Honeywell International Inc Shs Cert Deposito Arg Repr 0.125 Shs

No trades

1.00 USD

5.07 B USD

34.19 B USD

About Honeywell International Inc.

Sector

Industry

CEO

Vimal M. Kapur

Website

Headquarters

Charlotte

Founded

1906

Identifiers

2

ISIN:ARDEUT110038

Honeywell International, Inc. is a software industrial company, which offers industry specific solutions to aerospace and automotive products and services. It operates through the following business segments: Aerospace Technologies, Industrial Automation, Building Automation, Energy and Sustainability Solutions, and Corporate and All Other. The company was founded by Albert M. Butz in 1906 and is headquartered in Charlotte, NC.

Related stocks

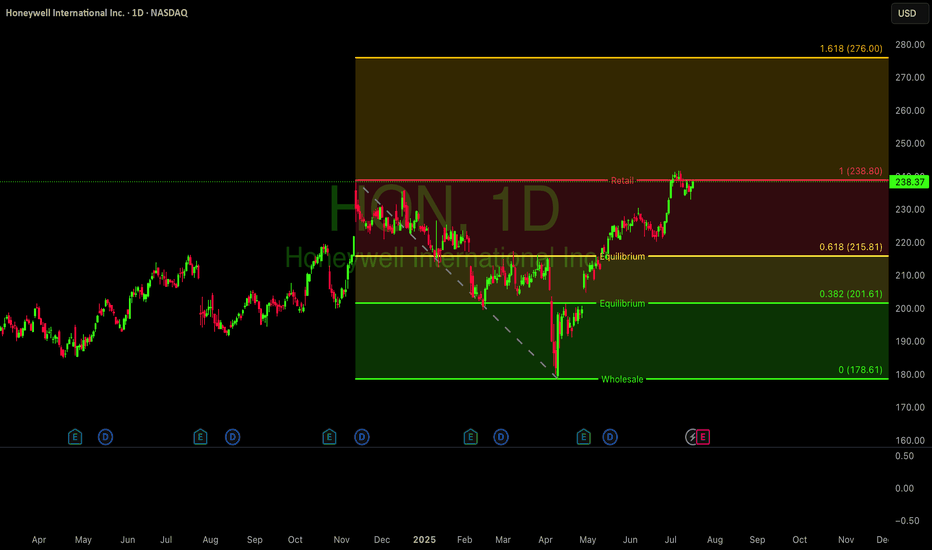

The 3-Step Rocket Booster Strategy + Evening Star Candlestick The number #1 candlestick pattern is the evening star ✴️.

This is the pattern you are looking at on on this screen.

Its a very strong pattern, now notice how the top of this price action looks?

You see when the "dead cross" happened everyone started short selling.

Then pop bomb 💣 to the top.

Af

Honeywell: Upward?The previously defined Target Zone was clearly breached to the upside, so we have now deactivated and grayed out that zone. The stock is currently in a downward move, which we interpret as a corrective pullback within green wave . We expect this move to conclude above the resistance level at $250.2

Honeywell: From Waste to FuelBy Ion Jauregui – Analyst at ActivTrades

Honeywell International Inc. (NASDAQ: HON) has unveiled a technology that could redefine the use of agricultural and forestry waste. The U.S.-based company has developed a process capable of converting these residues into biocrude, a low-emission marine fuel

the WY of Honeywell's Earnings Report Gap up and Run down It is very important that you understand what is happening in a company that impacts its stock price. HON has had Dark Pool Rotation going on since July of this year. Dark Pools are the most informed of all the Market Participant groups (there are 12 not 2).

The chart of HON has plenty of informatio

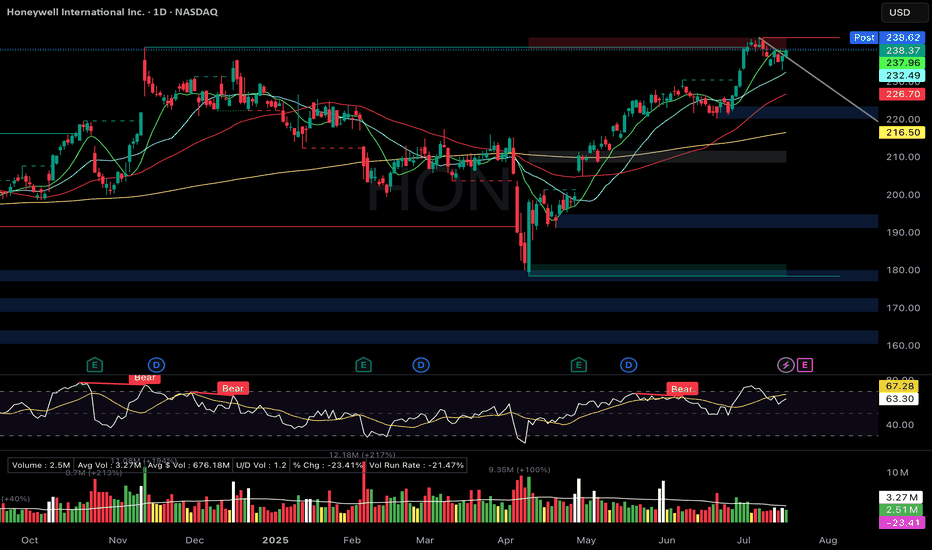

$HON Honey are you well NASDAQ:HON looking strong. Weekly chart is in a clear Stage 2 uptrend, now consolidating near all-time highs.

The 4-hour chart is holding key support around the $230-$233 level, with the Stochastic oscillator turning up from oversold territory. A decisive break above the $240 resistance could sign

HON Bull flag + hammer off 21EMAHON – Honeywell

Setup Grade: A

• Entry: $238.12 (7/17)

• Status: Active

• Trailing Stop: $6.85 (2x ATR)

• Setup: Aerospace/defense leader. Bull flag + hammer off 21EMA. RSI ~63.

• Target: $256 (measured move). ATH = $242.77

• Plan: Hold through breakout → blue sky setup.

• Earnings: July 24

Honeywell: Quantum Leap or Geopolitical Gambit?Honeywell is strategically positioning itself for significant future growth by aligning its portfolio with critical megatrends, notably aviation's future and quantum computing's burgeoning field. The company demonstrates remarkable resilience and foresight, actively pursuing partnerships and investm

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HON5761704

Honeywell International Inc. 5.35% 01-MAR-2064Yield to maturity

5.66%

Maturity date

Mar 1, 2064

HON5761703

Honeywell International Inc. 5.25% 01-MAR-2054Yield to maturity

5.65%

Maturity date

Mar 1, 2054

HON4583289

Honeywell International Inc. 3.812% 21-NOV-2047Yield to maturity

5.48%

Maturity date

Nov 21, 2047

HON4988328

Honeywell International Inc. 2.8% 01-JUN-2050Yield to maturity

5.43%

Maturity date

Jun 1, 2050

HON.HH

Honeywell International Inc. 5.375% 01-MAR-2041Yield to maturity

5.08%

Maturity date

Mar 1, 2041

HON.GB

AlliedSignal, Inc. 9.065% 01-JUN-2033Yield to maturity

5.04%

Maturity date

Jun 1, 2033

HON.GY

Honeywell International Inc. 5.7% 15-MAR-2037Yield to maturity

4.99%

Maturity date

Mar 15, 2037

HON.GW

Honeywell International Inc. 5.7% 15-MAR-2036Yield to maturity

4.86%

Maturity date

Mar 15, 2036

HON5587552

Honeywell International Inc. 4.5% 15-JAN-2034Yield to maturity

4.64%

Maturity date

Jan 15, 2034

HON5761178

Honeywell International Inc. 5.0% 01-MAR-2035Yield to maturity

4.63%

Maturity date

Mar 1, 2035

HON5497118

Honeywell International Inc. 5.0% 15-FEB-2033Yield to maturity

4.55%

Maturity date

Feb 15, 2033

See all HOND bonds

Curated watchlists where HOND is featured.