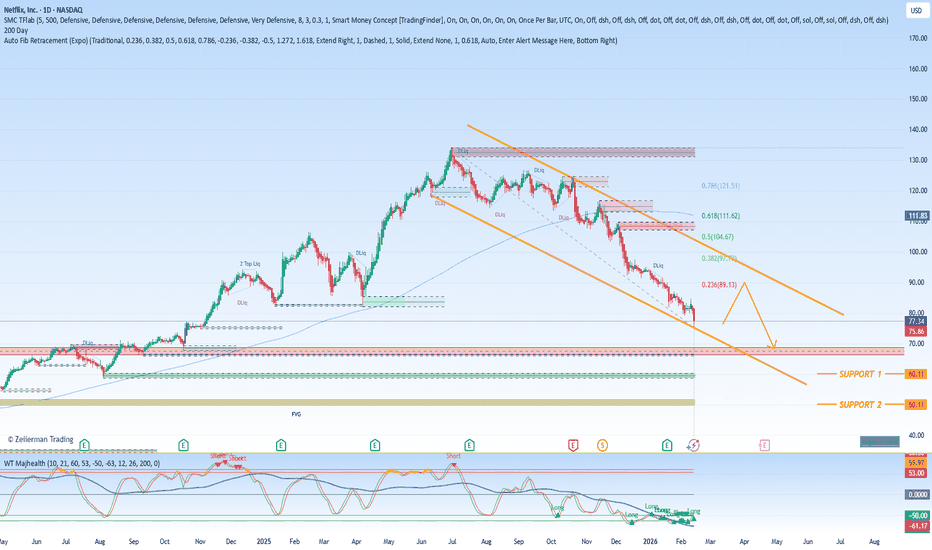

Netflix - Finally approaching support!🎥Netlix ( NASDAQ:NFLX ) will soon reverse higher:

🔎Analysis summary:

The recent -40% correction on Netflix was totally expected. But slowly, Netflix is approaching a major confluence of support at the previous all time high. If we see a final -15% drop, Netflix can then reverse towards the up

Netflix, Inc. Shs ert Deposito Arg Repr 0.0208333 Sh

No trades

65 ARS

13.68 T ARS

56.39 T ARS

About Netflix, Inc.

Sector

Industry

Website

Headquarters

Los Gatos

Founded

1997

IPO date

May 23, 2002

Identifiers

2

ISIN ARBCOM4601D2

Netflix, Inc operates as a streaming entertainment service company. The firm provides subscription service streaming movies and television episodes over the Internet and sending DVDs by mail. It operates through the following segments: Domestic Streaming, International Streaming and Domestic DVD. The Domestic Streaming segment derives revenues from monthly membership fees for services consisting of streaming content to its members in the United States. The International Streaming segment includes fees from members outside the United States. The Domestic DVD segment covers revenues from services consisting of DVD-by-mail. The company was founded by Marc Randolph and Wilmot Reed Hastings Jr. on August 29, 1997 and is headquartered in Los Gatos, CA.

Related stocks

Netflix ($NFLX) — odds are becoming favorable for a reversal.Netflix ( NASDAQ:NFLX ) — odds are becoming favorable for a reversal.

Why:👇

A small base is forming near the 2025 lows.

The extended downtrend is becoming increasingly unsustainable.

The $100 big round number often acts as a long-term magnet.

The entry was shared earlier today with members. I’l

Three Reasons to Buy the Streaming Leader at a DiscountNetflix Inc. finds itself in an unusual position. The company remains the undisputed global leader in subscription streaming, commands nearly 325 million paid memberships, and continues to generate double-digit revenue growth. Yet its stock has been conspicuously out of favor. Over the past 12 month

$NFLX Discounted Prices!!!!NFLX is back in the **wholesale zone 82.56–98.75** after rejecting the **retail/supply band ~115–135**.

If price reclaims **98.75**, the path opens back toward prior supply.

If it loses **82.56**, the market is signaling lower before higher.

Education only, not advice. Patience pays when risk is d

Easy Buy on Netflix - Breakout of Ascending Channel !Netflix is currently down almost 50% from its all time high in Nov 2021.

Currently traded in an ascending channel since Oct 2022 and briefly broke out above with strong volume to close at 357.42 as of market close.

Now we look for some profit taking and pullback to retest the top of the channel

B

NFLX Setting Up at a High-Probability Zone

NASDAQ:NFLX

Been looking at Netflix on the weekly and this is honestly a really interesting spot.

Stock’s down about 43% from the highs and now sitting right at the weekly 200 EMA + the 0.5 fib retracement. That’s a pretty serious confluence zone. My weekly entry signal also triggered recentl

Netflix at a Major Channel SupportMarket Structure

• Price has been moving inside a long-term ascending channel

• Recently:

• Strong rejection from channel top

• Sharp corrective move

• Current price is testing the lower channel boundary + key horizontal support

➡️ Decision zone

Key Levels

• Major Support: 80 – 78

• Ne

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NFLX5862368

Netflix, Inc. 5.4% 15-AUG-2054Yield to maturity

5.57%

Maturity date

Aug 15, 2054

NFLX5862367

Netflix, Inc. 4.9% 15-AUG-2034Yield to maturity

4.58%

Maturity date

Aug 15, 2034

NFLX4901374

Netflix, Inc. 4.875% 15-JUN-2030Yield to maturity

4.23%

Maturity date

Jun 15, 2030

USU74079AN1

Netflix, Inc. 5.375% 15-NOV-2029Yield to maturity

4.11%

Maturity date

Nov 15, 2029

NFLX4908613

Netflix, Inc. 6.375% 15-MAY-2029Yield to maturity

3.99%

Maturity date

May 15, 2029

NFCD

Netflix, Inc. 4.375% 15-NOV-2026Yield to maturity

3.94%

Maturity date

Nov 15, 2026

NFLX4826528

Netflix, Inc. 5.875% 15-NOV-2028Yield to maturity

3.88%

Maturity date

Nov 15, 2028

NFLX4764899

Netflix, Inc. 4.875% 15-APR-2028Yield to maturity

3.80%

Maturity date

Apr 15, 2028

XS198938050

Netflix, Inc. 3.875% 15-NOV-2029Yield to maturity

3.30%

Maturity date

Nov 15, 2029

XS207282979

Netflix, Inc. 3.625% 15-JUN-2030Yield to maturity

2.92%

Maturity date

Jun 15, 2030

XS198938017

Netflix, Inc. 3.875% 15-NOV-2029Yield to maturity

2.85%

Maturity date

Nov 15, 2029

See all NFLX bonds