Wealtris: Impact of Fed Rate Cut on BTC, Stocks, and GoldIn the evolving financial landscape of September 2025, the Federal Reserve's anticipated rate cut—priced in at a 94% probability for a 25 basis-point reduction at the September 16-17 meeting—could reshape asset classes from cryptocurrencies to traditional markets. With Bitcoin hovering at $115,000,

200 ARS

5.39 T ARS

21.74 T ARS

About Booking Holdings Inc. Common Stock

Sector

Industry

CEO

Glenn D. Fogel

Website

Headquarters

Norwalk

Founded

1997

ISIN

AR0171546572

FIGI

BBG01MDJW3K0

Booking Holdings, Inc. engages in the provision of online travel and related solutions. The firm offers services through the following brands: Booking.com, Priceline, Agoda, KAYAK, and OpenTable. It provides accommodation reservations including hotels, hostels, apartments, vacation rentals, and other properties. The company was founded by Jay Scott Walker on July 18, 1997, and is headquartered in Norwalk, CT.

Related stocks

Booking Holdings: Gaining MomentumBooking has regained upward momentum, moving close to resistance at $5,809. We expect prices to break through this level to establish the corrective top of green wave , with potential upside extending to the higher $6,101 mark. However, if $6,101 is decisively surpassed, we will need to anticipate

Booking: Raises Its Voice Over Dark Clouds in TourismBy Ion Jauregui – Analyst at ActivTrades

Booking Raises Its Voice

U.S. tourism is facing a concerning slowdown. Glenn Fogel, CEO of Booking Holdings (NASDAQ: BKNG), has warned that the United States is losing competitiveness as an international destination due to slow border control procedures.

Be

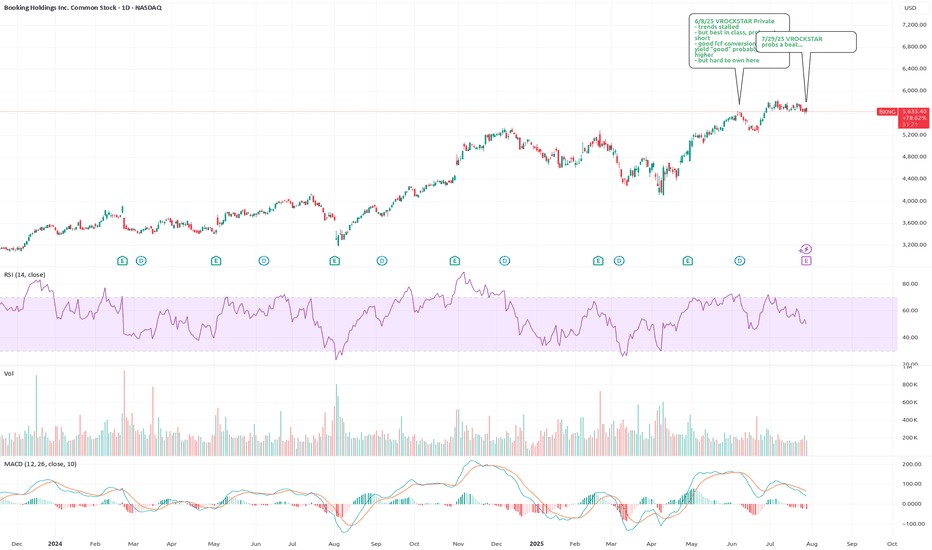

7/29/25 - $bkng - probs a beat...7/29/25 :: VROCKSTAR :: NASDAQ:BKNG

probs a beat...

- while everyone's happy to pay 150x for PLTR... there r a lot of consumer names that seem to be trapped in trump tariff paralysis.

- what happened... is trump... caused a dip... consumer spending paused... then nothing happened... and all that

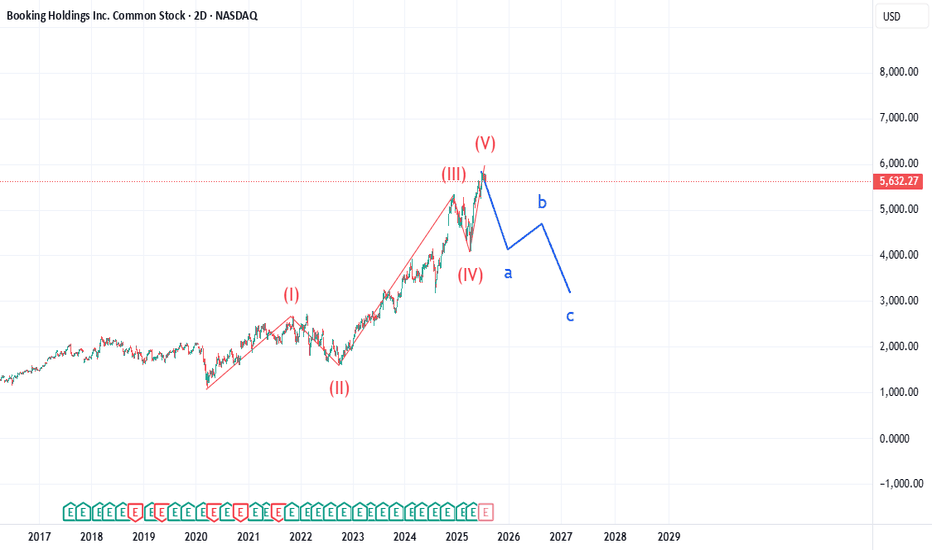

BKNG: Catalyst for the drop - EarningsBKNG has completed a super cycle 5 wave structure beginning at the completion of the March 2020 COVID drop. First target is 4030 by EOY to early next year. Many other stocks are showing a similar structure, so expecting selling volume to greatly increase over the next 90 days.

Booking Holdings,,, buy opportunity Uptrend

As you see in the chart, the previous high has been broken and it could be a small pullback to broken price level. The presence of Doji candles indicates a suitable correction. Find a good trigger for entry to buying position based on your strategy. I suppose nest target could be around 630

Booking Holdings (BKNG) Surges on Strong Q4 EarningsShares of Booking Holdings (NASDAQ: NASDAQ:BKNG ) rallied in Friday’s premarket trading after the travel giant delivered a strong fourth-quarter earnings report, surpassing analyst expectations across key financial metrics. The company also announced a 10% dividend increase and an aggressive $20 bi

Early Impulse on Booking Holdings. BKNGDowngoing triple drive/ABCDE completed, with price action highly suggestive of a reversal. MIDAS curve crossed, cross of vWAP and US also present. That huge candle crosses both also. Crosses on Stoch-RSI and VZO indicators as well. Highly suggestive picture of continuation of bullish price action.

Pre-Market Analysis: BKNG Potential Push Higher into EarningsBKNG saw strong earnings back in November that has since assisted in pushing it to that $5,337 High before a triple-top retest of that resistance level on the 5th, 6th, and 12th below retracing back to the current 50% Retracement on the 4-Hr reporting 6.694 beat on Earnings and 357.35M (4.68%+) on a

Booking Holdings: Soon…The Booking stock remains in a strong, ultra-long-term uptrend. Since reaching the correction low of the green wave in August, the stock has rallied by over 65%. We primarily place it in the larger blue wave (I) and anticipate further gains soon. However, according to our alternative scenario, a p

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BKNG4530421

Booking Holdings Inc. 3.55% 15-MAR-2028Yield to maturity

—

Maturity date

Mar 15, 2028

A4EAY7

Booking Holdings Inc. 4.5% 09-MAY-2046 2025-09.05.46Yield to maturity

—

Maturity date

May 9, 2046

XS307003287

Booking Holdings Inc. 4.125% 09-MAY-2038Yield to maturity

—

Maturity date

May 9, 2038

PCEC

Booking Holdings Inc. 3.6% 01-JUN-2026Yield to maturity

—

Maturity date

Jun 1, 2026

XS230832200

Booking Holdings Inc. 0.5% 08-MAR-2028Yield to maturity

—

Maturity date

Mar 8, 2028

XS277651203

Booking Holdings Inc. 3.75% 01-MAR-2036Yield to maturity

—

Maturity date

Mar 1, 2036

XS294561854

Booking Holdings Inc. 3.75% 21-NOV-2037Yield to maturity

—

Maturity date

Nov 21, 2037

XS294561862

Booking Holdings Inc. 3.875% 21-MAR-2045Yield to maturity

—

Maturity date

Mar 21, 2045

XS262100723

Booking Holdings Inc. 3.625% 12-NOV-2028Yield to maturity

—

Maturity date

Nov 12, 2028

XS255522086

Booking Holdings Inc. 4.25% 15-MAY-2029Yield to maturity

—

Maturity date

May 15, 2029

XS277744228

Booking Holdings Inc. 4.0% 01-MAR-2044Yield to maturity

—

Maturity date

Mar 1, 2044

See all BKNG bonds

Curated watchlists where BKNG is featured.