Roblox - Not the Same GameCorrection continues - fast and sharp, impulsive wave A .

On the uptrend chart, we see an extended 5th wave. During the correction, the move should ideally retrace a similar distance in the opposite direction - just like it did on the smaller wave.

Key targets:

First unfinished target: around 75

Then: 70 -> 63 -> 50

---

Please subscribe and leave a comment.

You’ll get new information faster than anyone else.

---

Roblox Corp. Shs A Cert Deposito Arg Repr 0.5 Sh A

No trades

Market insights

RBLX Coming for $82 and $72 NextRBLX continues to get taken to the woodshed, and looks likely to continue until this company addresses the child-safety issue meaningfully and with genuine concern. And with summer viral hits waning and nothing as of late emerging to capture attention, it's momentum has faded. Gaps to fill at $82 and $77, but it can fall even lower. Add in analyst downgrades, and it's bullish story has been postponed until some positive catalysts arrive and the mounting lawsuits aer resolved.

Roblox - is it going to zero?Roblox Should Go to H — And Take Its Stock With It

I don’t want this company to go to zero.

I want it to go to -15 — just like the mental state it leaves in kids after an hour of toxic gameplay.

What was supposed to be a platform for creativity, coding, and collaboration has turned into one of the most psychologically damaging ecosystems for children online.

Let’s call it what it is:

A digital warzone masked as education.

• Games that reward scamming

• Mechanics built around stealing

• Rage cycles disguised as “fun”

• Social toxicity coded into gameplay loops

My own son went from calm to chaotic in minutes.

That’s not learning. That’s corruption.

Now look at the chart — it speaks louder than PR:

• Rejected at $131.82

• Dumped below $113.02

• Struggling under $100.13

• Major support: $53.40

And if justice ever catches up? This thing goes to -15 , morally and mentally.

The Lawsuits Are Real — And Growing:

1. Child Exploitation & Grooming Allegations:

Families have sued Roblox over claims their children were groomed on the platform.

The courts are allowing these cases to proceed — refusing to sweep them under arbitration.

That’s not noise. That’s systemic failure.

2. Robux Gambling & Financial Harm:

Class action suits are targeting Roblox’s in-game economy — alleging it enables gambling-like behavior in minors, with no protection or refund mechanisms.

3. Content Moderation Collapse:

Despite “kid-safe” branding, Roblox has allowed sexually explicit, violent, and manipulative content into its ecosystem — including games where stealing and trolling are core mechanics.

Parents aren’t just angry. They’re organizing.

Roblox isn’t just negligent.

It’s liable — morally and increasingly, legally.

Perspective Shift

We track risk on charts.

But what about emotional risk? Psychological risk? Developmental risk?

What’s the cost of a game that teaches kids to scam, steal, lie, rage, and lose?

If you're a trader AND a parent, this chart should make your blood boil.

Roblox had one job — to build a better future for our kids.

Instead, it weaponized their attention spans, monetized their trust, and left parents picking up the pieces.

One Love,

The FXPROFESSOR

Disclaimer: I’m OK with my son playing GTA, COD, etc etc!!! But this shit? NO!!!

RBLX Roblox Corporation Options Ahead of EarningsIf you haven`t bought RBLX before the rally:

Now analyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week,

I would consider purchasing the 130usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $13.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Aging Investors Didn't Try The Product17 year olds are not adults. This is off the official Roblox website, good luck investors. If 1 law suit can do this and they have 13,300 incidents, it's only a matter of time before more follow in my opinion

Always try the product before investing in it, a simple search for Roblox on youtube immediately shows sexual content aimed towards minors. This is a stick of dynamite, and it just got lit

RBLX QuantSignals V3 Weekly 2025-11-05RBLX QuantSignals V3 Weekly 2025-11-05

RBLX Weekly Signal | 2025-11-05

• Direction: BUY PUTS | Confidence: 60%

• Expiry: 2025-11-07 (2 days)

• Strike Focus: $102.00

• Entry Range: $1.57

• Target 1: $2.51

• Stop Loss: $0.94

• Weekly Momentum: BEARISH (-1.03% 1W)

• Flow Intel: Neutral | PCR 0.80

• Max Pain: $104.00 (+1.9% vs spot)

• ⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

⚖️ Compliance: Educational commentary for QS Premium members only. No financial advice.

🎯 TRADE RECOMMENDATION

Direction: BUY PUTS

Confidence: 60%

Conviction Level: MEDIUM

🧠 ANALYSIS SUMMARY

Katy AI Signal: Neutral with slight bearish bias - predicts target of $102.81 (upside limited to +0.7%) with stop loss at $100.57, suggesting weak directional movement but slightly favoring downside risk

Technical Analysis: Strong bearish weekly momentum (-1.03% 1-week, -1.54% 2-week), price at 18.2% of weekly range lows, EMA alignment confirms BEARISH downtrend with 100% multi-timeframe confirmation

News Sentiment: Neutral sentiment with analyst upgrades (Macquarie raises target to $164) but stock remains down 24.9% on the day, indicating weak momentum despite positive coverage

Options Flow: PCR at 0.80 suggests slight put bias, max pain at $104.00 (+1.9% above current price), unusual activity at $103 put level, supporting potential downside pressure

Risk Level: MEDIUM - high gamma risk with 2 days to expiration, low VIX environment limits volatility expansion potential

💰 TRADE SETUP

Expiry Date: 2025-11-07 (2 days)

Recommended Strike: $102.00

Entry Price: $1.57 (mid price from table)

Target 1: $2.51 (60% gain)

Target 2: $3.14 (100% gain)

Stop Loss: $0.94 (40% loss)

Position Size: 2% of portfolio (moderate conviction in bearish momentum)

⚡ COMPETITIVE EDGE

Why This Trade: Combines Katy's neutral-bearish bias with strong technical confirmation and option

Image

QS Analyst

APP

— 5:31 PM

s flow positioning for a high-probability weekly move

Timing Advantage: Mid-week momentum continuation expected with weekly trend firmly established, low VIX provides attractive entry pricing

Risk Mitigation: Conservative strike selection (0.48 delta) balances probability with reward potential, tight stop limits exposure

🚨 IMPORTANT NOTES

Katy AI shows only 50% confidence in neutral signal - this is a momentum-based play with moderate conviction

Extremely low volume (0.0x average) indicates liquidity concerns - use limit orders only

2-day expiration creates high gamma risk - monitor positions closely

Consider scaling into position given high volatility of weekly options

📊 TRADE DETAILS 📊

🎯 Instrument: RBLX

🔀 Direction: PUT (SHORT)

🎯 Strike: 102.00

💵 Entry Price: 1.57

🎯 Profit Target: 2.51

🛑 Stop Loss: 0.94

📅 Expiry: 2025-11-07

📏 Size: 2.0

📈 Confidence: 60%

⏰ Entry Timing: N/A

🕒 Signal Time: 2025-11-05 20:31:07 EST

⚠️ MODERATE RISK WARNING: Consider reducing position size due to moderate confidence level.

RBLX | Range Breakout Setup: Close >145 (Stop <139.7)RBLX just printed a chunky green day and parked under the same ceiling it’s bumped into for two months. Price closed around 141.7 after pressing the 143 zone that has capped every pop since August. The whole last leg looks like a classic re-accumulation: big run April–July, then a sideways box between ~115 and ~143 while volume cooled and dips kept getting bought. This week the character shifted, momentum flipped up, the fast line crossed the slow on MACD, RSI is rising through the mid-60s without divergence, and the last few candles are real bodies with small upper wicks. In other words: buyers are finally showing intent, but they still need to finish the job with a proper range break.

If you map the recent swing from 123 to 150, the fibs frame both paths. On a clean push through 145 with expanding volume (think a full-bodied breakout candle that closes above prior highs), the next magnets line up at the 1.272 extension near 157, the 1.414 around 161, and the 1.618 up at ~167. That cluster also agrees with a simple measured move off the box height (20 points added to the 143 lid gives ~163), so there’s nice confluence in the high-150s to mid-160s if momentum really kicks.

If the breakout stumbles, the retracement rails are clear. First defense is the 38.2% at ~139.7; lose that and the work back into the box usually gravitates to the 50% at ~136.5 and the 61.8% at ~133.3, which also sits right on the mid-box memory from September. Deeper shakeouts can probe the 78.6% around ~128.8, with the last line of the whole structure down at the 123 base. Candle behavior matters at each step: a strong close back under 139.7 after poking highs would look like a failed breakout; a long-wick rejection near 145–150 with rising volume would scream “upthrust” and likely send it to those mid-box supports. Conversely, a breakout day that closes near the highs with volume 1.5x the recent average, followed by a shallow throwback that holds 143–145 and flips that level into support, is the textbook continuation look.

Tactically, this is one of those “trade the break, not the hope” setups. Confirmation above 145 with juice opens 150 quickly and then the 157 -> 161 -> 167 ladder as momentum builds; risk gets tucked below the most recent higher low or, for swing patience, beneath the 38.2% at ~139.7, with a hard invalidation if the structure caves through 133.3. If instead price can’t hold the 139–140 shelf, let it reset toward 136/133 and wait for a fresh reversal signal rather than forcing an entry in the middle of the box. Big picture: the range did its job, momentum has flipped, and the next few sessions should tell us whether this was just another poke at the ceiling or the start of the next markup leg.

Roblox Corporation NYSE: RBLX BUYRoblox Corporation RBLX is a leading global platform for immersive gaming and shared user experiences, distinguished by its strong community of creators and extensive virtual economy. In the first half of 2025, Roblox showed remarkable growth, with Q1 revenue growing 29% year-over-year to about $1.04 billion and Q2 revenue increasing 21% year-over-year to approximately $1.08 billion. Bookings, a key forward-looking financial metric, surged by 31% in Q1 and an impressive 51% in Q2, reaching $1.4 billion.

I think Roblox wants it's slower, long term trendRoblox doesn't seem to have the profit growth to support such a steep uptrend. I'm speculating it will want back on it's slower long term trend line and thus $70 is my target if it begins a downtrend. If it doesn't fall below $118 then I'm at the very least expecting it to still be around $118 in 2029. We'll see.

So as always good luck!

ROBLOX RBLX 211% explosive predictionRoblox has been accumulated since 2022. It is ready to take off.

How long it will take to get to 211% gain? Who knows, end of the year or may be middle 25

This a swing trade idea, buy and forget for at least six months

I added some important levels if you want to take profits along the way

Sharing is caring.

GLGT

-roosgart

Is ROBLOX Rebuilding ?Roblox has been on a strong run, up 320% since May last year. After spiking to $250 on earnings it pulled back 25%, but the stock looks to have stabilized and is pushing higher again. Both MACD and RSI are signaling renewed buying momentum.

This is the kind of setup I like to trade. A steady uptrend consistently making higher highs, a pullback into value off news, and then buyers stepping back in to drive the next leg higher.

Might be worth a watch.

Bearish Setup on RBLX: 107P Weekly Play

# 🎮 RBLX Weekly Options Setup (8/18 – 8/22)

📉 **Market Context**

* Current Price: **\$117.34**

* Last Week Drop: **−8.83%**

* Daily RSI: 40.5 → short-term weakness

* Weekly RSI: 71.5 → overbought but falling

* Call/Put Ratio: 1.00 → neutral sentiment

* VIX: 15.49 → favorable for options (low premiums)

---

## 🎯 Trade Setup (Naked Put)

* **Instrument**: RBLX

* **Direction**: PUT (SHORT)

* **Strike**: \$107.00

* **Expiry**: 2025-08-22

* **Entry Price**: \$0.85 (range: 0.85–0.95)

* **Profit Target**: \$1.80 (\~100% gain)

* **Stop Loss**: \$0.45 (50%)

* **Size**: 1 contract

* **Confidence**: 68% (bearish momentum tempered by mixed signals)

* **Entry Timing**: Market Open Monday

---

## 📈 Breakeven @ Expiry

👉 \$106.15 (Strike – Premium)

RBLX must **close < \$106.15 by 8/22** to finish ITM.

Plan: exit early on volatility or momentum spike to secure gains.

---

## 🧠 Key Risks

* Oversold bounces from bullish news 📰

* Low VIX → smaller premiums, potential whipsaw

* Mixed market signals → use cautious sizing ⚠️

---

# ⚡ RBLX 107P WEEKLY PLAY ⚡

🎯 In: \$0.85 → Out: \$1.80

🛑 Stop: \$0.45

📅 Exp: 8/22

📈 Bias: Bearish, but trade carefully around news & volatility

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "RBLX",

"direction": "put",

"strike": 107.0,

"expiry": "2025-08-22",

"confidence": 0.68,

"profit_target": 1.80,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.85,

"entry_timing": "open",

"signal_publish_time": "2025-08-18 09:30:41 UTC-04:00"

}

```

RBLX Targeting the Hights--$141 Target in SightHere’s your **RBLX swing trade** rewritten for **TradingView viral style** — fast to read, chart-ready, and built for engagement:

---

## 🎮 RBLX Swing Trade Setup (2025-08-09) 🎮

**Bias:** 📈 **Moderate Bullish w/ Caution** — momentum up across timeframes, but volume is weak.

**🎯 Trade Plan**

* **Ticker:** \ NYSE:RBLX

* **Type:** CALL (LONG)

* **Strike:** \$141.00

* **Entry:** \$1.04 (open)

* **Profit Target:** \$3.85 (+270%)

* **Stop Loss:** \$0.72 (-31%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 75%

**📊 Key Notes**

* RSI 56.9 → neutral, falling from highs

* Multi-timeframe momentum ✅

* Volume only 1.0x avg = weak conviction ❌

* Options sentiment neutral → no big institutional push yet

* VIX 15.88 = calm enough for swings

Insiders are selling Roblox ! Heres the levels you need to knowIn this video I lay out a solid plan for a move to the downside for Roblox after a 100% move to the upside since April of this year .

I demonstrate why I believe we will take a 30% retracement and provide confluent evidence to support this theory.

There are some fundamental reasons that I also did include alongside the technical analysis which is not my regular style but important given the context.

Tools used in the video 0.382 Fib , Standard Fib pull, Trend based fib and pivots .

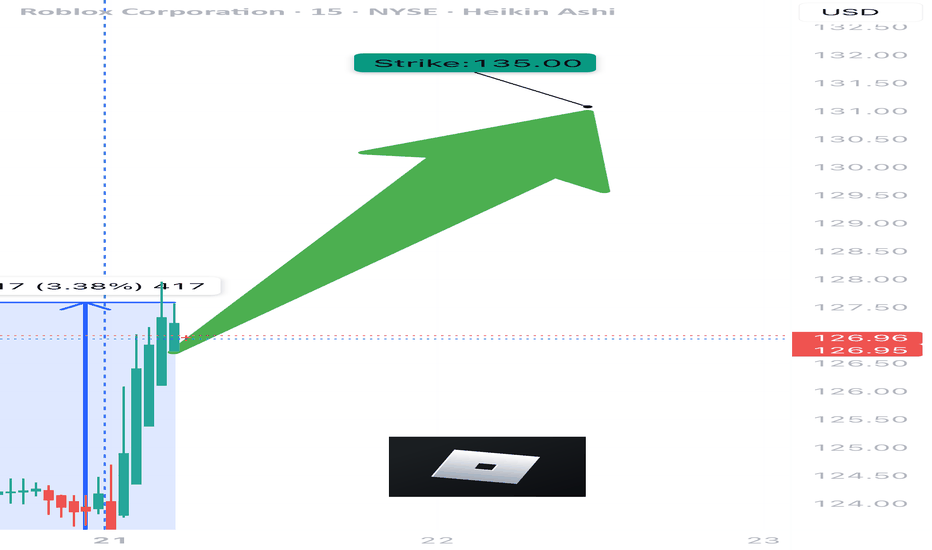

RBLX WEEKLY TRADE IDEA – JULY 21, 2025

🎮 NYSE:RBLX WEEKLY TRADE IDEA – JULY 21, 2025 🎮

📈 RSI MAXED. Volume Pumped. Call Flow on 🔥

This is a full-send momentum setup.

⸻

📊 Trade Setup

🔸 Direction: Long Call

🎯 Strike: $135.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry Price: $0.63

🎯 Profit Target: $1.25 (💯%)

🛑 Stop Loss: $0.30 (~50% risk)

📈 Confidence: 🔵 85%

🕰️ Entry Timing: Market Open Monday

📦 Size: 1 Contract (2–3% of account)

⸻

🧠 Why This Trade?

✅ Daily RSI: 84.9 / Weekly RSI: 89.5 → 🔥 Overdrive

✅ Volume = 1.5x last week → Institutional buildup

💥 Call/Put Ratio = 3.42 → Unusual bullish options flow

📉 VIX at 16.7 → Smooth gamma conditions for calls

🧩 5/5 Momentum Signals Confirmed across models

⸻

⚠️ Key Risks to Watch

• RSI = 🚨 Overbought → Monitor for fakeouts

• Exit by Thursday to dodge Friday decay trap

• Watch news headlines – unexpected events can swing this

• Be ready to scale profits early if $137–138 tested quickly

⸻

🛠️ Execution Strategy

🔹 No spreads. Naked call only for max gamma upside

🔹 Trail profit >30% if price spikes early

🔹 Keep stop hard at $0.30 to guard against fade

⸻

🏁 Final Word:

This is a textbook breakout + flow setup.

Let the call ride early-week momentum, but exit smart before theta kicks in.

NYSE:RBLX 135C — Risk $0.30 to Target $1.25 🚀

Don’t chase. Enter clean. Manage tight.

⸻

#RBLX #OptionsTrading #CallOption #WeeklyMomentum #BreakoutTrade #UnusualOptionsActivity #TradingViewIdeas #BullishFlow #InstitutionalOrderFlow #Roblox

HOOD - STOCK ANALYSIS: Market leader weekly chart bases and HOOD STOCK ANALYSIS

· What will the reader learn? Hi, in this stock analysis we’re going to talk about HOOD. Recently leading the way with super strong market action and being a clear leader.

· STAGE: 2 with continuation uptrend and currently going for ATH. It has given some great opportunities along the three base counts.

· Base counting: When the stock forms a base (5W min.) and breakouts, I want to see that breakout go +20% min. If it doesn’t, I still see it as the same base count (same color). Only when the breakout move goes +20% I’ll consider the new base as an extra count (different color).

Summary

· HOOD provides commission free trading serving over 25.8 million funded accounts.

Fundamental Overview (as of writing of this article)

· EPS: Growing triple digits

· Sales: Growing strong +36% +115% +50%

· Funds: Increasing, institutional money flowing in

· Industry Ranking: 32

· Composite Rating: 98

· RS Rating: 98

· EPS Rating: 81

· Acc/Dis Rating: A-

Technical Analysis

· Stage: 2

· Weekly Charts:

NASDAQ:HOOD

· Bases:

o 1: Tried to go 3 times. +76% move after it

o 2&3: Completely different base personalities (one shallow and one deep) but great results so far on both.

Final Thoughts:

· I think HOOD has been a great trader and has given many great opportunities. This is so far the TML so not going to make any suggestions for targets because these type of stocks can continue beyond what you think.

· So far is extended, the key to get in is to wait for bases on fundamentally sound stocks, so for now holding current position but not adding.

Do you agree with my analysis? And if not, what do you think I missed?

#RBLX (Y25.P2.E1). strong chartHi traders,

This ranged for years and I missed the breakout. I'm monitoring this chart for a study case and using my methodology to see if its accurate to forecast key level targets.

If I do see an opportunity to enter a long, so be it but its not giving any at the moment.

Elliott wave suggests extended 5th wave due to wave 2-3 being short. We will monitor this on our forum for opportunities in the coming weeks.

Anyway, its one of the charts that hit my interest.

All the best,

S.SAri.