BlackBerry Ltd Shs Cert Deposito Arg Repr 0.3333 Shs

No trades

10 ARS

−84.88 B ARS

508.97 B ARS

About BlackBerry Limited

Sector

Industry

CEO

John Joseph Giamatteo

Website

Headquarters

Waterloo

Founded

1984

IPO date

Oct 28, 1997

Identifiers

2

ISIN ARDEUT116142

BlackBerry Ltd. engages in the provision of intelligent security software and services. It operates through the following segments: Cybersecurity, Internet of Things (IoT), and Licensing and Other. The Cybersecurity segment includes the brand Cylance, BlackBerry Spark, AtHoc, and SecuSUITE. The IoT segment focuses on software licenses, support, maintenance, and professional services. The Licensing and Other segment involves the intellectual property licensing arrangements and settlement awards. The company was founded by Michael Lazaridis, James Laurence Balsillie, and Douglas E. Fregin on March 7, 1984 and is headquartered in Waterloo, Canada.

Related stocks

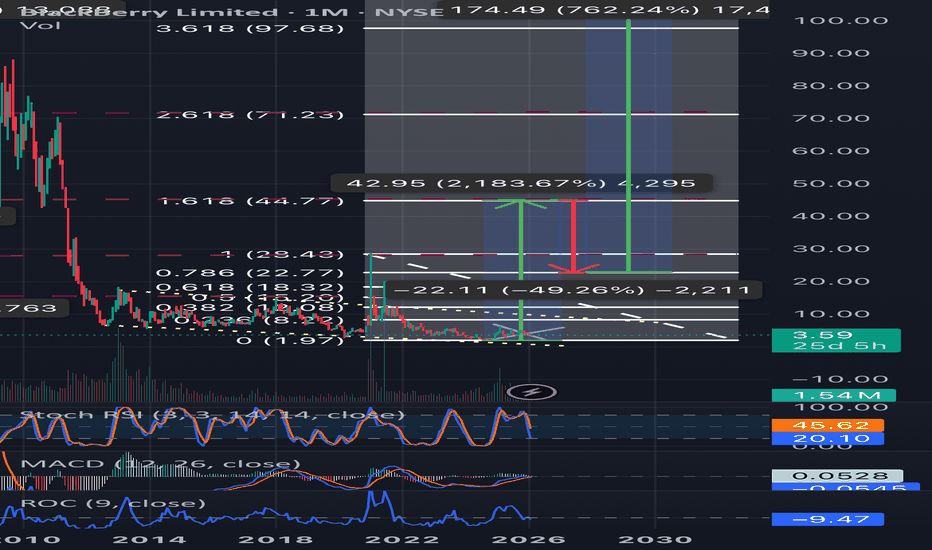

Czas na BLACKBERRY - 50% potential profit - 5.40 $Based on the current chart structure, the stock appears to be forming a base after a prolonged downtrend, with price stabilizing around the $3.60–$3.70 support zone. This area has acted as a historically significant demand level, where selling pressure is starting to weaken.

Price action shows comp

Blackberry Weekly ChartBlackberry is a meme stonk with actual fundamentals that require attention.

On this chart you will see a standard triangle formation with a recent breakout to the sell-side. However we may have support on the lower dotted trend line around $3.40.

If we stay at support or follow the lower trend li

BB BlackBerry Limited Options Ahead of EarningsIf you haven`t bought BB before the rally:

Now analyzing the options chain and the chart patterns of BB BlackBerry Limited prior to the earnings report this week,

I would consider purchasing the 4.50usd strike price Puts with

an expiration date of 2027-1-15,

for a premium of approximately $1.04.

I

BlackBerry still encrypts, just not phones anymoreBB closed the week at 4.28. The weekly chart shows a symmetric triangle forming after a fully completed falling wedge. The key point is that price has already reacted from the 0.618 Fibonacci level near 4.00, which aligns with the highest volume area on the Volume Profile and a clear demand zone. A

BlackBerry: Tech Momentum, Algo Flows & a Primary Elliott UPDATEBlackBerry has strengthened its positioning over the past month with progress in cybersecurity, automotive IoT and QNX, plus a buyback that signals confidence from management. Over the last two months, price action has been largely shaped by algorithmic, market-mover activity, sharp volatility clust

$BB Squeeze Incoming?✔️ What I see:

- Declining resistance is being tested right now.

- Falling wedge pattern forming since early November — bullish structure.

- Price is sitting ABOVE the lower green channel → strength.

- Recent candles show higher lows, even during weak volume → buyers present.

- 1H RSI = ~56 → neutra

Blackberry LtdThe company reports good performance in recent reports: for example, for Q4 FY25 revenue was $141.7 million, EBITDA and some indicators are above expectations.

The QNX segment looks promising: good margin, growth and a large royalty backlog (for example, ~€865 million according to reports) — which

From Fallen Giant to Trillion-Dollar Titan — "BlackBerry"From fallen giant to future trillion-dollar titan.

The world forgot BlackBerry… but smart money didn’t. 👀📈

Once the undisputed king of smartphones, BlackBerry (BB) collapsed under the weight of innovation it helped create. But while the world moved on, BlackBerry quietly evolved — transforming

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.