OPEN-SOURCE SCRIPT

ScalpSwing Pro Setup

Script Overview

This script is a multi-tool setup designed for both scalping (1m–5m) and swing trading (1H–4H–Daily). It combines the power of trend-following, momentum, and mean-reversion tools:

What’s Included in the Script

1. EMA Indicators (20, 50, 200)

- EMA 20 (blue): Short-term trend

- EMA 50 (orange): Medium-term trend

- EMA 200 (red): Long-term trend

- Use:

- EMA 20 crossing above 50 → bullish trend

- EMA 20 crossing below 50 → bearish trend

- Price above 200 EMA = uptrend bias

2. VWAP (Volume Weighted Average Price)

- Shows the average price weighted by volume

- Best used in intraday (1m to 15m timeframes)

- Use:

- Price bouncing from VWAP = reversion trade

- Price far from VWAP = likely pullback incoming

3. RSI (14) + Key Levels

- Shows momentum and overbought/oversold zones

- Levels:

- 70 = Overbought (potential sell)

- 30 = Oversold (potential buy)

- 50 = Trend confirmation

- Use:

- RSI 30–50 in uptrend = dip buying zone

- RSI 70–50 in downtrend = pullback selling zone

4. MACD Crossovers

- Standard MACD with histogram & cross alerts

- Shows trend momentum shifts

- Green triangle = Bullish MACD crossover

- Red triangle = Bearish MACD crossover

- Use:

- Confirm swing trades with MACD crossover

- Combine with RSI divergence

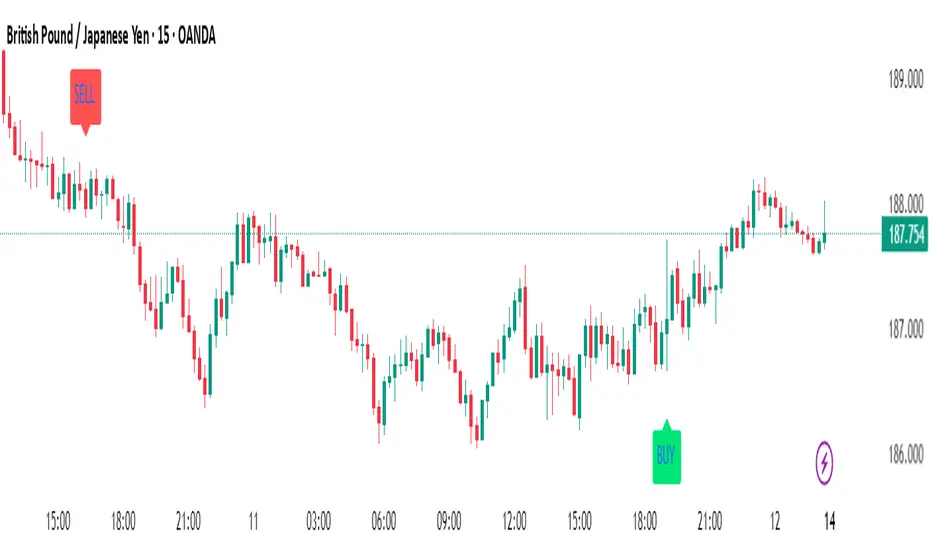

5. Buy & Sell Signal Logic

BUY SIGNAL triggers when:

- EMA 20 crosses above EMA 50

- RSI is between 50 and 70 (momentum bullish, not overbought)

SELL SIGNAL triggers when:

- EMA 20 crosses below EMA 50

- RSI is between 30 and 50 (bearish momentum, not oversold)

These signals appear as:

- BUY: Green label below the candle

- SELL: Red label above the candle

How to Trade with It

For Scalping (1m–5m):

- Focus on EMA crosses near VWAP

- Confirm with RSI between 50–70 (buy) or 50–30 (sell)

- Use MACD triangle as added confluence

For Swing (1H–4H–Daily):

- Look for EMA 20–50 cross + price above EMA 200

- Confirm trend with MACD and RSI

- Trade breakout or pullback depending on structure

This script is a multi-tool setup designed for both scalping (1m–5m) and swing trading (1H–4H–Daily). It combines the power of trend-following, momentum, and mean-reversion tools:

What’s Included in the Script

1. EMA Indicators (20, 50, 200)

- EMA 20 (blue): Short-term trend

- EMA 50 (orange): Medium-term trend

- EMA 200 (red): Long-term trend

- Use:

- EMA 20 crossing above 50 → bullish trend

- EMA 20 crossing below 50 → bearish trend

- Price above 200 EMA = uptrend bias

2. VWAP (Volume Weighted Average Price)

- Shows the average price weighted by volume

- Best used in intraday (1m to 15m timeframes)

- Use:

- Price bouncing from VWAP = reversion trade

- Price far from VWAP = likely pullback incoming

3. RSI (14) + Key Levels

- Shows momentum and overbought/oversold zones

- Levels:

- 70 = Overbought (potential sell)

- 30 = Oversold (potential buy)

- 50 = Trend confirmation

- Use:

- RSI 30–50 in uptrend = dip buying zone

- RSI 70–50 in downtrend = pullback selling zone

4. MACD Crossovers

- Standard MACD with histogram & cross alerts

- Shows trend momentum shifts

- Green triangle = Bullish MACD crossover

- Red triangle = Bearish MACD crossover

- Use:

- Confirm swing trades with MACD crossover

- Combine with RSI divergence

5. Buy & Sell Signal Logic

BUY SIGNAL triggers when:

- EMA 20 crosses above EMA 50

- RSI is between 50 and 70 (momentum bullish, not overbought)

SELL SIGNAL triggers when:

- EMA 20 crosses below EMA 50

- RSI is between 30 and 50 (bearish momentum, not oversold)

These signals appear as:

- BUY: Green label below the candle

- SELL: Red label above the candle

How to Trade with It

For Scalping (1m–5m):

- Focus on EMA crosses near VWAP

- Confirm with RSI between 50–70 (buy) or 50–30 (sell)

- Use MACD triangle as added confluence

For Swing (1H–4H–Daily):

- Look for EMA 20–50 cross + price above EMA 200

- Confirm trend with MACD and RSI

- Trade breakout or pullback depending on structure

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.