Key facts today

Chinese state-owned creditors have extended credit facilities to AT&T as part of their overseas lending operations in the U.S., alongside other Fortune 500 companies.

1,225 ARS

10.02 T ARS

112.02 T ARS

About AT&T Inc.

Sector

Industry

CEO

John T. Stankey

Website

Headquarters

Dallas

Founded

1983

ISIN

ARDEUT111713

FIGI

BBG000HDXSF8

AT&T, Inc. is a holding company, which engages in the provision of telecommunications and technology services. It operates through the Communications and Latin America segments. The Communications segment offers wireless, wireline telecom, and broadband services to businesses and consumers located in the US and businesses globally. The Latin America segment provides wireless services and equipment in Mexico. The company was founded in 1983 and is headquartered in Dallas, TX.

Related stocks

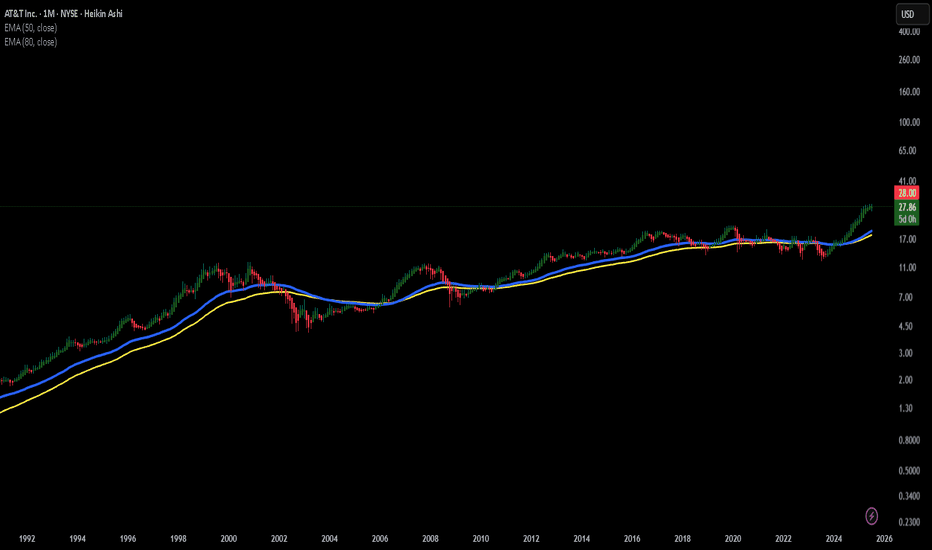

AT&T (T) — Bullish Breakout Setup Forming! Don’t Miss This MoveWall Street’s been sleeping on $T for too long…

After weeks in a clear downtrend, AT&T is showing serious signs of a **reversal setup** within this falling channel.

👀 Watch how price is bouncing off the lower trendline with strong volume support — a classic accumulation signal.

💪 Break above this d

AT&T – Still Ringing?AT&T. The name alone evokes landlines, long-distance charges, and a time when phones had cords (and possibly rotary dials). But don’t let the vintage vibes fool you — this telecom titan might still have some signal left on the price chart.

Now, I’m not saying AT&T is about to moonwalk up the NASDAQ

AT&T Wave Analysis – 16 May 2025- AT&T reversed from support zone

- Likely to rise to resistance level 28.35

AT&T recently reversed up with the daily Morning Star from the support zone between the key support level 26.00, 38.2% Fibonacci correction of the upward impulse from January and the lower daily Bollinger Band.

The active

AT&T I Tipping Point : Short Opportunity with Head & ShouldersHey traders after a previous trade trade on the hood hitting targets of 16.4%. Today I bring you NYSE:T

Technical + Fundamental View

Pro Tip

- Breakdown below the Entry Line will be considered at Trade Initiation. (Risky Traders)

R:R= 5.4

- Rest can follow entry at day close post breakdow

T Trading Guide 4/21/25AT&T (T) Trading Analysis for Monday, April 21, 2025

Sentiment Analysis

-Overview: Sentiment on X and StockTwits is neutral, with investors appreciating T’s 4.11% dividend yield but expressing concerns over tariff-driven cost increases. Analyst consensus remains stable, with a “Hold” rating and a

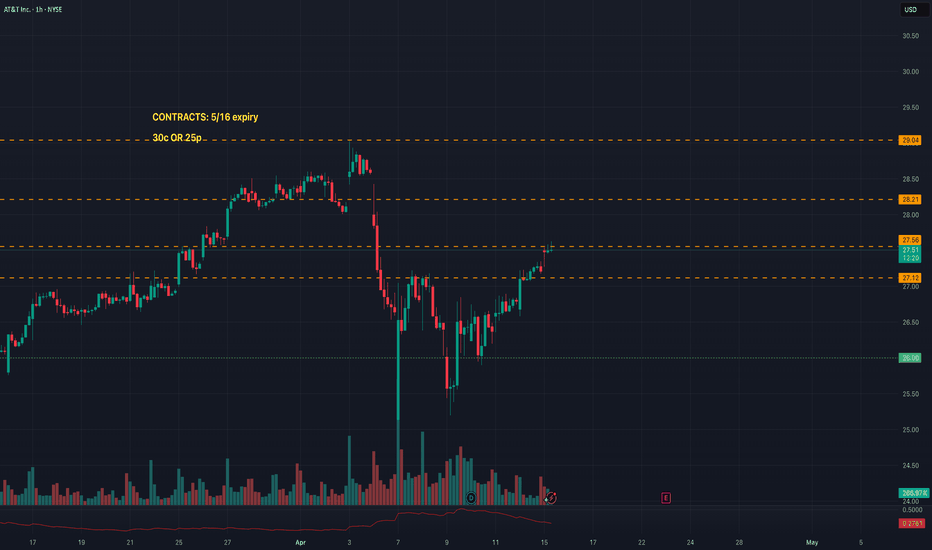

T Trade LevelsYou might notice that this is the Hourly timeframe.

For a ticker that moves 0.83 cents/day, I just needed to know the directional bias up top (ranging but leaning bullish).

I would expect day trades to move level to level.

The contracts listed will be your best options whether day or swing tradi

New Setup: TT : I have a swing trade setup signal. Looking to enter long if the stock can manage to CLOSE above the last candle high(BUY). If triggered, I will then place a stop-loss below (SL) and a price target above it(TP Zone) **Note: This setups will remain valid until the stock CLOSES BELOW my stop-loss l

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

T3689778

DIRECTV Holdings LLC 6.375% 01-MAR-2041Yield to maturity

16.18%

Maturity date

Mar 1, 2041

T3683245

DIRECTV Holdings LLC 6.35% 15-MAR-2040Yield to maturity

14.87%

Maturity date

Mar 15, 2040

T3684413

DIRECTV Holdings LLC 6.0% 15-AUG-2040Yield to maturity

14.16%

Maturity date

Aug 15, 2040

T3851436

DIRECTV Holdings LLC 5.15% 15-MAR-2042Yield to maturity

13.57%

Maturity date

Mar 15, 2042

TWX.BC

Time Warner Inc. 5.375% 15-OCT-2041Yield to maturity

8.84%

Maturity date

Oct 15, 2041

TWX4127766

Time Warner Inc. 4.65% 01-JUN-2044Yield to maturity

8.59%

Maturity date

Jun 1, 2044

TWX4080474

Time Warner Inc. 5.35% 15-DEC-2043Yield to maturity

8.20%

Maturity date

Dec 15, 2043

TWX3865120

Time Warner Inc. 4.9% 15-JUN-2042Yield to maturity

8.11%

Maturity date

Jun 15, 2042

TWX.AV

Time Warner Inc. 6.2% 15-MAR-2040Yield to maturity

8.01%

Maturity date

Mar 15, 2040

TWX4253754

Time Warner Inc. 4.85% 15-JUL-2045Yield to maturity

7.90%

Maturity date

Jul 15, 2045

TWX.AZ

Time Warner Inc. 6.1% 15-JUL-2040Yield to maturity

7.90%

Maturity date

Jul 15, 2040

See all T bonds