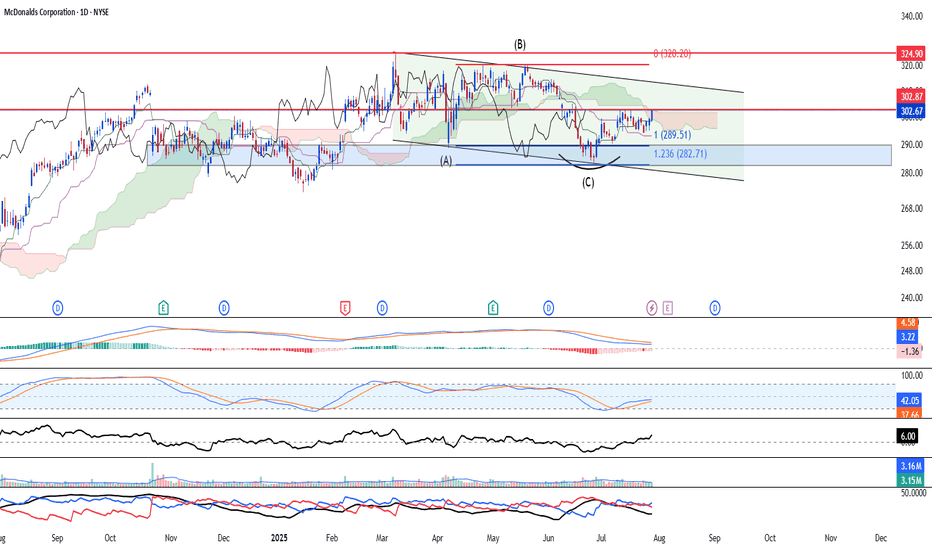

MCD Bulls Loading: Major Wave (3) Move ComingMcDonald’s has completed a clean 5-wave push to the upside, finishing Wave (1)/(A) near the recent high. After that, price entered a corrective channel forming an A-B-C pullback, which now looks close to completing as Wave (2)/(B). The drop is losing momentum near support, suggesting sellers are running out of strength. Once this correction finishes, the chart expects a sharp bullish move into Wave (3)/(C), targeting higher levels above recent highs. In simple terms: correction almost done → strong upside continuation likely.

Stay tuned!

@Money_Dictators

Thank you :)

Trade ideas

McDonald’s: Rally Interrupted, but Uptrend Remains IntactMcDonald’s shares initially saw a modest decline, but recent quotes indicate renewed attempts to soon establish the high of magenta wave . Once this phase concludes, we anticipate a moderate pullback as wave unfolds, followed by wave gaining enough momentum to push price above the $326.32 resistance level. However, if support at $283.47 is decisively breached, our alternative scenario will come into play. We currently assign a 37% probability to this outcome, in which the stock would likely move toward a new low of green wave alt. .

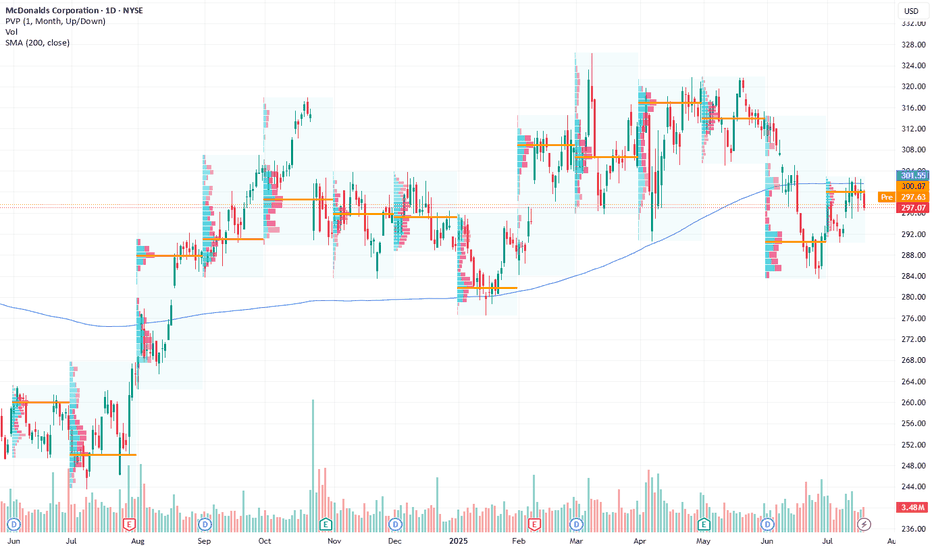

McDonald's stock monthly demand imbalance playing outMcDonald’s (MCD): Monthly Demand Level Still in Control

McDonald’s stock is currently respecting a monthly demand level at $294, which remains firmly in control. That’s a key point — the monthly timeframe is a much larger and more powerful structure than anything happening in the weekly or daily charts.

What I’m seeing now is a new bullish price action pattern forming in the smaller timeframes (weekly and daily), meaning buyers are stepping back in from that institutional zone. That gives me confirmation that demand is in control and that McDonald’s remains one of the strongest bullish stocks in the consumer sector.

A monthly demand level in control means that big money — institutions and funds — are accumulating. Retail traders might think it’s “too expensive” at $290+, but professional traders know that the presence of a monthly imbalance means there’s still room for price expansion to the upside.

This is where patience pays. The art of waiting for the price to return to that imbalance and observing how it reacts separates a disciplined trader from an impulsive one driven by greed or fear.

McDonald's Set to Break Out Amid Q4 Consumer StrengthCurrent Price: $297.01

Direction: LONG

Targets:

- T1 = $307.00

- T2 = $315.00

Stop Levels:

- S1 = $292.00

- S2 = $287.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that collated observations from experienced professionals often provide better clarity and reduce individual biases. When evaluating McDonald’s (MCD), many traders focus on strong seasonality, Q4 performance drivers, and consumer spending resilience, indicating a bullish set-up as we near year-end.

**Key Insights:**

McDonald’s shares are positioned well for a potential breakout as macroeconomic tailwinds and company-specific catalysts align. Analysts have highlighted several factors supporting growth, including menu innovation, higher-margin digital sales, and rising store traffic globally. Consumer spending is trending upward in 2025 despite inflationary pressures, suggesting McDonald’s will maintain robust revenue streams through cost-effective pricing strategies that appeal to value-oriented consumers.

Additionally, accelerated growth in delivery and digital channels has supported a higher-than-expected gross margin expansion. The company’s ability to pass costs onto consumers without eroding demand signals pricing power, a key strength during periods of potential economic uncertainty. With holiday-season trends likely to amplify foot traffic, traders believe McDonald’s is well-poised to outperform consensus targets over Q4 2025.

**Recent Performance:**

McDonald’s stock has shown resilience in recent weeks, climbing by nearly 4% since mid-September 2025, following strong Q3 earnings reported in July. The company exceeded expectations with $6 billion in revenue and a 12% year-over-year net income gain as same-store sales surged globally. Traders have noted a steady uptrend supported by positive sentiment and institutional accumulation, suggesting broad investor confidence in the company's ability to deliver consistent cash flow growth.

**Expert Analysis:**

Technical analysts identify consolidation near the $295-$300 range as a bullish continuation pattern, reflecting accumulation ahead of a likely breakout. Recent MACD crossover signals have turned bullish, supported by balanced RSI levels, creating favorable conditions for further upside momentum. On the fundamental side, experts emphasize the impact of cost efficiencies in raw materials procurement as net profit margins reach multiyear highs at approximately 25%.

From a valuation perspective, McDonald’s trades at a premium P/E of 26x forward earnings, but this is justified by its resilient business model and reliable dividend payouts. According to industry projections, the company could deliver an earnings beat for Q4, further reinforcing the long trade opportunity.

**News Impact:**

Recent announcements regarding McDonald’s strategic expansion of AI-powered drive-thru technology have boosted investor optimism. This initiative is expected to improve operating efficiencies and accelerate throughput rates during high-demand periods. Additionally, global marketing campaigns tied to new menu offerings for Q4 are anticipated to produce incremental revenue drivers. The favorable consumer response toward menu enhancements coupled with brand loyalty has strengthened sentiment among institutional investors, further incentivizing a bullish position.

**Trading Recommendation:**

Given the technical setup and favorable fundamentals, traders should consider a long position in McDonald’s at current levels. Strong consumer spending trends, paired with anticipated Q4 catalysts like seasonal demand and menu innovation, support a price move towards $307 in the short term. Risk management can be implemented using stop-loss levels at $292 and $287. With robust margins, revenue growth, and bullish technical indicators, McDonald’s is well-positioned to deliver high-probability upside during the remainder of 2025.

Do you want to save hours every week? register for the free weekly update in your language!

MCD produces ending diagonal to terminate 2020 advanceMcDonald’s (MCD) appears to be in the late stages of a long-term Elliott Wave advance, with the final 5th (5) wave nearing exhaustion inside a rising wedge pattern. Momentum divergences and the neckline support around $285 highlight growing risk of a breakdown. If the wedge fails, a corrective phase could unfold, targeting the 210–240 region where prior 4th wave support lies. Until then, upside is capped near $330–340, making the risk-reward skewed toward caution at current levels.

McDonald’s Bulls Hungry for $320 Breakout — Options Play Inside🍔 MCD Swing Trade Setup — Bulls Testing Momentum 🚀

📊 Market Consensus

✅ Moderate Bullish Bias confirmed by RSI (55+, rising)

⚡ Multi-timeframe alignment strong

📉 Weak volume = main risk ⚠️

🔍 Options flow neutral → watch for confirmation

🎯 Trade Setup

📈 Direction: CALL (Long)

🎯 Strike: $320.00

💵 Entry: $0.97 (market open)

🎯 Profit Target: $1.60

🛑 Stop Loss: $0.68 (30% risk)

📅 Expiry: 2025-09-05 (14D)

📊 Size: 1 contract

💪 Confidence: 75%

⚠️ Risk Note: Volume must confirm! If $316.16 level is rejected without strong buying, cut/reduce position.

**MCD, NYSE, 2H, Demand Zone Bounce, Buy Setup**

* MCD Price tanked hard in early June before bottoming in the **Daily Demand Zone** around 284–288.

* Strong rally into early July formed higher highs and higher lows — textbook bullish market structure.

* Recent pullback tagged the **local Demand Zone (299–300)**, aligning with a diagonal trendline (daily support).

* The latest rally tested the **Supply Zone at 311–314**, which rejected price, bringing us into this corrective move.

* **Earnings (Aug 6, Q2 2025)**: EPS **\$3.19 vs \$3.145 est** (beat by \$0.045), revenue **\$6.84B vs \$6.70B est** (beat by \$145M). Strong top-line surprise suggests resilience despite macro headwinds.

* **News sentiment**:

* McDonald's reported **increased consumer spending** driven by **price hikes and product changes**, though low-income customers remain pressured.

* CEO commentary noted consumers are “navigating a fog,” with Cava trimming sales outlook signaling a cautious restaurant sector.

**Elliott Wave Count:**

* Wave 1: June low → July breakout.

* Wave 2: Minor retrace in mid-July.

* Wave 3: Strong push to August highs.

* Wave 4: Current corrective wave, likely ending at 299–300 Demand Zone.

* Potential Wave 5 targeting 311–314 Supply Zone if bullish reaction confirms.

**Supply & Demand Zones:**

* **Demand Zone (Buy area):** 299.7–300.5

* **Supply Zone (Sell area):** 311.3–314.2

**Trade Idea:**

* **Entry:** 302 (Trendline Breakout)

* **Stop Loss:** 297.0 (below last low)

* **Take Profit:** 311.8 (Supply Zone low)

* **Risk/Reward:** ≈ 1:3

**Trade Management:**

* Consider moving SL to BE once RR hits 1:1 (\~303.2).

* Scale out partials near 311.3 and let runners test 314.2 if momentum is strong.

**Risk Management:**

* Max \$ risk = 1–3% of account equity.

* No over-leverage — remember, even McDonald’s can give you a “McWhiplash.” 🍔📉

> “It’s not about being right or wrong, it’s about how much you make when you’re right and how much you lose when you’re wrong.” – George Soros

**Disclaimer:**

This is not financial advice. Educational purposes only. Markets can turn against you — manage your risk.

MCD - Expanded flat likely completed Mcdonald's NYSE:MCD is looking at a resumption of the uptrend after price action indicates a strong bullish rebound at 123.6% extension of wave A-B (US$282.71). We believe further upside is likely to continue as Stochastic has shown clear oversold confirmation signal. Volume is also in a healthy position.

Strategy

Buy spot @ 302.67 or buy stop above 303.00. Limit buy @ 286.04 support in the event of a correction.

1st Target is at 311.50 (Est 1 month)

2nd Target is at 341.00 (Est 2-5 months)

3rd Target is at 360.00 (6 months and beyond)

McDonald's Signals Long Trade Opportunity: Bullish Momentum MounCurrent Price: $297.07

Direction: LONG

Targets:

- T1 = $305.50

- T2 = $312.00

Stop Levels:

- S1 = $294.00

- S2 = $290.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify promising trade setups. The wisdom of crowds principle indicates that aggregate perspectives often outperform single forecasting efforts—helping detect potential bullish movements in McDonald's.

**Key Insights:**

McDonald's has recently benefited from strong consumer demand in its core markets, bolstered by ongoing economic recovery trends and increased spending in the dining-out segment. The company's strategic pricing adjustments and menu innovation continue to attract new customers while retaining long-term loyalty. Technically, the stock is showing robust momentum, with moving averages aligning positively to support upside potential.

Investor sentiment around McDonald's remains optimistic amid its ability to weather inflationary pressures better than many competitors. Furthermore, labor cost efficiency and supply chain stability highlight operational success, strengthening its fundamental case for a long-term bullish bias.

**Recent Performance:**

The stock has recovered steadily from its mid-year slump, advancing over 10% in the last quarter. Over the past month, McDonald's shares have shown resilience during periods of broader market volatility, making new highs amid strong earnings reports and upbeat guidance. Its price is testing major resistance levels—a breakout could signal sustained upward movement.

**Expert Analysis:**

Technical experts point to a rising RSI (Relative Strength Index), suggesting no overbought risk, while MACD crossover confirms bullish tendencies. Support levels identified around $290 provide an attractive risk-reward ratio for long positions. Analysts emphasize McDonald's 2023 growth prospects, driven by innovation in product offerings and enhanced digital ordering platforms.

**News Impact:**

Recent news highlighting McDonald's expansion in international markets, particularly Asia-Pacific, adds further optimism to investor outlook. Regulatory adjustments easing food imports and operational barriers have been positive for sales growth abroad—building momentum for stronger quarterly performance. Moreover, partnerships with third-party delivery services keep McDonald's positioned for incremental revenue growth.

**Trading Recommendation:**

Traders should consider taking a long position at current levels, targeting $305.50 and $312.00. Set clear stops at $294.00 and $290.00 to manage downside risk. The bullish technical setup, coupled with favorable fundamental drivers and steady global expansion strategies, makes McDonald's a compelling short-to-medium-term investment opportunity.

The key is whether it can be supported and rise near 300.17

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(MCD 1D chart)

Before following the basic trading strategy, the first thing to check is whether the current price is above or below the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, there is a possibility that it will turn into a medium- to long-term downtrend.

Therefore, if possible, it is recommended to trade stocks whose prices are above the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, you should respond quickly and briefly using the short-term trading (day trading) method.

-

The support and resistance zones can be seen as the 287.46-290.14 zone and the 307.41-314.89 zone.

The 287.46-290.14 zone is the DOM(-60) ~ HA-Low zone, and the 307.41-314.89 zone is the HA-High ~ DOM(60) zone.

These two zones are likely to form a trend depending on how they break through, so they can be seen as support and resistance zones.

-

The 300.17-316.56 zone is the HA-High ~ DOM(60) zone on the 1W chart.

Therefore, we need to check whether it can receive support and rise in the 300.17-316.56 zone.

Therefore, if it falls near the 307.41-314.89 range, you should check for support near 300.17.

-

If it rises above the HA-High ~ DOM(60) range, it is likely to show a step-up trend, and if it falls in the DOM(-60) ~ HA-Low range, it is likely to show a step-down trend.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

McDonald 1H Long PositionMy self-built strategy has sent me a signal for a long position. I bought a tranche of NYSE:MCD long and will be targeting the upper gaps as my profit targets. The first station will be around $306, and the second target lies between $318 and $319. Currently, the 1H chart is forming a nice divergence and had a huge volume spike, and my strategy indicates a high probability setup for this chart.

Given the current market volatility, I’ll be keeping a close eye on my open position to be able to react quickly if needed.

McDonald (MCD): Near Critical Trendline Support Overview: McDonald's (MCD) on the daily chart has been consolidating within a broad range after a significant uptrend. The stock is currently trading at a pivotal point, testing a long-standing ascending trendline that has supported its bullish movement. Bearish pressure is evident from repeated rejections at a key resistance zone, suggesting a potential shift in market sentiment.

Context & Price History:

Ascending Trend: From approximately July 2024, MCD embarked on a strong uptrend, consistently finding support along the depicted blue ascending trendline. This indicates underlying bullish momentum and buyers stepping in on dips.

Major Resistance Zone (317 - 323): Since late 2024, MCD has repeatedly faced strong selling pressure in the 317 to 323 range, labeled as "320". This area has acted as a formidable ceiling, preventing further upward progression. We can observe what appears to be a multi-peak formation (potentially a triple top) at this resistance, a classic bearish reversal pattern.

Consolidation: Following the initial uptrend, the price action has entered a consolidation phase, oscillating between the "320" resistance and the rising trendline support.

Key Levels & Patterns:

Ascending Trendline (Blue Line): This is the primary support for the current market structure. A break below this line would signal a significant shift in the trend.

Major Resistance Zone (Red Shaded Area): Strong supply zone between $317 and $323. Multiple rejections here indicate significant selling interest.

Immediate Support Zone (Green Shaded Area): Around $290, this level represents the next key horizontal support below the trendline.

Key Level Support (Deep Green Shaded Area): A broader support range between $270 and $280. This area could provide strong demand if the stock experiences a deeper correction.

Minor Resistance/Bounce Point (Labelled 310): While not a strong horizontal support currently, the "310" label aligns with potential prior horizontal action and is shown as a retest point in the projected bearish scenario.

Current Situation: MCD is currently trading around $303.21. It has seen a sharp decline from the 317-323 resistance zone and is now directly approaching the confluence of the ascending trendline and recent lows. The highlighted blue circle indicates this critical area.

Potential Scenarios:

Bearish Breakdown (Primary Indication on Chart):

Breakdown Confirmation: If MCD fails to hold the ascending trendline support and closes convincingly below it (e.g., below $300), especially with increased volume, it would confirm a bearish breakdown.

First Target: The immediate target for bears would be the $290 horizontal support zone.

Second Target: If 290 fails to hold, the price could then move lower towards 270 to $280.

Bullish Reversal / Trendline Hold:

Reversal Confirmation: If MCD finds strong buying pressure at the current trendline support, we could see a bullish reversal candlestick pattern (e.g., a hammer, bullish engulfing, or morning star).

Upside Potential: A successful bounce could lead to a retest of prior minor resistance around the

310 and then towards 320

Trend Continuation: A decisive break above the $323 resistance would invalidate the current bearish pressure and signal a continuation of the broader uptrend.

Conclusion:

MCD is at a crucial juncture. The repeated rejections at the 317-323 resistance zone and the current approach to the ascending trendline indicate a potential for a significant directional move. Traders should closely monitor price action around the trendline. A break below opens the door for a move to 290 and potentially 270-280, while a strong bounce could see a retest of the higher resistance levels.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

Is the Golden Arches Losing Its Shine?McDonald's, a global fast-food icon, recently reported its most significant decline in U.S. same-store sales since the peak of the COVID-19 pandemic. The company experienced a 3.6 percent drop in the quarter ending in March, a downturn largely attributed to the economic uncertainty and diminished consumer confidence stemming from President Donald Trump's tariff policies. This performance indicates that the unpredictable nature of the trade war is prompting consumers to curb discretionary spending, directly impacting even seemingly resilient sectors like fast food through reduced customer visits.

The link between sinking consumer sentiment and tangible sales figures is evident, as economic analysts note the conversion of "soft data" (sentiment) into "hard data" (sales). While some commentators suggest that McDonald's price increases have contributed to the sales slump, the timing of the decline aligns closely with a period of heightened tariff-related anxiety and a contraction in the U.S. economy during the first quarter. This suggests that while pricing is a factor, the broader macroeconomic environment shaped by trade tensions plays a critical role.

In response, McDonald's emphasizes value offerings to attract and retain customers navigating a challenging economic landscape. The company's struggles mirror those of other businesses in the hospitality sector, which also report reduced consumer spending on dining out. The situation at McDonald's serves as a clear illustration of how complex trade policies and the resulting economic uncertainty can have far-reaching consequences, affecting diverse industries and altering consumer behavior on a fundamental level.

The 3 Step System Used To Buy This Stock Trying To forgive someone is very hard for me because I am emotional.Once a person disappoints me it's hard to trust that person again.

And because I enjoy keeping people accountable.Its not safe for me to enter that zone when I have not forgiven them.

So before I hold an account on anyone I need to make sure I forgive them first because emotions cloud judgement.

Even in trading your emotions will cloud your judgemental thinking.This is why I designed this system.

To cut out the extra fat from whatever strategy you decide to use.

It has 3 Steps:

👉Price has to be above the 50EMA

👉Price has to be above the 200 EMA👉Price should Run up or Gap up*

*This means the price should show you a sign of a trend upwards

This chart has fit all 3 Steps ✅

This is called the "rocket booster strategy "

To learn more 🚀 Rocket Boost This Content.

Disclaimer ⚠️ Trading is risky please learn more about risk management and profit taking strategies. Also feel free to use a simulation trading account before you use real money.

McDonald's Corporation (MCD) – Lovin’ the GrowthCompany Snapshot:

McDonald’s NYSE:MCD is the undisputed global leader in quick-service restaurants, with over 40,000 locations worldwide and a brand that resonates across generations. The company blends cultural relevance with operational excellence, continuously innovating to stay ahead of changing consumer trends.

Key Catalysts:

Pop Culture Marketing Wins 🎯

The Minecraft-themed Happy Meal creates emotional connection with younger audiences

Drives family traffic, social media buzz, and larger basket sizes

Reinforces McDonald’s strategy of tapping into nostalgia + digital engagement

Smart Value Play 💸

The $5 combo hits at the perfect time amid inflationary pressure

Maintains volume without sacrificing margin, appealing to price-sensitive consumers

Combines affordability with iconic menu consistency

Financial Strength & Dividend Power 💼

Over $214B market cap and reliable free cash flow engine

A favorite for dividend growth investors, with a track record of consistent payouts

Strong global real estate holdings provide stability and leverage for expansion

Tech-Driven Operations 📲

Continued investment in mobile app, AI drive-thru, and kitchen automation

Enhances customer experience and boosts operating efficiency

Investment Outlook:

✅ Bullish Above: $278.00–$280.00

🚀 Upside Target: $370.00–$380.00

📈 Growth Drivers: Digital engagement, brand partnerships, resilient demand across economic cycles

📢 MCD: A timeless brand evolving with the times—one meal, one moment at a time.

#MCD #Dividends #BrandPower #FastFoodInnovation #PopCultureMarketing

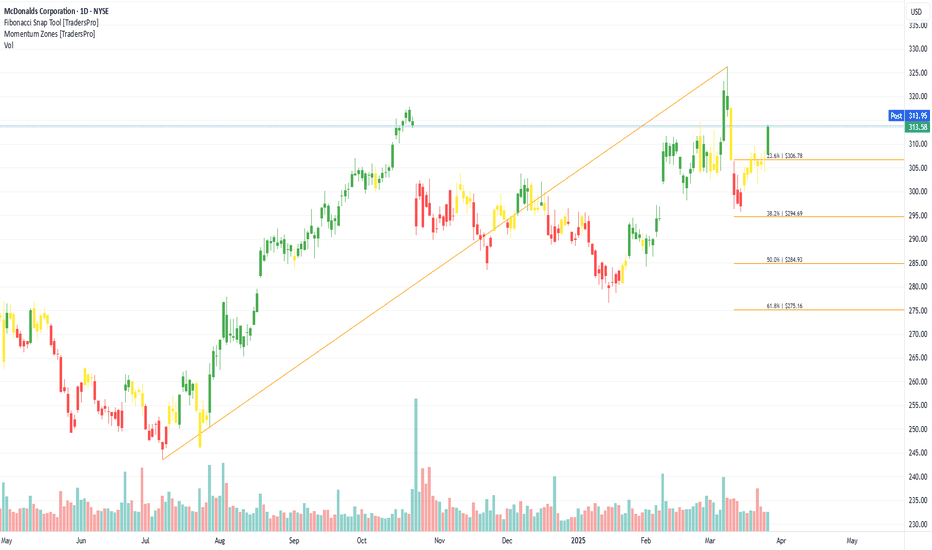

Comprehensive Research - McDonald’s Stock Set to SoarQuick read:

McDonald's stock is poised for a bullish move, with Wave 3 likely starting and strong support near 290.50–295.00. Traders should long on dips within this range, for next resistance levels, 326.00 and 348.00 with a invalidation below 276.00. This setup offers a solid risk-to-reward in a long-term uptrend. Alternative safe entry is possible after the break of corrective channel breakout of wave (2).

Elliott Wave Forecast:

TF - Daily

The chart suggests that McDonald’s stock is in the middle of a larger upward move known as Wave C, which comes after completing a complex correction. Wave C is expected to unfold in five smaller waves, a pattern that usually points to a strong uptrend. It appears the correction is behind us, and a fresh bullish phase is underway.

Starting from the low at 276.53 , marked as Wave B, the price climbed to 326.32 , forming Wave one. After that, the stock pulled back to 290.50 , forming Wave two. This pullback followed a typical ABC pattern within a corrective channel, which often signals the end of a downturn and the beginning of an upward move.

Now, Wave three seems to be starting, and this is usually the strongest part of Wave C. The price is expected to move above 335 , take a small pause for Wave four, and then rise again to complete Wave five somewhere around 345 to 350 dollars. This positive outlook remains intact as long as the price stays above 290.50 . With the breakout from the corrective channel, the setup looks strong and clear for buyers.

Fibonacci levels:

Fibonacci Extension Targets:

1.000 extension: 326

1.618 extension: 348

Correction Retracement Levels:

Wave 2 retracement: 78.6%

A = C in A-B-C correction: 289.21

Price Action & shifting of value:

TF: Weekly

McDonald’s stock has been steadily climbing inside a rising channel since late 2020, showing a clear long term uptrend. The price has respected both the top and bottom edges of this channel very well, and interestingly, the middle line has acted like a pivot, providing support or resistance multiple times over the years.

Recently, the stock made a higher low at 276.53 and bounced back strongly, keeping the bullish structure intact. It then pulled back to 290.50 , right around the middle line of the channel, and held above an upward sloping trendline. This kind of price action shows strength and suggests buyers are stepping in.

The sharp move from 276.53 up to current levels looks like a strong bullish leg, possibly driven by accumulation. If the stock can break above its recent high of 326.32 , it could head toward the upper end of the channel. As long as the price stays above 290.50 and especially above 276.53 dollars, the bulls remain in control. Even if the price dips a bit, the long term trend stays positive unless the lower boundary of the channel breaks down.

I will update more Information here.

McDonald's (MCD): Digital Expansion Fuels Stock StrengthMcDonald’s Corporation (MCD) is one of the most recognized global fast-food brands, known for its burgers, fries, and drive-thru convenience. With thousands of locations worldwide, McDonald’s continues to grow through menu innovation, digital ordering, delivery partnerships, and modernized restaurants. Its strong brand loyalty and focus on speed and consistency keep it competitive in the quick-service space, especially as global demand for affordable and reliable meals stays high.

The stock chart recently showed a confirmation bar with increasing volume, pushing the price into the momentum zone—defined as when the price breaks above the 0.236 Fibonacci level of the current trend. This pattern suggests rising investor confidence and the potential for continued upward movement if bullish momentum holds.

McDonalds is a beast, but short term price dropI love MCD and will always love to eat and trade.

For me MCD is like water ETF. Automation will increase the profits in the future...

BUT price of the stock won't increase more in short term...It will drop.

It is not an investment nor trading advice do your own analysis. I am not responsible for your losses.

McDonald’s Builds Momentum After Quarterly ResultsMcDonald’s share price has been stuck in the slow lane for months, but its latest earnings report has given the stock a much-needed boost. A stronger-than-expected sales performance saw shares jump nearly 5% during yesterday’s session, signalling that investors are starting to take notice again.

Quarterly Results: Signs of a Turnaround

McDonald’s reported a 0.4% rise in global comparable sales for the fourth quarter, a sharp contrast to the 0.4% decline analysts had been expecting. The recovery was driven in part by a stronger performance in international markets, particularly in the Middle East, where sales have improved following last year’s boycott-related weakness. While total revenue remained flat at $6.4 billion, the market’s reaction suggests confidence in the company’s ability to navigate recent challenges.

The US market was a notable weak spot, with comparable sales falling 1.4% as customers reined in spending. An E. coli outbreak in late 2023 also took a toll, temporarily forcing restaurant closures in some states. However, McDonald’s expects US sales to stabilise by Q2, helped by continued promotions and a steady recovery in footfall. Despite these near-term pressures, the latest figures suggest that the worst may be behind the company.

Technical Analysis: Momentum Building Again

McDonald’s share price has been struggling since the October E. coli outbreak triggered a sharp drop, leaving the stock stuck in a choppy range while the wider market pushed higher. Buyers finally stepped in at the 200-day moving average in mid-January, providing the foundation for a recovery. Since then, the stock has broken back above the 50-day moving average, signalling improving momentum.

Yesterday’s earnings reaction saw the shares gap higher and push further into positive territory on strong volume, closing near the highs of the session. The next key test lies ahead, with resistance at the top of the October gap and trend highs just above. A break through these levels could open the door for a more sustained move higher, shifting the focus firmly back towards the long-term uptrend.

McDonald’s (NYSE: MCD) Daily Candle Chart

Past performance is not a reliable indicator of future results

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.