Short VISAHi traders,

Entering a short position in VISA, while below 200 MA.

From fundamental stand point, crypto payments might affect future revenues

I will update idea if scenario changes

My 6 trading rules, audited track record at my signature

1. Never add to a losing position: Avoid averaging dow

Visa Inc. Shs A Cert Deposito Arg Repr 0.055555555 Shs

No trades

750 ARS

22.52 T ARS

45.38 T ARS

About Visa Inc.

Sector

Industry

CEO

Ryan McInerney

Website

Headquarters

San Francisco

Founded

1958

IPO date

Mar 25, 2008

Identifiers

2

ISIN ARBCOM460127

Visa, Inc engages in the provision of digital payment services. It also facilitates global commerce through the transfer of value and information among global network of consumers, merchants, financial institutions, businesses, strategic partners, and government entities. It offers debit card, credit card, prepaid products, commercial payment solutions, and global automated teller machine (ATM). The company was founded by Dee Hock in 1958 and is headquartered in San Francisco, CA.

Related stocks

Visa ($V) just broke down from a one-year range. Further downsidVisa ($V) just broke down from a one-year range.

Further downside looks likely. Why? 👇

• Range break = expansion.

A year-long consolidation builds pressure. The longer the range, the more significant the eventual move tends to be. Breaks from extended ranges often lead to strong follow-through.

•

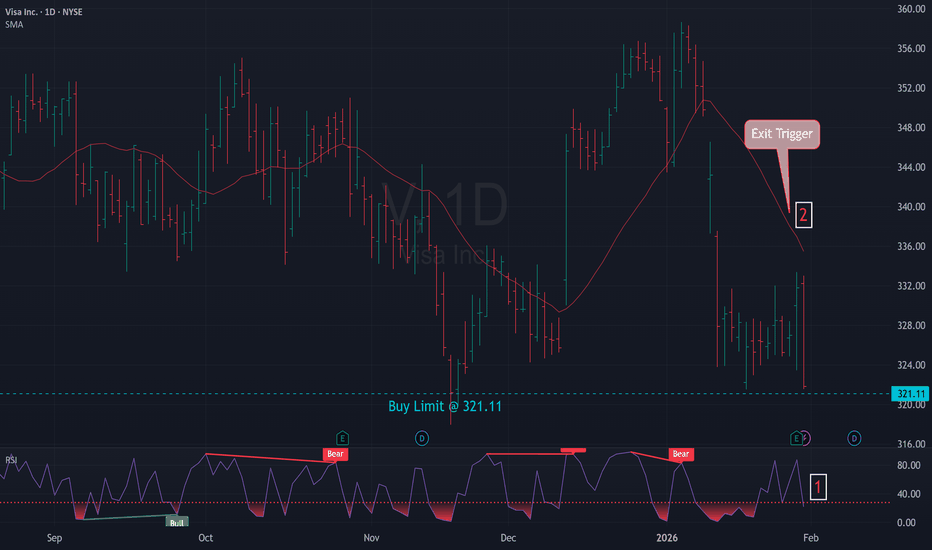

Mean Reversion Setup: V1. RSI in oversold region

2. Price likely to rebound back to the mean

Trade Rules:

Entry Trigger - RSI has cross below oversold region, enter limit buy at close price

Exit Trigger - Close at market when close price cross above exit trigger (Red Line)

Notes: Maximum of 3 open positions

Mean Reversion Setup: V1. RSI in oversold region

2. Price likely to rebound back to the mean

Trade Rules:

Entry Trigger - RSI has cross below oversold region, enter limit buy at close price

Exit Trigger - Close at market when close price cross above exit trigger (Red Line)

Notes: Maximum of 3 open positions

V Earnings Setup — Positive Gamma, Dealer Support Above 330💳 V (Visa) — Earnings Liquidity Playbook

🧭 Market Structure Snapshot

📈 Trend: Higher-timeframe pullback into weekly support + value

🏗 Structure: Acceptance holding above prior weekly lows

⚡ Momentum: SMI curling up from oversold → bullish momentum rebuild

📊 Volume: Selling pressure exhausted, volum

Mean Reversion Setup: V1. RSI in oversold region

2. Price likely to rebound back to the mean

Trade Rules:

Entry Trigger - RSI has cross below oversold region, enter limit buy at close price

Exit Trigger - Close at market when close price cross above exit trigger (Red Line)

Notes: Maximum of 3 open positions

$ V Retracement$V is Targeting the confirmations levels and the 1.618. $V has ER next Thursday 1/22 and the stock is currently beat down. This seems to be a "B" Wave Retracement, which means a Misleading Retracement like a fake out so to speak so the Run up move that I'm actually looking for is actually a fake run

Visa Is Ready To Move to All Time Highs Visa Is Ready To Move to All Time Highs 🚀

Right now, NYSE:V is putting on a masterclass in technical structure. If you’re a fan of high-probability setups, you’ll want to lean in for this one.

We aren't just looking at candles, we’re looking at a story of supply, demand, and a massive psychol

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US92826CAQ5

Visa Inc. 2.0% 15-AUG-2050Yield to maturity

5.29%

Maturity date

Aug 15, 2050

3V69

Visa Inc. 3.65% 15-SEP-2047Yield to maturity

5.27%

Maturity date

Sep 15, 2047

3V68

Visa Inc. 4.3% 14-DEC-2045Yield to maturity

5.25%

Maturity date

Dec 14, 2045

V4972835

Visa Inc. 2.7% 15-APR-2040Yield to maturity

4.87%

Maturity date

Apr 15, 2040

V6303668

Visa Inc. 4.7% 12-FEB-2036Yield to maturity

4.50%

Maturity date

Feb 12, 2036

US92826CAE2

Visa Inc. 4.15% 14-DEC-2035Yield to maturity

4.46%

Maturity date

Dec 14, 2035

V6303666

Visa Inc. 4.4% 12-FEB-2033Yield to maturity

4.18%

Maturity date

Feb 12, 2033

XS306372505

Visa Inc. 3.875% 15-MAY-2044Yield to maturity

3.98%

Maturity date

May 15, 2044

V6303410

Visa Inc. 4.1% 12-FEB-2031Yield to maturity

3.85%

Maturity date

Feb 12, 2031

V5028512

Visa Inc. 1.1% 15-FEB-2031Yield to maturity

3.82%

Maturity date

Feb 15, 2031

V4972836

Visa Inc. 2.05% 15-APR-2030Yield to maturity

3.81%

Maturity date

Apr 15, 2030

See all V bonds