Electronic Arts: Game Over on Wall Street?Ion Jauregui – Analyst at ActivTrades

Electronic Arts (Ticker AT: EA.US) , the historic developer behind iconic franchises such as EA Sports FC and Battlefield, may be on the verge of an unexpected turn. According to reports, the company is engaged in advanced talks to leave the New York Stock Ex

Key facts today

Andrew Wilson, Chairman of Electronic Arts, sold 5,000 shares for about $1 million on November 19, 2025, retaining 130,948 indirect shares in the company.

275 ARS

1.09 T ARS

7.22 T ARS

About Electronic Arts Inc.

Sector

Industry

CEO

Andrew P. Wilson

Website

Headquarters

Redwood City

Founded

1982

ISIN

ARBCOM4603Y4

FIGI

BBG017SL2KC6

Electronic Arts, Inc. engages in the development, marketing, publication, and distribution of games, content, and services for game consoles, PCs, mobile phones, and tablets. The company develops and publishes games and services across various genres, such as sports, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Anthem, Need for Speed, and Plants v. Zombies brands, and license games, including FIFA, Madden NFL, and Star Wars brands. The firm also provides advertising services and licenses its games to third parties to distribute and host its games. It markets and sells its games and services through digital distribution channels, as well as through retail channels, such as mass-market retailers, electronics specialty stores, and game software specialty stores. The company was founded by William M. Hawkins III and William Gordon in 1982 and is headquartered in Redwood City, CA.

Related stocks

Electronic Arts EA BUYIs a top global interactive entertainment company known for its strong portfolio of sports franchises including EA SPORTS FC (soccer), American Football, and The Sims, as well as blockbuster titles like Battlefield. In fiscal year 2025, EA reported net revenue of approximately $7.46 billion with net

Electronic Arts: Breakout and PullbackElectronic Arts broke out to new all-time highs last month, and now it’s pulled back.

The first pattern on today’s chart is the bullish gap on August 11 following a successful test of its Battlefield 6 video game. Combined with a strong quarterly report on July 29, those moves could reflect positiv

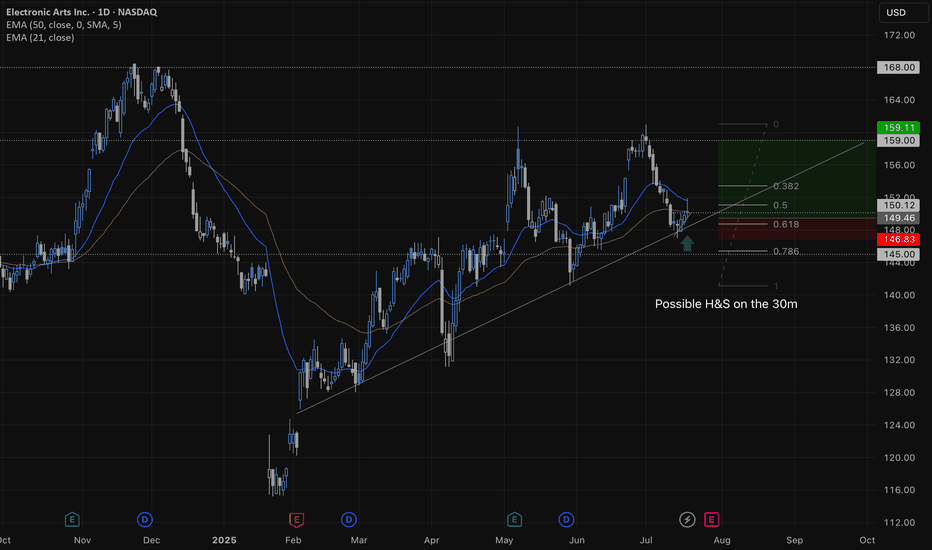

Electronic Arts Inc. (EA) – Inverse Head & Shoulders Breakout📈 Long Setup

🔍 Description:

Electronic Arts Inc. (NASDAQ: EA) has broken out above the neckline of an Inverse Head & Shoulders pattern — a bullish reversal signal. Price action confirms breakout strength, with a surge in volume accompanying the move. Bullish continuation is expected if the br

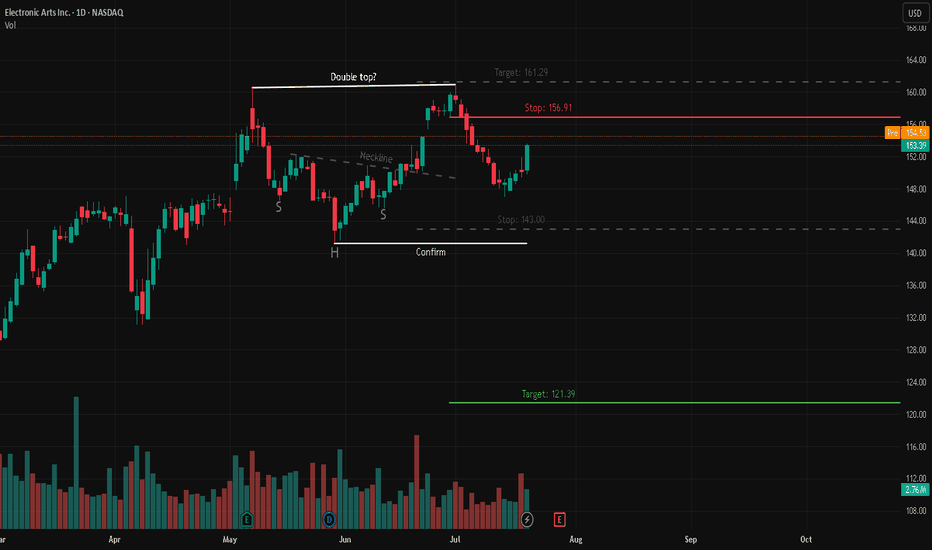

EA – Double Top Short Setup | Watch for Inverse H&S Breakout📘 Description:

Price is currently sitting between two potential outcomes:

A Double Top forming below the 156.91 resistance zone, which could trigger a bearish move toward 121.39 if confirmed by a breakdown through 143.00.

A possible Inverse Head & Shoulders pattern building at the same level

Electronic Arts: Under PressureEA has shown notable upward pressure, diverging from our expected downside continuation. Despite the recent strength, our primary scenario remains valid: we still anticipate an extension of the ongoing magenta five-wave decline, with wave (3) expected to break below support at $114.60. The remaining

Electronic Arts: Heading LowerElectronic Arts has dropped roughly 13% since our last update, continuing the expected decline within ongoing wave (3). This move is likely to break below support at $114.60 and gradually push the stock downward to the anticipated low. Our alternative scenario suggests the correction may already be

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ERTB

Electronic Arts Inc. 4.8% 01-MAR-2026Yield to maturity

8.56%

Maturity date

Mar 1, 2026

ERTS5129009

Electronic Arts Inc. 2.95% 15-FEB-2051Yield to maturity

3.31%

Maturity date

Feb 15, 2051

ERTS5129008

Electronic Arts Inc. 1.85% 15-FEB-2031Yield to maturity

2.58%

Maturity date

Feb 15, 2031

See all EA bonds

Curated watchlists where EA is featured.