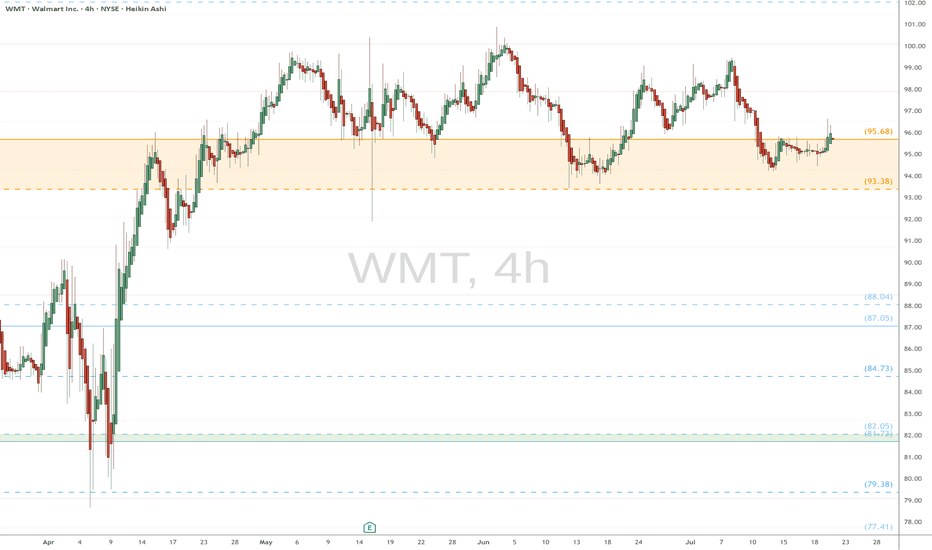

WMT eyes on $95.68 above 93.38 below: Double Golden fibs are KEYWMT has been orbitting this Double Golden zone.

$95.68 is a Golden Genesis, $83.38 a Golden Covid.

This is the "highest gravity" cluster any asset can have.

This is a very important landmark in this stock's lifetime.

==================================================

.

Trade ideas

Walmart Is Approaching a Breakout Zone — Major Move Ahead?Walmart is currently testing a major long-term ascending resistance line around 115–117 USD. This zone has rejected price multiple times, making it a crucial decision point. Momentum is bullish, but the trendline remains the main barrier.

Targets

Bullish Target (If breakout holds)

• 1st Target: 122 USD

• 2nd Target: 125 USD

Bearish Target (If rejection occurs)

• 1st Support: 112 USD

• 2nd Support: 105 USD

Stop-Loss

• For Long Positions: Below 111 USD (loss of structure)

• For Short Positions: Above 118 USD (confirmed breakout)

Mini Fundamental Analysis

• Walmart continues to benefit from strong consumer demand, especially in essential goods.

• The company is aggressively expanding into e-commerce, improving margins and market share.

• Recent earnings showed steady revenue growth and strong performance in grocery and online sales.

• Fundamentally, WMT remains defensive, stable, and resilient, which supports long-term upside.

Final Summary

Walmart is at a critical breakout zone.

• A clean break above 117 opens the way to 122–125.

• A rejection triggers a drop toward 112 or even 105.

Trend and fundamentals favor bullish continuation, but price must confirm the breakout.

Walmart. Current Growth Target.The previously proposed diagonal model is no longer valid, as the expected decline did not materialize.

The chart annotation has been adjusted in favor of developing a standard impulse wave, wave .

Target: 140.24, representing a +22.52% move from the current price.

📊

A potential entry will be signaled on a pullback within the next week or two. The structure for the subsequent advance is marked on the chart.

Note: the price during the correction should not break out of the channel boundaries.

Walmart Stays Strong, Ready for the Next LeapWalmart is proving once again why it remains one of the strongest companies in the world. Even as many retailers struggle, Walmart continues to grow, innovate, and win the confidence of investors.

Its stock is already up 22% this year, beating the S&P 500, and many signs show that the company could stay strong in 2026 as well.

◉ Why Walmart Is Winning

Walmart has become a perfect mix of traditional retail and modern technology.

Strong results:

● Revenue up 5.8% year over year

● Operating income up 8%

● EPS rising from $0.58 to $0.62

Market share growth:

Walmart gained more customers in grocery and general merchandise. Even higher-income shoppers have been spending more at Walmart.

E-commerce strength:

Online sales grew 27% as Walmart expands its online offerings and reaches customers beyond its stores.

Growing advertising business:

Walmart’s ad sales increased 53% in the latest quarter, turning it into a serious player in retail advertising.

◉ Technology Is Shaping Walmart’s Future

Walmart is investing heavily in technology to stay ahead:

● Partnering with OpenAI to let customers use ChatGPT for shopping and checkout

● Training developers to code faster with AI

● Automating supply chains and warehouses

● Buying Vizio to strengthen its advertising ecosystem

These changes are helping Walmart protect its low-price model while moving closer to becoming a tech-driven retailer.

◉ Leadership and Listing Changes

Two important updates were recently announced:

● CEO Doug McMillon is stepping down after ten years

● John Furner, head of Walmart U.S., will become the new CEO

Walmart also announced that it will move its stock listing from the New York Stock Exchange to the Nasdaq. This connects Walmart more closely with tech-focused indexes and funds.

◉ Dividend Stability

Walmart is a Dividend King, raising its dividend every year for more than 50 years. This adds strong stability for long-term investors.

◉ Technical Outlook

● From a technical point of view, the stock recently broke out of an ascending triangle pattern and touched a new all-time high.

● If this momentum continues, Walmart could see another strong rally in 2026.

◉ Final Thoughts

Walmart is winning today and building an even stronger position for the future. With solid financials, strong e-commerce growth, expanding advertising revenue, and steady leadership changes, the company is well-placed for 2026 and beyond.

Walmart (WMT) surged on expectations of robust consumer spending

The US indices have maintained their uptrend, supported by evidence of strong US consumer spending during Black Friday, which confirmed sustained consumer strength.

Adobe (ADBE) reported that consumers spent 11.9 bln USD online during Black Friday, marking a record high and a 9.1% increase YoY. The NRF survey results also indicated a record-high 186.9 mln people planned to shop from Thanksgiving through Cyber Monday.

Walmart (WMT) stock price surged, reflecting its 3Q earnings surprise and growing anticipation for increased year-end consumption. CFO Rainy commented that the early demand for the holiday season is very strong, with robust spending particularly notable among high-income customers.

WMT breached above the ascending channel's upper bound and broke to a new high. Diverging bullish EMAs indicate a potential uptrend extension.

If WMT closes above the channel's upper bound, the price could advance toward the new high and psychological resistance at 111.50.

Conversely, if WMT breaks below the channel's upper bound and the support at 109.00, the price may retreat to the subsequent support at 106.00.

Walmart’s post-earnings strength suggests continued upside this

Current Price: $107.18

Direction: LONG

Confidence Level: 68%

Targets:

- T1 = $109.50

- T2 = $111.20

Stop Levels:

- S1 = $105.80

- S2 = $104.00

**Wisdom of Professional Traders:**

Looking across the collective analysis from multiple professional traders, I’m seeing a consistent theme: Walmart is acting as a defensive leader in a shaky market, benefiting from strong earnings, resilient consumer demand for value, and rotation into staples and off-price retail. Many traders highlighted Walmart’s relative strength post-earnings compared to a declining broader market. The group sees it holding above key support levels and potentially breaking higher on holiday spending momentum.

**Key Insights:**

Here’s what’s driving this — earnings came in ahead of expectations, and traders repeatedly mentioned Walmart as one of the best performers in the retail sector alongside names like TJX. Several pointed out that value-conscious consumers are spending more at Walmart as they avoid higher-priced retailers like Target. The sentiment here is that Walmart is positioned to capture holiday traffic and maintain market share. Some also framed it as a “safe haven” in current volatile conditions, with retail and staples outperforming tech-heavy indices.

What caught my attention is the repeated reference to key support near $104-105 and the notion that as long as Walmart stays above that level, the bullish thesis remains in play. Holiday spending on consumables and clothing featured heavily in trader commentary, and that bolsters the idea of short-term upside into year-end.

**Recent Performance:**

This all played out in the price action last week — Walmart rallied sharply after its earnings beat even as the S&P 500 slumped, showing clear relative strength. It’s been holding gains in a narrow range between roughly $105 and $108, consolidating those post-earnings gains rather than giving them back. That type of price action often precedes another leg higher if volume picks up in the direction of the prior move.

**Expert Analysis:**

Multiple traders’ analysis points to $104 as a critical technical level, with one common setup being to “get long off $104” or to ride the trend as long as price maintains above near-term support. Retail sector rotation, off-price leadership, and consumer staples group strength are all cited as reasons why Walmart could push toward the $110 area in the near term. The consensus is that it’s showing leadership qualities in a market still digesting broader selling pressure.

**News Impact:**

The earnings beat attracted strong interest, and news flow around holiday discounts, Black Friday momentum, and consumer focus on value is supporting the bullish tone. Traders see Walmart benefiting not just from macro defensiveness but also from tactical seasonal buying patterns. Leadership transition concerns have been noted in one analysis, but near-term, sentiment remains constructive given operational execution and competitive pricing power.

**Trading Recommendation:**

Here’s my take — I’d look to enter a long position near current levels with stops just under $105.80 to protect against a breakdown of post-earnings support. With a 68% confidence rating due to strong trader consensus but limited social data from X, I’d play for a move to $109.50 as the first target and $111.20 as a secondary target this week. Seasonal strength and rotation into defensive retail give the setup a favorable bias in the short term.

Walmart Inc. Expands to Africa With First South Africa StoreWalmart Inc. (NYSE: NYSE:WMT ) has officially opened its first store in South Africa, marking a major step in the retailer’s long-term international expansion strategy. The launch took place in Roodepoort, west of Johannesburg, and signals Walmart’s ambition to deepen its presence in emerging markets while strengthening its global retail influence.

The opening drew overwhelming demand. Hundreds of shoppers lined up for hours, eager to access Walmart’s signature “Everyday Low Prices” and international items not widely available locally—such as Drew Barrymore designer appliances, Labubu dolls, and Dr Pepper beverages. Some customers targeted Black Friday tech deals, highlighting strong consumer interest from day one.

Walmart will compete directly with established local players, particularly Shoprite’s Sixty60 delivery service. The company is rolling out its own 60-minute delivery option to match South Africa’s rapid-commerce expectations. Executives emphasized that Walmart’s entry represents a commitment to long-term value, access, and affordability for South African consumers.

Beyond retail expansion, Walmart is prioritizing community impact. The new store created 80 jobs and partnered with 15 local SMEs to support regional supply chains. This combination of global variety and local empowerment strengthens Walmart’s positioning in a competitive market.

From an investment perspective, Walmart continues to outperform major benchmarks. Its 3-year return of 117.20% and 5-year return of 125.45% surpass the S&P 500 by a wide margin—reflecting consistent investor confidence in the retailer’s disciplined strategy and operational strength.

Technical Outlook

WMT recently bounced from the $100 support level after retracing from $109. Buyers defended the zone strongly, and price is now pushing back toward the $109 resistance. A decisive breakout above $109 opens the path toward new highs, supported by strong fundamentals and global expansion momentum. Failure to reclaim the level may lead to another retest of $100, but the broader structure remains bullish.

Walmart Inc. (WMT) Wins on Low-Price LoyaltyWalmart Inc. (WMT) is the world’s biggest retailer, running big-box stores, neighborhood markets, and a fast-growing online shop. It sells everything from groceries to gadgets, and keeps customers coming back with everyday low prices, private-label value, and one-stop convenience. Growth comes from its huge scale, smarter supply chain and automation, booming pickup and delivery, and steady gains in higher-margin areas like advertising, marketplace sellers, health services, and membership perks such as Walmart+. Even in soft economies, shoppers tend to trade down to Walmart.

On the chart, there’s a clear confirmation bar with increasing volume, and price has pushed into the momentum zone by moving above the .236 Fibonacci level. A trailing stop could be set using that .236 level from the Fibonacci snap tool, letting the trend work while protecting gains if price rolls over.

WMT Earnings: Neutral AI + Bearish Flow = No-Trade ZoneMT QuantSignals V3 — Earnings (2025-11-19)

Signal: NEUTRAL (NO TRADE)

Confidence: 50% | Low Conviction

📈 Price & Volatility

Last Price: $100.41

24h Move: –2.47%

Implied Move: $5.21 (5.2%)

Support: $99.68

Resistance: $103.34

Volume: 0.8× average (light participation)

📊 Signal Breakdown

Katy AI:

Neutral forecast

Predicted range: $100.09 – $100.82 (very tight, no directional edge)

Expected volatility: 0.0%

Technical Indicators:

RSI: 44.9 (neutral)

MACD: –0.2619 (weak bearish)

Momentum: Flat / low conviction

Options Flow:

PCR: 1.62 (bearish → heavy puts)

Unusual flow: $110 puts (institutional hedging)

News Sentiment:

Mixed

Acquisition news (long-term bullish)

Near-term earnings uncertainty → no clear direction

⚠️ Risk Summary

High volatility expected (5.2% implied move)

No edge from AI, technicals, or flow

VIX elevated → earnings risk amplified

🚫 Trade Decision

NO TRADE — Insufficient directional conviction (<55%)

Wait for post-earnings movement or a stronger signal.

$WMTWalmart reports earnings this Thursday, and the weekly chart is telling a very clear story:

✅ 1. Price Has Defended the $100 Level All of 2025

Even with market volatility and uncertainty, NYSE:WMT has held above $100, showing strong long-term demand. That level has acted as:

• Major liquidity zone

• Investor confidence floor

• Consumer-strength indicator

🟡 2. Missing Economic Data = Unclear Consumer Picture

Because of the government shutdown, we’re still missing key reports that normally show:

• Retail spending

• Consumer sentiment

• Household demand

• Inflation pressure

This lack of data makes it harder for investors to judge how strong Walmart’s traffic and revenue trends really are.

🔺 3. Tariffs Have Added Uncertainty

Tariff debates earlier this year created hesitation for investors.

Why? Because tariffs affect:

• Walmart’s import costs

• Consumer prices

• Margins

• Inventory strategy

That uncertainty kept some buyers on the sidelines waiting for clarity.

🔻 4. Expected Move: A Small Pullback Above $100

Based on the chart and current market conditions, I expect:

• Some investors may take profits before earnings

• A controlled pullback towards the $100–$102 area

• Buyers stepping back in if consumers show strength

The stock still looks healthy as long as it stays above $100.

📊 5. What Will Move the Stock?

Key items in the report:

• Same-store sales

• Grocery traffic

• E-commerce growth

• Commentary on tariffs + consumer strength

• Guidance for Q1 2026

🔵 Final Take

Walmart is still one of the strongest defensive names in retail, but without the full economic picture, investors may temporarily lock in profits. A pullback above 100 is normal the real move comes after earnings confirm how the U.S. consumer is holding up.

WMT - Wallmart Earnings Setup for This WeekHello Everyone , Followers,

Wallmart will release its financial reports on Thursday Before market open. I would like to share my view and follow up level depends on good and bad reports

Bullish Scenario

If earnings beat + guidance strong → next target: 110 - 111

Bearish Scenario

Weak numbers → potential drop to between 95 - 96

🔹 Key Support Zones

First support: 99.50 - 100

Deeper support: 95.50 - 95.80

🔹 Resistance Levels

Main resistance: 104.80 - 105.00

Breakout target: 111.50 - 112.00

🔹 Outlook

As long as It stays above 99.50 , momentum remains bullish.

A breakdown below that level could open the door for a deeper pullback. This is depends on Results of financial reports.

🔹 My Plan

I will wait for the financial report before i buy it . With a bearish scenario my buy level is 105 (It needs to close above this level)

If it can achive to stay above 99.50 and if you like to take a risk then you can buy it above this level before results are published .

If you enjoy and like clean, simple analysis — follow me for more.

Have a lovelly and Sunny Weekend to all.

WALMART can correct to $85.00 if this level breaks.Exactly 5 months ago (June 12, see chart below), we gave a strong buy signal on Walmart (WMT) right at the bottom of its trend, which eventually hit our $110 Target and then got rejected:

This time we move to the larger 1W time-frame as our former Target was eventually a new All Time High (ATH) almost at the top of the 13-year Channel Up. The price is hanging tightly now on the 1W MA50 (blue trend-line), which is where the previous correction (Feb-March 2025) found Support and rebounded.

With the 1M RSI printing a formation that previous delivered two technical pull-backs of -23.74%, we expect the stock to start correcting again if it closes below the 1W MA50. All previous breaks below it, eventually led to a 1W MA100 (green trend-line) test.

If that takes place, we expect Walmart to hit at least $85.00 inside 2026.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WMT - Overvalued - CEO Retiring - What Next?Walmart demonstrates exceptional operational strength with impressive 25.3% net income growth and consistent earnings performance, supported by successful digital transformation and strong market positioning.

Here's a hard truth... these positive fundamentals are overshadowed by valuation concerns that appear unsustainable for a mature retail business.

The assessment of overvaluation centers on elevated multiples including a 40.6 P/E ratio and 62.3 P/FCF ratio, which significantly exceed historical norms for the retail sector. Discounted cash flow models consistently indicate substantial premiums to fair value estimates, ranging from 62% to 153% above intrinsic value calculations. This valuation disconnect suggests the market has priced in optimistic growth expectations that may be difficult to sustain . (Sound familiar? It should)

While Walmart maintains excellent defensive characteristics and operational momentum, current price levels present limited upside potential and meaningful downside risk . I'm going to have a "hold" recommendation reflecting my view that existing shareholders should maintain positions given the company's strong fundamentals, but new capital should await more attractive entry points .

I would be much more confident if we were closer to the 38.2% fibonacci pullback around $97 or what would be even better would be $90-$93 which is at the 61.8% and 50% pullback, respectively.

WALMART

WMT has been trade around 7-year CHANNEL UP PATTERN since the January 12 2015 High.

The price has finally reached the top (Higher Highs trend-line) of this decade-long bullish pattern and that is easily identifiable by the 1W RSI sequence.

The rally that started on the May 16 2022 bottom is very similar to the one that started on the October 26 2015 bottom.

bullish momentum is just around this 2-4 weeks impact from Trump presidency, but negative outlook from current geopolitical and economically approach, it gonna dip

AIMING it will dip deep and close the gapping again , to return to its baseline price.

thats all

WMT - Weekly - OvervaluedBased on the analysis, the company demonstrates consistent financial health since 2022, suggesting stability despite a volatile market, and has shown year-over-year growth in both revenue and net income since 2020. However, there are technical concerns, including price manipulation detected since February 10, 2025, and the stock has been trading in a state of low volatility since March 17, 2025. Furthermore, the stock is currently trading above its fair value channel, which is estimated to be in the $84 - $90 range. This overvaluation, combined with the fact that monthly candles since January 2024 have been closing as neutral (indicating market indecision), suggests a correction is likely pending.

Not financial advice, always do your due diligence

Leave a like👍 and/or comment💬.

We appreciate and value everyone's feedback!

- RoninAITrader

Walmart (NYSE: $WMT) Bulls Eye a Reversal Near Key SupportWalmart’s stock is showing early signs of a potential rebound after testing a crucial support zone near the $100 level. This area has acted as both resistance and support in the past, making it a critical price floor for buyers. The chart displays a well-defined ascending trendline that has held since early 2025, signaling a long-term bullish structure.

Currently trading around $102, Walmart appears to be forming a higher low, which could serve as the base for a new bullish leg. This new leg may lead to a breakout toward $109 and possibly higher if volume confirms renewed buying pressure.

Fundamentally, Walmart continues to benefit from its dominant retail position and strategic investments in e-commerce and automation. The company’s ability to manage supply chains efficiently and maintain stable margins during inflationary periods has strengthened investor confidence. Additionally, its focus on expanding grocery delivery and membership programs has kept revenue growth steady even amid consumer spending shifts.

If the $100–$101 region continues to hold, technical traders may anticipate a bounce back toward the $108–$110 resistance zone. A clean break above that level could open the door for a move to new highs around $114. Conversely, a close below $98 would invalidate the bullish thesis and suggest further downside toward $94.

With strong fundamentals, consistent dividend growth, and a chart structure hinting at a technical reversal, Walmart’s setup appears attractive for medium- to long-term investors watching for confirmation of momentum.

Is Walmart Setting Up for a Bullish Momentum Shift?🛒 WMT: Walmart’s Wealth Heist Strategy 🚀 (Swing/Day Trade)

Asset: Walmart, Inc. (WMT)

Market: US Equities (not Forex, as WMT is a stock, not a currency pair! 😉)

Vibe: Bullish Breakout with a Thief Strategy twist! 🕵️♂️

📈 The Plan: Steal the Breakout! 💥

WMT is gearing up for a bullish breakout at $105.00!

🎯 For confirmation, we need a 4-hour candle close above the resistance level at $105.00 to lock in that buy signal. No sneaky moves before confirmation, or you’re gambling with your loot! 😎

🕵️♂️ Thief Strategy: Layered Limit Orders

This is where the Thief Strategy shines! 🌟 Instead of jumping in with one big order, we’re setting multiple buy limit orders to stack the deck in our favor:

$102.00

$103.00

$104.00

$105.00

$106.00

Pro Tip: Feel free to add more layers based on your risk appetite, but only place these limit orders after the breakout is confirmed (4H candle close above $105.00).

Setting layers blindly is like robbing a bank without a getaway car—risky business! 🚨

🛑 Stop Loss: Protect Your Stash

Set your stop loss at $101.00.

Note: Dear Thief OGs (Ladies & Gentlemen of the charts), this is my suggested SL, but it’s your heist, your rules! Adjust based on your risk tolerance. 💸

🎯 Take Profit: Cash Out Like a Pro

Our target is $112.00, where we expect strong resistance and potential overbought conditions. Watch out for a possible trap at this level—grab your profits and escape before the market pulls a fast one!

😈Note: This is my recommended TP, but you’re the boss of your trades. Take profits at your own discretion and keep the cash flowin’! 💰

🔗 Related Pairs to Watch (Correlations & Key Points)

Since WMT is a retail giant, its price action often correlates with consumer discretionary and retail sector stocks. Keep an eye on these related assets (all priced in USD):

NYSE:TGT (Target Corporation): Another retail titan. If WMT breaks out, TGT often follows the consumer spending vibe. 📊

NASDAQ:COST (Costco Wholesale): Big-box retail cousin. Strong correlation with WMT due to similar market dynamics. 🏬

AMEX:XRT (SPDR S&P Retail ETF): Tracks the broader retail sector. A bullish WMT could signal strength in XRT. 📈

Key Correlation Insight: WMT’s performance is tied to consumer confidence and economic data (e.g., retail sales, consumer price index). If these indicators are strong, expect WMT and related stocks to rally. Conversely, weak data could stall the breakout. Always check the economic calendar! 🗓️

📝 Final Notes for the Heist

Confirmation is King: Don’t set your layered limit orders until the 4H candle confirms the breakout above $105.00. Patience pays! ⏳

Risk Management: The Thief Strategy is slick, but don’t get greedy. Stick to your risk-reward ratio and protect your capital. 💼

Market Context: Watch for broader market sentiment (S&P 500, consumer sentiment reports) to support WMT’s bullish move. 🌍

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This Thief Style trading strategy is just for fun! Trade at your own risk and always do your own research. 😜

#Hashtags: #WMT #StockMarket #SwingTrading #DayTrading #ThiefStrategy #BullishBreakout #TechnicalAnalysis #TradingIdeas

Three Paths, One Plan – Walmart (WMT) Weekly Battle MapWalmart just broke to new all-time highs after building a strong base since February. This is a major technical moment — a clean structure that gives us three possible scenarios for the upcoming weeks:

🟢 Scenario 1 – Strong Breakout

Price keeps pushing higher with wide candles, confirming strength.

Plan: Stay long. Add on a clean retest of the pink zone if a color change confirms continuation.

Stop-Loss: Below the green line (~$101).

Target: $120–$125.

🟡 Scenario 2 – False Breakout / Loss of Momentum

If the next few candles stay small and the breakout fades, momentum dries up.

Plan: Reduce exposure or sell into a rebound to manage damage.

Defense Zone: $104–$105.

🔴 Scenario 3 – Stop & Reversal

If next week’s candle completely erases the breakout bar with a violent move, that triggers a reversal short.

Condition: Full candle wipeout with a close below the breakout body.

Target: Lower base of the range around $93 ±.

🎯 Final Take

As long as price holds above the pink zone ($105–$107), bias remains bullish.

Only a strong rejection and weekly close below $101 would confirm a reversal toward $93.

Walmart Inc. (WMT) Builds With AI and Data SolutionsWalmart Inc. (WMT) is the world’s largest retailer, operating thousands of stores and a rapidly growing e-commerce platform serving millions of customers globally. Known for its “Everyday Low Prices,” Walmart offers groceries, household goods, electronics, and apparel. The company’s growth is fueled by its expanding online presence, investments in automation and AI-driven logistics, and consistent focus on affordability that keeps shoppers loyal even in uncertain economies.

On the chart, a confirmation bar with rising volume highlights bullish momentum. The price has entered the momentum zone after moving above the .236 Fibonacci level. A trailing stop can be placed just below this Fibonacci line using the Fibonacci snap tool, helping traders secure profits while staying open to further upside potential.

Walmart (WMT) Stock Direction: Upward Surge on October 15, 2025Walmart (WMT) Stock Direction: Upward Surge on October 15, 2025

As of midday trading on October 15, 2025, Walmart Inc. (WMT) is experiencing a strong upward movement, with shares climbing to 107.31 USD, marking a gain of 5.08% from the previous close. This performance pushes the stock to a new all-time high, surpassing its prior peak of 106.11 USD set on September 17, 2025. The rally is driven primarily by the announcement of a strategic partnership with OpenAI, enabling seamless shopping through ChatGPT with instant checkout features, which positions Walmart at the forefront of AI-driven retail innovation.

Key Market Metrics

- **Price and Change**: Current price at 107.31 USD, up 5.19 USD (5.08%) intraday.

- **Volume**: 17.37 million shares traded, exceeding the average of 15.99 million, indicating heightened investor interest and potential institutional buying.

- **Market Cap**: Approximately 855.41 billion USD.

- **Valuation**: Trailing P/E ratio of 40.64, reflecting premium pricing amid growth expectations.

- **Broader Performance**: Year-to-date return of 19.64%, with a 34.93% gain over the past year, outperforming many retail peers.

Catalyst: OpenAI Partnership

The partnership integrates AI to enhance the shopping experience, allowing users to make purchases directly via ChatGPT. Analysts view this as a leap in "agentic commerce," accelerating Walmart's e-commerce edge and potentially expanding margins through reduced customer acquisition costs. Mizuho reiterated an Outperform rating with a 115 USD price target, highlighting the move as ahead of the curve in AI retail adoption. Overall analyst consensus remains "Strong Buy," with an average 12-month target of 112.95 USD, suggesting further upside potential.

Sentiment and Technical Outlook

Social media buzz on X reflects bullish enthusiasm, with users noting the breakout above key resistance levels like 104 USD and potential targets at 110-120 USD based on Fibonacci extensions and Elliott Wave patterns. Volume spikes and a bullish MACD crossover support sustained momentum, though some caution about profit-taking near upper channel extremes. Institutional flows appear supportive, with over 4,000 funds holding shares and positive reactions to the AI news.

Risks and Considerations

While today's direction is clearly upward, broader market factors like inflation and consumer spending could influence retail stocks. Upcoming earnings on November 20, 2025, will be key, with expectations for continued e-commerce growth. Support levels to watch include 103 USD and 101 USD for any pullback.

In summary, WMT's direction today is firmly upward, fueled by the OpenAI collaboration and robust trading activity, positioning it for potential continued gains in the near term.

Walmart Breaks Out of Double Bottom — Bullish MomentumWalmart Inc. (NYSE:WMT) has confirmed a bullish breakout from a well-defined double bottom pattern , signaling a potential trend reversal from recent consolidation.

📈 What’s Happening:

After forming two distinct troughs near the same support zone, Walmart has broken above the neckline resistance , confirming the double bottom formation.

Price action now suggests that bulls have regained control, setting the stage for further upside momentum.

🧩 Interpretation:

This technical structure typically marks the end of a downtrend and the beginning of a new bullish leg . Sustained price action above the neckline would strengthen the bullish bias and open room for continuation toward the projected target zone.

Reversal from 30D SMA:

price has taken reversal from 30D SMA recently indicating more upward momentum for the stock

🎯 Target: 103.82