OPEN-SOURCE SCRIPT

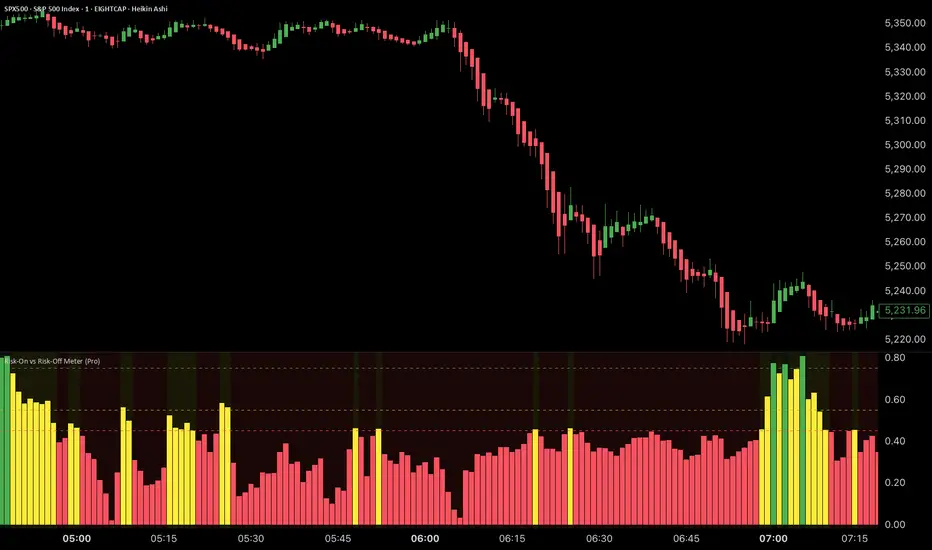

Risk-On vs Risk-Off Meter (Pro)

Risk-On vs Risk-Off Meter (Pro)

This macro-based tool analyzes capital flows across key assets to gauge overall market risk sentiment. It does not use ES, SPY, or stock data directly—making it a powerful confirmation tool for ES traders looking to align with macro forces.

🔹 Core Idea:

Tracks capital rotation between copper/gold, bonds, dollar, crude oil, VIX, and yield spreads to generate a normalized risk score (0–1). This score reflects whether macro money is flowing into risk or safety.

🔹 Use:

Use this indicator as confirmation of directional bias when scalping or day trading ES.

– Green Zone (>0.75): Risk-On environment. Favor long setups.

– Red Zone (<0.45): Risk-Off. Favor short setups or stand aside.

– Yellow Zone: Neutral, use caution.

– Divergence Alerts: Signals when ES price disagrees with macro risk trend—potential reversals or exhaustion zones.

HOT TO USE

– Combine with your existing price action or order flow signals

– Avoid trading against the macro sentiment unless strong setup

– Use divergence as a heads-up for fading or exiting trades

This gives you a macro-informed lens to validate or filter your entries.

This macro-based tool analyzes capital flows across key assets to gauge overall market risk sentiment. It does not use ES, SPY, or stock data directly—making it a powerful confirmation tool for ES traders looking to align with macro forces.

🔹 Core Idea:

Tracks capital rotation between copper/gold, bonds, dollar, crude oil, VIX, and yield spreads to generate a normalized risk score (0–1). This score reflects whether macro money is flowing into risk or safety.

🔹 Use:

Use this indicator as confirmation of directional bias when scalping or day trading ES.

– Green Zone (>0.75): Risk-On environment. Favor long setups.

– Red Zone (<0.45): Risk-Off. Favor short setups or stand aside.

– Yellow Zone: Neutral, use caution.

– Divergence Alerts: Signals when ES price disagrees with macro risk trend—potential reversals or exhaustion zones.

HOT TO USE

– Combine with your existing price action or order flow signals

– Avoid trading against the macro sentiment unless strong setup

– Use divergence as a heads-up for fading or exiting trades

This gives you a macro-informed lens to validate or filter your entries.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.