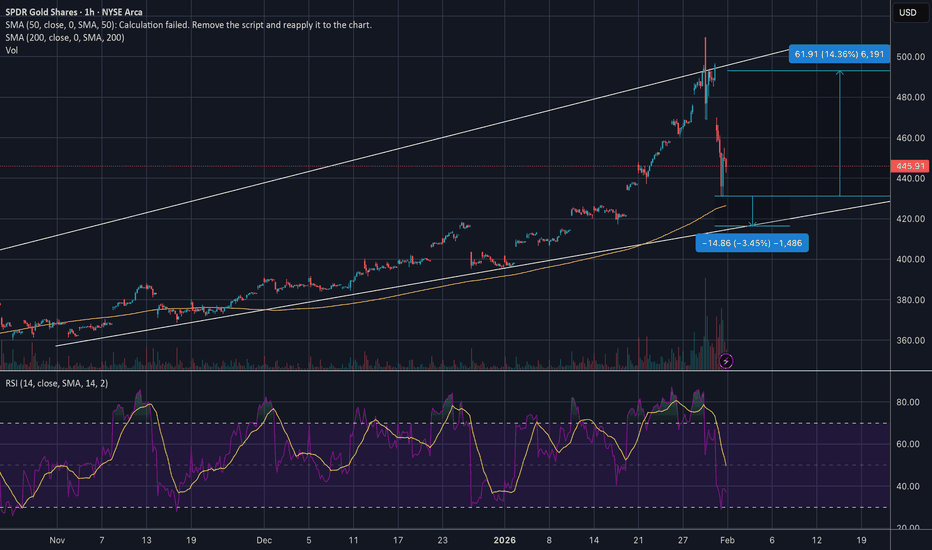

GLD shortFib# XYABCD pattern,

**Better both XY and AY crossed SMA50. Here is not perfect.

AY=XY * 2.618 (or 1.618, 3.618)

AB=AY * 0.786

CB=AB * 0.382 (or 0.5, 0.618)

CD=XY * 1.618 (0r 2.24 )

Short entry 508

Stop 516

Target 393 (B point), 369 (D point)

Buy NUGT Put as a tool to short GLD

NUGT is GLD x

Key stats

About SPDR Gold Shares

Home page

Inception date

Nov 18, 2004

Structure

Grantor Trust

Replication method

Physical

Distribution tax treatment

Return of capital

Income tax type

Collectibles

Max ST capital gains rate

39.60%

Max LT capital gains rate

28.00%

Primary advisor

World Gold Trust Services LLC

Distributor

State Street Corp. (Fund Distributor)

Identifiers

3

ISIN US78463V1070

GLD is the first to market to invest directly in physical gold. The product structure reduced the difficulties of buying, storing and insuring physical gold bullion for investors. Actively traded, the shares provide deep liquidity. NAV for the fund is determined using the LBMA PM Gold Price (formerly the London PM Gold Fix), so GLD has an extremely close relationship with spot prices. Its structure as a grantor trust protects investors, trustees cannot lend the gold bars. However, taxes on long-term gains can be steep, as GLD is deemed a collectible by the IRS. Also, GLD's NAV has a larger handle, which corresponds to more gold exposure per share. As such, those impacted by per-share trading costs may prefer GLD over similar funds.

Related funds

Classification

What's in the fund

Exposure type

Miscellaneous

Bonds, Cash & Other100.00%

Miscellaneous100.00%

Cash0.00%

Top 10 holdings

Where does GLD go nextAfter Friday's big flush, where does GLD go next? Nobody can predict the future but we can see what the charts might be saying.

It's too early to say for sure, but it appears that GLD has found a consolidation level at ~445, about half way between the 50 and 200 SMA and below the fib extension lev

Can GLD run to $1700?GLD has been on fire recently; does it have more room to run?

Posted idea (linked below) back in 2022 on GLD highlighted a cup and a handle that had a potential for a strong run. There wasn’t a specific price target but it was mentioned a possibility of at least 9X.

Ultimately gold will peak wh

GLD: short- and mid-term projection As long as price continues to close above 397, I’m expecting further short-term upside toward the 430–440 resistance zone, with potential extension to 460 in the coming weeks.

Chart (daily):

Within the broader macro structure, I am viewing these levels as a likely mid-term topping zone, foll

Gold Shockwave: A Tactical Call in a Divided MarketGLD Weekly Signal | 2026-01-20

🎯 Instrument: GLD

🔀 Direction: CALL (LONG)

🎯 Strike: 378.00

💵 Entry Price: 57.42

🎯 Profit Target: 60.06

🛑 Stop Loss: 55.70

📅 Expiry: 2026-01-23

📏 Size: 2.0

📈 Confidence: 56%

⏰ Entry Timing: N/A

🎯 TRADE RECOMMENDATION

Direction: BUY CALLS

Confidence: 56%

Conviction Le

Trading Spotlight: GLD Near Key Support — Watch for Bounce!GLD Weekly Signal | 2026-01-15

🎯 Instrument: GLD

🔀 Direction: CALL (LONG)

🎯 Strike: 369.00

💵 Entry Price: 54.70

🎯 Profit Target: 56.70

🛑 Stop Loss: 52.70

📅 Expiry: 2026-01-23

📏 Size: 2.0

📈 Confidence: 55%

⚡ COMPETITIVE EDGE

Timing Advantage: Thursday positioning often involves gamma rebalancing.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

GLD trades at 455.46 USD today, its price has risen 3.07% in the past 24 hours. Track more dynamics on GLD price chart.

GLD net asset value is 454.81 today — it's risen 11.00% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

GLD assets under management is 172.71 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

GLD price has risen by 11.46% over the last month, and its yearly performance shows a 72.75% increase. See more dynamics on GLD price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 11.00% over the last month, showed a 24.57% increase in three-month performance and has increased by 73.62% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 11.00% over the last month, showed a 24.57% increase in three-month performance and has increased by 73.62% in a year.

GLD fund flows account for 24.62 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

GLD invests in cash. See more details in our Analysis section.

GLD expense ratio is 0.40%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, GLD isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, GLD technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating GLD shows the buy signal. See more of GLD technicals for a more comprehensive analysis.

Today, GLD technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating GLD shows the buy signal. See more of GLD technicals for a more comprehensive analysis.

No, GLD doesn't pay dividends to its holders.

GLD trades at a premium (0.14%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

GLD shares are issued by World Gold Council Ltd.

GLD follows the LBMA Gold Price PM ($/ozt). ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Nov 18, 2004.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.