OPEN-SOURCE SCRIPT

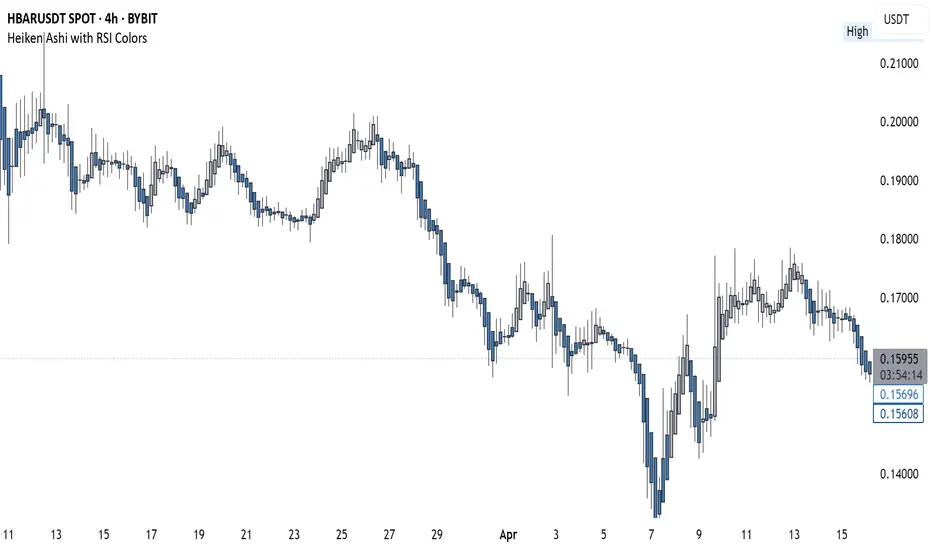

Heiken Ashi with RSI Colors

📜 Description:

This indicator blends Heiken Ashi candlesticks with RSI-based color filters to help traders quickly assess both trend structure and momentum extremes in a single glance.

✅ Heiken Ashi Mode: Smooths out price action to highlight clearer trends and suppress noise

✅ RSI Coloring: Applies candle color changes based on whether RSI is overbought, oversold, or neutral

It allows traders to visually spot potential exhaustion zones, continuation trends, or early reversal areas with enhanced clarity.

🔧 Settings:

Use Heiken Ashi Candles: Toggle between standard candles and Heiken Ashi smoothed values

RSI Length: Controls the lookback for RSI calculation (default 14)

Overbought/Oversold Levels: Customize your thresholds for extreme conditions (default: 70/30)

🎨 Candle Color Logic:

Green (Lime): RSI is overbought → price may be overextended upward

Red: RSI is oversold → price may be overextended downward

Gray: RSI is between extremes → neutral momentum

💡 Use Cases:

Confirm trend momentum with Heiken Ashi structure

Spot potential reversal points using RSI extremes

Enhance entry/exit decisions by combining price action and momentum in a single visual

This indicator blends Heiken Ashi candlesticks with RSI-based color filters to help traders quickly assess both trend structure and momentum extremes in a single glance.

✅ Heiken Ashi Mode: Smooths out price action to highlight clearer trends and suppress noise

✅ RSI Coloring: Applies candle color changes based on whether RSI is overbought, oversold, or neutral

It allows traders to visually spot potential exhaustion zones, continuation trends, or early reversal areas with enhanced clarity.

🔧 Settings:

Use Heiken Ashi Candles: Toggle between standard candles and Heiken Ashi smoothed values

RSI Length: Controls the lookback for RSI calculation (default 14)

Overbought/Oversold Levels: Customize your thresholds for extreme conditions (default: 70/30)

🎨 Candle Color Logic:

Green (Lime): RSI is overbought → price may be overextended upward

Red: RSI is oversold → price may be overextended downward

Gray: RSI is between extremes → neutral momentum

💡 Use Cases:

Confirm trend momentum with Heiken Ashi structure

Spot potential reversal points using RSI extremes

Enhance entry/exit decisions by combining price action and momentum in a single visual

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.