UNH Stock Technical Outlook – Bullish Momentum Confirmed😎 UNH Wealth Heist: Swing Trade Strategy Map 🤑💰

Asset: UnitedHealth Group Incorporated ( NYSE:UNH )

Market: US Stock

Market Strategy: Swing Trade (Thief Style 🕵️♂️)

📈 The Setup: Bullish Breakout in Sight! 🚀

Ladies and Gentlemen, welcome to the Thief OG playbook! 📖 NYSE:UNH is setting up for a potential bullish run, and we’re ready to layer our entries like masterminds! 🧠 Here’s the breakdown of this sneaky swing trade setup:

🌟 Bullish Trend Confirmation: The chart is screaming uptrend! We’ve got strong upside pressure from a demand zone 📍, signaling buyers are ready to pounce.

✨ Golden Cross Alert: The Hull Moving Average (HMA) at 786 periods has crossed above the price candles, confirming a bullish momentum shift. 🚀

🐍 Re-accumulation Phase: The stock is consolidating, building energy for the next leg up. It’s like NYSE:UNH is coiling for a big breakout! 💥

🕵️♂️ Entry Plan: The Thief Layering Strategy 🎯

We’re not just entering; we’re layering our entries like pros! 😎 The Thief Strategy uses multiple buy limit orders to scale into the trade with precision. Here’s how to set it up:

📊 Entry Levels: Place buy limit orders at $320.00, $330.00, $340.00, $350.00.

Pro Tip: Feel free to add more layers based on your risk appetite and account size! More layers = more chances to catch the move.

🔍 Why Layering?: This method spreads your entry across key support levels, reducing risk and maximizing potential. It’s like planting multiple traps for profits! 🪤

🛑 Stop Loss: Protect Your Loot! 🔒

🛡️ Thief Stop Loss: Set a stop loss at $300.00.

📝 Note: Dear Thief OGs, this is my suggested stop loss, but it’s your heist! Adjust based on your risk tolerance. Take the money and run at your own discretion! 😏

🎯 Target: Cashing Out Like a Boss 💸

💰 Profit Target: Aim for $420.00, where the Simple Moving Average (SMA) acts as a strong resistance.

⚠️ Why This Level?: The SMA has historically capped rallies, and we’re seeing signs of overbought conditions with a potential trap for late buyers. Escape with your profits before the trap springs! 🏃♂️

📝 Note: As always, Thief OGs, this is my suggested target. You decide when to pocket the gains — it’s your heist, your rules! 😎

👀 Related Pairs to Watch 🔎

To keep your eyes on the market’s pulse, here are correlated assets to monitor alongside NYSE:UNH :

📈 NYSE:CI (Cigna Corporation): Another healthcare giant, often moves in tandem with NYSE:UNH due to sector trends. Watch for similar bullish setups or divergences. 🩺

📊 NYSE:HUM (Humana Inc.): A key player in the health insurance space, showing high correlation with $UNH. If NYSE:HUM breaks out, it could confirm NYSE:UNH ’s move. 🚀

📡 AMEX:XLV (Health Care Select Sector SPDR Fund): This ETF tracks the broader healthcare sector. A bullish AMEX:XLV strengthens the case for NYSE:UNH ’s rally. 🌟

Key Correlation Point: NYSE:UNH , NYSE:CI , and NYSE:HUM often react to healthcare policy news, earnings cycles, and sector sentiment. Keep an eye on AMEX:XLV for broader sector confirmation. If AMEX:XLV is pumping, NYSE:UNH is likely to follow! 📊💥

📝 Final Notes for the Heist

This setup is designed for Thief OG traders who love a calculated, stylish swing trade. The layering strategy gives you flexibility, the bullish signals provide confidence, and the target keeps it profitable. But always remember: trade at your own risk, and don’t get caught in the market’s traps! 😜

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This is a Thief Style trading strategy, crafted for fun and educational purposes. Always do your own research and manage your risk. Trading involves risks, and I’m not responsible for any losses. Stay sharp, Thief OGs! 🕵️♂️

#UNH #SwingTrade #LayeredEntry #ThiefStrategy #StockMarket #HealthcareStocks #TradingIdeas #BullTrend #TechnicalAnalysis #GoldenCross #MarketWealthMap #TradingView

Trade ideas

UNH LONGOh man, what a chart to dig into.

(Read the fundamental analysis for this one—I don’t look into company financials or earnings. I’m also not following the news, so that’s on you. I’ve seen too many setups fail because of some unexpected headline or a random tweet on a f***ing Monday from the orange man.)

Why am I looking at this setup?

We’re sitting right at the 0.618 fib in a bullish trend. That lines up with the POC of a B-shaped volume profile, right at a support level. On top of that, liquidity under the trendline on the left has already been swept, and price is way overstretched from VWAP. So even if this isn’t a full reversal, we should at least get a pullback back toward the VWAP midline.

entries at 301

283

264

SL at 236

TP 50% at 492, and let the rest rides

There’s a lot going on here:

Trend direction is still up. As long as we don’t get a close below 187, this is just a pullback.

VWAP is miles away from the current price. Price doesn’t stay that far from it forever—it either pulls back or consolidates before heading higher.

Fibs and TLs: There’s a major trendline (marked as Area 2) that hasn’t been touched for the third time yet. That same zone lines up with the 0.78 fib. Price hasn’t reached it yet—might not—but that’s still a spot I’d seriously consider for a long.

POC zone: The marked long area is right on the POC of a B-profile. It’s a key level and should act as support. That’s a solid place to look for a bounce.

I’ve marked out the setup and three possible entries. These are the spots I’d look to long from. If they all fail, then Area 2 is the backup—it should hold.

One more thing: there’s a red line in the middle of the chart. If you want more confirmation, wait for price to close above it, then catch the retrace. That gives you more confidence in the setup.

Do your own analysis and keep an eye on the news.

TA only works if it lines up with the fundamentals. If not, it’s useless.

KISS : Keep it simple! $UNH Breakout play! - NYSE:UNH offers best risk to reward fundamentally for 2026. Premium increase is coming in 2026, that will boost the fundamentals and improve margins and boost revenue and free cash flow.

- I'm not gonna repeat my fundamental thesis. Please see my older post.

- For this post, just highlighting the technical breakout.

- NYSE:UNH has been beautifully grinding higher, pulling back, consolidating and then breaking out. This is exactly you want to see as a long term investor for a compounding machine.

- Breakout also helps momentum traders to ride the wave.

UNH - Awaiting Dip OpportunityUNH seems to have lagged a little even with S&P at all time high's, I'm a big fan of this stock long-term, but I always like to be able to buy on a pullback. Would love a retest of this trendline ccoinciding with that key VPR zone from earlier consolidation. Those 2 points meet October 8th, interested to see what happens, if we see a pullback as listed I'm hopping in to make some serious pennies.

Wave-Count Confidence: Below Average/Weak

Unfamiliar long-term structure, and overall odd's are weak for this playing out. But a man can wish.

UNH – Break of Downtrend, Bullish Setup EmergingUnitedHealth (UNH) has recently broken out of a sustained downtrend, signaling a potential shift in momentum. The stock is now retesting near-term levels, with the green uptrend line providing structural support for further upside.

🔍 Technical Analysis

Current Price: $347.89

Trend: Downtrend in red broken, new uptrend support holding.

Support & Stop-Loss:

$321 | SL: $311 (Medium risk – 4H support)

$280 | SL: $273 (Swing entry if reached – daily support)

Bias: Bullish while above $321.

🧭 Outlook

Bullish Case: Holding $321 paves the way for continued upside, potentially retesting prior breakdown levels.

Bearish Case: Losing $321 would weaken momentum, shifting focus toward the $280 swing support zone.

🌍 Fundamental View

UNH remains one of the largest healthcare insurers, benefiting from strong cash flows and defensive demand.

Risks include higher medical cost ratios and policy uncertainties in U.S. healthcare.

Valuation: While not “cheap,” UNH’s strong earnings base and dividend growth support long-term attractiveness compared to peers.

⚠️ Disclaimer

This analysis is for educational purposes only and does not constitute financial advice.

UNITEDHEALTH UNH Long Scenario based on Seasonality and FractalsFrom a fractals Perspective I expect a chance for around 30% gain from an upcoming upmove.

From a Seasonal Perspective I expect a retracement mode until End of Mid/September and then upside until early December.

I hope we make the bigger upmove in this time and complete that move otherwise this fractals target could take some time/moths/years.

Feel free to like / support the Idea, leave a comment or contact me in the chat.

Good luck to all

*this is not a trade call*

Cheers!

Gap Trap Collapse: Bears Destroy Bull Recovery

The Market Participant Battle:

The bulls have been completely destroyed by the bears who set a masterful trap at the $387 gap zone. At point 1, sellers showed such extreme conviction they gapped down aggressively, jumping multiple price levels - this wasn't normal selling, this was institutional distribution with purpose. This gap created a zone where sellers were waiting to re-enter or buyers looking for cheap loss exits. Points 2→4 created a lower low, proving point 3 as the dominant sellers who defeated the previous buyers. Bulls attempted to reclaim the gap area but have now been violently rejected. With price crossing below $341.83, institutional sellers have reclaimed control and the catastrophic return move to $201 has begun.

Confluences:

Confluence 1: The Gap Trap at $387

The gap at point 1 represents extreme selling conviction - sellers were SO eager they literally jumped price levels, creating a void. This gap now acts as massive resistance, not support. The fact that bulls showed equal eagerness to return to this zone (with another gap up) was actually the trap being set. The conviction gap down proves institutional distribution, and the rejection at this level confirms sellers still control this zone. This gap will NOT be filled - it's a ceiling, not a magnet.

Confluence 2: Multiple VWAP Rejections Confirming Distribution

The VWAP analysis reveals institutional distribution across all timeframes. Anchored VWAP from point 2 shows price hitting the 3rd standard deviation and reversing - this is an extreme rejection level. Earnings VWAP shows 2nd deviation rejection. Dividend VWAP has price above 2nd deviation at $342.43 - closing below this level confirms institutional abandonment. Monthly VWAP rejected at 2nd deviation with current bar under 1st deviation signals bearish continuation. When every VWAP timeframe shows distribution zones rather than accumulation, the message is clear.

Confluence 3: Oversold Divergences Signal More Downside

RSI oversold WITH bearish divergence means oversold will get MORE oversold. MFI oversold with divergence indicates selling is intensifying, not abating. CDV bearish divergence confirms continuous distribution. OBV piercing upper Bollinger Band shows exhaustion of buying pressure. Price being above BB 2nd deviation for 4 bars then breaking down is a classic reversal pattern. These aren't bottoming signals - they're acceleration warnings.

Confluence 4: Volume Footprint Reveals Hidden Institutional Selling

September 10th shows a bullish bar but with -167K delta - bulls cannot hold their gains. September 11th is the smoking gun: green bar but MASSIVE -452 delta divergence. September 12th confirms with negative delta plus fractal divergence on lower timeframes. This footprint pattern is textbook distribution - institutions are selling into every bounce, absorbing all buying pressure while maintaining price temporarily to offload positions.

Web Research Findings:

- Technical Analysis: UnitedHealth is in a falling trend channel showing investors have sold at progressively lower prices

- Earnings Disaster: Q2 EPS of $4.08 missed forecast by -$0.37, signaling deteriorating fundamentals

- Cost Explosion: $6.5 billion increase in medical costs for 2025, with Optum Health facing $6.6 billion earnings shortfall

- Structural Breakdown: Exiting plans covering 600,000 members, Medicaid showing negative margins of 1-1.7% for 2026

- Analyst Concerns: Despite "Buy" ratings, price targets may be revised lower given margin compression

Jace,

Machine Derived Information:

- Stop Loss at $390: Positioned at gap resistance zone - if hit, thesis invalidated - AGREES ✓

- Target at $201.37: Represents 59.15% downside potential from current levels - AGREES ✓

- Risk/Reward 4.03:1: Exceptional asymmetric opportunity favoring shorts - AGREES ✓

- Critical Level $341.83: Alert set for breakdown confirmation - crossing below accelerates decline - AGREES ✓

- Position Sizing: 750 share allocation appropriate for high-conviction setup - AGREES ✓

Conclusion:

Trade Prediction: SUCCESS

Confidence: HIGH

Key Reasons for Success:

- Gap trap at $387 has captured bull liquidity and proven as resistance

- Breaking $341.83 confirms institutional distribution accelerating

- Volume footprint showing -452 delta on green bars = massive hidden selling

- Fundamental deterioration with $6.5B cost headwind ensuring continued pressure

- Technical structure showing lower highs and lower lows in established downtrend

Key Risks:

- Short-term oversold bounce could test patience before continuation

- Medicare Advantage positive developments could cause temporary squeeze

- October 21st earnings represents binary event risk

Risk/Reward: Exceptional 4:1 setup justifies aggressive short position

Action: TAKE THE SHORT TRADE - Target $201

$UNH This Behemoth Is Not Going Anywhere and I am Loading Up United HealthGroup is extremely Appealing to me at these valuations. Health Insurance Is something all people need. I Don't See Medicaid/Medicare Cuts affecting NYSE:UNH To the extent People believe it will. Legislation can be temporary, This Company Produces 20B Plus in Free Cashflow Every single Year Let alone 420B in Revenue its a behemoth controlling more than 30% of American Health Insurance in terms of Market Share. The United States could never afford to socialize Healthcare the way Europe Or Canada does. Social Security/Health/Medicare already eat up 49% Of GDP. The United States is almost dependent on companies Like United Healthgroup to provide its services. This Could almost Give Companies like NYSE:UNH an opportunity to offer plans to gain more customers who before had Government assisted health insurance. While more downside is almost Guaranteed I see nothing more then even better discounts for the long-term. This is not a question of If UNH Can recover its only a question of how long will it take. We are back at Prices Pre Covid-19.

---------------------

Possible Reasons for the Major Drops:

The Big Beautiful Bill

DOJ Lawsuits

Rising Medicare Costs

Rising Expenses on Insurers

Swapped CEO Twice

Swapped CFO Once

Lawsuits

Scandals

---------------------

NYSE:UNH Fundamentals:

Price To Sales: 0.5x

Price To Earnings:10.3x

Price to Book: 2.2x

---------------------

Balance Sheet:

Cash: US$32.02b

Debt: US$104.78b

Total Liabilities: US$203.79b

Total Assets: US$308.57b

---------------------

Management Efficiency:

ROE: 21.1%

ROCE: 15.5%

ROA: 8.2%

---------------------

Dividend Safety:

Dividend Yield: 3.7%

Payout Ratio: 37% of Profits

---------------------

I recently Began Acquiring Shares around the $260 Mark and plan on continuing to load up for the long-term.

---------------------

This is not financial Advice, Just what I am doing on my own as an investor. I do not give Buy/Sell/Hold Signals.

UNH Swing Alert: $365 Call Ready to Run!

🚀 **UNH Swing Trade Alert | 2025-09-11** 🚀

**📈 Directional Bias:** Moderately Bullish (60% Confidence) ✅

**Why This Trade?**

* 🔹 Strong short-term momentum: Daily RSI 82.3 → overbought but bullish

* 🔹 Multi-timeframe gains: 5d/10d +15%/+18%

* 🔹 Low VIX favors directional call trades

* ⚠️ Weak volume (1.0x avg) → caution, risk of mean reversion

* ⚠️ Options flow neutral → no institutional confirmation

**💡 Recommended Trade:**

* **Instrument:** UNH

* **Strike:** \$365 CALL 💰

* **Expiry:** 2025-09-26

* **Entry Price (Mid):** \$5.55

* **Direction:** LONG ✅

* **Position Size:** 1 contract (scale to account risk)

* **Entry Timing:** Market open

**🎯 Targets & Stops:**

* **Profit Target:** \$10.00 (+80%)

* **Stop Loss:** \$3.60 (\~35% of premium)

* **Expected Hold:** 5–10 trading days (monitor daily; exit by Sep 24 if not hit)

**⚡ Key Risks:**

* Overbought RSI → potential mean-reversion pullback

* Weak volume → lack of institutional follow-through

* Put OI near \$350 → gamma friction may cap upside

* Naked call risk → premium-only loss possible if trade stalls

* Execution → use limit orders at mid to manage slippage

**💎 Trade Strategy:**

* Single-leg naked call

* Balanced delta (\~0.55–0.60) → probability vs leverage tradeoff

* Avoid deeper OTM or very cheap near-the-money calls

**📊 JSON Snapshot:**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 365.0,

"expiry": "2025-09-26",

"confidence": 0.60,

"profit_target": 10.00,

"stop_loss": 3.60,

"size": 1,

"entry_price": 5.55,

"entry_timing": "open",

"signal_publish_time": "2025-09-11 16:00:33 UTC-04:00"

}

United Health - The ultimate prediction!🚑United Health ( NYSE:UNH ) will bottom now:

🔎Analysis summary:

Over the course of the past fourty years, we always witnessed strong drops on United Health. Each drop was expected though and always followed by new all time highs. Therefore history tells us that we now witnessed a bottom and United Health will rally quite soon.

📝Levels to watch:

$300

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

UNH (UnitedHealth Group) — Daily TF Long

UnitedHealth Group (UNH) has printed a brutal downside move, losing over 50% from the highs above $600 down to sub-$230s in a vertical fashion. This massive drop likely resulted from a high-impact event earnings/guidance/legal). However, we’ve now witnessed a Break of Structure (BOS) to the upside from the lower high around $293.40, signaling a potential change in character.

This bounce came out of a well-defined Daily Demand Zone (227.38–239.23), and price has now cleared the BOS level and is approaching minor resistance.

Earnings:

The last earnings drop clearly triggered a significant revaluation.

Next earnings are likely in mid-to-late October, which could catalyze a continuation or rejection of the current move.

Expect earnings volatility to remain high due to investor uncertainty post-crash.

Short-term trend: Bullish reversal forming

Breakout Confirmed: BOS occurred on the retest and break of $293.40 zone

🟩 Key Supply/Demand Zones:

Demand (Daily): 227.38 – 239.23 ✅

Supply (Daily): 583.43 – 604.02 🔴 (main target)

🎯 Trading Plan (Swing):

Entry: Market/Limit between 327–330

Stop Loss: 293.40 (Below Channel)

Take Profit: 584.21 (Inside Supply)

Risk/Reward: ~1:7

Max Risk: 1–3% of your capital

🧭 Trade Management Tips:

Consider moving SL to Break Even at 1:1 RR (~380 level)

Scale out partially at 450 (previous support zone before breakdown)

Hold remainder for full push into Supply zone

Watch price action near upcoming earnings — may trigger a gap up/down

“The market is a device for transferring money from the impatient to the patient.” – Warren Buffett

⚠️ Disclaimer:

This analysis is for educational purposes only. This is not financial advice. Always perform your own due diligence and consult with a licensed financial advisor before trading.

UNH Options Alert: $340 Call Targets 100% Gain by Thursday!

🔥 **UNH Weekly Options Alert — Asymmetric Upside Play!**

**Directional View:** **Moderate Bullish** 💹

**Confidence:** 70%

**Trade Setup:**

* **Instrument:** UNH

* **Strategy:** BUY CALL (single-leg)

* **Strike:** \$340

* **Expiry:** 2025-09-12 (4 DTE)

* **Entry Price:** \$0.70

* **Entry Timing:** Market Open

* **Size:** 1 contract

**Targets & Risk:**

* **Profit Target:** \$1.40 (\~100% gain)

* **Stop Loss:** \$0.35 (\~50% loss)

* **Max Hold:** Close by Thursday midday/EOD to avoid gamma/theta acceleration

**Why This Trade?**

✅ Options Flow: Heavy call OI (11,025) and volume (10,119) → institutional directional bias

✅ Daily Momentum: RSI 73.5 — strong near-term bullish signal

✅ Volatility: Low VIX (\~15.3) supportive for directional buy

✅ Asymmetric Risk/Reward: Low premium, high upside potential

**Key Risks:**

⚠️ High gamma/short DTE → exit by Thursday mandatory

⚠️ Overbought daily RSI → potential mean reversion

⚠️ Weak weekly cash volume → trade may fail if stock doesn’t follow options flow

⚠️ Wide bid/ask on small OTM weekly calls → manage fills carefully

**Alternate Strikes:**

* \$337.50 call at \$0.91 → higher delta, slightly more expensive

* \$325 call at \$3.32 → near-ATM, higher probability but more capital required

**Quick Takeaway:**

* Strong options-driven setup for **short-term momentum play**

* Manage risk strictly with **50% stop + time-based exit**

* Exploit institutional call flow and low-cost asymmetric upside

---

📊 **TRADE DETAILS (JSON for precision)**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 340.0,

"expiry": "2025-09-12",

"confidence": 0.70,

"profit_target": 1.40,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.70,

"entry_timing": "open",

"signal_publish_time": "2025-09-08 12:38:03 UTC-04:00"

}

```

$UNH only 3 months left before re-pricing kicks in! - All the health insurers are going to raise prices starting 2026 which should improve the margins of healthcare insurers starting 2026

- We have only 3 months left to load up before fundamentals starts improving and start showing up in the numbers of earning reports.

- All the analyst estimates which have been lowered in last 6 months will be incorrect and NYSE:UNH should comfortably beat those which will lead to re-rating of the stock and eventually it should trade above 450+ before June 2026

$UNH – Macro Outlook UpdateBack in April, I suggested the long-term uptrend from 2008 may have topped, shifting into a multi-year correction toward the 260–150 support zone. The decline unfolded faster than expected, with news-driven selling hitting the upper edge of that macro support — followed by a strong rebound.

Apr mind www.tradingview.com

Currently, price is consolidating constructively. As long as 282 holds, I favor a continuation higher into the 360–430 resistance zone where we’ll reassess the broader structure.

Daily chart

Macro chart

Thank you for your attention and I wish you successful trading and investing decisions!

$UNH: UnitedHealth Group – Healthcare Hero or Reform Risk?(1/9)

Good evening, everyone! 🌙 NYSE:UNH : UnitedHealth Group – Healthcare Hero or Reform Risk?

With UNH at $505.69, post-7% drop, is this healthcare giant a safe bet or a reform casualty? Let’s diagnose! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 505.69 as of Mar 18, 2025 💰

• Recent Move: Stable after 7% drop, per user data 📏

• Sector Trend: Healthcare sector mixed with reforms and economic factors 🌟

It’s a steady pulse—let’s see if it’s time to buy or hold! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $465B (920M shares) 🏆

• Operations: Health insurance and services across the U.S. ⏰

• Trend: Leading player with strong fundamentals, per data 🎯

Firm in healthcare, but reforms keep it on its toes! 🏥

(4/9) – KEY DEVELOPMENTS 🔑

• Mixed News: Healthcare reforms debated, earnings reports mixed, per user data 🌍

• Q4 2024 Earnings: Assume beat or miss based on context, per data 📋

• Market Reaction: Stabilized after drop, showing resilience 💡

Navigating through choppy waters! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Healthcare Reforms: Regulatory changes could impact business 🔍

• Competition: Other insurers and providers in the market 📉

• Economic Slowdown: Reduced consumer spending on healthcare ❄️

It’s a risky prescription—watch the side effects! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in U.S. healthcare 🥇

• Diversified Portfolio: Insurance and services balance risk 📊

• Financial Strength: Strong earnings and cash flow, per data 🔧

Got the muscle to handle challenges! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Regulatory scrutiny, high debt (if any) 📉

• Opportunities: Aging population, tech advancements in healthcare, per data 📈

Can it capitalize on growth or stumble on weaknesses? 🤔

(8/9) – POLL TIME! 📢

UNH at $505.69—your take? 🗳️

• Bullish: $600+ soon, reforms are manageable 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $450 looms, reforms hit hard 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

UNH’s $505.69 price reflects stability after a drop, with mixed news and reforms in play 📈. DCA-on-dips could be a strategy to manage volatility. Gem or bust?

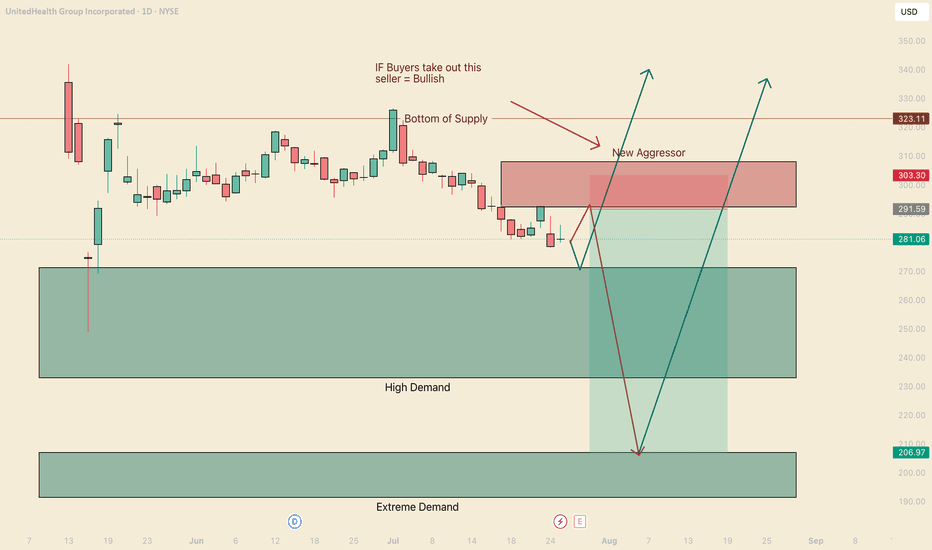

Bears are still in controlHello I am the Cafe Trader.

Today we are going to be taking a look at UNH. No doubt this has to have come across your feed or in the news recently. Why is every so Bullish? People are so bullish, that it spooks me... Everyone is pumping this emphatically, I feel like they are getting paid to pump it. This is a bold statement, but It's a gut feeling.

Tin Foil

If people get paid to pump, The huge seller isn't done selling, and needs you to keep buying to sell into you. Yes this should make you hesitant and weary. Does this mean you shouldn't buy? Not necessarily. Here are two scenarios to help you squeeze some juice out of this rock.

Bears are still in Control

A fresh new aggressive seller stepped in at $292.44. This is going to put some pressure on the high demand zone. May 25th, we sunk deep into the zone before recovering. This was an extremely hot reaction with passive buyers sitting at 271.30

11th of June aggressive buyers stepped in, but got crushed.

27th of June aggressive buyers stepped in, but as soon as they hit the real liquidity from the big seller (Tues jul 1st), you saw a huge follow through and more aggressive selling. This tells us that bears are still in control and I foresee two scenarios.

Green Scenario

Test off the liquidity at $271. Get a hot reaction from the buyers, putting tons of pressure on the new seller, ripping their faces and blasting off into never land.

Long

Entry 271

Stop 260

Partial TP 323

Final TP 425

Red Scenario

We test the New aggresor before the high demand Liquidity, get sold into heavily, and put so much pressure on buyers it blows pass the high demand and gets to the most probable bounce location at top of Extreme Demand $207.

Short

Entry 292

Stop 302.50

Partial TP 271

Final TP 207

Bonus Scenario

That 207 Area should attract massive buyers, even with the seller as heavy as he is. I think if there is going to be any big bounce strait off the cuff, this will be the spot.

Entry 207

Stop 185

TP 425 (play the long long game here)

Long Term

If you did your DD and you want a good price. The following will be measured by your personal sentiment.

Aggressive = 271

Fair price = 240

"Steal" = 191 - 207

That's all for UNH, Remember to follow/Boost.

Stay tuned for more market analysis. Happy Trading!

@thecafetrader

UNH Breakdown Ahead?= 297.5 PUT Jackpot

# 🚨 UNH Weekly Options Alert (2025-08-26) 🚨

🔥 Tactical Bearish Play or Sit Out? 🔥

### 📊 Key Takeaways

* ⚖️ Multi-timeframe conflict: Daily RSI \~61.7 (neutral-bullish) vs Weekly RSI 36.5 (bearish).

* 📉 Weekly trend = bearish, weak volume (0.4x).

* 📈 Options flow mildly bullish (C/P \~1.21) but no strong conviction.

* 📰 DOJ probe news = extra downside risk.

* 🤔 Most models say **NO TRADE** → but DeepSeek signals a tactical bearish PUT.

---

### 🎯 Trade Idea (High Risk / Tactical)

* 🏦 **Instrument**: \ NYSE:UNH

* ⬇️ **Direction**: PUT (short bias)

* 🎯 **Strike**: 297.50

* 💵 **Entry Price**: \$3.10 (midpoint)

* 💰 **Profit Target**: \$4.96 (+60%)

* 🛑 **Stop Loss**: \$1.86 (-40%)

* 📅 **Expiry**: 2025-08-29 (weekly)

* 📏 **Size**: 1 contract (conservative)

* ⏰ **Entry Timing**: At open

---

### ⚠️ Risks

* 📰 News volatility → DOJ probe can cause sharp reversals.

* ⌛ 3 DTE = **fast time decay** & gamma risk.

* 📉 Low volume = lack of institutional conviction.

---

### 🧭 Conclusion

* Majority: 🚫 No trade → wait for RSI alignment + stronger volume.

* Tactical bears: ✅ Take small PUT at 297.5 for downside skew.

---

### 📌 TRADE JSON (for algos/automation)

```json

{

"instrument": "UNH",

"direction": "put",

"strike": 297.5,

"expiry": "2025-08-29",

"confidence": 0.55,

"profit_target": 4.96,

"stop_loss": 1.86,

"size": 1,

"entry_price": 3.10,

"entry_timing": "open",

"signal_publish_time": "2025-08-26 18:42:52 EDT"

}

```

---

🔥 Suggested **title for TradingView post**:

**“🚨 UNH Weekly Options Play – DOJ Probe Sets Up Tactical Bearish PUT (297.5 Strike)”**