XVS/USDT – Major Demand Zone Test: Accumulation or Breakdown?On the Weekly timeframe, XVS remains in a macro bearish trend after a massive decline from its ATH around 147 USDT. The price structure continues to print lower highs and lower lows, confirming long-term bearish pressure.

Currently, price is reacting again at a very strong historical demand zone, which has acted as a key support multiple times since 2022.

The 3.8 – 2.8 USDT zone (yellow block) represents a multi-year major support area. Price behavior around this zone will be crucial in determining whether XVS forms a medium-term reversal base or continues its bearish continuation / capitulation phase.

---

Key Levels on the Chart

Major Demand / Strong Support:

3.8 – 2.8 USDT (yellow zone)

→ Historical institutional demand & accumulation area

Step-by-Step Resistance Levels (Supply Zones):

5.7 – 7.0 USDT (minor supply / range resistance)

12.0 USDT

17.3 USDT

38.5 USDT (major resistance / large distribution zone)

---

Pattern & Price Structure Explanation

Falling Structure (Macro Downtrend):

Price has been moving in a lower high – lower low structure since 2021.

Base Building / Potential Accumulation:

Inside the 3.8 – 2.8 USDT zone, volatility is contracting and selling pressure appears to be weakening — indicating a possible accumulation phase.

Range Compression:

Sideways price action after a prolonged downtrend often signals a transition phase before a major expansion.

At this stage, no strong bullish confirmation yet, but the current price location is highly strategic.

---

Bullish Scenario (Reversal / Relief Rally)

The bullish scenario becomes valid if:

Price holds above 3.8 USDT

Strong weekly rejection candles or bullish weekly closes appear

Price breaks and closes above 5.7 – 7.0 USDT

Bullish Targets:

1. 5.7 – 7.0 USDT (initial resistance / reversal confirmation)

2. 12.0 USDT

3. 17.3 USDT

4. 38.5 USDT (medium-term target / major supply zone)

➡️ As long as price remains above the yellow zone, risk-to-reward for medium-term longs remains attractive, but entries should be scaled and confirmation-based.

---

Bearish Scenario (Breakdown / Continuation)

The bearish scenario is confirmed if:

Price closes weekly below 2.8 USDT

The major demand zone fails to hold

Bearish Implications:

Continuation of the macro downtrend

Potential capitulation move

Very limited historical support below this zone

➡️ A breakdown below the yellow zone would signal invalidated multi-year demand and significantly increase downside risk.

---

Conclusion

XVS is currently trading at a critical structural decision zone.

The 3.8 – 2.8 USDT area is the last stronghold for buyers. Price reaction here will determine whether XVS can form a medium-term base for reversal or enter a deeper bear market phase.

Confirmation is key — not FOMO.

#XVS #XVSUSDT #CryptoAnalysis #TechnicalAnalysis #WeeklyChart #DemandZone #SupportResistance #Altcoin #BearMarket #PotentialReversal

Xvsusdtanalysis

XVS/USDT at Major Downtrend Resistance – Breakout or Rejection?VENUS (XVS) on the 3D timeframe is still trading within a medium-to-long-term bearish structure, characterized by a clear sequence of lower highs and lower lows. However, a strong reaction from the 3.52 USDT low suggests early bullish interest, pushing price back toward the 5.7 USDT area. Price is now approaching a critical decision zone near the descending trendline.

---

Pattern & Technical Structure

Descending Trendline (Major Resistance)

The yellow diagonal line represents the primary downtrend resistance originating from the 12.8 USDT peak. This trendline has repeatedly capped bullish attempts.

Bearish Market Structure

Price remains below:

The major descending trendline

Historical supply zones between 7.0 – 8.9 USDT

Potential Trend Exhaustion

The strong bounce from the 3.52 USDT level indicates weakening selling pressure, though a confirmed trend reversal has not yet formed.

---

Key Levels & Important Zones

Resistance Levels (Supply Zones):

7.00 USDT (first key resistance)

8.05 – 8.50 USDT

8.90 USDT

10.30 – 10.90 USDT

11.80 USDT

12.80 USDT (major high)

Support Levels:

5.10 – 5.70 USDT (minor support & consolidation area)

4.50 USDT

3.52 USDT (major bottom / critical support)

---

Bullish Scenario

Price breaks and closes strongly above the descending trendline.

Successful break & retest of the 7.00 USDT level as new support.

Upside targets:

8.05 – 8.50 USDT

8.90 USDT

10.30 – 10.90 USDT

Strong confirmation occurs when market structure shifts into higher highs and higher lows on the 3D timeframe.

➡️ This bullish case represents a trend reversal scenario, valid only with clear breakout confirmation and volume support.

---

Bearish Scenario

Price fails to break the trendline and forms rejection or bearish price action.

Breakdown below 5.10 USDT.

Downside targets:

4.50 USDT

Retest of the 3.52 USDT low

A breakdown below 3.52 USDT would signal bearish continuation.

---

Conclusion

VENUS remains under dominant bearish control, but price is currently at a key decision area. A confirmed breakout above the descending trendline may trigger a medium-term trend reversal, while rejection would reinforce the ongoing bearish trend. Waiting for clear price action confirmation is highly recommended.

#XVS #VENUS #XVSUSDT #CryptoAnalysis #Altcoin #Downtrend #Trendline #SupportResistance #PriceAction #BearishMarket #PotentialReversal

XVS/USDT — Major Accumulation Zone or the Final Breakdown?XVS is once again standing at a critical historical zone between $4.00 and $3.00, a level that has defined market direction for more than three years.

Every touch on this area has led to either a major bullish reversal or a sharp continuation to the downside.

Recently, price printed a deep wick below the zone and quickly recovered — a classic sign of a liquidity grab, where smart money sweeps retail stop-losses before deciding the real direction.

From a technical perspective, XVS has been trading in a massive sideways range since 2022, with strong demand around 3–4 and multi-layer resistance levels above.

Every time this base has held, a strong rally followed — making this area one of the most decisive zones in XVS’s chart history.

---

Bullish Scenario

A weekly close above $4.50 would confirm that buyers are defending the zone, indicating potential accumulation by strong hands.

A follow-up breakout above $7.00 would shift the mid-term structure to bullish, confirming the start of a new upward phase.

Upside targets stand at $7.00 → $12.00 → $14.50 → $17.35, with a macro extension toward $38.50, the previous major supply zone.

Bullish narrative:

The 3–4 area may represent a final liquidity sweep before a new accumulation phase begins. If volume confirms, XVS could trigger a short-covering rally leading to sharp price recovery.

---

Bearish Scenario

A weekly close below $3.00 would invalidate the support zone and confirm a macro breakdown.

In that case, price could slide toward $1.70 – $1.16, the historical demand base from previous cycles.

Losing this zone could spark a capitulation phase, as major stop clusters are likely resting below it.

Bearish narrative:

Failure to defend the 3–4 range would mark the start of a deeper markdown phase — a potential final leg before a long-term bottom forms.

---

Pattern Overview

XVS is forming a macro horizontal accumulation structure since 2022.

The latest wick below the support zone indicates a possible shakeout event — an early hint of reversal if confirmed by higher closes.

Still, without confirmation above resistance levels, this remains a high-stakes battleground between bulls and bears.

---

The 3–4 zone isn’t just a number — it’s the defining line between recovery and collapse.

If the level holds, XVS could enter a powerful recovery phase toward mid-range resistance.

But if it breaks, the chart opens room for a capitulation wave toward historical lows.

The upcoming weekly closes will determine the next major chapter of this asset.

---

#XVS #XVSUSDT #Crypto #CryptoTrading #SupportZone #LiquiditySweep #SmartMoney #Accumulation #TechnicalAnalysis #Altcoins #RangeTrading #MarketStructure

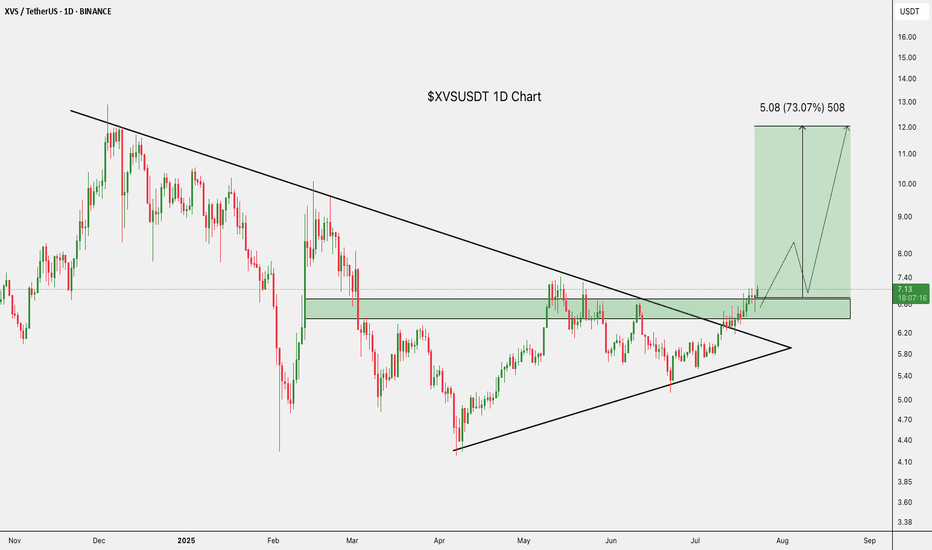

XVS/USDT – Accumulation Nearing Its End, Major Breakout?For over two years, XVS/USDT has been locked inside a massive multi-year accumulation phase, forming a clear Symmetrical Triangle pattern on the weekly timeframe.

Each move has been creating higher lows and lower highs, showing a tightening range and volatility compression — a classic setup before a major expansion phase begins.

Now, price action is once again testing the apex area of the triangle, suggesting that a decisive breakout is approaching.

This type of structure often precedes powerful reversals or trend continuations, depending on which direction the breakout confirms.

---

📈 Bullish Scenario

Breakout Confirmation: A weekly close above the descending trendline (around 7.0–9.2) with strong volume expansion.

Once confirmed, the medium-term targets are 11.87 → 17.70 → 21.60, with a possible extended rally toward 38.30 if broader market sentiment turns bullish.

The structure suggests that buyers have been quietly accumulating — and when this compression releases, momentum could accelerate quickly.

💡 Interesting Note: The longer a triangle forms, the stronger the breakout potential.

XVS has been building this base for over 100 weeks, indicating a significant amount of pent-up energy waiting to be released.

---

📉 Bearish Scenario

Failure to break above resistance followed by a weekly close below the rising trendline (~5.0) would shift momentum bearish.

Downside targets sit near 3.8 – 3.01, which represents the final historical demand zone.

A confirmed breakdown below 3.0 could invalidate the structure and potentially extend the downtrend further.

---

🔍 Pattern Analysis & Interpretation

Pattern Type: Symmetrical Triangle — a sign of prolonged accumulation and tightening market pressure.

Meaning: Such structures often mark a pivotal transition zone between accumulation and expansion.

Volume: Watch for a clear increase in trading volume during the breakout; without it, false breakouts are common.

---

🧭 Summary

XVS is entering a critical decision zone after years of sideways action.

A confirmed breakout above 9.2 could trigger the next major bullish cycle, while a breakdown below the lower boundary would confirm renewed weakness toward long-term support.

This is not just another consolidation — it’s a battle between accumulation and distribution, and its resolution could define XVS’s direction into 2026 and beyond.

---

#XVS #XVSUSDT #CryptoAnalysis #AltcoinBreakout #DeFi #TechnicalAnalysis #SymmetricalTriangle #CryptoChart #CryptoSetup #AccumulationPhase #CryptoMarket #BullishSetup

XVS/USDT Indicating downward movement retrace on support!💎 XVS has witnessed significant developments in the market.

💎 Presently, XVS has broken down the support trendline, indicating the potential for a downward movement with a retracement to the support area around 9.5. A prudent strategy involves waiting for XVS to reach this support level.

💎 If it successfully bounces, there's a possibility of a return to upward movement, probability aiming to break and reach our target strong resistance area

💎 However, if XVS reaches the support area and shows weak consolidation with low volume, it raises concerns. A lack of a robust response may signify the risk of XVS losing support. In such a scenario, a bearish trend is confirmed, and the next downward target could be the demand area around 6.3.

💎 To maintain an upward trajectory, XVS must bounce at the demand area and reclaim the position above the resistance area. Failure to do so may result in a continued downward movement, potentially reaching the strong support area.

XVS LOOKS READY 👍Anticipating a potential surge in XVS price—expecting a rise of at least 20-40% from its current position. This anticipated breakout could be the confirmation we're waiting for!

Remember: This is my personal opinion, not financial advice. Always conduct your research before making any trading decisions. 📊💡

Happy Trading! 🌟

XVSUSDT.1DBased on the given market data, we can observe that the XVS currency is currently priced at $4.75 against USDT. The 4-hour indicators show that the relative strength index (RSI) is 47.65, which indicates a neutral market. The MACD (Moving Average Convergence Divergence) is 0.02, slightly above zero, indicating a weak bullish signal. The Bollinger Band (BB) at 5.19 suggests a slight volatility in the price.

The support levels are at $4.82, $4.54 and $4.45 respectively and resistance levels are at $5.20, $5.52 and $5.45 respectively. If the price breaks the resistance level of $5.20, it might go up to $5.52 or even $5.45. Conversely, if the price breaks the support level of $4.82, it might fall to $4.54 or even $4.45.

The daily indicators show an RSI of 52.48, indicating a slightly bullish market. The MACD is 0.03, suggesting a weak bullish signal. The BB at 5.41 indicates a slight volatility. The support and resistance levels are similar to the 4-hour chart but with higher values.

The 7-day indicators show an RSI of 52.48, similar to the daily chart, suggesting a slightly bullish market. The MACD is negative (-0.06), indicating a bearish signal. The BB at 5.26 suggests less volatility. The support levels are lower than the daily and 4-hour chart, indicating a potential fall in price. The resistance levels are higher, suggesting a potential rise in price.

In my opinion, the market for XVS is currently neutral with a slight bullish tendency. However, it is crucial to consider other market factors and news related to XVS before making any investment decisions.

XVS ; VENUS - ive got my greedy beady eye on you ; pump it CZXVS ; ive got my greedy beady eye on you ; pump it CZ

been sitting on this chart for a bit.

play on CZ. play on BNB DEFI. better ROI than BNB short term i think.

IF the feds dont try and dismantle the Binance empire. thats the risk. and imo its a pretty decent risk at this point. prob hard to do but not impossible. the US financial goons run everything. hopefully cz isnt full of shite and they are indeed fine..

warming up to buy a small spot sack of this one.

so fundamentally there was a big hack and the guy moved his fake minted BNB to this platform and swapped it for stables.. which have basically been blacklisted and isolated from what i read.

IF it is indeed contained properly that might make this a good 'over crushed asset' play.

reboundoooooor

XVSUSDT Analysis (LOCAL VISION)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Entry: market and lower

Target: 14 and 19

after first target reached move ur stop to breakeven

Stop: 7.7 (depending of ur risk). ALWAYS follow ur RM .

Risk/Reward: 1 to 4

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions.

XVSUSDT Analysis (perspective couple of months)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Upward movement from the current price or through 5$.

Entry: market and lower

Target: 10 - 15 - 20

after first target reached move ur stop to breakeven

Stop: (depending of ur risk). ALWAYS follow ur RM .

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions.

XVSUSDT AnalysisHello friends.

Please support my work by clicking the LIKE button(If you liked).Thank you!

Everything on the chart.

open pos: market and lower

target: 30 - 36 - 45

after first target reached move ur stop to breakeven

stop: ~under 20 (depending of ur risk). ALWAYS follow ur RM .

risk/reward 1 to 4

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to your questions or suggestions.