ZOOM : go LONG

1. Technical Analysis (Based on the Heikin Ashi Chart)

The Heikin Ashi chart is used to smooth out price fluctuations, making it easier to identify market trends.

* Strong Bullish Reversal Signal:

* Following a period of consolidation or slight correction (late September to mid-October), the chart shows a series of consecutive green Heikin Ashi candles, signaling a shift from a sideways/downward trend to an uptrend.

* The appearance of long-bodied green candles with little or no lower wick, particularly in late October and early November, is a powerful indicator that buying pressure is dominating.

* Breakout Above Resistance/Accumulation Zone:

* The stock price has broken out above the horizontal support/resistance line marked at approximately $82.66. This area was likely a zone of accumulation or prior resistance. Breaking this level with strong green candles suggests investor consensus and the potential for continued upward momentum.

* Potential Price Target:

* Based on the trade setup shown on the chart, the potential target price is set at $122.38. This represents a significant potential return relative to the current price ($87.23), indicating an attractive risk/reward ratio if the stop-loss is placed logically below the broken support level.

* Current Entry Point:

* The current price of $87.23 is right after the confirmation of the bullish signal (post-breakout of $82.66), which could represent an optimal entry point to ride this new uptrend.

2. Fundamental Analysis

While Zoom faces intense post-pandemic competition, the following fundamental factors still support a buy thesis:

* Revenue and Earnings Beat Expectations:

* Zoom has raised its revenue outlook for the full fiscal year 2025 (projecting $4.61 billion - $4.62 billion) and reported adjusted Earnings Per Share (EPS) higher than previous forecasts, indicating the company's ability to grow and manage costs effectively.

* Consistently beating analysts' estimates in recent earnings reports (e.g., Q4 revenue of $1.15 billion) builds positive confidence in the business's capabilities.

* Sustainable "Hybrid Work" Trend:

* Although the pandemic is over, the hybrid work model (combining remote and in-office work) has become a long-term trend. Demand for professional, user-friendly video conferencing solutions like Zoom Phone, Zoom Rooms, and Zoom Video Webinar remains strong and steady.

* Product Diversification and Acquisition Strategy:

* Zoom is actively expanding into other enterprise services like Zoom Phone and Zoom Rooms to reduce reliance on the core video meeting application and seek more sustainable revenue streams from larger customers (Enterprises).

* The integration of Artificial Intelligence (AI) into its services is also a key focus, promising to enhance user experience and create new competitive advantages.

* The company has engaged in a Share Buyback plan, which is generally viewed positively, as it reduces the number of outstanding shares and can support the stock price.

* Strong Financial Position:

* The company maintains a large Free Cash Flow and holds a significant amount of cash on its balance sheet, providing flexibility to invest in growth, pursue acquisitions, or navigate economic uncertainties.

Trade ideas

ZM Long📈 ZM Stock Update (Zoom Video)

ZM is forming a classic Cup and Handle pattern — a bullish continuation setup that often signals a potential breakout ahead.

✅ The cup reflects a strong recovery and accumulation phase.

✅ The handle is forming with light consolidation, indicating reduced selling pressure.

🚀 A breakout above the handle’s resistance could confirm the move, with a measured target around $87.50$

Keep an eye on volume during the breakout — increasing volume adds strong confirmation.

ZMTechnical Analysis (Daily Chart – ZM, NASDAQ):

The stock is currently trading around $83.98, slightly below the local resistance at $85.12.

A symmetrical triangle pattern has formed (A–B–C–D), and the recent breakout to the upside suggests potential bullish continuation.

The buy zone is marked near $80, with a protective stop-loss at $69. This provides a favorable risk–reward setup.

The first major resistance and profit-taking zone is highlighted at $110.35 – $110.83, which is the initial target for this bullish move.

Multiple moving averages (short- and mid-term) are turning upward and crossing above the long-term black moving average, confirming a shift toward bullish momentum.

As long as the price holds above $77–80 support, the bullish scenario remains valid. A breakdown below $69 would invalidate this setup and signal renewed downside risk.

Outlook:

Short-term: Potential retest of the breakout area (~$80) before resuming the upward move.

Medium-term: Bullish bias toward the $110 zone.

Risk management is crucial—tighten stops if the stock struggles around $85–90.

📌 Summary:

Current trend shows a bullish breakout from consolidation. Entry is favorable around $80, stop-loss at $69, with the first target zone between $110.35 and $110.83.

The Pitchfork Precision: ZM's Multi-Tool Reversal Signal

The Pitchfork Precision: ZM’s Multi-Tool Reversal Signal

## The Seller's Validation (Points 1→3)

The power dynamic shifted decisively when Point 2 sellers crushed through Point 1 buyers , driving price to a new low at Point 3. This wasn’t a minor victory – it was proof of seller supremacy in the local structure. Now at Point 4, price has returned to these proven sellers’ domain, setting the stage for potential rejection.

## Andrews Pitchfork: The Mathematical Edge

Applying Andrews Pitchfork to Points 1, 2, and 3 reveals something remarkable: Point 4 sits precisely at the upper median line (edge) . This isn’t coincidence – it’s mathematical precision. According to pitchfork theory, price at the edge faces two probable paths:

- Return to the median line (bearish)

- Push to the opposing outer median line (extremely bearish)

Both scenarios favor the downside, making this a high-probability short setup.

## The Six-Signal Convergence

1. Momentum Divergence

- Price: Higher high at Point 4

- RSI/MFI: Lower highs = Classic bearish divergence

This disconnect between price and momentum reveals waning buyer strength.

2. Oscillator Extremes

- RSI: Overbought territory

- MFI: Overbought territory

Both momentum indicators scream overextension.

3. Micro Confluence

The bearish candle at Point 4 provides immediate confirmation – a micro-level signal validating the macro setup.

4. OBV Double Resistance

- OBV Downtrend Line: Acting as dynamic resistance

- OBV Bollinger Band Upper: Additional resistance layer

When volume indicators align with price resistance, the signal strengthens exponentially.

5. VWAP 2nd Deviation Touch

Point 4 precisely tags the 2nd standard deviation of VWAP (anchored from Point 1). This represents a 95% statistical extreme – price rarely sustains above this level.

6. Structural Resistance

Return to proven seller territory established at Point 2.

## The Probability Stack

What makes this setup exceptional isn’t any single indicator – it’s the convergence of six independent signals :

- Structure says sellers dominate

- Pitchfork says we're at mathematical resistance

- Momentum says buyers are exhausted

- Volume says selling pressure building

- Statistics say we’re at an extreme

- Price action confirms with bearish candle

When this many unrelated indicators align, probability shifts dramatically in favor of the trade.

## The OBV Tell

The OBV downtrend line deserves special attention. While price has been attempting recovery, volume has been declining – a classic bear market signature. The fact that OBV also sits at its Bollinger Band upper resistance creates a volume ceiling that price will struggle to overcome.

## Execution Framework

Entry: Bearish confirmation at Point 4

Stop: Above Point 2 (seller validation level)

Target 1: Pitchfork median line

Target 2: Pitchfork lower median line

Target 3: Point 3 support / opposing outer median

Risk Management: The confluence of signals allows for tight stops while targeting multiple profit zones based on pitchfork projections.

## Market Context

ZM’s post-pandemic normalization continues to play out technically. The repeated failures at resistance levels, combined with declining volume patterns, suggest institutional distribution rather than accumulation. This technical setup aligns with the fundamental narrative of reduced video conferencing dependency.

---

Key Insight: When Andrews Pitchfork, VWAP deviation, momentum divergence, volume analysis, and price structure all point the same direction, you’re not gambling - you’re executing a high-probability, mathematically-backed trade setup.

Zoom's Next Move: Breakout or Fakeout? Watching $83.95 With MACDZoom Communications (ZM) — Technical Setup

Price recently broke above key resistance at $83.95 and is now retesting that level, which could act as new support. If this level holds, I'm anticipating a bullish continuation toward the next resistance at $92.72 — representing a potential 10.4% upside.

📈 Golden Cross: The 50 EMA has just crossed above the 200 EMA, signaling a longer-term trend reversal to the upside.

🔍 Indicators:

MACD: Bullish crossover above the signal line and rising above the 0 line with green histogram bars — showing early momentum.

RSI: Hovering around 63 — approaching overbought but still in a healthy uptrend zone.

Stochastic: In overbought territory, but no bearish cross yet. Watching closely.

📉 Volume: Breakout occurred on moderate volume. A pickup in volume would help confirm a continuation.

🔻 If $83.95 fails to hold as support, I’m watching the next key level down at $78.23 (~6.8% downside) as a possible retracement zone.

🎯 Plan: Watching for price action and volume around $83.95. A strong bounce here could trigger a long entry targeting the $92 zone, with a stop below the support.

Let me know your thoughts in the comments — do you think support will hold, or is this a false breakout?

$ZM (Zoom Video Communications) - Long SetupTrading Idea: NASDAQ:ZM (Zoom Video Communications) - Long Setup

🎯 Idea: LONG

⏰ Timeframe: Daily

📊 Pattern: Bullish Breakout + Momentum Continuation

Fundamental Context:

Fundamental Score: 5/9 (Neutral).

Growth: Strong Net Income Growth YoY.

Balance Sheet: Excellent (Debt Score: 10/10). Zero debt.

Valuation: Fairly Valued on P/E and P/B; Overvalued on P/S.

Technical Setup:

Trend (D1): Bullish ✅

Entry: $85.90 (Break above consolidation & Bollinger Band squeeze).

Stop Loss (SL): $77.50 (Below key support and the 20-period SMA).

Take Profit (TP): $102.65 (Previous high target + Measured Move).

Momentum: Strong RSI (67) and positive MACD support the move.

Risk Management:

Risk/Reward (R:R): 1:2.0

Position size based on the risk between entry and stop.

Summary: A technical breakout play on a company with a clean balance sheet (no debt) and strong earnings growth, targeting a move to new highs.

⚠️ Disclaimer: Not Financial Advice

This analysis is for educational and informational purposes only. It is NOT a recommendation to buy or sell any security.

Conduct your own research (DYOR) before making any investment decisions.

You are solely responsible for your own trades and investments.

Past performance is never indicative of future results.

Trading involves significant risk of loss and is not suitable for all investors.

#TradingView #ZM #Long #Breakout #TechnicalAnalysis #GrowthStocks #VideoCommunication #TradingSetup

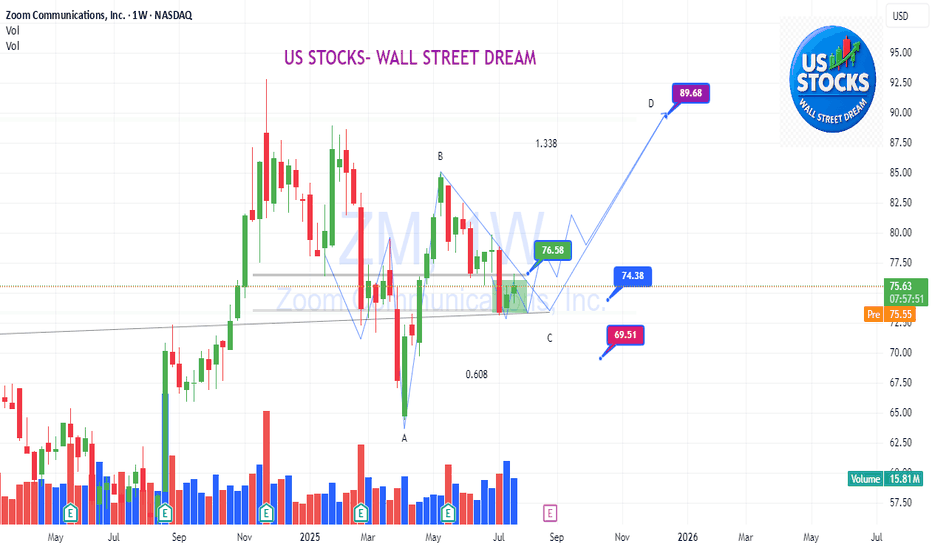

Zoom moving higher

Zoom as been performing bad as of the last few years. As you can see from the second image, ZM double bottom at all time lows, found support, moved higher and formed a small bull flag and has broken above the Bull flag and is now moving higher. ZM is still in the early stages of what could be a large move up, this is a great time to get in early.

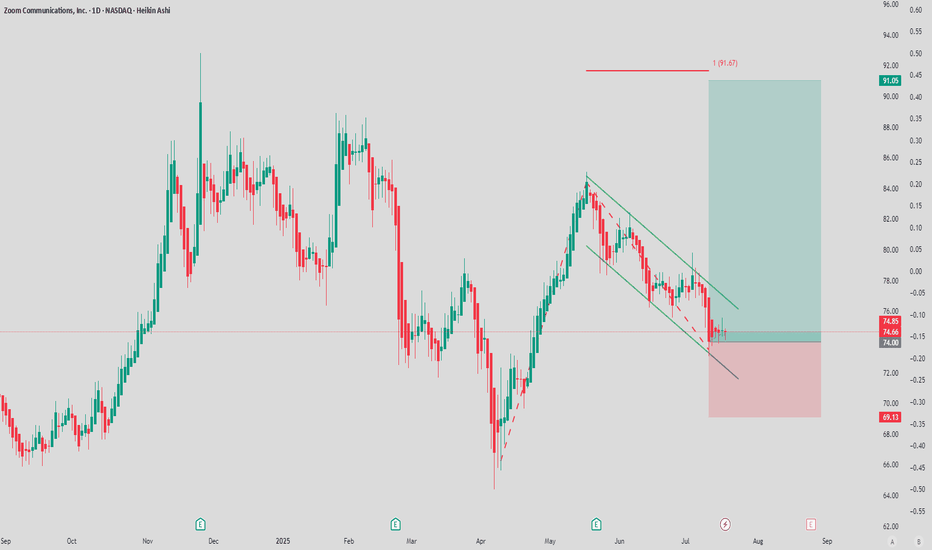

$ZM | Zoom Communications – Flagging Between Earnings📊 NASDAQ:ZM | Zoom Communications – Flagging Between Earnings

Co-incidence or pattern? NASDAQ:ZM has been flagging from the previous earnings report all the way into this upcoming ER.

🔎 Chart Notes

Price has been respecting a descending channel with multiple CHoCH (Change of Character) signals.

Current level sits near $72.19, testing equilibrium.

Upside target: $82.38 if momentum shifts bullish and breaks premium supply zones.

Downside risk: $64.43 strong low if the channel continues to hold and ER disappoints.

💡 Volume profile suggests accumulation phases inside the channel, but the breakout direction will likely align with ER catalyst.

⚖️ Trading Plan

Watch for confirmation outside the flag.

Bullish break → eyes on $78–$82 supply.

Bearish rejection → potential sweep toward $64.

ER could be the catalyst that resolves months of coiling price action.

3 Ways to Trade Zoom for a Fast 20% Gain3 Ways to Trade Zoom for a Fast 20% Gain

First Impressions 🤔

Zoom’s daily chart paints a story of prolonged consolidation. After its post-pandemic plunge, the stock has been grinding sideways between roughly $60 and $90 for years.

As an investor, you might feel a bit of relief, no more wild swings, but also some itchiness: “Is this the calm before the storm?” 🌪️

At first glance, the sideways drift signals indecision, but the tightening range since May hints that something’s about to give.

Pattern Recognition

Short-Term Falling Channel Break

Since May 2025, price carved a small downward sloping channel, from about $82 down to $71.

This mini-channel is textbook: two parallel trendlines touching a series of lower highs and lower lows.

A channel like this often resolves with a quick breakout, and indeed, we see price poking up through the upper trendline. Breaks upward suggest buyers are stepping in , momentum often carries price at least the channel’s height (~$11) above the breakout which is the resistance zone!! This is what I love of Chart Patterns.

Key Support & Resistance

Support at $59–$60, Major floor since mid-2021, a solid zone where institutions historically piled in.

Resistance at $89–$90: The ceiling of the wide trading rectangle, broken this would open a clear path to $124.

Rectangle (Accumulation)

Zoom has been trading inside a large rectangle ($59–$90) for more than two years. This is an accumulation pattern: sellers above $90 have repeatedly stopped rallies, but buyers at $60 stand firm. A break above $90 could trigger a 30–40% rally , while a drop below $60 would signal fresh bearish momentum (not our base case, given fundamentals).

Analyst & Fundamental Context

Most analysts sit around a $95–$105 consensus target, slightly above the current price but also the resistance level. Their medium-term thesis rests on steady subscription growth , upsells of Zoom Phone and Zoom Events , and margin improvement as travel rebounds strengthen corporate spending.

On one hand, the chart’s sideways chop aligns with analysts’ view: slow but steady progress. On the other, the short-term channel break suggests a tactical bump toward $89 may come quicker than fundamentals alone justify.

Investment Ideas, with clear entry and exit levels

Here are three ways to play the setup, tailored to your style and patience:

1. Channel Break Entry (Tactical, FOMO-Friendly)

Entry : On a clean breakout above $72–$73 (the small channel’s upper line)

Target : $89 (20% upside)

Stop Loss: $71 (mid-channel) → Risk ~4%

Rationale : Quick move, tight risk; $74–$75 is now a micro-support where institutions could jump in. 📈

2. Patient Pullback (Medium-Term, Low Stress)

Entry : Near $60 support if the stock dips back

Target : $85–$90 (40% upside)

Stop Loss : $55–$57 → Risk 5–8%

Rationale : Buying at a rock-bottom area maximizes reward/risk; ideal if you need some time to have cash available.

3. Confirmation Above Rectangle (Momentum Play)

Entry : On a sustainable close above $90–$91

Target : $120+ (30%+ upside)

Stop Loss : $84–$86 (inside box) → Risk 5–8%

Rationale : Classic breakout with guaranteed momentum, the next logical zone is the top of the preceding local downtrend or analyst targets which is much tighter. Anyway, a break would happen if there si something that shows that ZM has transformed and that would be the reason to see analyst moving the price to $120 instead of the current $95 to $100.

🚫 Bearish scenarios don’t align with Zoom’s growing enterprise revenue and profitability. This accumulation pattern screams “base for the next leg up,” not a continuation lower.

________________________________________

Key Takeaway:

Zoom is coiled in a multi-year base and just broke a short-term falling channel. Whether you’re chasing a quick run to $89, patiently waiting at $60, or needing full confirmation above $90, the reward/risk looks skewed in your favor.

Happy trading! 😊

💬 Does this setup align with your view on NASDAQ:ZM ?

🚀 Hit the rocket if this helped you spot the opportunity and follow for more easy, educational trade ideas!

Zoom $78 Calls: Huge Earnings Upside Potential!

## 🚀 Zoom Earnings Play: Cheap Calls Before the Bell (Aug 21, 2025) 🚀

### 🏦 Earnings Outlook

* 📊 **Revenue Growth:** +2.9% TTM – stagnant post-COVID growth

* ⚖️ **Margins:** Gross 75.9%, Profit 22.3% → Strong efficiency

* 📈 **Historical Beat Rate:** 100% over last 8 quarters

* 🖥️ **Sector:** Tech / SaaS – AI and cloud trends impact growth sentiment

* 🧭 **Analyst Consensus:** Buy, with upside potential

---

### 🔎 Options Flow Insight

* 📉 **Put Activity:** OTM puts (\$66-\$67) highlight cautious institutional sentiment

* ⚖️ **Put/Call Skew:** Slightly bearish, hedging activity present

* 💡 **Opportunity:** Take advantage of earnings momentum with \$78 calls

---

### 📉 Technical Setup

* 📊 **Current Price:** \$72.16 → below 50D (\$75.09) & 200D (\$78.61) MA

* 🔑 **Support:** \$71.00

* 🔑 **Resistance:** \$75–\$78

* 💥 Volume: Slightly below average, indicates muted momentum

---

### 🎯 Trade Setup (Earnings Play)

* 🟢 **Direction:** CALL (Bullish Bias)

* 🎯 **Strike:** \$78.00

* 💵 **Entry Price:** \$0.98

* 📅 **Expiry:** Aug 22, 2025

* 📊 **Size:** 1 contract

* 🕒 **Entry Timing:** Pre-earnings close

📌 **Profit Target:** \$2.94 (200% 🚀)

📌 **Stop Loss:** \$0.49 (50% of premium)

📌 **Exit Rule:** Within 2 hours post-earnings to avoid theta decay

---

🔥 Hashtags for Reach 🔥

\#ZoomEarnings #ZMOptions #EarningsPlay #TechStocks #OptionsTrading #TradingSetup #DayTrading #SwingTrading #WallStreet

Possible Long ZMThe price is at a turning point:

In the short term, the key is to see if it can break the 61.8% Fibonacci resistance (USD 72.29) and confirm with volume.

Downside risk remains as long as it does not break above the descending trendline.

Aggressive traders could look for entries on a confirmed breakout, while conservative profiles would wait for a close above USD 74.7 to reduce risk.

ZM: Prepare not to miss this Long opportunityZM: Prepare not to miss this Long opportunity

Starting in early December 2022, I tested several strong support areas located near 60.50 - 64.50 that pushed the price higher compared to the past.

At the bottom of the structure, the ZM confirmed several times that buyers are well positioned near that area.

It is possible that Zoom will test this strong support area again before rising further.

I prefer to wait for the price test of 60.50 - 64.50- before taking advantage of this long opportunity.

Target areas: 84, 99 and 116

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

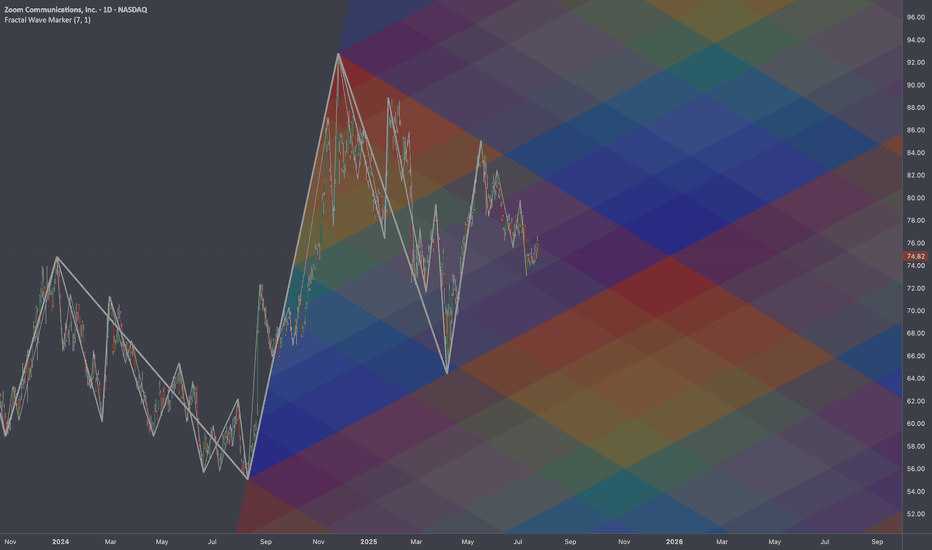

ZM: Cross-Cycle Knot in Triangle🏛️ Research Notes

Original

Alternative Interconnection Experimenting with cross-cycle interconnection so coordinates of the 3 point of fib channels are placed on structure's latest connecting point while abiding its original angles.

When elements are extended we have a projection that looks like this:

Other aspects of the shape are being tested

Fibonacci Channels based on angle of the trend fragments the cycle creating probabilistic levels. (The steeper the angle of the FC the more it relates to time axis.)

$ZM: Fibonacci Gradient 🏛️ Research Notes

Original Structure

Substitute for projection (TV's drawing tool)

I was thinking if using same 3 coordinates of cycle to cover future 2-polar expansions after breakout. That's why descending fibs would start with coldest (at breakout zone it would be relevant) and vise versa.

Same but with added counter-direction to produce gradient effect of decay.

$ZM Multi-Timeframe AI Buy Signal | VolanX Protocol Activation📈 NASDAQ:ZM Multi-Timeframe AI Buy Signal | VolanX Protocol Activation

Zoom ( NASDAQ:ZM ) has triggered a triple BUY signal on the VolanX QuanT v3.0 across 1H, 1D, and 1W timeframes with 95% confidence each. The system highlights rare asymmetric opportunity setups:

🔹 Entry: $74.92

🔹 Stop: $73.65

🔹 Targets:

1H: $246.08 (+222.3%)

1D: $258.10 (+238.1%)

1W: $257.52 (+237.3%)

🔹 Risk/Reward Ratios: 50.06–719.41

🔹 Position Size: 2.8% per signal

🔹 Signal Reliability: All-time high

🧠 DSS Forecast:

15-day target: $75.90 (+1.7%)

30-day target: $78.68 (+5.5%)

⚠️ Risk Layer:

Annualized Volatility: 30.8%

VaR (99%): -4.62%

ZM 1D Expected Hold Time: ~81.8 days

🔍 Weekly Chart Context:

After a multi-year drawdown, ZM is stabilizing at long-term accumulation zones with upside airpocket gaps above $125, then $200+. A breakout above $85 could trigger gamma squeeze potential.

🔐 VolanX Protocol Notes:

This trade aligns with our institutional-grade DSS framework. All executions tracked under WaverVanir Alpha Layer for macro-quant fusion trades. Confidence-weighted execution is key. Precision matters.

#VolanX #WaverVanir #ZM #AITrading #SmartMoney #NeuralSignals #OptionsFlow #MacroConvergence #TradingSignals #MarketStructure #DSS

I am starting to think TradingView is Haunted. Anyways... ZM🎯 BOATS:ZM Gap Fill Setup – Targeting $84.53 by Week of 7/22

Zoom (ZM) may be setting up for a bullish gap-fill retracement off strong confluence support near $73.81. After a full fib retrace to the 0.5–0.618 zone, the current candle structure shows potential for a reversal toward the unfilled gap at $84.53.

🧠 VolanX Thesis:

✅ 0.5 Fib from March–May rally holding firm

✅ Gap from early June remains unfilled

✅ Bullish reversal candle forming at support

⚠️ Volume drying up on downside = potential exhaustion

🎯 Fib Levels to Watch:

🔹 0.618 = $77.27 (resistance → reclaim zone)

🔹 Gap Fill = $84.53

🔹 1.236 / 1.618 = $89.68 / $92.60 (momentum extension zones)

📈 Trade Idea (Illustrative):

plaintext

Copy

Edit

Entry: $74.50

Stop: $71.90

Target 1: $84.53 (gap fill)

Target 2: $89.60 (Fibonacci extension)

Gap fills often occur within 3–7 trading days when supported by fib reversal structure + buyer absorption.

Not Fin Advice! TY

📌 #ZM #Zoom #VolanXProtocol #GapFill #SmartMoneyConcepts #FibRetracement #DailySetup #WaverVanir #BreakoutTrading #TradingView