Germany Blocks €10 Billion in Payments, Shaking PayPalIon Jauregui – Analyst at ActivTrades

German banks have put PayPal (NASDAQ: PYPL) under pressure after blocking more than €10 billion in transactions on suspicion of massive fraud. According to Süddeutsche Zeitung, institutions such as Sparkasse, Bayerische Landesbank, Hessische Landesbank, and DZ Bank halted direct debits processed by the platform after its anti-fraud system failed, allowing unfiltered operations to go through.

The problem, which spread across Europe, hit Germany particularly hard. The Association of Savings Banks (DSGV) acknowledged the significant impact, although it confirmed that services had already been restored. PayPal, for its part, assured that the interruption was “temporary” and that security controls have been reinforced. Regulators BaFin (Germany) and CSSF (Luxembourg) were informed, with no further intervention required.

The reputational blow was quickly reflected in markets: PayPal shares fell between 1.9% and 2.5% following the news.

Solid Fundamentals Despite the Setback

The incident comes at a time when the company had been showing progress in its turnaround strategy. In the second quarter of 2025, PayPal reported revenues of USD 8.29 billion (+5% year-on-year) and adjusted earnings per share of USD 1.40, beating expectations. Total Payment Volume (TPV) reached USD 443.5 billion (+6%), with Venmo standing out with a 20% increase in revenue. Additionally, the company raised its annual profit guidance to a range of USD 5.15–5.30 per share.

Despite these figures, the market reacted cautiously due to a slowdown in its core checkout business, which led to stock declines of up to 8–9% after earnings.

Technical Analysis

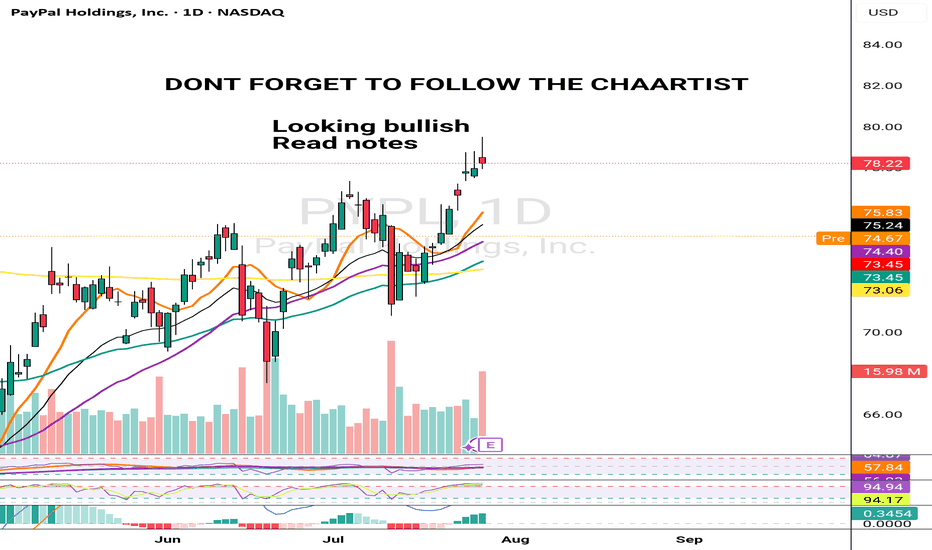

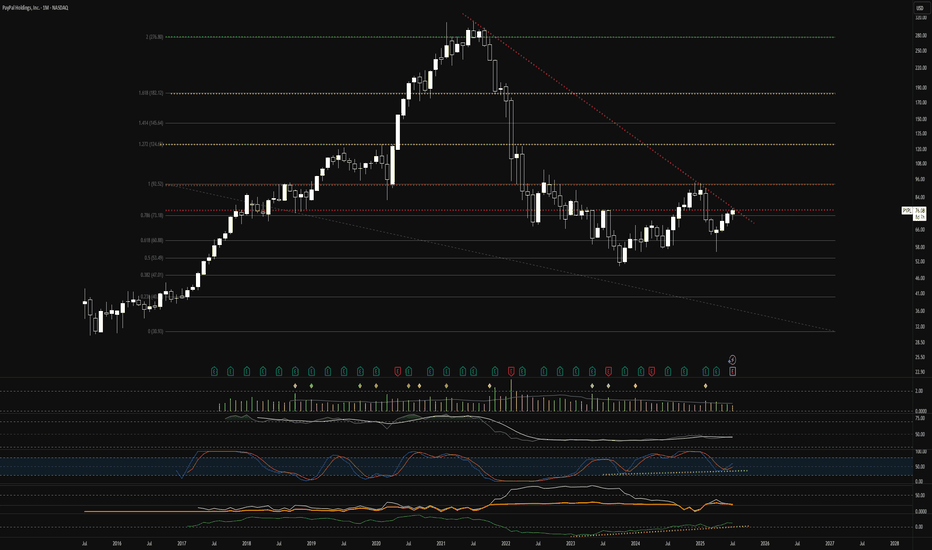

The stock has been trading in a range between $50 and $94 since June 2022, though this band has recently narrowed to between $66.51 and $79.61. Yesterday’s close was $70.06, right in the middle of the long-term range and aligned with the Point of Control (POC), reflecting market indecision.

Technically, the stock registered a death cross at the beginning of August (50-day MA crossing below the 200-day MA), reinforcing downside pressure. The current price is testing resistance at the 50-day MA, near $72. A clear breakout above this level could open the way toward $79.50, the July highs.

Among the indicators, the RSI sits in neutral territory (49.7), leaving room for movement in either direction, while the MACD remains negative but is trending upward, suggesting a possible attempt to retest resistance at $72.

On the downside, key support levels are at $66.51 and the cycle low of $55.85. A break below this latter level could reopen the door to further declines toward the base of the 2022 range.

Meanwhile, the ActivTrades US Market Pulse indicator signals an environment of “Extreme Risk On”, reflecting excess market greed that may trigger volatile moves and sudden reversals.

Reputation at Stake and Ongoing Restructuring

The German case reignites the debate over the reliability of security systems in large fintechs. The failure in Germany strikes PayPal’s reputation at a critical stage of its restructuring. In the short term, the stock remains at an inflection point within a tight range that needs to be broken decisively to reflect meaningful change. In the medium term, however, strong fundamentals support recovery prospects and imply a potential upside of 10–20% if the company can restore market confidence.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Trade ideas

PayPal Holdings, Inc. (PYPL)PayPal Holdings, Inc. (PYPL) — one of the world’s leading technology companies in the field of digital payments. The company’s ecosystem includes the PayPal and Venmo digital wallets for consumers, as well as a full range of payment solutions for businesses: from the branded PayPal Checkout button to unbranded processing via the Braintree platform. The company offers online and mobile payment services, P2P transfers, “Buy Now, Pay Later” (BNPL) services, and is actively developing cryptocurrency and stablecoin offerings. The post-earnings correction presents a good entry point for PYPL shares.

Investment attractiveness factors:

Resilient business model allows the company to generate significant cash flows. Expected free cash flow is $6–7 billion, providing a yield of around 10%. Such strong cash flows enable the company to implement a large-scale share buyback program of about $6 billion in 2025, which should support the stock price.

Development of strategic initiatives: the launch of the global “PayPal World” platform with integration of major global payment systems (including India’s UPI system, China’s Tenpay , Latin America’s Mercado Pago, and PayPal’s own Venmo service) will allow nearly two billion users to make international purchases and money transfers using their familiar local wallets, creating growth potential. The platform launch is scheduled for the end of 2025: it will not impact current financial results but creates a positive news backdrop. PayPal is also actively developing its cryptocurrency strategy, making the PYUSD stablecoin a key growth asset.

Target price — $80.

Recommendation — Buy.

Price at the time of analysis — $67.65.

Upside potential — 18.3%.

paypal holding can see its gloriuos days againpay pal has capacity to restore what has been retrace throghout past years if it can hold throuh next 3 weeks. 67$ and 55$ will be significant support at under any circumtances better should not fall. if it can see this targaet after that we coul see if its momentum strong enough to hold for long term like next year

Bearish Flag in PayPal?PayPal has limped as the broader market flirts with new highs, and some traders may see downside risk.

The first pattern on today’s chart is the drop on July 29 after the company reported quarterly results. While some of the numbers beat, investors focused on lower profitability. Are fundamentals deteriorating?

Second, prices continued lower the next three sessions. They inched slightly higher before stalling again, creating a potential bearish flag.

The drop occurred at the 8-day exponential moving average (EMA), which is also below the 21-day EMA. MACD is falling as well. Those patterns may be consistent with a short-term downtrend.

Finally, the 50-day simple moving average (SMA) had a “death cross” below the 200-day SMA in April and has stayed there since. That may suggest a longer-term downtrend has begun.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

PayPal’s Stablecoin Ambitions Falter Ahead of Earnings ReportWhen PayPal launched its own stablecoin PYUSD in August 2023, the move was seen by many as a bold step toward dominating the digital payments space. However, nearly two years later, PYUSD has yet to meet expectations. Its market share remains minimal, trading volume is weak, and trust from the DeFi community is limited — all while PayPal’s next earnings report looms and investor pressure mounts.

What’s the issue?

According to data from DefiLlama and CoinGecko, PYUSD’s market cap stands at just over $400 million, despite high-profile marketing campaigns and its integration with Venmo. In comparison, USDT has surpassed $110 billion in circulation, and USDC stands at around $32 billion. PYUSD hasn’t even broken into the top five stablecoins on Ethereum by trading activity.

A key problem is low liquidity and limited DeFi adoption. Although PYUSD is available on several decentralized exchanges (DEXs), it often suffers from high slippage. Moreover, PayPal operates under strict regulatory scrutiny as a public fintech company, limiting its ability to innovate or respond rapidly to market trends.

Why earnings matter

PayPal’s Q2 earnings report is expected next week, and investors will be closely watching not only core metrics like revenue and profit but also figures related to its Web3 and digital asset initiatives. With PYUSD underperforming, pressure is building for PayPal to justify its continued push into the crypto space.

There is growing speculation that the company may consider partnering with an established stablecoin provider or even abandoning PYUSD in favor of a white-label solution — a move that could realign its Web3 roadmap.

The strategic lens

Despite current struggles, PayPal still has the brand and user base to play a significant role in digital finance. However, as DLT analysts emphasize, a stablecoin is more than a payment tool — it’s infrastructure. Success depends on liquidity, trust, and deep integration within the DeFi ecosystem. Without robust adoption across chains and use cases, PYUSD risks becoming an internal-only solution with limited external relevance.

Unless the earnings report reveals a strategic pivot or new partnerships, investors may interpret PYUSD as a lost opportunity rather than a long-term asset.

PYPL - Potential to 85.00Hello Everyone,

This week i will be busy on Sunday and not have time to work on Charts. Therefore today i spent some time and make some analysis.

PYPL is the first one.

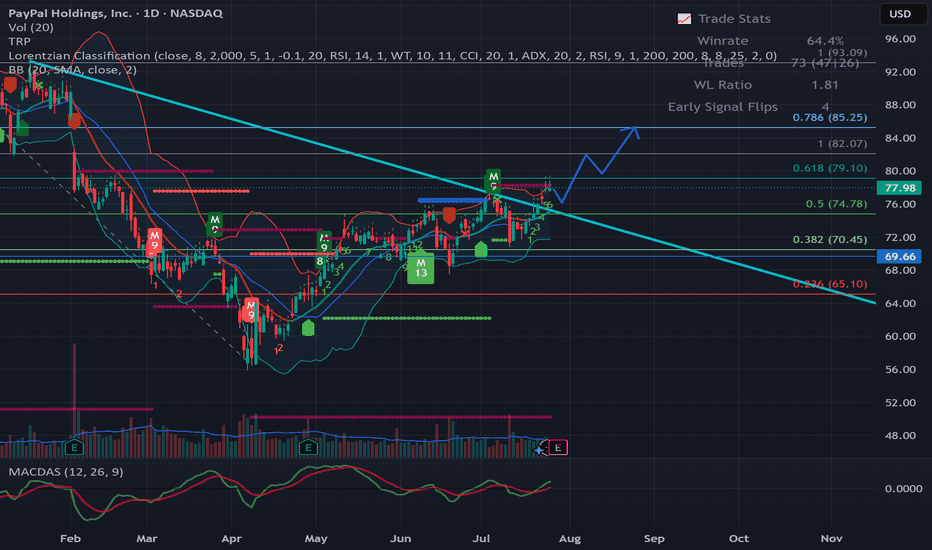

Look like there is a break out to up trend and I am expecting it to reach 85 soon which is more than %10 .

It could re-test to 74.50 - 75.00 , if it will re-test then these price levels could be a good entry point to maximize profit. If not then maybe we can see some back off in 79.00.

Final target for me 85.00 / 86.00 . All in All trend is UP

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a good start a Weekend

$PYPL should be in your kids kids accountNASDAQ:PYPL breaking out! PayPal forming solid base above $70 after 3-month consolidation. Recent upgrade from Seaport Global signals shifting sentiment. Chart shows golden cross with volume confirmation.

Key resistance at $75 once broken, path to $85+ looks clear.

Long-term target: $141 .

Ultimate goal: reclaim ATH of $275.51! Digital payments growth story intact! #PayPal #Fintech #BullishBreakout

"PYPL Money Grab – Ride the Bull Wave Before the Reversal!"🔥 PAYPAL HEIST ALERT: Bullish Loot Grab Before the Trap! 🔥 (Thief Trading Tactics)

👋 Greetings, Market Bandits & Cash Pirates! 🏴☠️💰

This is not financial advice—just a strategic robbery blueprint for PayPal (PYPL).

🎯 THE MASTER PLAN (Day/Swing Heist)

🔑 Entry (Bullish Swipe):

*"The vault’s cracked—bullish loot is ripe! Enter at ANY PRICE or snipe pullbacks (15m/30m swing lows/highs)."*

🛑 Stop Loss (Escape Route):

Thief’s SL: Recent swing low candle body/wick (3H TF).

Your SL = Your Risk. Adjust for lot size & multiple orders.

📈 Target: 82.00 (or escape earlier if bears ambush!)

⚡ SCALPERS’ NOTE:

Longs ONLY. Hit quick profits? Run. Still hungry? Ride the swing heist!

Trailing SL = Your Getaway Car. 🚗💨

⚠️ DANGER ZONE (Yellow MA):

Overbought | Consolidation | Bear Trap | Trend Reversal Risk!

Take profits early—greed gets caught! 🏆💸

📡 FUNDAMENTAL BACKUP (DYOR!):

Check: COT Reports | Macro Trends | On-Chain Data | Sentiment Shifts 🔍🔗 (.Linnkkss. 👉 is there to read!)

🚨 NEWS ALERT (Volatility Warning!):

Avoid new trades during news.

Trailing SL = Survive the Chaos.

💥 BOOST THE HEIST!

👊 Smash "Like" & "Boost" to fuel our next robbery! More loot = More plans! 🚀

🔔 Stay tuned—next heist coming soon! 🤑🎉

PayPal: Bears Losing Control – AgainPayPal (PYPL) has faced renewed downside pressure since our last update, but the bears failed to maintain control for long. The stock quickly rebounded toward key resistance at $78.86. If this level is decisively breached, we will consider the broader correction complete with the alternative low of beige wave alt.II. This would position the stock in the early stages of a new bullish impulse – wave alt.1 – with a 45% probability assigned to this scenario. However, under our primary scenario, we still envision wave II reaching its regular low below support at $50.18. Thus, renewed selling pressure is expected to push the price beneath that level in the near term. Once the low is in place, we reckon with a new impulsive advance.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

PayPal: Rebound or Rerun?PayPal in 2025: A breakout with backbone or just another spineless fintech?

PayPal is still in the rehabilitation ward after its fall from grace in 2021. Management drama, growth slowdown — the full fintech fatigue package. But something has shifted behind the scenes. A new CEO is cutting costs, AI integration is being whispered about, and earnings have started to surprise again. Wall Street pretends not to notice — but volume tells a different story.

Technically, we’re looking at a well-formed inverse head and shoulders. The neckline stretches from $72.00 to $74.76, aligning with the 0.5 Fibonacci level. A confirmed breakout above this zone opens the path to a clear target at $93.66 — the 1.0 Fibonacci extension. Multiple EMA clusters and strong pattern symmetry reinforce the setup. But no fairy tales here: the real entry comes after a retest. Without confirmation, it’s just another pretty formation for chart enthusiasts.

PYPL: Strong Resistance Zone in Play – Watch 73.34 for EntryNASDAQ:PYPL is showing a potential triple top formation near the 73 level. If price breaks above the 73.34 resistance , there's room to move toward 74.15 – a medium-term swing high.

💡 Trade idea: Enter 1 tick above 73.34, set your target and SL based on the 5-minute chart.

Is PayPal's Dominance Built on Tech and Ties?PayPal strategically positions itself at the forefront of digital commerce by combining advanced technological capabilities with key partnerships. A core element of this strategy is the company's robust fraud prevention infrastructure, heavily reliant on sophisticated machine learning. By analyzing vast datasets from its extensive user base, PayPal's systems proactively detect and mitigate fraudulent activities in real time, providing a critical layer of security for consumers and businesses in an increasingly complex online environment. This technological edge is particularly vital in markets facing elevated fraud risks, where tailored solutions offer enhanced protection.

The company actively pursues strategic collaborations to expand its reach and integrate its services into new digital ecosystems. The partnership with Perplexity to power "agentic commerce" exemplifies this, embedding PayPal's secure checkout solutions directly within AI-driven chat interfaces. This move anticipates the future of online shopping, where AI agents will facilitate transactions. Furthermore, initiatives like PayPal Complete Payments demonstrate a commitment to empowering businesses globally, offering a unified platform for accepting diverse payment methods across numerous markets, optimizing financial operations, and reinforcing security measures.

PayPal also adeptly navigates regulatory landscapes to broaden its service offerings and enhance user convenience. Responding to directives like the EU's Digital Markets Act, PayPal has enabled contactless payments on iPhones in Germany, providing consumers with a direct alternative to existing mobile payment options. This ability to leverage regulatory changes to expand accessibility and choice, coupled with its foundational technological strength and strategic alliances, underpins PayPal's assertive approach to maintaining its leadership position in the dynamic global payments market.