Zksync

ZK is approaching its lows. I'm expecting a rebound. Full plan.ZK is slowly approaching its lows. It is dangerous to enter at the current level because the RSI clearly shows that we are approaching it.

I have marked the approximate buy zone in green and indicated the stop zone. Please proceed with caution.

I have also shown the targets for taking profits on the chart, so you can make informed decisions. Personally, I will exit at the first zone and move the stop to BU. If it goes up, great! If not, we've already made money with stops at BU.

ZK/USDT - Falling Wedge – Breakout or Breakdown Ahead?ZK/USDT is entering a critical phase after a prolonged decline since early November. Price is now holding right above the 0.0347–0.0320 demand zone, the same area that previously triggered a strong bullish reaction. At the same time, sellers have been compressing price into a falling wedge structure, a pattern that historically carries a high probability of triggering major trend reversals.

This narrowing wedge signals that volatility is being compressed to its maximum point. The tighter the structure becomes, the stronger the potential breakout. If buyers manage to break above the upper wedge trendline, ZK may release weeks of accumulated bearish pressure and shift into a new bullish phase.

But this demand zone is also the bulls’ final line of defense. A clean breakdown below 0.0320 would invalidate the structure and open the door for deeper downside toward previous lows.

---

Bullish Scenario (High Probability Reversal if Confirmed)

Bullish confirmation checklist:

1. A strong 4H candle closes above the upper wedge.

2. A successful retest of the trendline as new support.

3. Increased volume on the breakout (momentum confirmation).

If confirmed, ZK’s upside potential opens toward:

Target 1: 0.0405

Target 2: 0.0455

Target 3: 0.0540

Major extension: 0.0645 – 0.0685

This structure often appears just before mid-trend to major reversals.

---

Bearish Scenario (Trend Continuation if Support Fails)

Bearish confirmation checklist:

1. Price rejects the upper wedge and loses upward momentum.

2. A decisive 4H close below 0.0320.

3. Retest of 0.0320 acting as new resistance.

Downside targets if breakdown occurs:

Target 1: 0.0280

Target 2: 0.021–0.023 if bearish momentum accelerates.

A breakdown at this zone would re-establish a deeper bearish structure with new lower lows.

---

Why This Zone Matters

1. The 0.0347–0.0320 demand zone has acted as a strong accumulation area before.

2. Falling wedges are often used by smart money as a transition pattern from distribution to accumulation.

3. Extended consolidation at support usually precedes large directional moves.

4. Low-volume dips into demand often indicate the final phase before reversal.

This makes the current price zone not just a support level, but a decision point for the next major trend.

#ZKSync #ZKUSDT #CryptoAnalysis #PriceAction #FallingWedge #DemandZone #BreakoutSetup #CryptoTrading #AltcoinAnalysis

#ZK/USDT - Don't waste this opportunity!#ZK

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.03466. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.03580

First target: 0.03640

Second target: 0.03720

Third target: 0.03830

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

ZK – THE SPRING IS FULLY COMPRESSED!Something extremely juicy is forming on ZK right now…

After weeks of tight consolidation, the chart looks like a loaded spring that’s literally begging to get released. All the classic signs of an upcoming pump are here. One strong candle and boom — we’re off!

My upside targets:

🎯 Target 1 — 0.0420

🎯 Target 2 — 0.0440

🎯 Target 3 — 0.0470

🎯 Extended target — 0.0510 (if momentum stays crazy)

❌Invalidation (whole idea cancelled): daily close below 0.03954

Risk is tight, reward is massive. Watching this one like a hawk!

Who’s ready for the ZK moonshot? Drop a 🚀 below and follow for real-time updates!

#ZK/USDT - Don't waste this opportunity!#ZK

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.03800. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.0900

First target: 0.04077

Second target: 0.04253

Third target: 0.04425

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#ZK/USDT - Don't waste this opportunity!#ZK

The price is moving within an ascending channel on the 1-hour timeframe and is holding well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.03760, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.03890

First target: 0.04025

Second target: 0.04211

Third target: 0.04442

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#ZK/USDT - Don't waste this opportunity!#ZK

The price is moving in a descending channel on the 1-hour timeframe and is expected to break out and continue upwards.

We have a trend to stabilize above the 100-period moving average again.

We have a downtrend on the RSI indicator, which supports an upward move if it breaks above it.

We have a key support zone in green that pushed the price higher at 0.04550.

Entry price: 0.04630

First target: 0.04765

Second target: 0.04901

Third target: 0.05019

For risk management, don't forget your stop-loss and money management.

The stop-loss is below the support zone in green.

Upon reaching the first target, take some profits and then change your stop-loss order to an entry order.

For any questions, please comment.

Thank you.

#ZK/USDT - Don't waste this opportunity!#ZK

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.04970, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.05645

First target: 0.05930

Second target: 0.06255

Third target: 0.06732

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

Breaking: ZKsync ($ZK) Spike Almost 60% Watch This Next Levels ZKsync ( NYSE:ZK ) ZKsync a blockchain powering the next generation of builders with limitless scale. Secured by math and designed for native interoperability saw a noteworthy uptick of 56% in the past 24 hours.

This move was primarily due to Vitalik Buterin's endorsement of ZKsync.

Vitalik Buterin praised ZKsync's contributions to Ethereum after the Atlas upgrade, highlighting technical innovations that enhanced scalability. His endorsement sparked significant token interest, coinciding with institutional attention to ZKsync's ecosystem role.

As of the time of writing, the asset is up 24% amidst bullish sentiment. With the RSI at 59, there is more room for the asset to climb to new resistance point.

However, in the case of a reversal, these fibonacci levels should be watched;

38.2% Fib level

50% Fib level

61.8% fib level

ZKsync Price Data

The ZKsync price today is $0.062094 USD with a 24-hour trading volume of $900,092,732 USD. ZKsync is up 56.81% in the last 24 hours. The current CoinMarketCap ranking is #106, with a market cap of $508,077,055 USD. It has a circulating supply of 8,182,339,815 ZK coins and a max. supply of 21,000,000,000 ZK coins.

#ZK/USDT#ZK

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0676

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0729

First target 0.0792

Second target 0.0838

Third target 0.0896

#ZK/USDT — Descending Triangle Key Support, Breakout or Breakd#ZK

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.03736, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.03853

First target: 0.04019

Second target: 0.04189

Third target: 0.004443

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ZKSync (ZK) — Decision Point: Breakout or Breakdown?The ZKUSDT (Daily) pair has reached a critical juncture that will decide its next major move. Since early 2025, price action has been trapped below a descending trendline, acting as a dominant wall of selling pressure. Every breakout attempt has been rejected, reaffirming bearish control.

Now, the price is sitting right at the crossroads — between the descending trendline above and a key accumulation/support zone at 0.0465–0.040 (yellow block) below.

This zone isn’t just another range — it’s the battleground that will determine whether ZKSync is preparing for a major reversal or about to continue its downtrend into new lows.

---

Pattern & Structure:

Formation of a Descending Triangle with a flat horizontal base (0.0465–0.040) and a falling trendline resistance.

The structure shows persistent selling pressure, but every dip into the lower zone attracts strong buying reactions — a clear tug-of-war between bulls and bears.

A recent liquidity grab (false breakout wick) signals stop-hunting activity, often a precursor to a major move.

The market is coiling tightly — volatility compression suggests a large expansion phase is near.

---

Bullish Scenario: “Reversal Confirmed”

If ZK successfully closes and holds above the descending trendline with strong momentum and volume, it could mark the start of a new medium-term uptrend.

Key confirmation:

Daily close above 0.048–0.050

Successful retest of the trendline as new support

Upside targets:

1. 0.058 — first resistance and structural pivot

2. 0.070 — confirmation of trend reversal

3. 0.082 → 0.132 — extended bullish targets if momentum continues

Rationale:

Breaking a descending triangle to the upside often triggers a short squeeze as traders exit bearish positions, accelerating price movement and initiating a shift in market structure.

---

Bearish Scenario: “Final Breakdown”

If ZK fails to hold its ground and closes daily below 0.040, the descending triangle pattern would confirm as a bearish continuation, signaling further downside.

Key confirmation:

Strong daily close below 0.040

Failed retest from below (support turned resistance)

Downside targets:

1. 0.028 — previous local low

2. 0.023 — potential capitulation zone

Rationale:

Losing this base indicates buyers have fully lost control. Historically, such breakdowns lead to sharp selloffs as short-term holders exit rapidly, increasing momentum on the downside.

---

Conclusion:

> ZKSync is sitting at a make-or-break level — a zone that will define the next directional wave.

Bullish case: breakout above trendline → targets 0.058–0.070.

Bearish case: breakdown below 0.040 → targets 0.028–0.023.

Expect a major volatility expansion once this compression phase resolves.

---

Trading Strategy & Risk Notes:

Wait for daily candle confirmation, not just wicks — avoid getting trapped in fakeouts.

Conservative entry: after breakout + retest.

Aggressive entry: near support with clear rejection confirmation.

Stop-loss: below 0.040 (for longs) or above 0.0465 (for shorts).

Maintain a risk/reward ratio of at least 1:2 and scale out profits at each target level.

---

Key Technical Levels:

Support zone: 0.0465 – 0.040

Trendline resistance: ~0.048–0.050

Upside levels: 0.058 → 0.070 → 0.082 → 0.132

Downside targets: 0.028 → 0.023

#ZKUSDT #ZKSync #CryptoAnalysis #DescendingTriangle #BreakoutTrading #SupportResistance #CryptoBreakout #ChartAnalysis #PriceAction #CryptoTrader #ReversalZone #BearishOrBullish

ZKUSDT — Descending Triangle Key Support, Breakout or Breakdown?Full Analysis

On the 2-day timeframe, ZKUSDT is forming a very clear descending triangle pattern:

Downtrend line (yellow) shows sellers’ dominance with consecutive lower highs.

Horizontal support zone (yellow box 0.0366 – 0.0531) is still being defended multiple times, showing that buyers are not giving up.

Price is now moving near the triangle apex, meaning a major decision point is approaching soon.

📉 Traditionally, descending triangles lean bearish, but in crypto markets, bullish fakeouts often happen when buyers step in strongly around critical demand zones.

---

Pattern and Market Dynamics

1. Volatility Compression: Price range is narrowing, volume decreasing — a build-up phase before an explosive move.

2. Buyer Defense: The 0.0366 – 0.0531 support zone has become a crucial demand area. Each dip has been absorbed by buyers.

3. Seller Pressure: Meanwhile, sellers consistently push price lower, creating the descending trendline.

4. Apex Zone: The convergence of trendline and support will decide the next major direction.

---

Bullish Scenario

If price closes a 2D candle above the descending trendline with strong volume, then:

Immediate upside targets:

0.0653 (minor resistance)

0.0800 (psychological level & supply zone)

0.0943 (strong resistance)

Extended targets:

0.1094 → if the altcoin market recovers further

0.1451 → confirmation of a medium-term reversal

From the current level, upside potential could reach +170% if the bullish scenario fully plays out.

---

Bearish Scenario

If price closes below the support box (0.0366 – 0.0531) and confirms with selling volume, then:

Initial target: 0.0366 (recent low)

Next target: around 0.0200 (psychological zone)

Extreme case: down to 0.0100 if panic selling occurs

From current levels, downside risk could be as deep as −80% in a worst-case breakdown scenario.

---

Pattern Conclusion

Descending Triangle = Neutral–Bearish bias, but no breakout yet.

Price is entering the “last squeeze” phase — the market is about to decide direction in the coming weeks.

Breakout or breakdown with volume will be the ultimate confirmation.

---

Strategy & Risk Management

Conservative traders: Wait for breakout/breakdown confirmation on the 2D close, enter on the retest with a tight stop-loss.

Aggressive traders: Can start accumulating near support with SL below 0.0366, targeting 0.0653–0.0800.

Reminder: Fakeouts are common in descending triangles — do not over-leverage without confirmation.

---

ZKSync (ZKUSDT, 2D) is standing at a major crossroad. A descending triangle is nearing its apex, with sellers pressing down and buyers defending the key 0.0366 – 0.0531 support.

Bullish case: breakout above trendline → targets 0.0653 – 0.1451

Bearish case: breakdown below support → targets 0.0366 down to 0.0200 or even 0.0100

🚨 The next move will decide: is ZK ready for a major rally, or a deeper fall?

Watch the 2D close + volume for confirmation.

#ZKSync #ZKUSDT #CryptoAnalysis #Altcoins #DescendingTriangle #CryptoBreakout #SupportResistance

ZKUSDT | Range Defined by Blue and RedOn ZKUSDT, the blue box is acting as demand support while the red box marks firm resistance. For now, the structure is capped within this range.

I’m specifically watching the order flow:

Volume footprint shows clear absorption inside the blue box buyers quietly stacking bids.

CDV is still flat; I want to see it tilt upward before trusting the breakout.

If price pushes through the red box with volume, and CDV confirms the move with positive divergence, then a retest of that level becomes a clean long setup. Until that happens, patience is the edge.

Smart trades come from volume confirmation, not guessing the breakout.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ZK Secondary trend.-82% Wedge. Reversal zones. 01 05 2025Logarithm. Time frame 3 days. Decrease from listing about -82%. For cryptocurrencies of such liquidity and capitalization, this is not the maximum decrease (-90-96%). But sometimes from such values as now (-82-85%), taking into account the news hype during the listing "whales $ 458 million", a reversal and strong pumping can occur under the market as a whole. For example, like another hype project of "hanging noodles" - Flare (distributed to XRP holders). Decrease by -82% and then pumping slightly above the listing price under the next alt season of the cycle + 560%.

This does not necessarily mean that this will happen, this is an example of what happens from such values of decline with such liquidity and hype. In some ways, not only in the structure of the TA formation, but in the hype and disappointment of "investors", the projects are identical.

Main trend , and the previously shown zone, in which the price is now.

ZkSync Main trend. L2 for ETH. $458 million funds 21 02 2025

Main trend now in the moment (full trading history).

There is no need to guess the minimums and maximums. It is important to know these zones and have an acceptable average price, from the position of the trend and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

ZK Breakout PotentialGiven its recent uptrend and second attempt to break resistance, BINANCE:ZKUSDT shows strong potential to decisively overcome its downtrend and initiate a significant upward wave. A closer look at the chart provides a more detailed perspective.

⛔ Disclaimer: No Guarantee of Profit or Loss

Please be aware that all investments, trading, and financial decisions involve risk. The information provided is for general informational purposes only and should not be considered as financial advice. We do not guarantee any specific outcomes, profits, or returns.

You are solely responsible for your own investment decisions. The past performance of any investment or strategy is not a reliable indicator of future results. We recommend conducting your own research and consulting with a qualified financial advisor before making any financial decisions.

By using this information, you acknowledge that you will not hold us liable for any losses or damages incurred as a result of your financial activities.

#ZK/USDT Trendline Break #ZK

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.05688.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area (in green) at 0.05628, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.05665

First target: 0.05866

Second target: 0.5982

Third target: 0.06144

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ZK/USDT — Testing Long-Term Downtrend: Breakout or Rejection at?Summary

The daily chart shows a clear long-term downtrend from the previous highs — the descending trendline (yellow) has been capping price action, forming a sequence of lower highs and lower lows. Currently, price is hovering around 0.0591 USDT, testing both the trendline resistance and a key horizontal resistance at ~0.06173 (red dashed). Since the low at ~0.0366 (June), the market has been slowly forming higher lows, suggesting potential accumulation, but the main downtrend structure is still intact until a confirmed breakout occurs.

---

Pattern Overview

Descending trendline (yellow) = downtrend structure remains valid until a daily close above it.

Accumulation signs from the 0.0366 low → forming several higher lows.

Key resistance: 0.06173 (decision zone).

Next resistances (yellow dashed): 0.07999 → 0.11475 → 0.15566 → 0.22443 → 0.26273 → 0.27270.

Key support: ~0.042 (intermediate) → structural low at 0.03660.

---

Bullish Scenario (confirmation needed)

1. Breakout confirmation: A daily close above the descending trendline and above 0.0617 with stronger-than-average volume.

2. Post-breakout behavior: Potential retest of the broken trendline as support — a conservative entry point.

3. Upside targets:

Target 1: 0.07999 (~+29% from 0.06173; ~+35% from current price 0.05907)

Target 2: 0.11475 (~+86% from 0.06173)

Extended targets: 0.15566 → 0.22443 → 0.26273 → 0.27270

4. Risk management: Initial stop-loss under retest zone or, for aggressive entries, just below breakout candle’s low.

---

Bearish Scenario (rejection/failure)

1. Rejection at 0.0617 / trendline: If price fails to break and closes bearish with upper wicks, a pullback toward support is likely.

2. Support watch: ~0.042 (intermediate) → 0.03660 (structural low).

Downside from 0.0617: ~−29% to 0.042, ~−38% to 0.0366.

3. Further risk: A daily close below 0.0366 could trigger continuation of the major downtrend.

---

Key Levels (Quick View)

Current: 0.05907

Breakout trigger: 0.06173

Targets: 0.07999, 0.11475, 0.15566, 0.22443, 0.26273, 0.27270

Supports: ~0.042 → 0.03660

#ZK #ZKUSDT #Crypto #Altcoin #TechnicalAnalysis #TA #Trendline #Breakout #PriceAction

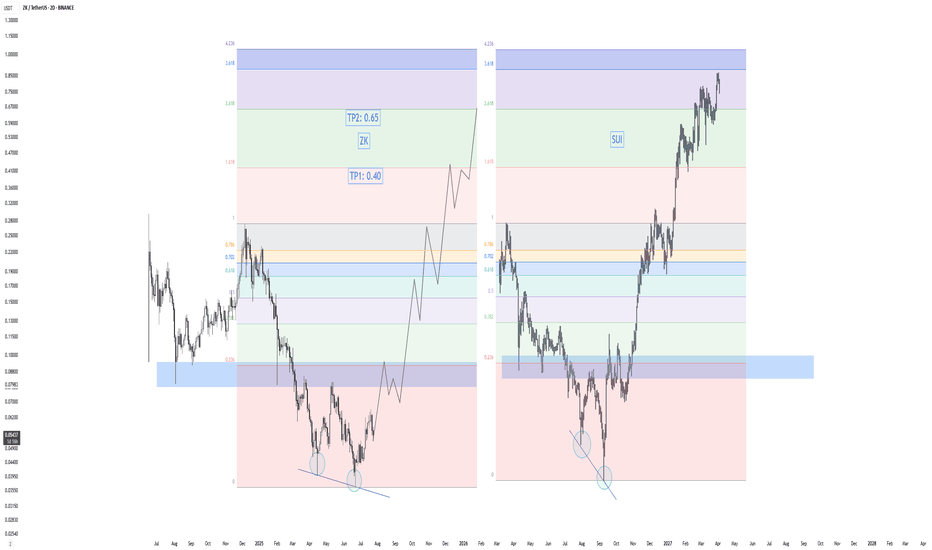

ZK - Golden opportunity? 0.40? Hello everyone, here’s my new analysis on ZK.

Recently, the price surged nearly 80%, followed by an 18% pullback over the last two days. From its all-time high, ZK is currently down about 80%, which in my opinion presents a golden opportunity.

Based on my research, the peaks of altseasons often occur between December–January or April–May. After analyzing the Others Market Cap dominance chart, I believe we’re setting up for a strong altseason in the next 5 months. Over the last few years, BTC has significantly outperformed altcoins—but recently, I’ve noticed a major shift in market dynamics, indicating that capital might be rotating back into alts.

On the chart, ZK is showing a classic crypto crash-recovery pattern. For example, SUI dropped around 80–85% before rallying over 1000% in just 4 months. I see a strong structural similarity between the bottoming pattern of SUI and the current structure of ZK.

If ZK breaks the resistance zone at 0.080–0.095, I expect a rapid move up toward 0.22–0.26. After that, a healthy correction around the previous ATH would be expected—before potentially heading to 0.40 as Take Profit 1 (TP1).

Need to be careful.A new downward wave may occur. Need to pay attention.

The market is very enthusiastic about Ethereum, we need to be cautious in these exciting moments.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.