OPEN-SOURCE SCRIPT

MNQ Morning Indicator | Clean Signals

MNQ Morning Trading Indicator Summary

What It Does

This is a TradingView indicator designed for day trading MNQ (Micro Nasdaq-100 futures) during morning sessions. It generates BUY and SELL signals only when multiple technical conditions align, helping traders identify high-probability trade setups.

Core Strategy

BUY Signal Requirements (All must be true):

✅ Price above VWAP (volume-weighted average price)

✅ Fast EMA (9) above Slow EMA (21) - uptrend confirmation

✅ Price above 15-minute 50 EMA - higher timeframe confirmation

✅ MACD histogram positive - momentum confirmation

✅ RSI above 55 - strength confirmation

✅ ADX above 25 - trending market (not choppy)

✅ Volume 1.5x above average - strong participation

SELL Signal (opposite conditions)

Key Features

🎯 Risk Management

Stop Loss: 2× ATR (Average True Range)

Take Profit 1: 2× ATR (1:2 risk-reward)

Take Profit 2: 3× ATR (1:3 risk-reward)

Dollar values: Calculates P&L based on MNQ's $2/point value

⏰ Session Filter

Default: 9:30 AM - 11:30 AM ET (customizable)

Safety feature: Avoids first 15 minutes (high volatility period)

Won't generate signals outside trading hours

🛡️ Signal Quality

Rates each signal: 🔥 STRONG, ⚡ MEDIUM, or ⚠️ WEAK

Requires minimum 15 bars between signals (prevents overtrading)

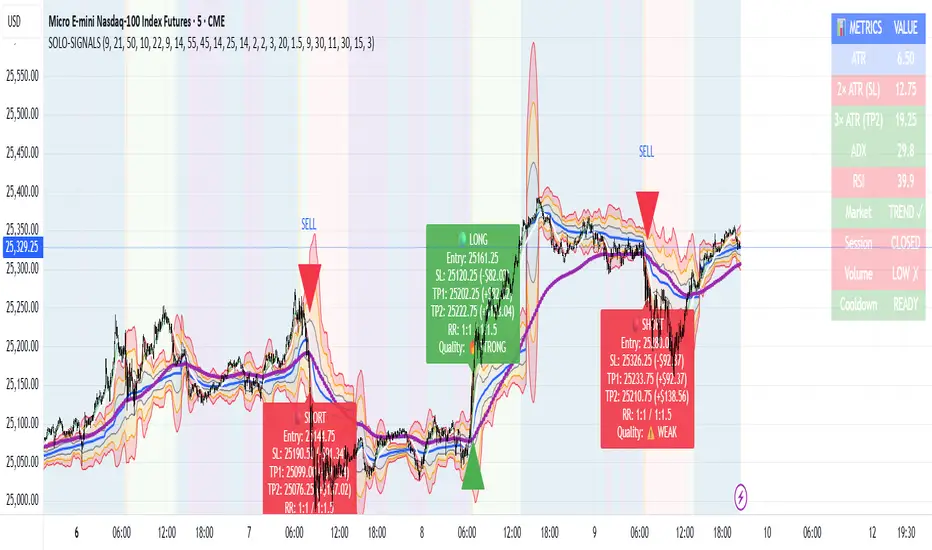

📊 Visual Dashboard

Shows real-time metrics:

ATR values

ADX (trend strength)

RSI (momentum)

Market condition (TREND/CHOP)

Session status

Volume status

Signal cooldown timer

Visual Elements

📈 VWAP with standard deviation bands (1σ, 2σ, 3σ)

📉 Multiple EMAs with trend-based coloring

🟢/🔴 Buy/Sell arrows on chart

📋 Detailed trade labels showing entry, SL, TPs, and risk-reward ratios

🎨 Background highlighting for market conditions

Safety Features

Cooldown period between signals

Session restrictions (no trading outside set hours)

First 15-minute avoidance (post-open volatility)

Multi-confirmation requirement (all 7 conditions must align)

Trend filter (ADX minimum to avoid choppy markets)

Best For

Day traders focused on morning sessions

MNQ futures traders

Traders who prefer systematic, rule-based entries

Those wanting pre-calculated risk management levels

Customization

All parameters are adjustable:

EMA periods

MACD settings

RSI thresholds

ADX minimum

ATR multipliers

Session times

Visual preferences

This indicator is designed to be conservative — it waits for strong confirmation before signaling, which means fewer but potentially higher-quality trades.

What It Does

This is a TradingView indicator designed for day trading MNQ (Micro Nasdaq-100 futures) during morning sessions. It generates BUY and SELL signals only when multiple technical conditions align, helping traders identify high-probability trade setups.

Core Strategy

BUY Signal Requirements (All must be true):

✅ Price above VWAP (volume-weighted average price)

✅ Fast EMA (9) above Slow EMA (21) - uptrend confirmation

✅ Price above 15-minute 50 EMA - higher timeframe confirmation

✅ MACD histogram positive - momentum confirmation

✅ RSI above 55 - strength confirmation

✅ ADX above 25 - trending market (not choppy)

✅ Volume 1.5x above average - strong participation

SELL Signal (opposite conditions)

Key Features

🎯 Risk Management

Stop Loss: 2× ATR (Average True Range)

Take Profit 1: 2× ATR (1:2 risk-reward)

Take Profit 2: 3× ATR (1:3 risk-reward)

Dollar values: Calculates P&L based on MNQ's $2/point value

⏰ Session Filter

Default: 9:30 AM - 11:30 AM ET (customizable)

Safety feature: Avoids first 15 minutes (high volatility period)

Won't generate signals outside trading hours

🛡️ Signal Quality

Rates each signal: 🔥 STRONG, ⚡ MEDIUM, or ⚠️ WEAK

Requires minimum 15 bars between signals (prevents overtrading)

📊 Visual Dashboard

Shows real-time metrics:

ATR values

ADX (trend strength)

RSI (momentum)

Market condition (TREND/CHOP)

Session status

Volume status

Signal cooldown timer

Visual Elements

📈 VWAP with standard deviation bands (1σ, 2σ, 3σ)

📉 Multiple EMAs with trend-based coloring

🟢/🔴 Buy/Sell arrows on chart

📋 Detailed trade labels showing entry, SL, TPs, and risk-reward ratios

🎨 Background highlighting for market conditions

Safety Features

Cooldown period between signals

Session restrictions (no trading outside set hours)

First 15-minute avoidance (post-open volatility)

Multi-confirmation requirement (all 7 conditions must align)

Trend filter (ADX minimum to avoid choppy markets)

Best For

Day traders focused on morning sessions

MNQ futures traders

Traders who prefer systematic, rule-based entries

Those wanting pre-calculated risk management levels

Customization

All parameters are adjustable:

EMA periods

MACD settings

RSI thresholds

ADX minimum

ATR multipliers

Session times

Visual preferences

This indicator is designed to be conservative — it waits for strong confirmation before signaling, which means fewer but potentially higher-quality trades.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.