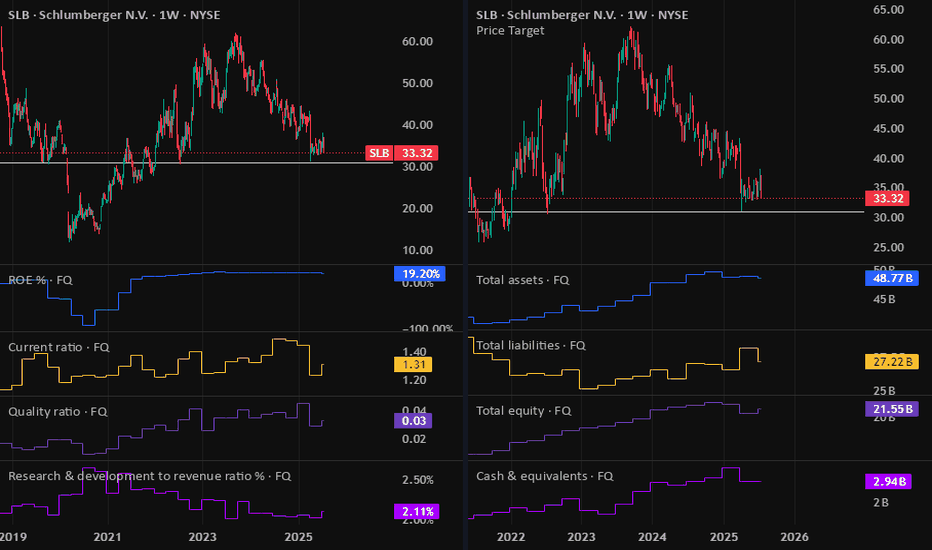

SLB - Ground Floor Opportunity### Slb weekly trend analysis and one-year projection

You’ve got a strong weekly push: Stochastic is pinned high (99), RSI is constructive (61), MACD is positive, and SAR dots likely sit below price — classic continuation signals. The caveat is overbought momentum often demands either time or price

SLB Limited Shs Cert.Deposito Arg.Repr. 0.3333 Shs

No trades

Key facts today

SLB N.V. has signed a five-year deal with Saudi Aramco to deliver stimulation services for unconventional gas fields, focusing on advanced techniques to boost gas extraction.

0.70 USD

3.96 B USD

32.25 B USD

About SLB Limited

Sector

Industry

CEO

Olivier Le Peuch

Website

Headquarters

Houston

Founded

1926

Identifiers

2

ISINARDEUT111515

SLB Ltd. engages in the provision of energy technology. It operates through the following business segments: Digital and Integration, Reservoir Performance, Well Construction, and Production Systems. The Digital and Integration segment involves the combination of digital solutions and data products with its Asset Performance Solutions. The Reservoir Performance segment consists of technologies and services for productivity and performance optimization. The Well Construction segment includes the full portfolio of products and services for well placement and performance, drilling, and wellbore assurance. The Production Systems segment focuses on the development of technologies and provides services to production and recovery from subsurface reservoirs to the surface, into pipelines, and to refineries. The company was founded by Conrad Schlumberger and Marcel Schlumberger in 1926 and is headquartered in Houston, TX.

Related stocks

Very rare diamond patternThis very rare pattern usually indicates a change of trend. Is doing it in the weekly timeframe and setting up for a massive breakout of the descending channel. Also, oil is setting up an inverse HS and many of the big oil companies show bullish patterns. SL and TP are shown on the charts.

Good luc

AI assissted Anaysis of SLBThis chart shows Schlumberger (SLB) stock with some interesting technical analysis annotations. Looking at the price action, I can see several key observations:

The Bearish Channel Breakout:

The stock appears to have been trading within a descending channel (marked by the red dotted lines) for about

Schlumberger Stock Chart Fibonacci Analysis 082725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 36/61.80%

Chart time frame:C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SLB4080519

Cameron International Corporation 5.125% 15-DEC-2043Yield to maturity

5.88%

Maturity date

Dec 15, 2043

SLB3692252

Cameron International Corporation 5.95% 01-JUN-2041Yield to maturity

5.67%

Maturity date

Jun 1, 2041

SLB3673764

Cameron International Corporation 7.0% 15-JUL-2038Yield to maturity

5.23%

Maturity date

Jul 15, 2038

SLB5816417

Schlumberger Investment SA 5.0% 01-JUN-2034Yield to maturity

4.86%

Maturity date

Jun 1, 2034

SLB6039167

Schlumberger Holdings Corporation 5.0% 01-JUN-2034Yield to maturity

4.73%

Maturity date

Jun 1, 2034

SLB6056526

Schlumberger Holdings Corporation 4.85% 15-MAY-2033Yield to maturity

4.72%

Maturity date

May 15, 2033

SLB5584893

Schlumberger Investment SA 4.85% 15-MAY-2033Yield to maturity

4.66%

Maturity date

May 15, 2033

US806854AJ4

Schlumberger Investment SA 2.65% 26-JUN-2030Yield to maturity

4.32%

Maturity date

Jun 26, 2030

USU8066LAF1

Schlumberger Holdings Corporation 4.3% 01-MAY-2029Yield to maturity

4.27%

Maturity date

May 1, 2029

SLB6040253

Schlumberger Holdings Corporation 4.5% 15-MAY-2028Yield to maturity

4.25%

Maturity date

May 15, 2028

SLB5816413

Schlumberger Holdings Corporation 5.0% 15-NOV-2029Yield to maturity

4.23%

Maturity date

Nov 15, 2029

See all SLBD bonds