OPEN-SOURCE SCRIPT

Dynamic Volume Based Key Price Levels

Description

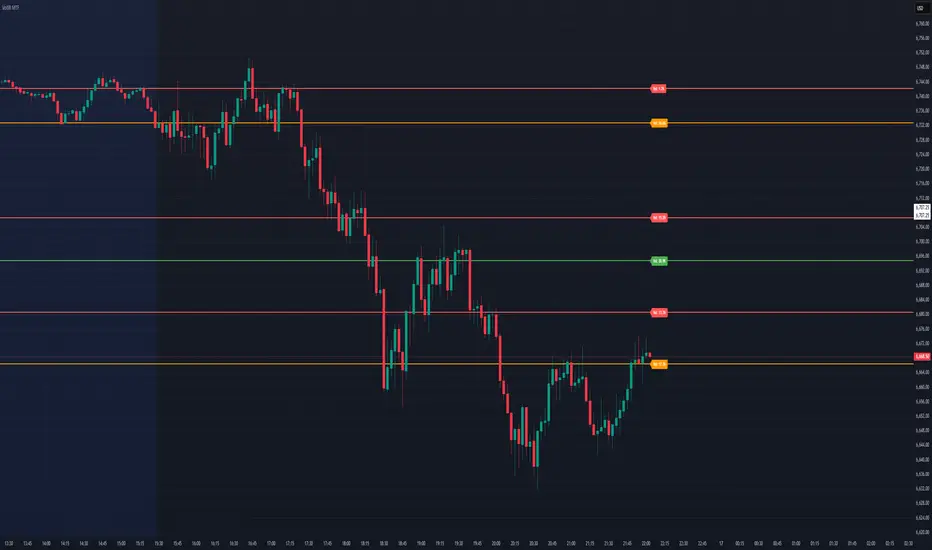

This indicator introduces a volume-based approach to detecting support and resistance zones.

Instead of relying on price swings or pivots, it analyzes where the most trading activity occurred within a selected lookback period, then marks those levels directly on the chart.

The result is a clear visual map of price areas with strong historical participation, which often act as reaction zones in future moves.

How It Works

The script divides the analyzed range into price bins, sums traded volume for each bin, and highlights the strongest levels based on their share of total volume.

It also includes an optional multi-timeframe mode, allowing traders to analyze higher timeframe volume structures on a lower timeframe chart.

Key Features

🔹 Volume-Based Key Levels Detection: Finds statistically meaningful price zones derived from raw volume data.

🔹 Multi-Timeframe Mode: Optionally use higher timeframe volume to identify key market structure levels.

🔹 Visual Customization: Configure colors, line styles, transparency, and label formatting.

🔹 Automatic Ranking: Highlights the strongest to weakest levels using a color gradient.

🔹 Dynamic Updates: Levels adapt automatically as new bars form.

Inputs Overview

How to Use

This tool helps visualize where market participation was strongest, giving traders a clearer view of potential reaction zones for both intraday and swing analysis.

It’s intended as a visual analytical aid, not a signal generator.

⚠️Disclaimer:

This script is provided for educational and informational purposes only. It is not financial advice and should not be considered a recommendation to buy, sell, or hold any financial instrument. Trading involves significant risk of loss and is not suitable for every investor. Users should perform their own due diligence and consult with a licensed financial advisor before making any trading decisions. The author does not guarantee any profits or results from using this script, and assumes no liability for any losses incurred. Use this script at your own risk.

This indicator introduces a volume-based approach to detecting support and resistance zones.

Instead of relying on price swings or pivots, it analyzes where the most trading activity occurred within a selected lookback period, then marks those levels directly on the chart.

The result is a clear visual map of price areas with strong historical participation, which often act as reaction zones in future moves.

How It Works

The script divides the analyzed range into price bins, sums traded volume for each bin, and highlights the strongest levels based on their share of total volume.

It also includes an optional multi-timeframe mode, allowing traders to analyze higher timeframe volume structures on a lower timeframe chart.

Key Features

🔹 Volume-Based Key Levels Detection: Finds statistically meaningful price zones derived from raw volume data.

🔹 Multi-Timeframe Mode: Optionally use higher timeframe volume to identify key market structure levels.

🔹 Visual Customization: Configure colors, line styles, transparency, and label formatting.

🔹 Automatic Ranking: Highlights the strongest to weakest levels using a color gradient.

🔹 Dynamic Updates: Levels adapt automatically as new bars form.

Inputs Overview

- Lookback Bars: Number of historical bars used for analysis.

- Price Bins: Defines the precision of volume distribution.

- Number of Lines: How many key levels to display.

- Min Volume %: Filters out less relevant low-volume bins.

- Extend Lines: Choose how lines are projected into the future.

- Use Higher Timeframe: Pull data from a higher timeframe for broader perspective.

How to Use

- Apply the indicator to your chart and adjust the lookback period.

- Optionally enable higher timeframe mode for more stable long-term zones.

- Observe the horizontal lines — these represent volume-weighted support and resistance areas.

- Combine with your existing tools for trend or momentum confirmation.

This tool helps visualize where market participation was strongest, giving traders a clearer view of potential reaction zones for both intraday and swing analysis.

It’s intended as a visual analytical aid, not a signal generator.

⚠️Disclaimer:

This script is provided for educational and informational purposes only. It is not financial advice and should not be considered a recommendation to buy, sell, or hold any financial instrument. Trading involves significant risk of loss and is not suitable for every investor. Users should perform their own due diligence and consult with a licensed financial advisor before making any trading decisions. The author does not guarantee any profits or results from using this script, and assumes no liability for any losses incurred. Use this script at your own risk.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.