Micron Technology, Inc. Shs Cert Deposito Arg Repr 0.2 Sh

No trades

Trade ideas

Micron(MU) Ceiling: A Technical Thesis for a Short PositionThis trade is a strategic short on Micron Technology (MU), grounded in a technical analysis thesis of price rejection at a significant trendline resistance. The core premise is that the strong upward momentum has exhausted itself as the price has encountered a formidable ceiling, signaling an imminent corrective move. The trade is designed to capitalize on the anticipated retracement to a key underlying support level.

The price of MU has been on a strong ascent, but this rally has recently culminated in a critical inflection point. As shown by the red arrow on the chart, the price has failed to convincingly break above a major resistance trendline, which has been respected over a long-term horizon. This rejection is a high-probability bearish signal, indicating a shift in market control from buyers to sellers.

Trade Idea:

Entry Signal: The short position is initiated at the point of rejection, precisely where the red arrow is located.

Exit Strategy: The primary profit target is set at the strong support level, marked by the green support line.

MU hitting $200?Micron technology could be hitting $200 due to an uptrend and a upcomign earnings date. Higher highs, higher lows, which indicates a strong bullish uptrend, and the breakout from 130 followed by a massive volume is also indicating a bullish uptrend. The price is ridign the upper bollinger band, indicating strong momentum.

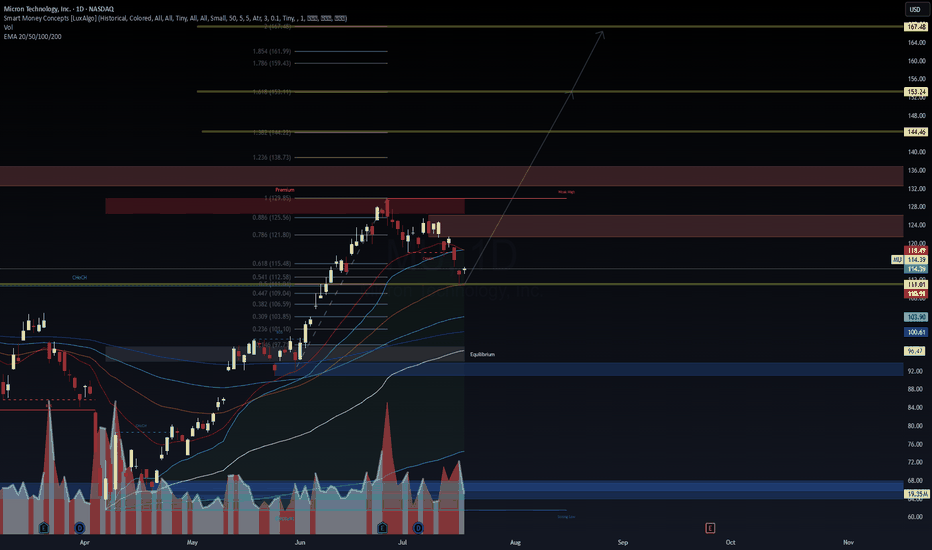

MU - SMC Premium Zone Rejection | Targeting Equilibrium Before E📉 MU - SMC Premium Zone Rejection | Targeting Equilibrium Before Expansion

🔍 WaverVanir DSS Framework | SMC x Fibonacci x Liquidity

We just observed rejection from the Premium zone and 0.886 Fibonacci retracement near $129.85, aligning with prior weak high liquidity. Price has shown signs of distribution, with a likely retracement to the Equilibrium zone ($98–$103) before any bullish continuation.

🧠 Key Observations:

ChoCH confirmed post-run to premium → Expect redistribution

Price rejected 0.886 (122.06) and weak high near 129

Strong EMA confluence forming around 110–103 range

Equilibrium zone and volume spike near $98–$103 offers valid demand

Long-term target remains open toward Fib extension @ $146.10, but only after deeper retrace

📉 Short Bias Until $103–$98 Demand Zone

🔁 Then flip long if bullish confirmation appears

📊 VolanX Market View:

Structure: Breaker → ChoCH → Premium Rejection

Bias: Retracement → Reaccumulation

Tools Used: Smart Money Concepts, Fib, Volume, EMA stack, Liquidity zones

🧠 Built using the WaverVanir DSS, designed to navigate institutional flows and macro-infused setups. We’re tracking this sequence closely across cycles.

📅 Chart Date: July 14, 2025

📍 Asset: NASDAQ:MU (Micron Technology Inc.)

💬 Follow @WaverVanir for macro-aware, alpha-focused setups.

📈 Disclaimer: Not financial advice. Educational content only.

#SMC #OptionsFlow #FibLevels #LiquidityZones #WaverVanir #VolanX #TradingView #MU #Micron #TechStocks #InstitutionalTrading #VolumeProfile #ChoCH #Equilibrium #SmartMoney

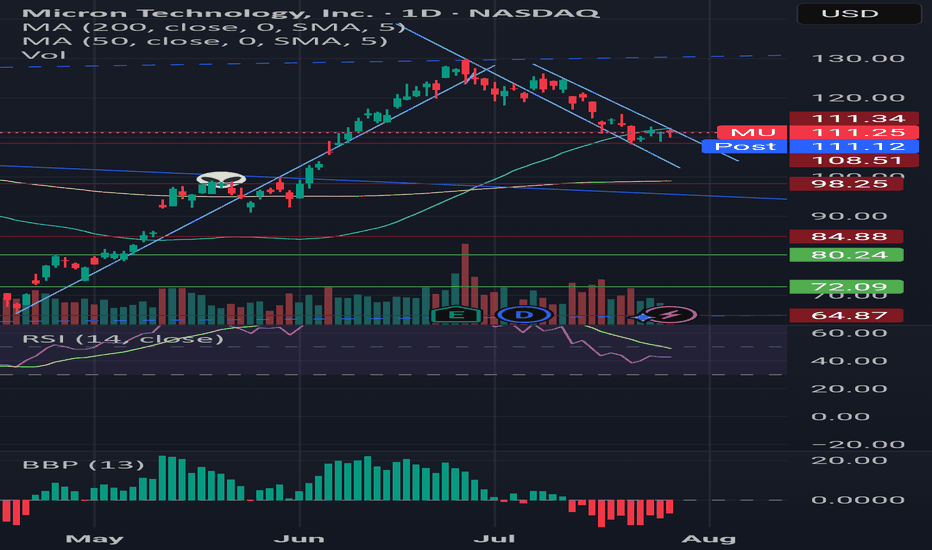

$MU – Preparing for Institutional Flow Reversal?📈 NASDAQ:MU – Preparing for Institutional Flow Reversal?

Micron ( NASDAQ:MU ) is at a crucial confluence zone, holding just above the 0.618 retracement ($115.48) after a CHoCH breakdown. With EMAs (20/50/100/200) aligning under price, the technical setup hints at an early-stage liquidity grab before potential expansion.

🔹 Technical Outlook

Current price: $114.39

CHoCH confirmed near premium zone ($129–$138)

Rejection from 0.886 Fibonacci zone ($125.56)

Holding above major EMAs (Support: $110.91 / $111.01)

Volume spike suggests accumulation at equilibrium ($100–$103)

🔹 VolanX DSS Probability Scenarios

LSTM-GRU model predicts price recovery toward $135–$140 by late August

Short-term risk zones: $108.67 stop loss (weekly), upside target $124.69

1W Neural Forecast: +5.9% upside bias, confidence skewed toward recovery

VaR (99%): -8.68% max drawdown exposure

🔹 Macro & Risk Consideration

Semiconductor cyclicals are catching tailwinds from AI infrastructure demand

Risk: High beta and earnings volatility; monitor inflation & Fed communication

Volatility: 52.4% annualized – risk remains elevated

🔹 Strategic Play (Not Financial Advice)

Entry Zone: $111–$114 (support + VWAP alignment)

SL: $108.67 (below weekly structure)

TP Zones: $124.69, $138.73, $153.24 (Fib levels)

💡 “We don’t trade the price, we trade the narrative. Follow the Smart Money—ride the VolanX Protocol.”

#Micron NASDAQ:MU #TradingView #SMC #LSTM #AITrading #SmartMoney #TechStocks #Fibonacci #OptionsFlow #VolanX #WaverVanir #MarketIntel #InstitutionalTrading #ProbabilityBasedTrading

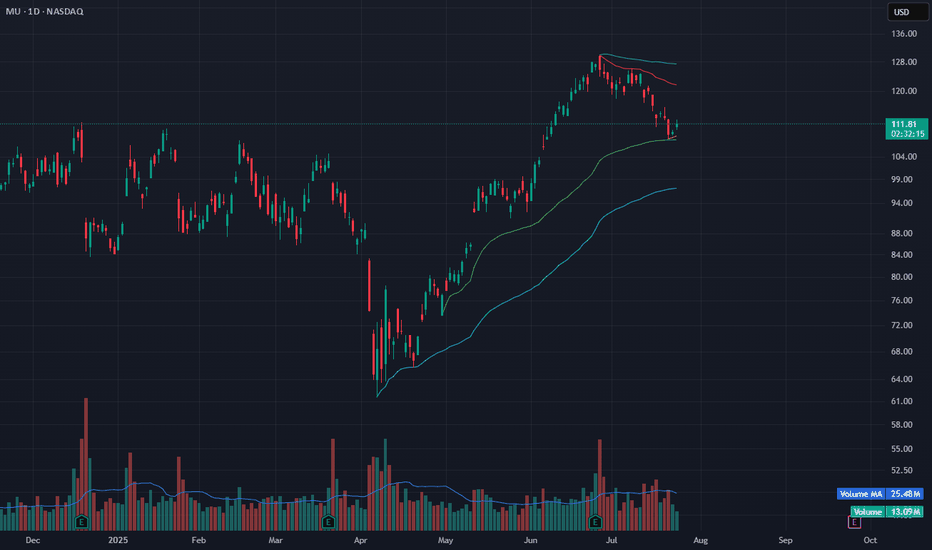

MU eyes on $132-134: Key Resistance about to break for new ATH? MU has been recovering nicely after our last trade call.

Looks ready to break key Resistance at $132.18-134.25

Looking for a Break-n-Retest to start next leg to new ATH.

.

Previous Analysis that caught the EXACT BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report next week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2025-10-17,

for a premium of approximately $9.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MU - POTENTIAL 52-WEEK HIGHMU - CURRENT PRICE : 118.89

The share price rises almost 111% from the bottom of 07 April 2025 to the high of 26 June 2025. Then the stock starts to pullback. It retraces at Fibonacci golden ratio of 38.2%. Last Friday the stock rises and closed as a bullish LONG WHITE CANDLE with high volume - indicating strong buying interest from investors/traders.

This bullish scenario is also supported by some other indicators such as :

1) Price above 50-days EMA

2) Price closes above ICHIMOKU CLOUD (KUMO)

3) RSI reading at 58.95 (above 50 considered bullish)

4) Price is trading near 52-week high level

With all the evidence mentioned above, now may considered as a buying opportunity. 1st target should be one- or two-dollar below the actual 52-week high resistance level.

ENTRY PRICE : 115 - 119

TARGET : 128 and 135

SUPPORT : 108

MU LEAP Alert: $165 Call Poised for Multi-Month Run!

🚀 **MU LEAP ALERT – \$165 CALL**

**Target:** 200% Premium 💎 | **Stop:** \$16.25 🛑 | **Entry:** \$25.00 ⏰

💡 **Thesis:**

* AI + Memory Cycle Recovery 🔋💻

* Weekly RSI \~77 → Strong momentum 📈

* Low VIX (\~15) → Perfect for long-term LEAPs 🌟

* Institutional volume spike supports upside 🔥

🎯 **Trade Details:**

* **Instrument:** MU

* **Direction:** CALL (LONG)

* **Strike:** \$165

* **Expiry:** 2026-09-18

* **Entry Price:** \$25.00

* **Profit Target:** \$75 (200% Gain)

* **Stop Loss:** \$16.25 (35%)

* **Size:** 1 Contract

* **Confidence:** 75% ✅

* **Entry Timing:** Market Open ⏱️

⚠️ **Risks / Notes:**

* Overbought RSI → potential pullback ⚡

* Sector correlation → weakness can affect MU 🏭

* Weekly monitor & partial profit-taking recommended 🪙

💥 **Action Plan:**

1️⃣ Buy at open \$25.00 (or use limit at ask)

2️⃣ Partial exit at +100% premium

3️⃣ Trail remainder toward +200% target

4️⃣ Exit if weekly closes < \$147

🔥 **High-Conviction, Long-Term Bullish Play!**

\#MU #LEAP #OptionsTrading #AI #TechStocks

Micron Technology Inc (MU) – Breakout AlertWe’re currently seeing a breakout setup forming on MU. A confirmation on the next candle would strengthen this move, potentially paving the way for further momentum.

Using technicals, the target price of $145 comes from the Fibonacci expansion. Specifically, it aligns with the 61.8% level from the most recent move up, making it the first key Fibonacci target to watch.

If price action holds, I’m anticipating a swing toward $145. Patience and confirmation are key here. Let’s see how the next session unfolds.

Micron Technology Moving HigherAs you can see, MU has been in an uptrend for a little while now. It broke above a key trendline, consolidated for a bit, then broke even higher last Friday and confirmed with a full candle close above yesterday. I can see MU going to the top orange line which is a long-term weekly trend line in the mid $180's.

MU $135 Call Swing – Momentum + Low VIX Edge!

🚀 **MU Swing Alert! \$135 Call Play 💎📈**

💡 **Momentum + Low VIX → Short-Term Bullish Swing Opportunity!**

**Trade Snapshot:**

* **Instrument:** MU

* **Strategy:** Buy Call (single-leg, naked)

* **Strike:** \$135

* **Expiry:** 2025-09-19 (12-day swing)

* **Entry Price:** \$2.97 (ask at open)

* **Profit Targets:** \$4.46 (+50%) initial, \$5.94+ (+100%) secondary

* **Stop Loss:** \$1.79 (\~40% of premium)

* **Size:** 1 contract

* **Confidence:** 70%

**Rationale:**

* 🔹 Daily RSI 71.4 → bullish momentum

* 🔹 Multi-timeframe positive returns → short-term upside probability

* 🔹 Low VIX → favorable for momentum swing trades

* 🔹 Preferred strike \$135 balances leverage & probability

**Key Notes:**

* Entry at market open; consider slight limit inside ask if desired

* Tight stop & defined profit targets to manage risk

* Max hold: exit by 2025-09-17 unless momentum confirms continuation

* Watch for low volume → could reduce move reliability

📊 **Summary:** Models converge on \$135 call as the optimal swing trade with 12-day horizon. Favorable technicals + low VIX + manageable risk make this a high-probability momentum play.

Smart Money Flow into $MU Calls – Earnings Week Opportunity

# 🚀 MU Earnings Play (Aug 31 – Sep 5) 🚀

💎 **Moderate Bullish | 65% Conviction** 💎

🎯 **Trade Setup**

📊 **Ticker**: \ NASDAQ:MU

🔀 **Direction**: CALL 📈

🎯 **Strike**: \$125.00

📅 **Expiry**: 2025-09-05

💵 **Entry**: 0.68 (ASK)

📦 **Size**: 1 contract (risk 💸 \$68)

🛑 **Stop**: 0.34 (−50%)

🎯 **Target**: 1.36 (+100%)

⏰ **Timing**: Market open 8/31 → exit by 9/4 (Thu)

⚡ **Why Bullish?**

* 📈 RSI strong on weekly (68.7); neutral daily (52.3) → upside potential

* 🔥 Options flow: C/P ratio 1.23, heavy \$124–125 call action

* 🧘 Low VIX (\~15) → cheap premium, low gamma risk

* 🤖 Consensus from 5 AI models = **Moderate Bullish**

✅ **Plan**: Buy ONLY if MU holds above **\$120** w/ healthy opening volume. Cut fast if <\$120.

---

### 📌 Suggested Tags

\#MU #Micron #EarningsPlay #OptionsTrading #CallOptions #WeeklyOptions #BullishSetup #MomentumTrading #TradeIdeas #StockMarket 🚀📊

$MU — Cup & Handle Breakout WatchNASDAQ:MU — Cup & Handle Breakout Watch

Broke the downtrend of the handle within a larger cup & handle base

All major MAs (21/50/200) are tight and stacked, creating a launchpad

Resistance at 128.60 (handle high) → breakout trigger

Volume lighter on pullback, constructive for setup

RS Rating 86, strong earnings acceleration (+208% EPS last qtr, +37% sales), funds adding

Trade Plan:

– Entry on breakout through $128.60 w/ volume

– Stop under handle low (~$118)

– Target zone $133–135 initial, room higher if momentum carries

Classic CAN SLIM setup aligning technical + fundamental strength.

#Cupandhandle #TechnicalAnalysis #SwingTrading

Micron Technology - The bullrun is not over!⛓️💥Micron Technology ( NASDAQ:MU ) will break out soon:

🔎Analysis summary:

Over the past couple of years, Micron Technology has perfectly been respecting the rising channel pattern. With the current retest of the previous all time high, a breakout becomes more and more likely. Therefore the bullrun will only end with a retest of the channel resistance trendline.

📝Levels to watch:

$125, $180

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

MU Momentum Play – $130 Calls in the Crosshairs!🚀 MU Swing Trade Setup – Riding the Momentum!**

**Moderate Bullish Bias | Aug 13, 2025**

**📊 Key Highlights:**

* **RSI:** Strong – Multi-timeframe momentum confirmed ✅

* **Volatility:** Low – Ideal for swing plays

* **Volume:** Weak ⚠️ (watch for fakeouts)

* **Options Flow:** Neutral – Institutions not leaning heavy yet

* **Resistance:** \$129.73 (52-week high)

---

**💡 Trade Plan:**

* **Type:** Aug 29 ’25 \$130 CALL

* **Entry:** \$2.45 (at open)

* **Stop Loss:** \$1.47 (-40%)

* **Target:** \$4.90 (+100%)

* **Confidence:** 72%

---

**⚠️ Risk Factors:**

* Weak volume could stall breakout

* Neutral options sentiment – big money still on the sidelines

* Pullback risk if price fails to hold above support

---

📆 **Signal Time:** 2025-08-13 12:28 EDT

💎 **Execution:** Buy calls at open, scale out at target

---

\#MU #SwingTrade #OptionsAlert #CallOptions #NASDAQ #BreakoutTrade #MomentumStocks #StockMarket

Micron Technology Bullish-But Is a Pullback the Real Money Make? 📈 MU Weekly Swing Setup (2025-08-10) 📈

**Bias:** ✅ **Moderate Bullish** — RSIs aligned across timeframes, options flow supports upside, but volume is light.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:MU

* **Type:** CALL (LONG)

* **Strike:** \$127.00

* **Entry:** \$0.71 (open)

* **Profit Target:** \$1.42 (+100%)

* **Stop Loss:** \$0.36 (-49%)

* **Expiry:** 2025-08-15

* **Size:** 1 contract

* **Confidence:** 75%

**📊 Key Notes**

* RSI strong on daily + weekly → momentum confirmed 📈

* Call/put ratio 1.27 → bullish options sentiment ✅

* Weekly performance +13.36% → trend intact 🔥

* Volume weak → watch for early stall ⚠️

* Low gamma risk into expiry → safer for quick swings 🛡️

MU WEEKLY TRADE IDEA (2025-07-29)

### 🚀 MU WEEKLY TRADE IDEA (2025-07-29)

**Micron Technology (MU) – Bullish Call Play**

🔹 **Sentiment:** Moderate Bullish

🔹 **C/P Ratio:** 2.91 (Bullish Flow)

🔹 **RSI (Weekly):** 53.6 📈

🔹 **Volume:** Weak (⚠️ caution — low conviction)

---

### 🎯 Trade Setup

* **Strike:** \$116.00

* **Type:** CALL (LONG)

* **Expiry:** 2025-08-01

* **Entry:** \$0.62

* **Target:** \$0.89

* **Stop:** \$0.31

* **Risk:** 2–4% of account

* **Confidence:** 65% 🧠

* **Entry Timing:** Market Open

---

### 🤖 Multi-Model Consensus

5 AI Engines Agree:

✅ Buy \$114–\$116 Calls

🧠 Models: Grok, Gemini, Claude, Llama, DeepSeek

📉 Main Risk: Weak volume divergence despite strong options flow

---

### ⚠️ Key Notes

* 📊 Institutional call buying ✅

* ⚠️ Low volume = reduced confirmation

* 🎯 Play is short-dated — gamma spikes expected

* 💥 Manage exits actively near target zones

---

### 🧠 Quick Recap (for speed-readers)

**MU 116C ➜ \$0.62 → \$0.89**

💥 Weekly flow supports upside

⚠️ Volume = weak, but RSI rising

⏱️ Hold short-term with stops

MU Bounce at VWAP Support – Eyeing Relief Toward $118MU is showing signs of a potential reversal after a multi-week pullback. Price held the anchored VWAP zone (green line) near $109 and bounced today with a +1.83% move on 13M volume.

This level also aligns with the lower Bollinger Band — a common mean-reversion setup after extended downside. A short-term bounce toward $118–120 could be in play if the move gains momentum.

Volume is below average but stabilizing. Price must stay above $109 for this bounce to hold.

Indicators used:

Anchored VWAP (support zone)

Bollinger Bands (oversold structure)

Volume + Volume MA (momentum context)

Entry idea: Bounce confirmation above $112

Target: $118–120

Stop: Below $109

MU eyes on $95/97: Double Golden fib zone Ultra-High GravityMU looking to exit a Double Golden zone $95.33-97.23

Break could pop to next resistance zone $109.41-111.38

Expecting some orbits around this ultra high gravity zone.

.

Previous Plot that caught the bottom EXACTLY:

==================================================

.