Fast Bounce Setup | Price: 53.98 $ → Target: 56.67 $ (+5%)📈 Stock: MDLZ – Mondelez International 🍫🏭

🟢 Entry: 53.98 ⚡

🎯 Exit / Target: +5% → ~56.67 💰📈

🧱 Technical Support Strength

Price is holding a strong demand zone 🧱🟢

Repeated buyer reactions = solid support ✅✅

High-confidence base 🔒📉

📊 Weekly RSI Reset

RSI is deeply oversold, signaling potential rebo

Mondelez International, Inc. Shs Cert Deposito Arg Repr 0.0666666667 Shs

No trades

Key facts today

B of A Securities has lowered its price target for Mondelez International Inc. (MDLZ) from $69.00 to $62.00 per share.

0.145 USD

4.10 B USD

32.37 B USD

About Mondelez International, Inc.

Sector

Industry

CEO

Dirk van de Put

Website

Headquarters

Chicago

Founded

1903

Identifiers

2

ISINAR0774942129

Mondelez International, Inc. engages in the manufacture and marketing of snack food and beverage products. Its products include beverages, biscuits, chocolate, gum and candy, cheese and groceries, and meals. Its brands include 5Star, 7Days, Alpen Gold, Barni, Belvita, Bournvita, Cadbury, Cadbury Dairy Milk, Chips Ahoy! Clif, Clorets, Club Social, Côte d'Or, Daim, Enjoy Life Foods, Freia, Grenade, Halls, Honey Maid, Hu, Kinh Do, Lacta, Lu, Marabou, Maynards Bassett’s, Mikado, Milka, Oreo, Perfect Snacks, Philadelphia, Prince, Ritz, Royal, Sour Patch Kids, Stride, Tang, Tate’s Bake Shop, Tiger, Toblerone, Triscuit, TUC, and Wheat Thins. It operates through the following geographical segments: Latin America, Asia, Middle East, and Africa, Europe, and North America. The company was founded by James Lewis Kraft in 1903 is headquartered in Chicago, IL.

Related stocks

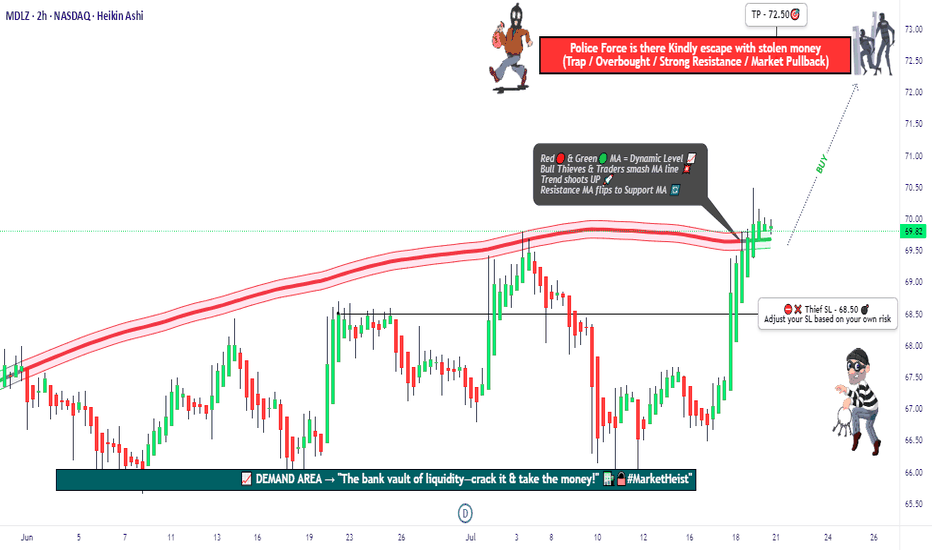

"MDLZ Heist LIVE! Quick Profit Grab Before Reversal!"🚨 MONDELEZ HEIST ALERT: Bullish Loot Zone! (Swing/Day Trade Plan) 🚨

Thief Trading Strategy | High-Risk, High-Reward Play

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba!

To all Money Makers & Strategic Robbers 🤑💸—this is your blueprint to plunder "MONDELEZ INTERNATIONAL, INC" with

MDLZ - Bullish Flag patternBullish Flag pattern

The Bull Flag pattern forecasts in the near future. Currently, it's just early planning with small profits and a reminder to set a stop loss if the pattern cannot breakout upwards.

Both the M50 and MACD indicators suggest the potential for price increase.

The volume is still l

Mondelez (MDLZ): Snack Giant Preps for Possible BreakoutMondelez International, Inc. (MDLZ) is a global snacking powerhouse, best known for beloved brands like Oreo, Chips Ahoy, Cadbury, Ritz, and Toblerone. With a presence in over 150 countries, the company continues to grow by focusing on high-margin snacks, expanding into emerging markets, and boostin

Reversal on Mondelez Looking Favorable. MDLZA clear Elliott 5 wave impulse down is complete, along with classical divergences on the momentum indicator. Willing to bet that this is a reversal with MIDAS line cross and US/vWAP acting as resistance in synchronicity. Interestingly, there's a double harmonic that formed in the more long term aspe

Mondelez at the Edge: Can Bulls Hold the Line?A Pivotal Moment for Mondelez – Will the Bulls Step Up?

Mondelez International (NASDAQ: MDLZ) is trading at $58.05, clawing back some ground but still down 26.1% from its all-time high of $78.59. The stock has been oscillating near a critical resistance level at $58.40, testing the patience of bot

Long-Term Target Analysis for Mondelēz International (MDLZ):Bullish Long-Term Scenario:

If MDLZ reverses course and breaks above the $60.50-$65.00 resistance zone, a long-term bullish trajectory could emerge. Historical price action and Fibonacci projections suggest:

First bullish target: $67.00, the 200-day EMA level and a previous key resistance point.

Se

MDLZ $72.00 - Don't Miss Out on This 18%NASDAQ:MDLZ announced it would like to buy NYSE:HSY which led to a drop to $60. The sell-off came with a high volume and an oversold RSI. The buyers were able to buy the stop up to $61.44 getting it into the support zone. The sell-off did also respect the current bearish channel we're in. From th

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US609207AP0

Mondelez International, Inc. 4.625% 07-MAY-2048Yield to maturity

6.20%

Maturity date

May 7, 2048

XS132408530

Mondelez International, Inc. 4.5% 03-DEC-2035Yield to maturity

5.96%

Maturity date

Dec 3, 2035

MDLZ5041193

Mondelez International, Inc. 2.625% 04-SEP-2050Yield to maturity

5.65%

Maturity date

Sep 4, 2050

MDLZ3672261

Mondelez International, Inc. 6.875% 01-FEB-2038Yield to maturity

5.43%

Maturity date

Feb 1, 2038

MDLZ3673483

Mondelez International, Inc. 6.875% 26-JAN-2039Yield to maturity

5.41%

Maturity date

Jan 26, 2039

MDLZ3677608

Mondelez International, Inc. 6.5% 09-FEB-2040Yield to maturity

5.31%

Maturity date

Feb 9, 2040

MDLZ3671416

Mondelez International, Inc. 7.0% 11-AUG-2037Yield to maturity

5.20%

Maturity date

Aug 11, 2037

MDLZ6067981

Mondelez International, Inc. 5.125% 06-MAY-2035Yield to maturity

4.82%

Maturity date

May 6, 2035

MDLZ5878983

Mondelez International, Inc. 4.75% 28-AUG-2034Yield to maturity

4.78%

Maturity date

Aug 28, 2034

M

MDLZ5263459

Mondelez International Holdings Netherlands BV 1.25% 24-SEP-2026Yield to maturity

4.69%

Maturity date

Sep 24, 2026

See all MDLZD bonds

Curated watchlists where MDLZD is featured.