OPEN-SOURCE SCRIPT

Updated Buying Opportunity Score V2.1

Overview

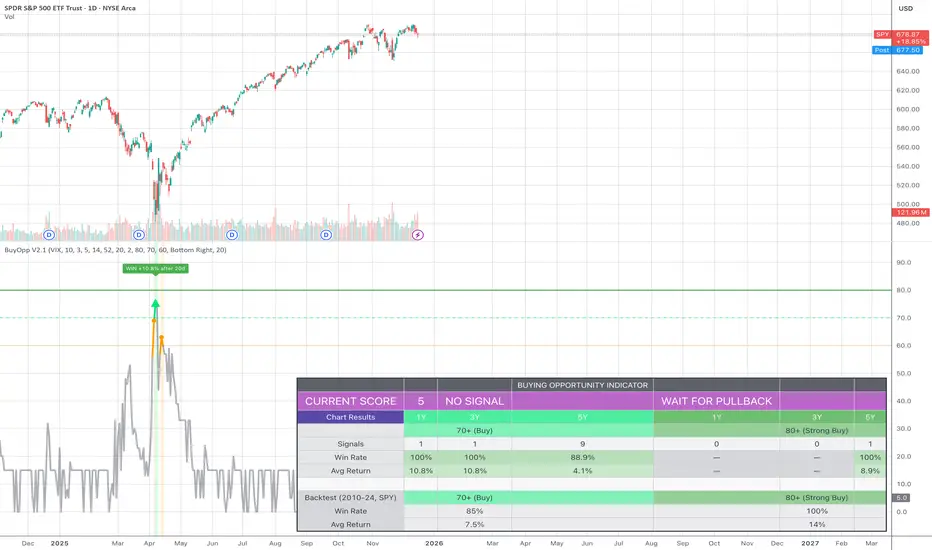

A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

Release Notes

Overview:A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

Release Notes

OverviewA composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Current Score

The table displays your live score (0-100) with context:

0-29 = WAIT FOR PULLBACK - Market calm, no opportunity

30-49 = NOT ACTIONABLE - Mild stress

50-59 = MONITOR - Fear rising

60-69 = WATCH - Potential entry soon

70-79 = BUY - Consider entering

80+ = STRONG BUY - High conviction entry

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS result after 20 days

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Check the CURRENT SCORE row for today's reading

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Chart Results show rolling 1Y/3Y/5Y performance from loaded data

Backtest row shows validated 2010-2024 SPY results

Past performance does not guarantee future results

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.