target 2: 1.52

Target 3: 1.58

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Xrpusdlong

XRP Weekly Chart Fib Layout!As of right now we are currently stuck in the Mid Level between fib 1 and fib 0.786 This is just a potential layout of what can possibly happen if we break out the mid level which shows the all time high levels. Tell me what you guys think don't forget to give me a follow for updates.

#XRP/USDT#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.53, and the price has bounced from this level several times. Another bounce is expected.

The indicator shows a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.60

Target 1: 1.63

Target 2: 1.67

Target 3: 1.72

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#XRP/USDT (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.90, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.93

First Target: 1.94

Second Target: 1.97

Third Target: 2.00

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

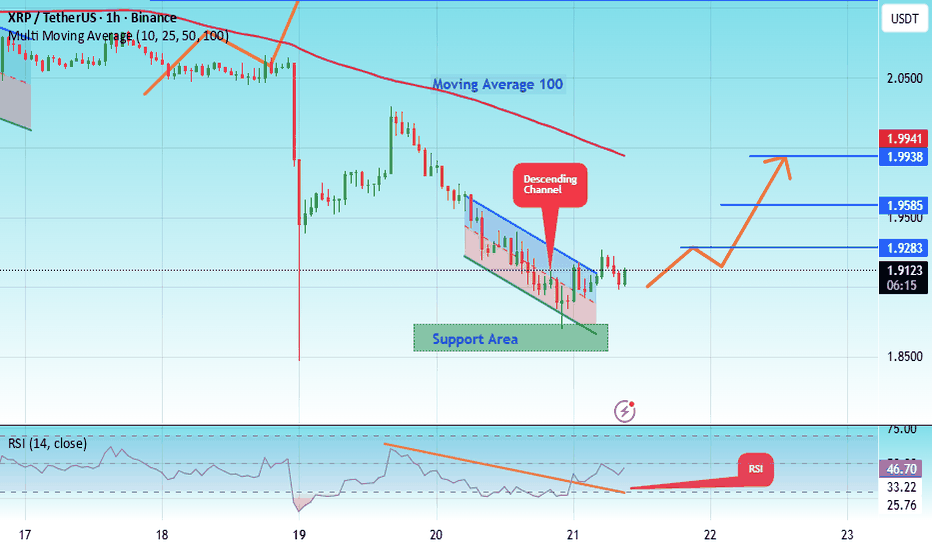

#XRP/USDT XRP (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.86, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.91

First Target: 1.92

Second Target: 1.95

Third Target: 1.99

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

XRP Symmetrical triangle got native supportAs per my last analysis on March 10

It was in ascending triangle but since it broke that so now it got very native support on initial resistance of the yellow line.

I think it will go up from here.

XLong

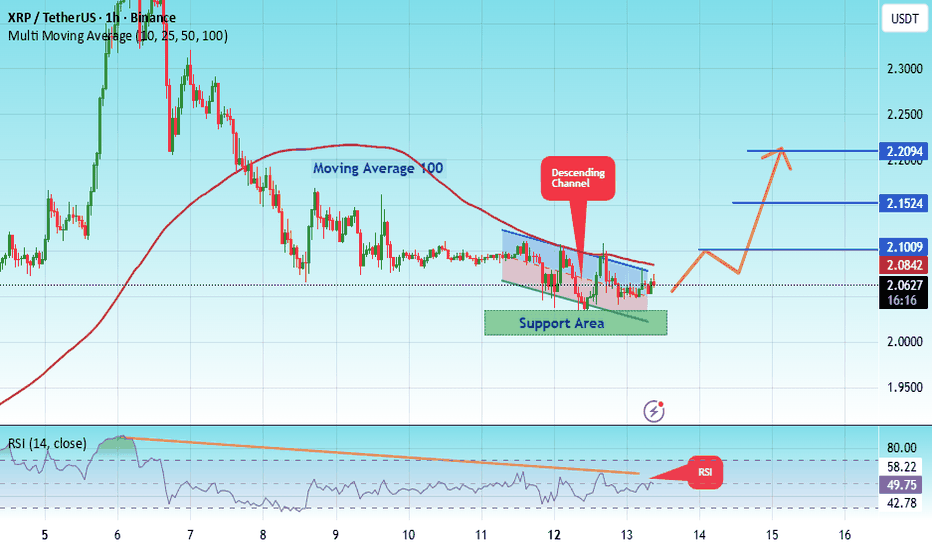

#XRP/USDT XRP (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is heading towards breaking it. A retest of this boundary is expected.

The Relative Strength Index (RSI) is showing an upward trend, as it has approached the upper boundary. A bearish reversal is expected.

There is a key support zone in green at 2.02. The price has bounced from this zone several times and is expected to bounce again.

A consolidation trend is observed above the 100-period moving average, which we are approaching. This trend supports a decline towards this level.

Entry Price: 2.06

Target 1: 2.10

Target 2: 2.15

Target 3: 2.19

Stop Loss: Above the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

very bullish scenario for XRP (and XRPT 2x daily long etf)I'm expecting an explosive move on XRP over upcoming weeks. From what I see, the final low has now been made on XRP after it took out the lows on 4 hr triple consecutive bearish candle at 1.77 on 12/19/25 (those are often retested for liquidity). This is now the final retracement of the bullish structural breakout zone on 4 hr tf at 2$ range so next comes the steady progression to 7$, 10$ & then 24-26$ likely in 2027. A break above 4$ will reinforce this bullish thesis. I think it's likely to have some continued volatility/choppiness as we progress higher but overall expecting buyer control & bullish dominance at least to 24$ level. (could still have another steep retracement on monthly tf back to 12-13$ range after 24$ is reached so will definitely exit XRPT at those levels out of caution)

Perfect scenario for buying XRPT imo given the immense upside potential on what would be considered a very early entry on a large buy cycle. I would typically not entertain the idea of swinging leveraged ETFs that long but I believe this setup will not disappoint for those open to incorporating some higher volatility instruments for outsized profits.

#XRP/USDT XRP (1h) (spot)#XRP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 2.02, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 2.06

First Target: 2.10

Second Target: 2.15

Third Target: 2.21

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

#XRP/USDT Technical Analysis. Bearish and Bullish overview!XRP/USDT – Daily Technical Analysis

XRP is showing early signs of a relief bounce after completing a full corrective move within a clearly defined descending channel. Price recently swept liquidity near the 1.77–1.80 demand zone and reacted strongly from this support.

Structure & Trend

The broader market structure remains bearish, with consistent lower highs and lower lows inside the descending channel. The current move appears to be a counter-trend bounce rather than a confirmed trend reversal.

Key Levels (Fibonacci Retracement)

0.618 at 2.01 is the immediate support. Holding above this level keeps the bounce intact.

0.5 at 2.09 and 0.382 at 2.17 act as intermediate resistance levels.

0.236 at 2.26 is a strong resistance zone.

The 2.40–2.42 region is a major resistance and previous rejection area, aligning with channel resistance.

EMA Structure

Short-term EMAs have started to curl upward, indicating improving momentum. Price needs to stay above these EMAs to maintain bullish continuation.

Bullish Scenario

If price holds above 2.00–2.05 and breaks above 2.26, XRP can extend toward the 2.40–2.42 resistance zone. A daily close above the descending channel would indicate a potential trend shift.

Bearish / Risk Scenario

Failure to hold above 2.00 could lead to a pullback toward 1.90–1.80. A breakdown below 1.77 would invalidate the bounce and resume the broader downtrend.

Summary

XRP is at a critical reaction zone. Momentum has improved after a strong support bounce, but confirmation only comes above 2.40. Until then, price action remains corrective within a larger downtrend.

If you like this idea, please hit the like button and share your views in the comments section.

Thank you

#PEACE

#XRP/USDT XRP (1h) (spot)#XRP

The price is moving within an ascending channel on the 1-hour timeframe and is holding well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the price of 2.14, representing a strong support point.

We have a trend to stabilize above the 100-period moving average.

Entry price: 2.18

First target: 2.21

Second target: 2.28

Third target: 2.35

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

XRP Ripple Technical Analysis and Trade IdeaXRP / Ripple has now broken market structure to the upside 📈🚀.

This is clearly visible on both the Daily and 4H timeframes 📊👀.

I’m now looking for a potential buy opportunity 🟢 if price pulls back into my optimal entry zone, as explained in the video 🎥📍.

As always, patience is key — I want price to come to my levels and confirm the setup 🧠✅.

⚠️ Not financial advice. Trade responsibly and manage risk at all times 💰🛡️.

#XRP/USDT (1H) chart, here’s a full technical read #XRP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 1.86. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 1.88

First target: 1.90

Second target: 1.93

Third target: 1.98

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

XRP | FVG Retrace Then Consolidation Before Breakout

Executive Summary

XRP is trading at $2.02 within an ascending triangle on the 4H timeframe. After reclaiming the psychological $2 level, price faces resistance at $2.02-$2.12. Expecting a short-term bearish move into the FVG (Fair Value Gap) at $1.75-$1.80, followed by consolidation, then a breakout either up or down.

BIAS: NEUTRAL - Bearish Short-Term, Then Consolidation, Then Breakout

Current Market Data

Current: $2.0231 (+0.85%)

Day's Range: $2.0059 - $2.0385

52-Week: $1.6106 - $3.6662

Market Cap: $122.74B

ETF Holdings: $1.16B+ (24 consecutive days of inflows)

Performance:

1W: +9.82% | 1M: -7.96% | 3M: -31.88%

6M: -10.94% | YTD: +9.99% | 1Y: -15.73%

Key News

XRP spot ETFs hold $1.16B+ with $1.4B total inflows

Ripple unlocked 1B XRP on Jan 1 (monthly escrow) - supply pressure

JPMorgan GTreasury integration on XRP Ledger

CLARITY Act markup scheduled for January 2026

$2 zone has rejected XRP since 2017 - major resistance

Technical Structure - 4H

Ascending Triangle:

Rising support trendline - higher lows

Horizontal resistance at $2.00-$2.02

Upper resistance at $2.12

FVG filled on left, was resistance, then broken

FVG Zone:

$1.75-$1.80 - Unfilled gap / liquidity sweep zone

Expect retrace here before consolidation

Ideal long entry if bounce confirms

Key Levels:

Resistance:

$2.00 - $2.02 - Horizontal resistance

$2.12 - Upper resistance (breakout level)

$2.20 - $2.50 - Bullish targets

Support:

$1.88 - $1.91 - Immediate support

$1.75 - $1.80 - FVG zone / liquidity sweep

$1.72 - Major support zone (bottom red line)

SCENARIO ANALYSIS

SHORT-TERM: Bearish Into FVG

Price retraces to $1.75-$1.80 FVG zone

Sweeps liquidity below $1.80

Consolidation phase begins

THEN: Breakout Either Direction

BULLISH: Break above $2.12 → Targets $2.20, $2.50

BEARISH: If no FVG bounce → Break below $1.72 → Targets $1.61, $1.45

My Assessment

Ascending triangle at $2 resistance. Short-term bearish into FVG at $1.75-$1.80, then consolidation. Wait for breakout confirmation before committing to direction. The $2 zone has rejected XRP since 2017 - this is a make-or-break level.

Strategy:

Expect short-term drop to $1.75-$1.80 FVG

Watch for consolidation and breakout direction

Long above $2.12 → Target $2.20-$2.50

Short below $1.72 → Target $1.61-$1.45

Comment your thoughts on the XRP 2026 Bull or Bear RALLY!

XRP Price Prediction: These Holders Now Dominate 11.5% SupplyXRP trades near $1.86 at the time of writing, remaining well below the $2.00 mark lost last week. The decline followed a failed attempt to break out of a month-long downtrend earlier this month. Momentum remains fragile under current conditions.

The token is holding above the $1.85 support level, which has been tested previously. XRP may consolidate below $1.94 if selling pressure eases. However, worsening sentiment could push price toward $1.79, extending short-term losses.

A recovery scenario depends on improving network activity and broader market stability. A break above $1.94 would be the first step toward reclaiming $2.00. Flipping $2.02 into support could drive XRP toward $2.20, invalidating the bearish trend.

XRP/USDT – Chart Analysis (Weekly)XRP/USDT – Chart Analysis (Weekly)

XRP has broken out of a multi-year downtrend line → confirming a major trend reversal

Strong impulsive rally after prolonged accumulation

The current price action is a healthy corrective pullback, not a bearish reversal

As long as the higher support zones hold, the structure remains bullish.

Fibonacci Analysis.

(Fibonacci drawn from macro low → to recent high)

0.236 – 2.88 → Strong rejection zone (local top)

0.382 – 2.41 → Supply / Resistance

0.5 – 2.03 → Mid-range level

0.618 – 1.65 → Golden Support Zone

0.786 – 1.11 → Strong demand and last bullish defense

The price is currently trading between 0.5 and 0.618, close to a high-probability demand zone.

Moving Average Confirmation

The price is still above the rising weekly MA (~1.65)

The MA is acting as dynamic support

In a bull cycle, the price often dips below the MA and recovers

As long as the weekly closes remain near/above the MA, the bullish trend remains intact.

DYOR | NFA.

XRP/USDT Professional Analysis – SMA Breakout Validated🌐 Professional XRP/USDT Trade Map — Breakout, Targets, Risk Controls

Asset: XRP/USDT – “RIPPLE VS TETHER”

Crypto Market Opportunity Blueprint (DAY/SWING Trade) 🚀📊

🔥 TRADE PLAN OVERVIEW

Plan: Bullish plan confirmed with Simple Moving Average breakout 📈✨

Entry: YOU CAN ENTRY ANY PRICE LEVEL 🟩🟢

This structure is built on momentum continuation + clean SMA upside confirmation.

🛡️ STOP LOSS GUIDANCE

Stop Loss: This is thief SL @ 2.0000

Dear Ladies & Gentleman (Thief OG's) — adjust your SL based on your strategy & your own risk.

⚠️ Note: I am not recommending you to set only my SL. It's your own choice; you can make money then take money at your own risk.

🎯 TARGET LEVEL – PROFIT MANAGEMENT

Target: TRIANGULAR Moving Average acts as a strong resistance + overbought zone + trap region.

📌 OUR target @ 2.3000 — kindly escape with profits before the trap activates.

⚠️ Note: Dear Ladies & Gentleman (Thief OG's), I am not recommending you to set only my TP. It's your own choice; you can make money then take money at your own risk.

🌍 RELATED PAIRS TO WATCH — CORRELATIONS & KEY POINTS

Monitoring correlated assets gives extra confirmation of trend strength, liquidity flow, and momentum shifts. Here are the pairs to keep an eye on:

💠 1. BINANCE:BTCUSDT – Bitcoin Controls Crypto Liquidity

Why watch it:

BTC is the macro driver of overall crypto momentum.

A bullish BTC → stronger inflow into alts like XRP.

If BTC rejects from key levels, XRP often slows or traps.

Key correlation:

Rising BTC dominance can limit XRP upside.

Falling dominance supports large-cap alt breakouts.

💠 2. BINANCE:ETHUSDT – Ethereum Trend Confirms Alt-Market Strength

Why watch it:

ETH often leads altcoin rotations; when ETH trends strong, major alts follow.

ETH breaking resistance = broader bullish environment for XRP.

Key correlation:

Strong ETH liquidity → better confidence for XRP swing trades.

💠 3. BINANCE:XLMUSDT – Directly Related Utility Sector Coin

Why watch it:

XLM and XRP often move with similar cross-border payment narratives.

When XLM surges first, XRP commonly follows with a delayed reaction.

Key correlation:

Positive XLM momentum strengthens confidence in XRP bullish setups.

💠 4. BINANCE:ADAUSDT – Risk-On Altcoin Indicator

Why watch it:

ADA rallies typically signal strong retail participation in altcoins.

Helps confirm whether the market is in alt season rotation mode.

Key correlation:

ADA strength → XRP follow-through probability increases.

💠 5. BINANCE:XRPBTC – Relative Strength Indicator

Why watch it:

If XRP/BTC is rising, XRP is outperforming Bitcoin → strong signal.

If XRP/BTC is dropping, XRP bullish trades may weaken or get trapped.

Key correlation:

XRP/BTC breakout = highest-quality long confirmation.

📌 SUMMARY FOR TRADINGVIEW READERS

This XRP blueprint delivers a clear bullish continuation setup powered by SMA breakout momentum, structured risk guidance, and a realistic trap-aware profit target. Monitoring correlated pairs amplifies your confidence, especially during critical breakout or overbought zones.

Will XRP Price Fall to $2 Again or Will This Explosion Save It?XRP is trading at $2.06 after two failed attempts to break the $2.20 resistance this week. The altcoin is now drifting toward the familiar $2.02 support level, which previously acted as a strong rebound point.

If XRP sees renewed investor confidence and a bounce from $2.02, the price could climb back to $2.20. A successful breakout above this resistance may open the door to $2.26, supported by the potential volatility surge indicated by the squeeze.

However, a breakdown remains a risk. Losing the $2.02 support would place $2.00 in immediate danger. A fall below that threshold could push XRP toward $1.94 or even $1.85, invalidating the bullish outlook and signaling deeper correction potential.

XRP Approaching Key Supply Zone: Break or Reject?Hi!

Bullish Scenario

A bullish continuation becomes likely only if price breaks and closes above the $2.12–$2.18 S&D zone.

If that happens:

Buyers regain control

A retest could confirm support

Next target -> descending trendline at $2.35–$2.45

Conclusion:

Break S&D -> Long toward the descending trendline.

Bearish Scenario

If price rejects from the S&D zone and fails to reclaim $2.12–$2.18:

Momentum shifts back to the downside

Price may retest the $1.90–$1.92 zone, the most recent low

Further breakdown could lead to new cycle weakness

XRPUSD testing monthly 20EMA supportCritical area for XRP bulls. If the Monthly 20EMA holds (overlayed on this 4H chart) we could see price retrace to the high 2.20s/low 2.30s to test the resistance at the Monthly 10EMA. Needless to say that the RSI is oversold on multiple time frames but with the algorithm set to "sell off" the RSI has become useless for now. As always, on a play like this, tight SL and sniper entries.

XRP Monthly Chart — Long-Term Price Outlook & Key Buying ZonesHello everyone, I’m Trader Oli.

For my first idea here on TradingView, I wanted to share my analysis of the XRP monthly chart, including a few scenarios and potential buying zones that could offer interesting long-term opportunities.

Just so you know, I’m a French-speaking trader, so some of my explanations and content will reflect that. I’ve been trading for 10 years, and I’ve now decided to start posting ideas here on a regular basis.

Feel free to comment and share your thoughts — I truly enjoy discussing with the community.

This is not financial advice, just my personal analysis.

I’m bullish on XRP over the long term, but today I wanted to highlight a potential opportunity before the price reaches new highs and potentially never returns to these levels.

Looking forward to connecting with you!

XRP Price Is 9% From Crashing To $2, Can It Be Avoided?At the time of writing, XRP is priced at $2.21, trading below the key resistance at $2.27. If long-term holders begin selling aggressively, the altcoin could fall toward $2.00, marking a 9% decline from current levels.

A drop to $2.00 would require XRP to break through supports at $2.13 and $2.02, both critical levels for short-term stability. If these fail to hold, the altcoin could experience accelerated losses.

However, if investor sentiment strengthens, XRP could rebound above $2.27 and aim for $2.35. A decisive break beyond $2.54 would confirm recovery and invalidate the current bearish outlook, signaling renewed bullish control.