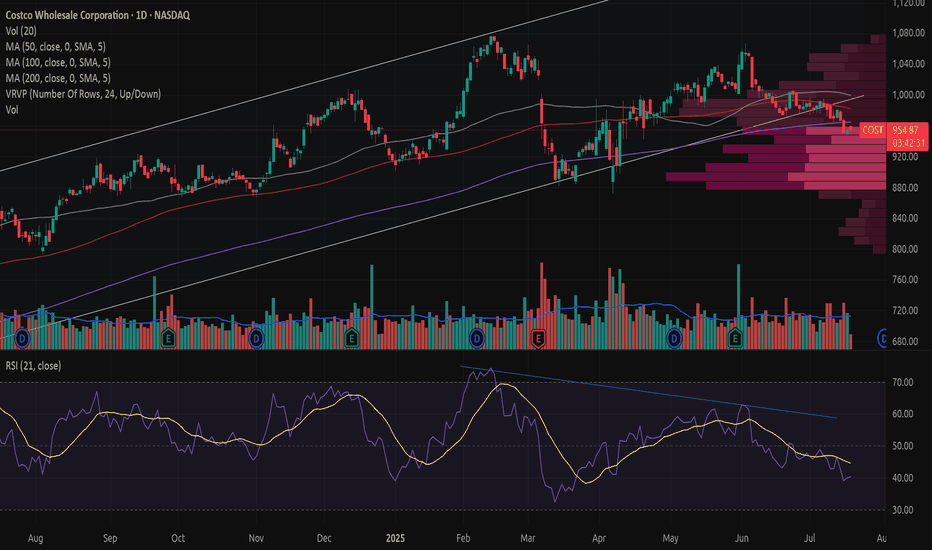

Costco Stock BullishToday market was very weak, however, COST(Costco stock) was bullish and rising higher on a true volume. It will continue going up, a good trade to make money.

According to my Trade Navigator model — a data-driven system that tracks breakout momentum and overall market strength; the readings remain

1.25 USD

6.61 B USD

224.57 B USD

About Costco Wholesale Corporation

Sector

Industry

CEO

Roland M. Vachris

Website

Headquarters

Issaquah

Founded

1983

ISIN

ARDEUT110863

FIGI

BBG000HF6L40

Costco Wholesale Corp. engages in the provision of operation of membership warehouses through wholly owned subsidiaries. It operates through the following geographical segments: United States, Canada, and Other International Operations. The company was founded by James D. Sinegal and Jeffrey H. Brotman in 1983 and is headquartered in Issaquah, WA.

Related stocks

$COST: Shaping a corrective Flat NASDAQ:COST : An interesting pattern might be forming since its February all-time high (ATH). It could be developing into a flat structure with an ABC pattern, and the wave (C) seems to be taking the shape of a wedge. So far, the weekly candlestick is printing an inside week.

Costco has broken down from a rising trend Costco has broken down from a rising trend with increased volume and a significant price drop exceeding 3%.

The trendline has not been retested after the breakdown, but a retest is not required.

The price has support around 910 and 875.

There is a declining RSI(21) and negative volume balance over t

Costco AnalysisThe price has now touched a major support level, one that has already proven its strength multiple times in the past. Each time price reached this zone, it reversed strongly to the upside, showing that buyers consistently step in here.

From my perspective, I think the same scenario could play out a

COSTCO NEEDS TO AVOID BREAKING H-n-S TO CONTINUE ITS UPSIDE RALLCostco (COST) has posted another strong fiscal year, with revenue climbing to $86.2B and net income up to $5.49B. However, the weekly chart is showing a developing head-and-shoulders pattern threatens the upside momentum, and price must hold above 871 with a rejection candle this week to avoid a dee

COST SHORT **UPDATE**My personal thoughts on COST. I always have my

3 step rule before entering a trade or a reason why i

believe in the direction.

1. We have a weekly head and shoulders

2. Closing out and rejecting the upside on the daily

and currently working on the weekly candle.

3. Fib target of 923.36. From a lot o

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

COST4977644

Costco Wholesale Corporation 1.75% 20-APR-2032Yield to maturity

4.15%

Maturity date

Apr 20, 2032

COST4977643

Costco Wholesale Corporation 1.6% 20-APR-2030Yield to maturity

4.00%

Maturity date

Apr 20, 2030

COST4495548

Costco Wholesale Corporation 3.0% 18-MAY-2027Yield to maturity

3.71%

Maturity date

May 18, 2027

COST4977642

Costco Wholesale Corporation 1.375% 20-JUN-2027Yield to maturity

3.70%

Maturity date

Jun 20, 2027

See all COSTD bonds

Curated watchlists where COSTD is featured.