OPEN-SOURCE SCRIPT

Efficiency Weighted OrderFlow [AlgoAlpha]

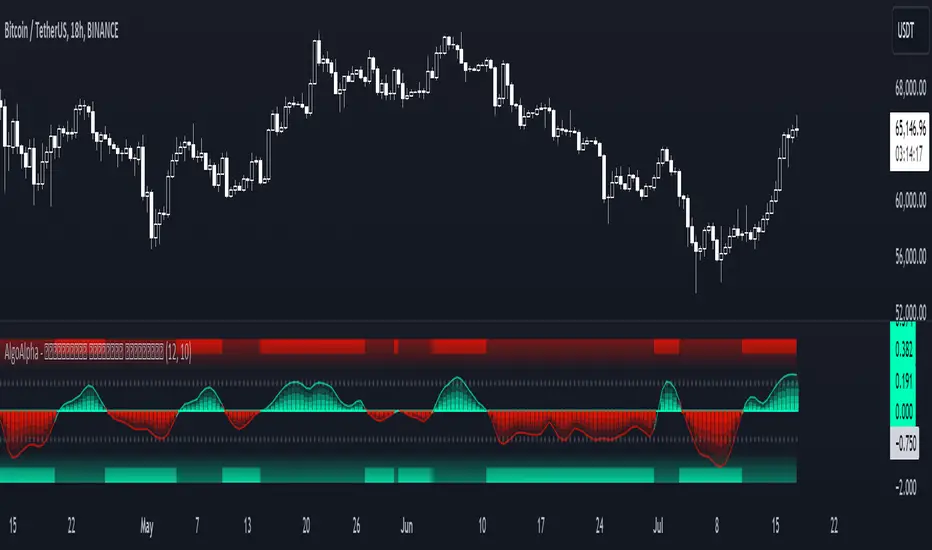

Introducing the Efficiency Weighted Orderflow Indicator by AlgoAlpha! 📈✨

Elevate your trading game with our cutting-edge Efficiency Weighted Orderflow Indicator, designed to provide clear insights into market trends and potential reversals. This tool is perfect for traders seeking to understand the underlying market dynamics through efficiency-weighted volume calculations.

🌟 Key Features 🌟

🚀 Quick Guide to Using the Efficiency Weighted Orderflow Indicator

🛠 Add the Indicator: Search for "Efficiency Weighted Orderflow [AlgoAlpha]" in TradingView's Indicators & Strategies. Customize settings like smoothing and order flow period to fit your trading style.

📊 Market Analysis: Watch for trend reversal alerts to capture trading opportunities by studying the behaviour of the indicator.

🔔 Alerts: Enable notifications for significant order flow changes to stay updated on market trends.

🔍 How It Works

The Efficiency Weighted Orderflow Indicator starts by calculating the efficiency of price movements using the absolute difference between the close and open prices, divided by volume. The order flow is then computed by summing these efficiency-weighted volumes over a specified period, with an option to apply Hull Moving Average (HMA) smoothing for enhanced signal stability. To ensure robust comparison, the order flow is normalized using standard deviation. The indicator plots these values as columns, with distinct colors representing bullish and bearish trends. Customizable parameters for period length and smoothing allow traders to tailor the indicator to their strategies. Additionally, visual cues and alert conditions for trend reversals and significant order flow changes keep traders informed and ready to act. This indicator improves on the Orderflow aspect of our Standardized Orderflow indicator. The Efficiency Weighted Orderflow is less susceptible to noise and is also quicker at detecting trend changes.

Elevate your trading game with our cutting-edge Efficiency Weighted Orderflow Indicator, designed to provide clear insights into market trends and potential reversals. This tool is perfect for traders seeking to understand the underlying market dynamics through efficiency-weighted volume calculations.

🌟 Key Features 🌟

- ✨Smooth OrderFlow Calculation: Option to smooth order flow data for more consistent signals.

- 🔧Customizable Parameters: Adjust the Order Flow Period and HMA Smoothing Length to fit your trading strategy.

- 🔍Visual Clarity: Easily distinguish between bullish and bearish trends with customizable colors.

- 📊Standard Deviation Normalization: Keeps order flow values normalized for better comparison across different market conditions.

- 🔔Trend Reversal Alerts: Stay ahead with built-in alert conditions for significant order flow changes.

🚀 Quick Guide to Using the Efficiency Weighted Orderflow Indicator

🛠 Add the Indicator: Search for "Efficiency Weighted Orderflow [AlgoAlpha]" in TradingView's Indicators & Strategies. Customize settings like smoothing and order flow period to fit your trading style.

📊 Market Analysis: Watch for trend reversal alerts to capture trading opportunities by studying the behaviour of the indicator.

🔔 Alerts: Enable notifications for significant order flow changes to stay updated on market trends.

🔍 How It Works

The Efficiency Weighted Orderflow Indicator starts by calculating the efficiency of price movements using the absolute difference between the close and open prices, divided by volume. The order flow is then computed by summing these efficiency-weighted volumes over a specified period, with an option to apply Hull Moving Average (HMA) smoothing for enhanced signal stability. To ensure robust comparison, the order flow is normalized using standard deviation. The indicator plots these values as columns, with distinct colors representing bullish and bearish trends. Customizable parameters for period length and smoothing allow traders to tailor the indicator to their strategies. Additionally, visual cues and alert conditions for trend reversals and significant order flow changes keep traders informed and ready to act. This indicator improves on the Orderflow aspect of our Standardized Orderflow indicator. The Efficiency Weighted Orderflow is less susceptible to noise and is also quicker at detecting trend changes.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

🚨Get premium: algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

🚨Get premium: algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.