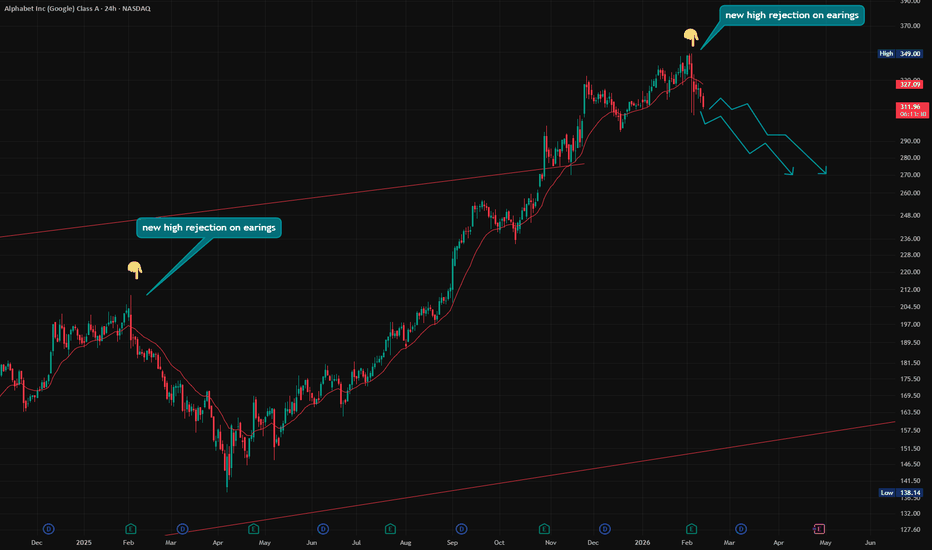

Alphabet - The only surviving stock!🏅Alphabet ( NASDAQ:GOOG ) is clearly not bearish yet:

🔎Analysis summary:

The entire tech sector is currently collapsing. But Alphabet remains totally strong and is sitting close to new all time highs. But considering that current retest of the major resistance trendline, a short term pullback

Alphabet Inc (Google) Class A

No trades

Key facts today

In 2025, Alphabet invested about $180 billion in AI data centers, with spending expected to rise in 2026. This will significantly impact financials, with depreciation costs likely to double.

230 ARS

164.61 T ARS

501.86 T ARS

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

IPO date

Aug 19, 2004

Identifiers

2

ISIN ARDEUT116159

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

GOOGL Stock Analysis | Pullback Within an Established Uptrend🎯 GOOGL: The Great Heist Setup | Moving Average Pullback Play 💰

📊 Market Intelligence Brief

Asset: GOOGL (Alphabet Inc.) - NASDAQ

Strategy Type: Day/Swing Trade - Bullish Momentum

Risk Profile: Medium | Reward Potential: High 🚀

🔍 THE MASTER PLAN

We're eyeing a classic moving average pullback scenar

Alphabet ($GOOGL) is likely heading back toward at least $270.Alphabet ( NASDAQ:GOOGL ) is likely heading back toward at least $270.

Four reasons: 👇

- New high rejection on earnings. We saw a similar setup about a year ago — markets often repeat behavior.

- The 2025 trend showed a late-stage acceleration, which historically often precedes a reversal.

- The

GOOG bullback shall be considered as compelling opportunityGiven massive volumes on April tariffs shake-outs, I believe that Google started a new major impulse run.

What I counted with black digits is wave 1 in bigger 5-waves structure.

I will buying around $260-270 as I believe this pullback might end around 38.2 fib of wave 3. However, technically, it

GOOGL Weekly Rebound Setup: Institutional Flow Signals Upside GOOGL QuantSignals V4 — Weekly Bullish Rebound Trade

Signal: BUY CALLS

Conviction: Moderate

Alpha Score: 72

Time Horizon: Weekly (Exp: Friday)

Projected Move: +2.5–3%

👉 Primary Thesis: Smart-money call accumulation + heavy call OI near $325 creates a magnetic effect for price, supporting a ta

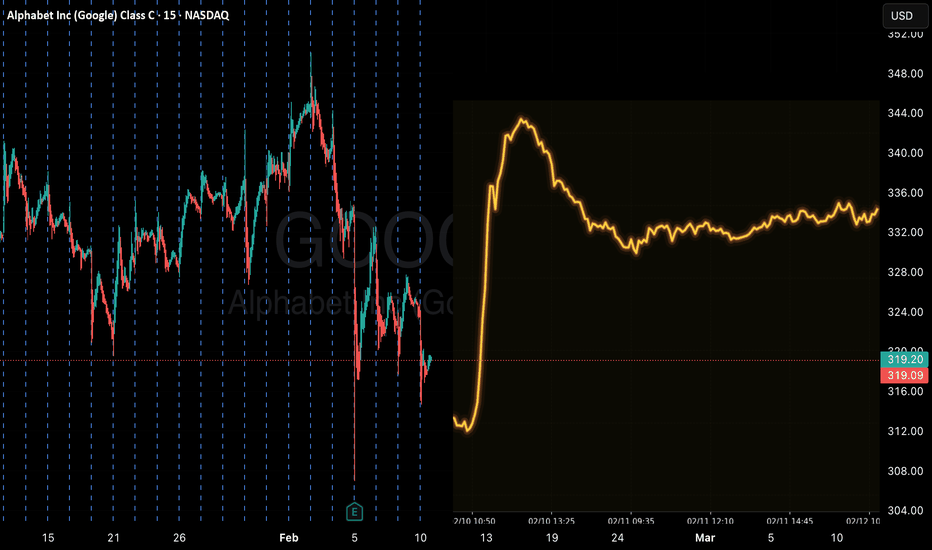

GOOG: Will Buyers Defend the Earnings Low Again?Google Cloud grew ~48% YoY last quarter, outpacing Microsoft’s cloud growth. The market narrative remains clear: Google is viewed as an AI winner, and that perception hasn’t shifted.

After earnings, GOOG opened weak at 312.22 but aggressively reversed intraday to 331.25. That move signaled clear re

Google Holds Below $350 Ahead of EarningsAlphabet (Google) shares have fallen more than 4.5% over the last two sessions, heading into today’s earnings release. The market is awaiting Q4 2025 results, with expectations pointing to revenue of around $111 billion, which would represent approximately 15% year-over-year growth, along with an ex

Google - Last earnings call before tariffs affect revenue?Hi guys please find below the analysis we did for Google (ALPHABET)

Alphabet Inc. (NASDAQ: GOOG) is poised to deliver a robust Q1 2025 earnings report, with analysts projecting revenue of $89.22 billion—an 11% year-over-year increase—and net income of $24.71 billion ($2.01 per share), up from $23.

GOOG:Wave(3)Truncated 350.15 – Wave (4) Deepens, Targets 315-320GOOG has shown clear signs of truncation in Wave (3) at 350.15 (failed to reach the projected 360 level), invalidating the prior impulsive extension and confirming the ongoing A-B-C corrective Wave (4) from the 341.20 high.

Primary Count (Orange Line – 5-3-5 structure):

Wave (3) truncated, curren

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GOOG6224229

Alphabet Inc. 5.7% 15-NOV-2075Yield to maturity

5.72%

Maturity date

Nov 15, 2075

GOOG6308427

Alphabet Inc. 5.75% 15-FEB-2066Yield to maturity

5.64%

Maturity date

Feb 15, 2066

XS328556227

Alphabet Inc. 5.5% 13-NOV-2041Yield to maturity

5.64%

Maturity date

Nov 13, 2041

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.63%

Maturity date

May 15, 2065

GOOG6308428

Alphabet Inc. 5.65% 15-FEB-2056Yield to maturity

5.53%

Maturity date

Feb 15, 2056

GOOG6224228

Alphabet Inc. 5.45% 15-NOV-2055Yield to maturity

5.52%

Maturity date

Nov 15, 2055

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.49%

Maturity date

May 15, 2055

GOOG5025304

Alphabet Inc. 2.05% 15-AUG-2050Yield to maturity

5.37%

Maturity date

Aug 15, 2050

GOOG6308906

Alphabet Inc. 5.5% 15-FEB-2046Yield to maturity

5.35%

Maturity date

Feb 15, 2046

GOOG6224227

Alphabet Inc. 5.35% 15-NOV-2045Yield to maturity

5.34%

Maturity date

Nov 15, 2045

GOOG5025305

Alphabet Inc. 2.25% 15-AUG-2060Yield to maturity

5.26%

Maturity date

Aug 15, 2060

See all GOOGL bonds