Trade ideas

$SLB UPGRADE FROM HOLD TO BUY FOR SCHLUMBERGERSeems like a highly unusual upgrade as the stock is teetering on the edge of another decline as support is tested. The Stifel analysts Stephen Gengaro has based his price target on the free cash floe generation, and thinks that it has a very compelling risk/reward for investors at these levels. He also reminds investors of the safe $2.00 dividend and that you get paid to wait, but for how long?, the stock is sitting on a support level that if it fails there is nothing below to stop the decline, there may be a good opportunity for a trade in the days to come on the long or short side.

AVERAGE ANALYSTS PRICE TARGET $51

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 24

COMPANY PROFILE

Schlumberger NV engages in the provision of technology for reservoir characterization, drilling, production and processing to the oil and gas industry. It operates through the following business segments: Reservoir Characterization, Drilling, Production, Cameron and Elimination and other. The Reservoir Characterization Group segment consists of the principal technologies involved in finding and defining hydrocarbon resources. The Drilling Group segment includes the drilling and positioning of oil and gas wells such as bits and drilling tolls, drilling and measurement, land rigs and integrated drilling services. The Production Group segment provides technologies in the lifetime production of oil and gas reservoirs such as well services, completions, artificial lift, well intervention, water service, integrated production services and others. The Cameron Group segment consists of the pressure and flow control for drilling and intervention rigs, oil and gas wells and production facilities. The company was founded by Conrad Schlumberger and Marcel Schlumberger in 1926 and is headquartered in

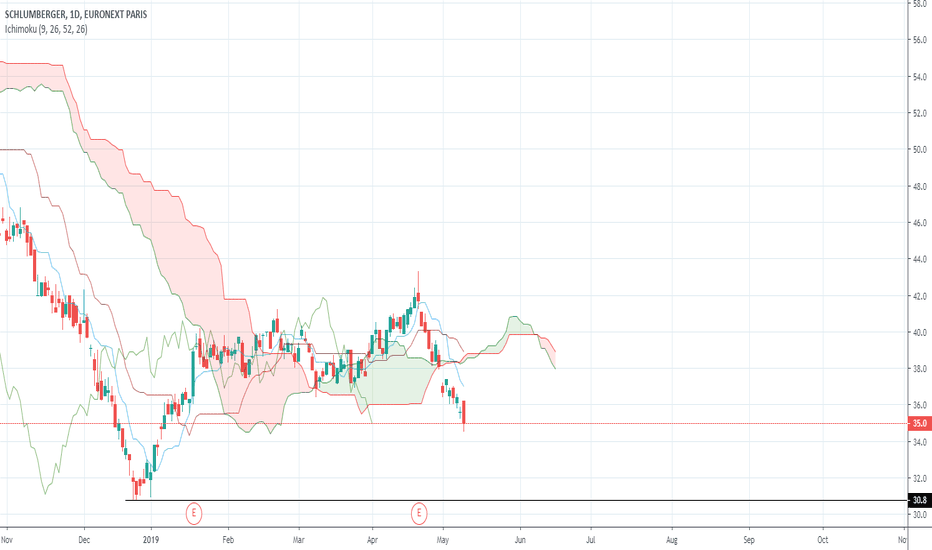

SCHLUMBERGER ; reprise de l'image plus largeAprès un temps de range/hausse, schlumberger reprend la baisse.

Ce qui vient reprendre l'image en weekly/monthly. Assez intéressant dans le contexte global. Les plus faibles courent à la perte.

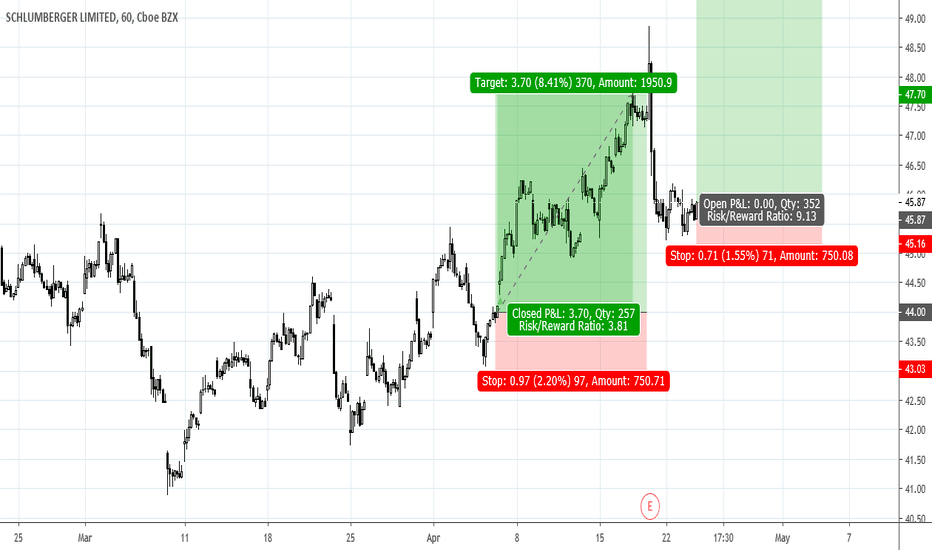

SLB: Sort opportunityAn intraday high potential, Back Tested Sort Analysis.

We ll try to enter into the correction of the uptrend movement.

DETAILS ON THE CHART

NOTE: Entry range area above the entry point, is calculated upon 80% of the recorded pullback back tested past performances

DISCLAIMER: This is a technical analysis study, not an advice or recommendation to invest money on.

Trade 1Hello, I am new to publishing but have been trading for a while. I plan to post a few trades a month which usually run for 3-6weeks (if they're winners). Its worth noting my stop is a mental stop but I use strict risk management (1.5%). I will comment when I have closed the trade. Also, I do not use any indicators and only trade US Stocks.

Many thanks.

Schlumberger Key Battle, Breakout or Breakdown???On the Hourly chart SLB is in a short term bull trend (White Diagonal Line), meeting the long term downtrend resistance (Red Diagonal Line). Although WTI seems to be on an uptrend, it does not look like it may have a positive correlation for price for SLB in terms of a swing trade.

Beatish Sentiment:

The RSI has shown oversold and the SMII is down trending, which points to a most probable scenario of a breakdown in the short term swing trade. Should price breakdown below the diagonal white line and below the 100 EMA, an opportunity to enter a short is on the table. The red horizontal lines are support/resistance for price should there be a breakdown.

Bullish Sentiment:

If the price makes a clear break above the long term diagonal red line, then this could be an opportunity to enter a long trade on the breakout.

Eyes will be on SLB for the next 2 days, to see which direction it will take.

Happy Trading :0)

This is not advice to buy or sell, it is only meant for educational perspective.