RBLXB trade ideas

ROBLOX RBLX 211% explosive predictionRoblox has been accumulated since 2022. It is ready to take off.

How long it will take to get to 211% gain? Who knows, end of the year or may be middle 25

This a swing trade idea, buy and forget for at least six months

I added some important levels if you want to take profits along the way

Sharing is caring.

GLGT

-roosgart

Is ROBLOX Rebuilding ?Roblox has been on a strong run, up 320% since May last year. After spiking to $250 on earnings it pulled back 25%, but the stock looks to have stabilized and is pushing higher again. Both MACD and RSI are signaling renewed buying momentum.

This is the kind of setup I like to trade. A steady uptrend consistently making higher highs, a pullback into value off news, and then buyers stepping back in to drive the next leg higher.

Might be worth a watch.

I think Roblox wants it's slower, long term trendRoblox doesn't seem to have the profit growth to support such a steep uptrend. I'm speculating it will want back on it's slower long term trend line and thus $70 is my target if it begins a downtrend. If it doesn't fall below $118 then I'm at the very least expecting it to still be around $118 in 2029. We'll see.

So as always good luck!

Bearish Setup on RBLX: 107P Weekly Play

# 🎮 RBLX Weekly Options Setup (8/18 – 8/22)

📉 **Market Context**

* Current Price: **\$117.34**

* Last Week Drop: **−8.83%**

* Daily RSI: 40.5 → short-term weakness

* Weekly RSI: 71.5 → overbought but falling

* Call/Put Ratio: 1.00 → neutral sentiment

* VIX: 15.49 → favorable for options (low premiums)

---

## 🎯 Trade Setup (Naked Put)

* **Instrument**: RBLX

* **Direction**: PUT (SHORT)

* **Strike**: \$107.00

* **Expiry**: 2025-08-22

* **Entry Price**: \$0.85 (range: 0.85–0.95)

* **Profit Target**: \$1.80 (\~100% gain)

* **Stop Loss**: \$0.45 (50%)

* **Size**: 1 contract

* **Confidence**: 68% (bearish momentum tempered by mixed signals)

* **Entry Timing**: Market Open Monday

---

## 📈 Breakeven @ Expiry

👉 \$106.15 (Strike – Premium)

RBLX must **close < \$106.15 by 8/22** to finish ITM.

Plan: exit early on volatility or momentum spike to secure gains.

---

## 🧠 Key Risks

* Oversold bounces from bullish news 📰

* Low VIX → smaller premiums, potential whipsaw

* Mixed market signals → use cautious sizing ⚠️

---

# ⚡ RBLX 107P WEEKLY PLAY ⚡

🎯 In: \$0.85 → Out: \$1.80

🛑 Stop: \$0.45

📅 Exp: 8/22

📈 Bias: Bearish, but trade carefully around news & volatility

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "RBLX",

"direction": "put",

"strike": 107.0,

"expiry": "2025-08-22",

"confidence": 0.68,

"profit_target": 1.80,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.85,

"entry_timing": "open",

"signal_publish_time": "2025-08-18 09:30:41 UTC-04:00"

}

```

Aging Investors Didn't Try The Product17 year olds are not adults. This is off the official Roblox website, good luck investors. If 1 law suit can do this and they have 13,300 incidents, it's only a matter of time before more follow in my opinion

Always try the product before investing in it, a simple search for Roblox on youtube immediately shows sexual content aimed towards minors. This is a stick of dynamite, and it just got lit

RBLX Targeting the Hights--$141 Target in SightHere’s your **RBLX swing trade** rewritten for **TradingView viral style** — fast to read, chart-ready, and built for engagement:

---

## 🎮 RBLX Swing Trade Setup (2025-08-09) 🎮

**Bias:** 📈 **Moderate Bullish w/ Caution** — momentum up across timeframes, but volume is weak.

**🎯 Trade Plan**

* **Ticker:** \ NYSE:RBLX

* **Type:** CALL (LONG)

* **Strike:** \$141.00

* **Entry:** \$1.04 (open)

* **Profit Target:** \$3.85 (+270%)

* **Stop Loss:** \$0.72 (-31%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 75%

**📊 Key Notes**

* RSI 56.9 → neutral, falling from highs

* Multi-timeframe momentum ✅

* Volume only 1.0x avg = weak conviction ❌

* Options sentiment neutral → no big institutional push yet

* VIX 15.88 = calm enough for swings

Insiders are selling Roblox ! Heres the levels you need to knowIn this video I lay out a solid plan for a move to the downside for Roblox after a 100% move to the upside since April of this year .

I demonstrate why I believe we will take a 30% retracement and provide confluent evidence to support this theory.

There are some fundamental reasons that I also did include alongside the technical analysis which is not my regular style but important given the context.

Tools used in the video 0.382 Fib , Standard Fib pull, Trend based fib and pivots .

Roblox Set for a Potential Rally Ahead of EarningsCurrent Price: $118.82

Direction: LONG

Targets:

- T1 = $122.50

- T2 = $129.00

Stop Levels:

- S1 = $116.00

- S2 = $113.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Roblox.

**Key Insights:**

Roblox Corporation (RBLX) is strategically positioned as a key infrastructure leader in metaverse development, making its equity an attractive play for investors anticipating major tech adoption trends. The company’s focus on innovation and user engagement has allowed it to maintain steady revenue growth, despite macroeconomic pressures. Metrics such as Daily Active Users (DAU) and average revenue per user are expected to drive momentum during earnings week. Analysts are watching how Roblox navigates rising costs and inflationary challenges without compromising product innovation.

Further, Roblox's partnerships with video gaming and enterprise brands to define the metaverse market promise continued growth opportunities. However, its reliance on younger demographics poses inherent risks in a downturned technology landscape, something traders should keep in mind before going long.

**Recent Performance:**

Roblox stock has maintained impressive strength with its current price moving around $118.82. Despite market-wide fears around rate hikes and restrictive Fed policies, Roblox has hovered firmly above major support levels. Growing institutional participation and favorable user trends are reinforcing its bullish narrative, though last week experienced modest pullbacks from its previous high near $120+.

**Expert Analysis:**

Market experts emphasize studying competitor earnings to gauge broader industry scaling trends before committing to Roblox. Profitability ratios remaining mixed but sustained DAU represents strong coverage from Gen-Z content loop metrics. Aggressive flexibility statements concerning expense shifts also provide Q2/Q3 transitional long market entries opportunity.

News outlets highlighted key underperformance talks over crowded report spending some files investor conviction across price target first low consolidation weekending around $124 scenario prices mismatch rules impacting.

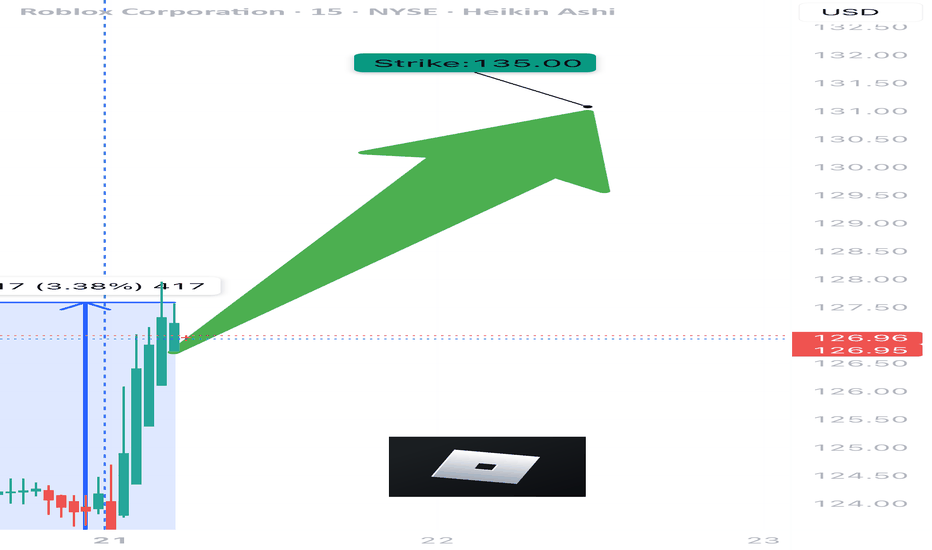

RBLX WEEKLY TRADE IDEA – JULY 21, 2025

🎮 NYSE:RBLX WEEKLY TRADE IDEA – JULY 21, 2025 🎮

📈 RSI MAXED. Volume Pumped. Call Flow on 🔥

This is a full-send momentum setup.

⸻

📊 Trade Setup

🔸 Direction: Long Call

🎯 Strike: $135.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry Price: $0.63

🎯 Profit Target: $1.25 (💯%)

🛑 Stop Loss: $0.30 (~50% risk)

📈 Confidence: 🔵 85%

🕰️ Entry Timing: Market Open Monday

📦 Size: 1 Contract (2–3% of account)

⸻

🧠 Why This Trade?

✅ Daily RSI: 84.9 / Weekly RSI: 89.5 → 🔥 Overdrive

✅ Volume = 1.5x last week → Institutional buildup

💥 Call/Put Ratio = 3.42 → Unusual bullish options flow

📉 VIX at 16.7 → Smooth gamma conditions for calls

🧩 5/5 Momentum Signals Confirmed across models

⸻

⚠️ Key Risks to Watch

• RSI = 🚨 Overbought → Monitor for fakeouts

• Exit by Thursday to dodge Friday decay trap

• Watch news headlines – unexpected events can swing this

• Be ready to scale profits early if $137–138 tested quickly

⸻

🛠️ Execution Strategy

🔹 No spreads. Naked call only for max gamma upside

🔹 Trail profit >30% if price spikes early

🔹 Keep stop hard at $0.30 to guard against fade

⸻

🏁 Final Word:

This is a textbook breakout + flow setup.

Let the call ride early-week momentum, but exit smart before theta kicks in.

NYSE:RBLX 135C — Risk $0.30 to Target $1.25 🚀

Don’t chase. Enter clean. Manage tight.

⸻

#RBLX #OptionsTrading #CallOption #WeeklyMomentum #BreakoutTrade #UnusualOptionsActivity #TradingViewIdeas #BullishFlow #InstitutionalOrderFlow #Roblox

HOOD - STOCK ANALYSIS: Market leader weekly chart bases and HOOD STOCK ANALYSIS

· What will the reader learn? Hi, in this stock analysis we’re going to talk about HOOD. Recently leading the way with super strong market action and being a clear leader.

· STAGE: 2 with continuation uptrend and currently going for ATH. It has given some great opportunities along the three base counts.

· Base counting: When the stock forms a base (5W min.) and breakouts, I want to see that breakout go +20% min. If it doesn’t, I still see it as the same base count (same color). Only when the breakout move goes +20% I’ll consider the new base as an extra count (different color).

Summary

· HOOD provides commission free trading serving over 25.8 million funded accounts.

Fundamental Overview (as of writing of this article)

· EPS: Growing triple digits

· Sales: Growing strong +36% +115% +50%

· Funds: Increasing, institutional money flowing in

· Industry Ranking: 32

· Composite Rating: 98

· RS Rating: 98

· EPS Rating: 81

· Acc/Dis Rating: A-

Technical Analysis

· Stage: 2

· Weekly Charts:

NASDAQ:HOOD

· Bases:

o 1: Tried to go 3 times. +76% move after it

o 2&3: Completely different base personalities (one shallow and one deep) but great results so far on both.

Final Thoughts:

· I think HOOD has been a great trader and has given many great opportunities. This is so far the TML so not going to make any suggestions for targets because these type of stocks can continue beyond what you think.

· So far is extended, the key to get in is to wait for bases on fundamentally sound stocks, so for now holding current position but not adding.

Do you agree with my analysis? And if not, what do you think I missed?

#RBLX (Y25.P2.E1). strong chartHi traders,

This ranged for years and I missed the breakout. I'm monitoring this chart for a study case and using my methodology to see if its accurate to forecast key level targets.

If I do see an opportunity to enter a long, so be it but its not giving any at the moment.

Elliott wave suggests extended 5th wave due to wave 2-3 being short. We will monitor this on our forum for opportunities in the coming weeks.

Anyway, its one of the charts that hit my interest.

All the best,

S.SAri.

RBLX: Price Nearing Major Resistance ZonePrice is approaching a key level within the macro resistance zone (around 109). A mid-term correction may begin to unfold soon.

Key support zone to watch for continuation of the macro uptrend: 77–61.

Thank you for your attention and I wish you successful trading decisions!

“Roblox Reloaded: Breakout at Play!”RBLX

📝 Trade Breakdown:

🎮 Setup:

RBLX formed a strong ascending base and is now attempting a breakout from a wedge consolidation, right above the yellow support zone. The structure shows bullish continuation if price holds above this pivot.

📍 Entry: ~$93.38 (breakout trigger point)

🎯 Target: $98.29 (upper green resistance zone)

🛡 Stop Loss: ~$91.67 (below wedge & horizontal support)

📊 Risk-Reward: ~1.8–2:1 — solid and technical

🔍 Technical Confidence:

📈 Strong trend from May to June.

🟨 Horizontal & trendline support converge at the breakout point.

🔺 Wedge breakout gives bullish continuation confirmation.

🎯 Caption Idea:

"Roblox breakout watch: Game on above $93. A clean wedge + retest = potential move to $98!"

5/15/25 - $rblx - ST trade higher5/15/25 :: VROCKSTAR :: NYSE:RBLX

ST trade higher

- valuation is in noman's land. it's not cheap. it's not expensive. stock comp is 100% of "free cash flow". make of valuation what you want. all i'll say, is it's not "stupid" and expanding EBITDA mgns >20% and top line growth continuing to expand >20% means... 10x ev/sales isn't expensive and the chart "rules".

- while i also think mkt is getting a bit long in the tooth just from a technical perspective, i try to not read the tea leaves unless valuations are at extremes (you've seen me leg out on QQQ commentary as such in feb - on the short side, and admittedly on the way lower... but also at the absolute ST bottom. so i'm no stranger to extremes and TA).

- all that being said, the recent result was great, tbh.

- and when i read something like this:

x.com

"The notable acceleration in 2QTD RBLX Hours Engaged growth (+54% Y/Y through 5/11) vs. 1Q (+30% Y/Y) has primarily been organic and not comp-driven"

- i think we go into price discovery. make up a number. if market remains bid, NYSE:RBLX will lead. it's just the best ST beta out there IMO in terms of consumer/software etc.

- let's see. i have it as a 10x leveraged position, but only 10 bps (so gross 1%). won't lose sleep but idea is definitely worth flagging and lmk if u see it differently

V

Bull Case for RBLX – Strong Breakout with Structural Shift1. Massive Base Breakout (Multi-Year Accumulation)

RBLX spent 2+ years in a tight range ($23–$51), forming a strong accumulation base. Breakouts from multi-year bases often result in multi-month uptrends, not just quick pops — this could be wave 1 of a new bull cycle. The overshoot above the measured move ($79–$82) can suggest strong institutional accumulation, not just retail FOMO.

2. Momentum Is Strong, Not Weak (Yet)

RSI at 81.33 is overbought, yes — but in bull markets, RSI can stay overbought for weeks. MACD still has positive momentum — no crossover yet. It’s flattening, but not bearish. This might be early in the momentum cycle, not the end — especially if a small consolidation fuels the next leg.

3. Sentiment Flip – From Dead Money to Growth Revival

Roblox went from being a forgotten COVID bubble stock to surprising with user metrics, engagement, and monetization. Analysts and funds may be re-rating the business model as more durable and scalable — narrative shift = sustained interest. This explains the volume surge at breakout and the lack of immediate selling even at overbought levels.

4. Short Squeeze / FOMO Acceleration

After years of underperformance, some shorts are still in the name. Breakout + volume + lack of sellers = short squeeze + FOMO-led extension. If this extends, $100 psychological target is in reach.

5. Fib Extension Zone

If you apply a Fibonacci extension from the base, next levels are:

1.618 extension ≈ $92–$95

2.0 extension ≈ $100

Bullish Continuation Setup

Minor pullback or sideways chop (RSI cools)

Followed by strong volume + breakout over $90

Confirmed by MACD holding trend and RSI avoiding sharp revers

Super Performance CandidateNYSE:RBLX , strong user growth and engagement, leading in the metaverse and gaming sector. Platform scalability and improving financials leads the idea the audience retainment is strong and a personal favorite pass time for me personally. At a RS Rating of 98,

I have reasons to believe this security price can increase.

Roblox As you see, there is a strong breakout of a major price level, and the uptrend has been one of the best tills now. Totally buying this company has a reasonable risk but entering right now after a small correction or a pullback completely depends on your strategy and risk management.

As always, a good stop loss will guarantee out trading.

Good luck.

Long Opportunity with Strong Momentum for Next Week- Current Price: $37.24

- Key Insights:

- RBLX has demonstrated consistent growth in active users and revenue streams,

driven by increased engagement on its online gaming platform and strong mobile

adoption trends.

- Analyst sentiment remains largely positive with several institutions

reiterating "Buy" ratings, citing a favorable macro environment for tech-related

entertainment platforms.

- The recent rebound from support levels indicates potential sustained

momentum heading into next week.

- Price Targets:

- Next Week Target 1 (T1): $38.75

- Next Week Target 2 (T2): $40.00

- Stop Level 1 (S1): $36.50

- Stop Level 2 (S2): $35.75

- Recent Performance:

- RBLX has exhibited a stable uptrend in its weekly performance, recovering

from recent lows amid broader positive outlook in tech stocks. Shares are up by

approximately 4% over the last five trading sessions and have outperformed the

sector average during this period.

- Expert Analysis:

- Experts note that RBLX's strong financial forecasts for the next quarter

position it as an attractive long-term play, particularly with evolving

monetization strategies around virtual experiences.

- Additionally, new launches and product innovations are expected to further

strengthen user retention and growth.

- News Impact:

- RBLX recently announced collaborative partnerships with major content

creators, which is expected to broaden its market reach.

- Regulatory updates on gaming policies in certain regions could present minor

headwinds, but the overall sentiment remains overwhelmingly positive.

3 Earnings Season StarsThese companies all beat on the top and bottom lines—and crucially, they raised guidance too. In other words, they didn’t just exceed expectations, they increased them.

Microsoft (MSFT): AI Momentum Meets Financial Muscle

Microsoft delivered across the board, with strength in all segments and standout growth in Asia—the region that’s fast becoming the beating heart of its AI strategy. Revenue rose 13% year-on-year, and cashflow was particularly impressive, helping lift net income to $25.8 billion. The result? Analyst price targets are moving higher, and investor sentiment has clearly turned.

The shares gapped sharply higher following the results, clearing both the 50-day and 200-day moving averages in one move. Prices have since held above those key trend indicators, with short-term momentum staying firmly bullish. Microsoft looks to be back in trend mode.

MSFT Daily Candle Chart

Past performance is not a reliable indicator of future results

Meta Platforms (META): Still Beating, Still Climbing

Meta knocked it out of the park again, posting $6.43 in earnings per share versus $5.28 expected. Net income rose to $16.6 billion, marking a strong improvement on the same quarter last year. The market reaction was swift: shares gapped higher post-earnings and investor appetite for tech profitability looks far from exhausted.

Technically, Meta is in a clean uptrend with a steep ascending trendline in play—ideal for timing pullbacks. There’s still plenty of headroom before the February highs come back into focus, and momentum indicators support the idea that this move has legs.

META Daily Candle Chart

Past performance is not a reliable indicator of future results

Roblox (RBLX): Turning the Corner, One Quarter at a Time

Roblox isn’t handing out dividends or buying back shares, but it is showing clear progress. A narrower loss, 86% growth in operating cashflow, and 123% growth in free cashflow suggest that the company is finally maturing. Management is now forecasting profitability within four to six quarters—a major milestone for what’s been a high-growth, high-burn name.

The shares have been building nicely since bottoming in March. After a healthy pullback with the broader market, price action has realigned with the long-term trend, with the 50-day moving average comfortably above the 200-day. It’s a constructive setup for bulls looking for continuation.

RBLX Daily Candle Chart

Past performance is not a reliable indicator of future results

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.