PROTECTED SOURCE SCRIPT

Updated Sweep + BOS Alerts

//version=5

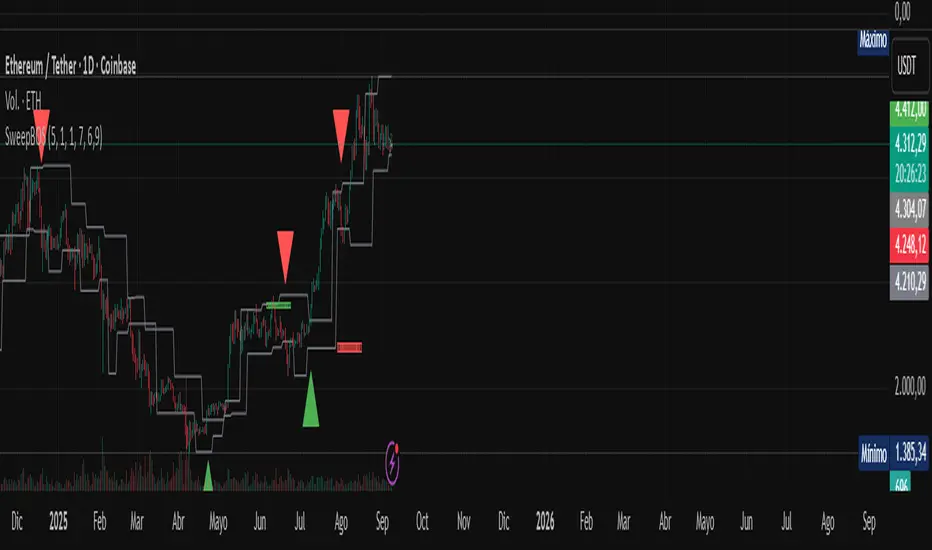

indicator("Sweep + BOS Alerts", overlay=true, shorttitle="SweepBOS")

// === User inputs ===

// Lookback length for pivot highs/lows. Higher values produce fewer swings/signals.

length = input.int(5, title="Pivot length", minval=1, maxval=50)

// Minimum relative wick size to qualify as a sweep (ratio of wick to body)

minWickMult = input.float(1.5, title="Min wick‑to‑body ratio", minval=0.0)

// Volume confirmation multiplier: volume must be at least this multiple of average volume

volMult = input.float(1.0, title="Volume multiple for BOS confirmation", minval=0.0)

// Maximum signals per month (to limit to ~5–7 as requested)

maxSignals = input.int(7, title="Max signals per month", minval=1, maxval=20)

// Only alert once per sweep/BOS pair

onlyFirst = input.bool(true, title="Only first BOS after sweep")

// === Helpers ===

// Identify pivot highs/lows using built‑in pivot functions

pivotHighPrice = ta.pivothigh(high, length, length)

pivotLowPrice = ta.pivotlow(low, length, length)

// Track the most recent swing high/low and their bar indices

var float lastSwingHigh = na

var float lastSwingLow = na

var int lastSwingHighBar = na

var int lastSwingLowBar = na

if not na(pivotHighPrice)

lastSwingHigh := pivotHighPrice

lastSwingHighBar := bar_index - length

if not na(pivotLowPrice)

lastSwingLow := pivotLowPrice

lastSwingLowBar := bar_index - length

// Calculate average volume for confirmation

avgVol = ta.sma(volume, 20)

// === Sweep detection ===

// Flags to signal a sweep occurred and BOS expected

var bool awaitingBearBOS = false

var bool awaitingBullBOS = false

// Check for sell sweep (buyside liquidity sweep)

// Condition: current high breaks previous swing high and closes back below the swing high with a long upper wick

bearSweep = false

if (not na(lastSwingHigh) and high > lastSwingHigh)

// compute candle components

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

isLongUpperWick = bodySize > 0 ? upperWick / bodySize >= minWickMult : false

// price closes below the last swing high (reversion inside range)

closesInside = close < lastSwingHigh

bearSweep := isLongUpperWick and closesInside

// Check for buy sweep (sellside liquidity sweep)

bullSweep = false

if (not na(lastSwingLow) and low < lastSwingLow)

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

isLongLowerWick = bodySize > 0 ? lowerWick / bodySize >= minWickMult : false

closesInside = close > lastSwingLow

bullSweep := isLongLowerWick and closesInside

// When sweep occurs, set awaiting BOS flags

if bearSweep

awaitingBearBOS := true

awaitingBullBOS := false

if bullSweep

awaitingBullBOS := true

awaitingBearBOS := false

// === BOS detection ===

// Evaluate BOS only if a sweep has happened

autoSellSignal = false

autoBuySignal = false

if awaitingBearBOS

// Look for break of structure to downside: close lower than last swing low.

// Confirm with volume if needed: if average volume is zero (e.g. at start of data), accept any volume.

bool volOkDown = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingLow) and close < lastSwingLow and volOkDown)

autoSellSignal := true

// If only first BOS should trigger, reset flag; otherwise keep awaiting further BOS

awaitingBearBOS := not onlyFirst

if awaitingBullBOS

// Look for break of structure to upside: close higher than last swing high.

bool volOkUp = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingHigh) and close > lastSwingHigh and volOkUp)

autoBuySignal := true

awaitingBullBOS := not onlyFirst

// === Signal throttling per month ===

// Convert current date to month index (year*12 + month)

monthIndex = year * 12 + month

var int currentMonth = monthIndex

var int signalCount = 0

if monthIndex != currentMonth

currentMonth := monthIndex

signalCount := 0

// Limit number of signals per month

buyAllowed = autoBuySignal and (signalCount < maxSignals)

sellAllowed = autoSellSignal and (signalCount < maxSignals)

if buyAllowed or sellAllowed

signalCount += 1

// === Plotting signals ===

plotshape(buyAllowed, title="Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny, text="BUY")

plotshape(sellAllowed, title="Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, text="SELL")

// Plot swing levels (optional for visual reference)

plot(lastSwingHigh, title="Swing High", color=color.gray, style=plot.style_linebr)

plot(lastSwingLow, title="Swing Low", color=color.gray, style=plot.style_linebr)

// === Alerts ===

// These alertconditions allow TradingView to trigger notifications

alertcondition(buyAllowed, title="Buy Alert", message="Sweep+BOS Buy signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

alertcondition(sellAllowed, title="Sell Alert", message="Sweep+BOS Sell signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

indicator("Sweep + BOS Alerts", overlay=true, shorttitle="SweepBOS")

// === User inputs ===

// Lookback length for pivot highs/lows. Higher values produce fewer swings/signals.

length = input.int(5, title="Pivot length", minval=1, maxval=50)

// Minimum relative wick size to qualify as a sweep (ratio of wick to body)

minWickMult = input.float(1.5, title="Min wick‑to‑body ratio", minval=0.0)

// Volume confirmation multiplier: volume must be at least this multiple of average volume

volMult = input.float(1.0, title="Volume multiple for BOS confirmation", minval=0.0)

// Maximum signals per month (to limit to ~5–7 as requested)

maxSignals = input.int(7, title="Max signals per month", minval=1, maxval=20)

// Only alert once per sweep/BOS pair

onlyFirst = input.bool(true, title="Only first BOS after sweep")

// === Helpers ===

// Identify pivot highs/lows using built‑in pivot functions

pivotHighPrice = ta.pivothigh(high, length, length)

pivotLowPrice = ta.pivotlow(low, length, length)

// Track the most recent swing high/low and their bar indices

var float lastSwingHigh = na

var float lastSwingLow = na

var int lastSwingHighBar = na

var int lastSwingLowBar = na

if not na(pivotHighPrice)

lastSwingHigh := pivotHighPrice

lastSwingHighBar := bar_index - length

if not na(pivotLowPrice)

lastSwingLow := pivotLowPrice

lastSwingLowBar := bar_index - length

// Calculate average volume for confirmation

avgVol = ta.sma(volume, 20)

// === Sweep detection ===

// Flags to signal a sweep occurred and BOS expected

var bool awaitingBearBOS = false

var bool awaitingBullBOS = false

// Check for sell sweep (buyside liquidity sweep)

// Condition: current high breaks previous swing high and closes back below the swing high with a long upper wick

bearSweep = false

if (not na(lastSwingHigh) and high > lastSwingHigh)

// compute candle components

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

isLongUpperWick = bodySize > 0 ? upperWick / bodySize >= minWickMult : false

// price closes below the last swing high (reversion inside range)

closesInside = close < lastSwingHigh

bearSweep := isLongUpperWick and closesInside

// Check for buy sweep (sellside liquidity sweep)

bullSweep = false

if (not na(lastSwingLow) and low < lastSwingLow)

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

isLongLowerWick = bodySize > 0 ? lowerWick / bodySize >= minWickMult : false

closesInside = close > lastSwingLow

bullSweep := isLongLowerWick and closesInside

// When sweep occurs, set awaiting BOS flags

if bearSweep

awaitingBearBOS := true

awaitingBullBOS := false

if bullSweep

awaitingBullBOS := true

awaitingBearBOS := false

// === BOS detection ===

// Evaluate BOS only if a sweep has happened

autoSellSignal = false

autoBuySignal = false

if awaitingBearBOS

// Look for break of structure to downside: close lower than last swing low.

// Confirm with volume if needed: if average volume is zero (e.g. at start of data), accept any volume.

bool volOkDown = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingLow) and close < lastSwingLow and volOkDown)

autoSellSignal := true

// If only first BOS should trigger, reset flag; otherwise keep awaiting further BOS

awaitingBearBOS := not onlyFirst

if awaitingBullBOS

// Look for break of structure to upside: close higher than last swing high.

bool volOkUp = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingHigh) and close > lastSwingHigh and volOkUp)

autoBuySignal := true

awaitingBullBOS := not onlyFirst

// === Signal throttling per month ===

// Convert current date to month index (year*12 + month)

monthIndex = year * 12 + month

var int currentMonth = monthIndex

var int signalCount = 0

if monthIndex != currentMonth

currentMonth := monthIndex

signalCount := 0

// Limit number of signals per month

buyAllowed = autoBuySignal and (signalCount < maxSignals)

sellAllowed = autoSellSignal and (signalCount < maxSignals)

if buyAllowed or sellAllowed

signalCount += 1

// === Plotting signals ===

plotshape(buyAllowed, title="Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny, text="BUY")

plotshape(sellAllowed, title="Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, text="SELL")

// Plot swing levels (optional for visual reference)

plot(lastSwingHigh, title="Swing High", color=color.gray, style=plot.style_linebr)

plot(lastSwingLow, title="Swing Low", color=color.gray, style=plot.style_linebr)

// === Alerts ===

// These alertconditions allow TradingView to trigger notifications

alertcondition(buyAllowed, title="Buy Alert", message="Sweep+BOS Buy signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

alertcondition(sellAllowed, title="Sell Alert", message="Sweep+BOS Sell signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

Release Notes

//version=5indicator("Sweep + BOS Alerts", overlay=true, shorttitle="SweepBOS")

// === User inputs ===

length = input.int(5, title="Pivot length", minval=1, maxval=50)

minWickMult = input.float(1.5, title="Min wick‑to‑body ratio", minval=0.0)

volMult = input.float(1.0, title="Volume multiple", minval=0.0)

onlyFirst = input.bool(true, title="Only first BOS after sweep")

buyColor = input.color(color.green, title="Buy arrow color")

sellColor = input.color(color.red, title="Sell arrow color")

// Liquidity detection

liqLen = input.int(7, title='Liquidity Detection Length', minval=3, maxval=13, group='Liquidity')

liqMargin = input.float(6.9, title='Liquidity Margin', minval=4, maxval=9, step=0.1, group='Liquidity')

showLiqBuy = input.bool(true, title='Show Buyside Liquidity', group='Liquidity')

showLiqSell = input.bool(true, title='Show Sellside Liquidity', group='Liquidity')

// === Helpers ===

pivotHighPrice = ta.pivothigh(high, length, length)

pivotLowPrice = ta.pivotlow(low, length, length)

var float lastSwingHigh = na

var float lastSwingLow = na

if not na(pivotHighPrice)

lastSwingHigh := pivotHighPrice

if not na(pivotLowPrice)

lastSwingLow := pivotLowPrice

avgVol = ta.sma(volume, 20)

// === Sweep detection ===

var bool awaitingBearBOS = false

var bool awaitingBullBOS = false

bearSweep = false

if not na(lastSwingHigh) and high > lastSwingHigh

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

isLongUpper = bodySize > 0 ? upperWick / bodySize >= minWickMult : false

closesInside = close < lastSwingHigh

bearSweep := isLongUpper and closesInside

bullSweep = false

if not na(lastSwingLow) and low < lastSwingLow

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

isLongLower = bodySize > 0 ? lowerWick / bodySize >= minWickMult : false

closesInside = close > lastSwingLow

bullSweep := isLongLower and closesInside

if bearSweep

awaitingBearBOS := true

awaitingBullBOS := false

if bullSweep

awaitingBullBOS := true

awaitingBearBOS := false

// === BOS detection ===

autoSellSignal = false

autoBuySignal = false

if awaitingBearBOS

bool volOkDown = (avgVol == 0) or (volume >= volMult * avgVol)

if not na(lastSwingLow) and close < lastSwingLow and volOkDown

autoSellSignal := true

awaitingBearBOS := not onlyFirst

if awaitingBullBOS

bool volOkUp = (avgVol == 0) or (volume >= volMult * avgVol)

if not na(lastSwingHigh) and close > lastSwingHigh and volOkUp

autoBuySignal := true

awaitingBullBOS := not onlyFirst

// === Signals without monthly limits ===

buyAllowed = autoBuySignal

sellAllowed = autoSellSignal

// === Liquidity detection ===

liqHigh = ta.pivothigh(high, liqLen, liqLen)

liqLow = ta.pivotlow (low, liqLen, liqLen)

var float[] liq_highs = array.new<float>()

var float[] liq_lows = array.new<float>()

if not na(liqHigh)

array.unshift(liq_highs, liqHigh)

if array.size(liq_highs) > 50

array.pop(liq_highs)

if not na(liqLow)

array.unshift(liq_lows, liqLow)

if array.size(liq_lows) > 50

array.pop(liq_lows)

liqATR = ta.atr(10)

liqDetect(level, prices) =>

int count = 0

float minVal = na

float maxVal = na

for i = 0 to array.size(prices) - 1

float p = prices.get(i)

if p < level + (liqATR/liqMargin) and p > level - (liqATR/liqMargin)

count += 1

minVal := na(minVal) ? p : math.min(minVal, p)

maxVal := na(maxVal) ? p : math.max(maxVal, p)

if count > 2

[minVal, maxVal]

else

[na, na]

var box[] liqBuyZones = array.new<box>()

var box[] liqSellZones = array.new<box>()

if bar_index > 0

if array.size(liq_highs) > 2 and showLiqBuy

[liMin, liMax] = liqDetect(liq_highs.get(0), liq_highs)

if not na(liMin)

bool updated = false

if array.size(liqBuyZones) > 0

for i = 0 to array.size(liqBuyZones) - 1

box b = liqBuyZones.get(i)

if close < b.get_top() and close > b.get_bottom()

b.set_top(liMax + (liqATR/liqMargin))

b.set_bottom(liMin - (liqATR/liqMargin))

b.set_right(bar_index)

updated := true

break

if not updated

box newBox = box.new(bar_index - liqLen, liMax + (liqATR/liqMargin),

bar_index + liqLen, liMin - (liqATR/liqMargin),

bgcolor=color.new(color.green,80), border_color=color.new(color.green,0))

array.unshift(liqBuyZones, newBox)

if array.size(liqBuyZones) > 5

box oldBox = array.pop(liqBuyZones)

oldBox.delete()

if array.size(liq_lows) > 2 and showLiqSell

[liMinS, liMaxS] = liqDetect(liq_lows.get(0), liq_lows)

if not na(liMinS)

bool updatedS = false

if array.size(liqSellZones) > 0

for i = 0 to array.size(liqSellZones) - 1

box b = liqSellZones.get(i)

if close < b.get_top() and close > b.get_bottom()

b.set_top(liMaxS + (liqATR/liqMargin))

b.set_bottom(liMinS - (liqATR/liqMargin))

b.set_right(bar_index)

updatedS := true

break

if not updatedS

box newBoxS = box.new(bar_index - liqLen, liMaxS + (liqATR/liqMargin),

bar_index + liqLen, liMinS - (liqATR/liqMargin),

bgcolor=color.new(color.red,80), border_color=color.new(color.red,0))

array.unshift(liqSellZones, newBoxS)

if array.size(liqSellZones) > 5

box oldBoxS = array.pop(liqSellZones)

oldBoxS.delete()

// === Plotting ===

// Usa size.normal para flechas más grandes; puedes cambiarlo a size.small, size.large, etc.

plotshape(buyAllowed, title="Buy Signal", style=shape.arrowup, location=location.belowbar, color=buyColor, size=size.normal)

plotshape(sellAllowed, title="Sell Signal", style=shape.arrowdown, location=location.abovebar, color=sellColor, size=size.normal)

// Swing levels

plot(lastSwingHigh, title="Swing High", color=color.gray, style=plot.style_linebr)

plot(lastSwingLow, title="Swing Low", color=color.gray, style=plot.style_linebr)

// Alertas

alertcondition(buyAllowed, title="Buy Alert", message="Sweep+BOS Buy signal on {{ticker}} @ {{close}}")

alertcondition(sellAllowed, title="Sell Alert", message="Sweep+BOS Sell signal on {{ticker}} @ {{close}}")

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.