OPEN-SOURCE SCRIPT

🔥 MomentumWave HA Trend

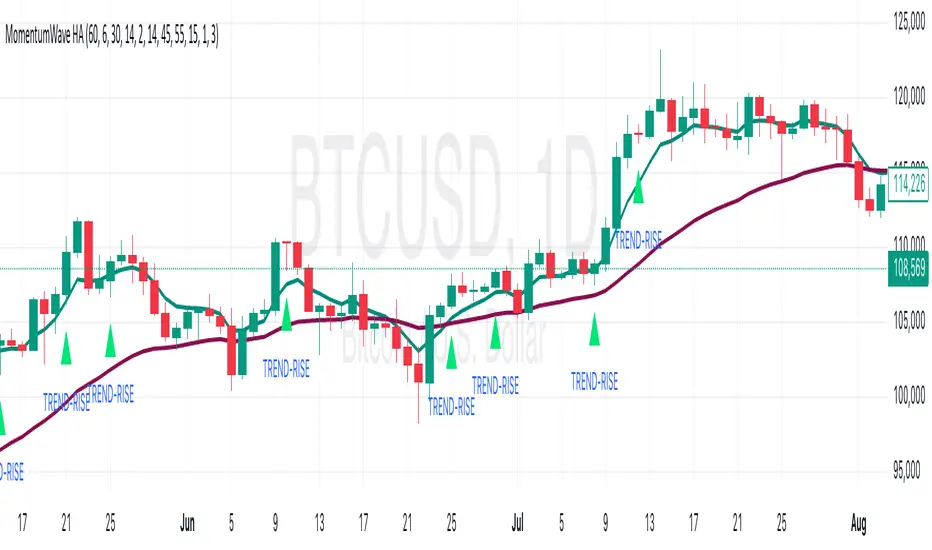

1. Heikin Ashi Candles

The indicator calculates Heikin Ashi candles to smooth price movements.

Heikin Ashi reduces market noise, making it easier to spot trends than regular candlesticks.

Bullish candle: close > open → green-ish candle.

Bearish candle: close < open → red-ish candle.

2. Exponential Moving Averages (EMA)

Two EMAs are plotted on the chart: fast EMA and slow EMA.

Fast EMA: reacts quickly to recent price changes.

Slow EMA: shows the overall trend.

When fast EMA > slow EMA → market is trending up.

When fast EMA < slow EMA → market is trending down.

3. Momentum Filters

EMA slope: the indicator checks if the fast EMA is rising or falling to confirm momentum.

ROC (Rate of Change): ensures price movement is strong in the current direction.

RSI filter: prevents signals when the market is overbought or oversold.

RSI above lower bound → allows bullish trend.

RSI below upper bound → allows bearish trend.

4. Optional MACD Filter

If enabled, the indicator uses the MACD slope to confirm trend strength.

This reduces false signals in weak trend periods.

5. Confirmation of Consecutive Candles

The indicator requires a certain number of consecutive Heikin Ashi candles in the same direction before generating a signal.

This avoids acting on a single volatile candle and increases accuracy.

6. Cooldown Period

After a signal is generated, a cooldown period prevents immediate repeated signals.

This reduces overtrading in volatile markets.

7. Signals

TREND-RISE (triangle below candle): indicates a confirmed bullish trend.

TREND-FALL (triangle above candle): indicates a confirmed bearish trend.

Alerts can be set for both signals to notify you in real time.

8. How to Use

Open a chart and add the MomentumWave HA Trend indicator.

Look at the EMA fast (teal) and EMA slow (maroon) lines.

Wait for a signal:

TREND-RISE: consider long positions or buying opportunities.

TREND-FALL: consider short positions or selling opportunities.

Check RSI and MACD (if enabled) to confirm signal strength.

Observe consecutive Heikin Ashi candle confirmation.

Respect the cooldown period before opening another position.

Apply risk management (stop-loss, position size) based on your strategy.

9. Disclaimer

This indicator is a technical analysis tool and does not guarantee profits.

Always use proper risk management and validate signals with your own analysis before trading.

The indicator calculates Heikin Ashi candles to smooth price movements.

Heikin Ashi reduces market noise, making it easier to spot trends than regular candlesticks.

Bullish candle: close > open → green-ish candle.

Bearish candle: close < open → red-ish candle.

2. Exponential Moving Averages (EMA)

Two EMAs are plotted on the chart: fast EMA and slow EMA.

Fast EMA: reacts quickly to recent price changes.

Slow EMA: shows the overall trend.

When fast EMA > slow EMA → market is trending up.

When fast EMA < slow EMA → market is trending down.

3. Momentum Filters

EMA slope: the indicator checks if the fast EMA is rising or falling to confirm momentum.

ROC (Rate of Change): ensures price movement is strong in the current direction.

RSI filter: prevents signals when the market is overbought or oversold.

RSI above lower bound → allows bullish trend.

RSI below upper bound → allows bearish trend.

4. Optional MACD Filter

If enabled, the indicator uses the MACD slope to confirm trend strength.

This reduces false signals in weak trend periods.

5. Confirmation of Consecutive Candles

The indicator requires a certain number of consecutive Heikin Ashi candles in the same direction before generating a signal.

This avoids acting on a single volatile candle and increases accuracy.

6. Cooldown Period

After a signal is generated, a cooldown period prevents immediate repeated signals.

This reduces overtrading in volatile markets.

7. Signals

TREND-RISE (triangle below candle): indicates a confirmed bullish trend.

TREND-FALL (triangle above candle): indicates a confirmed bearish trend.

Alerts can be set for both signals to notify you in real time.

8. How to Use

Open a chart and add the MomentumWave HA Trend indicator.

Look at the EMA fast (teal) and EMA slow (maroon) lines.

Wait for a signal:

TREND-RISE: consider long positions or buying opportunities.

TREND-FALL: consider short positions or selling opportunities.

Check RSI and MACD (if enabled) to confirm signal strength.

Observe consecutive Heikin Ashi candle confirmation.

Respect the cooldown period before opening another position.

Apply risk management (stop-loss, position size) based on your strategy.

9. Disclaimer

This indicator is a technical analysis tool and does not guarantee profits.

Always use proper risk management and validate signals with your own analysis before trading.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.