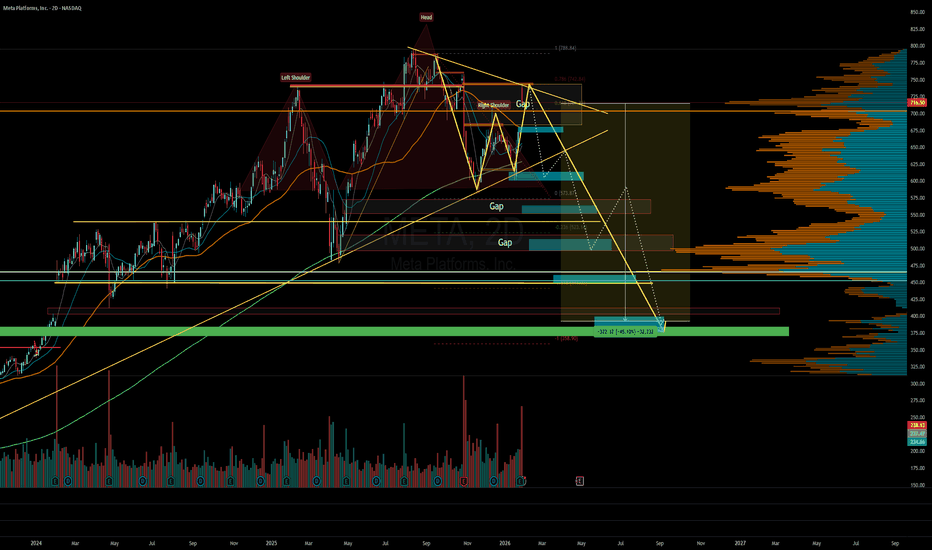

META - a deeeeep pullback soon META had solid bull run and probably this gonna follow rest of the names in this pullback.

Short it anywhere with some longer expiry puts. My preference would be Enter and Exit with good R:R zones and take profits. Expecting a fast move to the downside soon.

I prefer to use round number targets

Meta Platforms Inc Shs A Cert Deposito Arg Repr 0.041666666 Shs

No trades

Key facts today

Meta Platforms (META) plans to boost capital spending to $125 billion in 2026, up from $72 billion last year, raising investor concerns about competition and profitability in AI.

Meta Platforms is in court over child safety, accused of enabling online predators and directing minors to explicit content. The lawsuit seeks penalties and demands age verification changes.

The European Commission has accused Meta Platforms of violating EU antitrust laws by limiting access to its WhatsApp Business API for rival AI chatbots, following a policy change on January 15.

1,250 ARS

75.30 T ARS

250.29 T ARS

About Meta Platforms, Inc.

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

IPO date

May 18, 2012

Identifiers

2

ISIN ARBCOM460168

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

META - SELLERS REMAIN IN CONTROLMETA W1 - Remains capped below the key weekly resistance at 711.00. As long as price fails to break and hold above the resistance level, selling pressure may resume, opening the door for a move toward 479.80 as the first downside target, followed by 393.73 if bearish momentum accelerates.

The over

META Reload Zone — Structural Strength Supports Swing HigherMETA QuantSignals V4 Swing | Feb 3, 2026

Technical Positioning:

Price sits above both the 50-MA ($652) and 200-MA ($682)

MACD bullish, confirming upward momentum

Fundamental Backdrop:

Revenue growth: +23.8%

Analyst target near $858 → ~23% upside

Long-term structure remains constructive despi

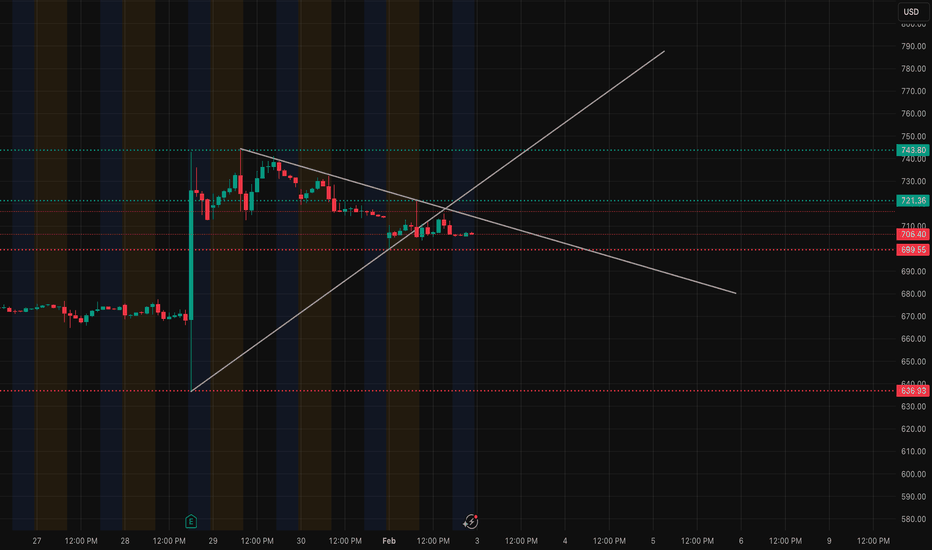

META – Feb 3 Trade Plan (HTF → LTF + GEX)1H – Big picture

META lost its clean upside momentum after the post-earnings impulse and is now compressing under a descending structure. Price rejected from the upper range near the low-740s and has been grinding lower into a tight consolidation.

This is no longer a momentum continuation chart. It

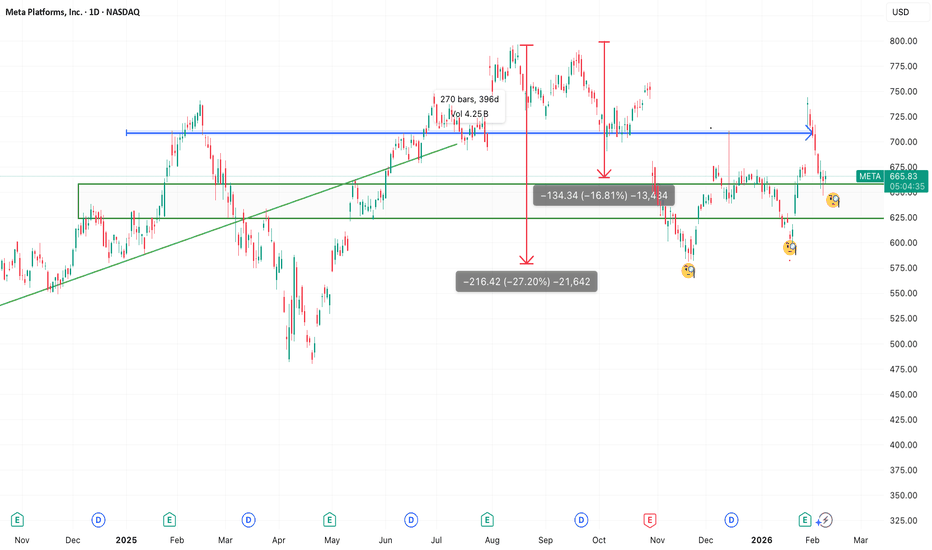

META: Third Higher Low + good Risk/Reward Setup#META

Third test of $625 support after -25% pullback from ATHs.

The Setup:

- Entry: $665

- Stop: $644

- Target 1: $720

- Target 2: ATHs ($750+)

Why I like it:

- Triple bottom = institutional accumulation

- Higher lows = buyers stepping up earlier each time

- Risk/reward 3:1 to first target

Target

BUY for META at Discounted Price - AI CAPEX Priced In!Market sentiment dragging prices down due to concerns over AI CAPEX, but from what I see, these are one time costs with sustained future ROI and non-linear positive scaling effect on META's family of apps and advertising services.

Catalysts upcoming include META's AI Frontier models release - Avoca

META under regulatory pressure in EuropeMETA under regulatory pressure in Europe: the social media debate reopens risks for the sector

By Ion Jauregui – Analyst at ActivTrades

The technology sector has once again moved to the center of the European political debate following strong criticism from Telegram founder Pavel Durov of the S

Three Trades to Watch: 30 January 2026The final week of January has delivered the volatility traders were promised. We are witnessing a historic decoupling in precious metals and a rise in META and TSLA following better than expected earnings reports.

Here is the technical and fundamental alpha you need to capture the momentum.

1. Gol

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

16.08%

Maturity date

Aug 15, 2032

FB6221365

Meta Platforms, Inc. 5.75% 15-NOV-2065Yield to maturity

6.11%

Maturity date

Nov 15, 2065

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

6.09%

Maturity date

May 15, 2063

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

6.09%

Maturity date

Aug 15, 2064

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.01%

Maturity date

Aug 15, 2062

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.96%

Maturity date

Aug 15, 2054

FB6221364

Meta Platforms, Inc. 5.625% 15-NOV-2055Yield to maturity

5.95%

Maturity date

Nov 15, 2055

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

5.92%

Maturity date

Aug 15, 2052

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

5.87%

Maturity date

Aug 15, 2062

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.81%

Maturity date

May 15, 2053

FB6221369

Meta Platforms, Inc. 5.5% 15-NOV-2045Yield to maturity

5.64%

Maturity date

Nov 15, 2045

See all META bonds