Trade ideas

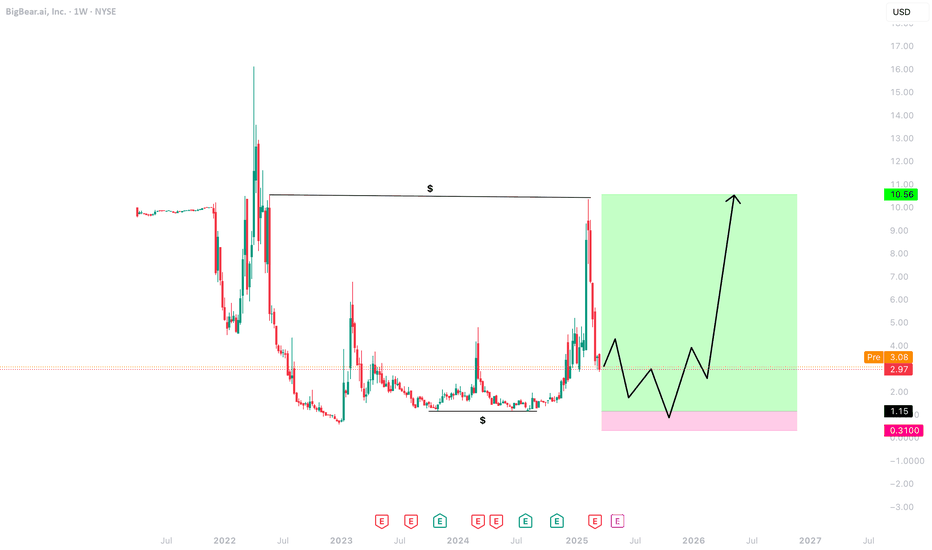

$BBAI upside targets $8-10?NYSE:BBAI looks set to run higher here. As you can see, we've broken out of the bottoming formation and have now retested support.

As long as we're able to stay above support, we should see a large move higher up to the two resistance levels.

Let's see how high we end up going. Think it's very likely that we end up going to the top of the range.

OptionsMastery: A potential swing on BBAI!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Edges of the GapPrice is testing the edges of a gap area and the 50 EMA and a key level the 3.54 price area. If we get an upward breakout price can possibly go to the 4.12 area, a bearish breakout can take price to the 10 EMA 2.85 price area; oscillators are strong CCI very overbought and Earnings this week. Please be very careful have a great day.

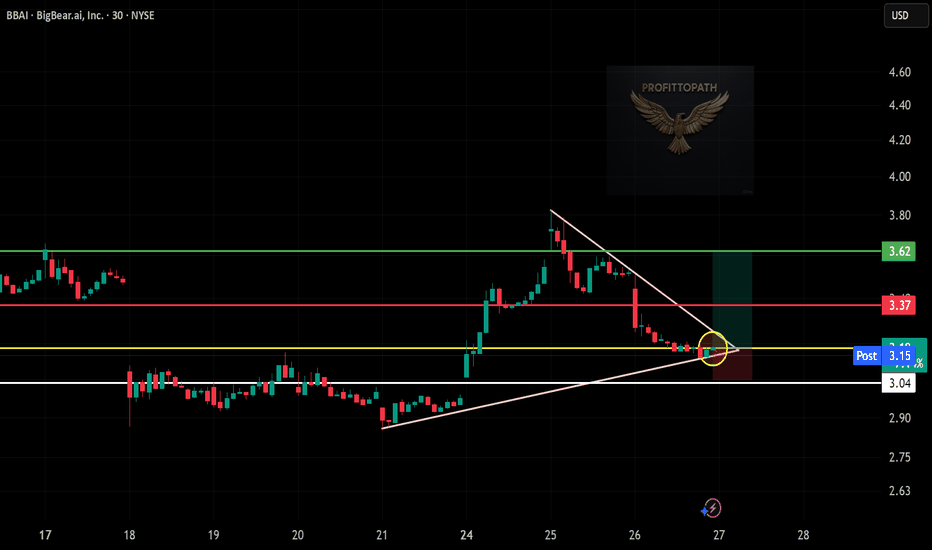

Bullish Breakout Setup BBAI!📊 B – Trendline Support + Wedge Squeeze 🚀

BBAI is forming a bullish wedge pattern with price respecting ascending support at $3.04. Momentum is compressing near the apex, hinting at a potential breakout. A clean breakout above $3.15 may trigger a strong upside move.

✅ Trade Plan (Long Position)

• Entry: Breakout confirmation above $3.15

• Stop-Loss: Below $3.04 (structure + rising trendline support)

🎯 Take Profit Targets:

• TP1: $3.37 (local resistance / breakout zone)

• TP2: $3.62 (major upside level)

• TP3: $3.80+ (extended potential zone)

📈 Risk-Reward Breakdown

• Risk: $3.15 - $3.04 = $0.11

• Reward to TP1: $0.22 → ~1:2

• Reward to TP2: $0.47 → ~1:4.3

• Reward to TP3: $0.65 → ~1:5.9

💡 High reward potential for a small, well-defined risk.

🔍 Technical Breakdown

✅ Falling Wedge Pattern: Classic bullish reversal setup

✅ Support Holding: Price bouncing from rising trendline

✅ Momentum Shift: Compression near apex = breakout potential

✅ Volume Watch: Awaiting surge on breakout for confirmation

🧠 Strategy & Risk Management

• Wait for a 30-min candle close above $3.15

• Move SL to breakeven after hitting TP1 at $3.37

• Book partial profits and trail stop toward TP2 & TP3

• Manage position with discipline, not emotions

📚 Trader Insight:

This pattern reflects accumulation at support following a short-term pullback. When price coils with higher lows and squeezes into a breakout zone, it creates a prime opportunity for momentum traders who understand structure and timing.

⚠️ Risk Checklist

❌ Weak volume = false breakout risk

❌ Loss of $3.04 = setup invalid

✅ Be patient. Let confirmation lead the entry.

🎯 Final Thoughts

Clean structure, solid trendline support, and a textbook bullish wedge. If it confirms, this trade could offer multiple reward levels with minimal risk. 💥

🔗 #BBAI #ProfittoPath #TradingView #BreakoutSetup #BullishChart #MomentumStocks #SmartTrading #StockEducation #TechnicalAnalysis 💰📊

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

A ton of good news in Earning Call - Bull Rally is comingPrice has been down before Earning.

Earning will definitely bring good news, price will rise to $7.50.

However, there will be people who will still short it to $5.50.

Hold on tight, because next week there will be many analysts

upgrading BBAI from Hold to Buy,

Price will go crazy, because big contracts from the government

with Big Bear for border protection are on the desk.

Don't blame me for not telling you to Buy & Hold it!

Disclaimer

BBAI – 30-Min Long Trade Setup!📌

🔹 Asset: BigBear.ai, Inc. (BBAI)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Falling Wedge Breakout Long Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $6.07 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $5.28 (Break of Support & Trendline)

🎯 Take Profit Targets

📌 TP1: $6.92 (First Resistance Level)

📌 TP2: $8.00 (Final Target – Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📈 Risk (SL Distance): $6.07 - $5.28 = $0.79 risk per share

📈 Reward to TP1: $6.92 - $6.07 = $0.85 (1.08 R/R)

📈 Reward to TP2: $8.00 - $6.07 = $1.93 (2.44 R/R)

🔍 Technical Analysis & Strategy

📌 Falling Wedge Breakout Setup: BBAI has been consolidating in a downward-sloping wedge, with a breakout expected at $6.07.

📌 Trendline & Support Bounce: The price is attempting to break out of the wedge, indicating buyer accumulation.

📌 Breakout Confirmation: A strong bullish candle above $6.07 with increasing volume would confirm momentum.

📌 Momentum Shift Expected: If price holds above $6.07, a rally toward $6.92 (TP1) and $8.00 (TP2) is likely.

📊 Key Support & Resistance Levels

🟢 $5.28 – Strong Support / Stop-Loss Level

🟡 $6.07 – Entry / Breakout Level

🔴 $6.92 – First Resistance / TP1

🟢 $8.00 – Final Target / TP2

🚀 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $6.07 before entering.

📈 Trailing Stop Strategy: Move SL to entry ($6.07) after TP1 ($6.92) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $6.92, let the rest run to $8.00.

✔ Adjust Stop-Loss to Break-even ($6.07) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If price fails to hold above $6.07 and breaks back down, it could indicate a false breakout—exit early.

❌ Wait for a strong candle close above $6.07 for confirmation before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Holding above $6.07 could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.08 to TP1, 1:2.44 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #BBAI #BigBearAI #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath #DayTrading #MomentumStocks #SwingTrading #TradingView #LongTrade #TradeSmart #RiskManagement #StockBreakout #Investing #StockAlerts #ChartAnalysis 🚀📈

$BBAI back on track to break the $10.00 resistanceAfter the crash in sync with PTLR yesterday due to Trump's Defense spending cuts. If you don't cut losses, and still hold tight, even DCA to load more share below $8.00, especially the $6.80 - $7.00 area. Congratulations! Profits are in sight.

Most of the popular indicator is

Option trading ideas:

Buy Call $10, exp 3/21

Buy Call $11 and $12, exp 4/17

Most popular indicators are supporting this bullish momentum. BUT!!! Watch out for profit-taking pressure near the upcoming ER 3/6. BBAI's valuation is already too high compared to its projected earnings, so be careful!

Disclaimer

$NYSE:BBAI 72% Upside - Breaking double bottom resistanceLooks like NYSE:BBAI is finally breaching the double bottom resistance line.

Volume is respectable, relatively higher.

Squeeze is starting to expand

MACD and Williams %R are also flowing in the right direction.

Entry point - anything after the stock closes above $4.81

Initial Price target is ~$8

72% Upside

$BBAI next target $11 - $12 in the last week of Feb 2025Please see the sample chart I shared. The bullish flag pattern appears once again. So if BBAI can hold the support level of $8.00 - $8.50, it is likely to rise to $11 - $12 in the next push. The most ideal entry point is the price zone of $7.80 - $8.00. However, I am not sure that this can happen when the profit-taking pressure is too strong at the $9.xx area. My confidence level is only 66% for the bullish case. And 33% possibility of a decline to the price zone of $7.00 - $7.50. So, Stop Loss must be setup or hold tight up to you. Good luck Bigbear brothers!

Can AI Weather the Storm of Volatility?BigBear.ai has captured the market's attention with its dramatic stock performance, navigating through a sea of volatility with recent gains fueled by significant contract wins and positive AI sector developments. The company's journey reflects a broader narrative in the tech industry: the high stakes of betting on AI innovation. With its stock soaring over 378% in the last year, BigBear.ai demonstrates the potential for rapid growth in an era where AI is increasingly central to strategic sectors like defense, security, and space exploration.

However, the narrative isn't without its twists. Analyst warnings about cyclical business patterns and valuation concerns introduce a layer of complexity to the investment thesis. BigBear.ai's ability to secure pivotal contracts with the U.S. Department of Defense showcases its technological prowess, yet the challenge lies in converting this into sustainable profitability. This scenario invites investors to ponder the delicate balance between innovation, market sentiment, and financial stability in the AI landscape.

The strategic acquisition of Pangiam and partnerships like the one with Virgin Orbit illustrate BigBear.ai's ambition to not only ride the wave of AI hype but also to steer it into new territories. These moves are about expanding market presence and redefining what AI can achieve in practical, real-world applications. As BigBear.ai continues to evolve, it challenges us to consider how far AI can go in reshaping industries and whether the market can keep pace with such rapid technological advancements. This saga of BigBear.ai is a microcosm of the broader AI investment landscape, urging us to look beyond immediate gains to the long-term vision and viability of AI-driven companies.

Trade Setup Breakdown for BBAI (30-Min Chart)!📊

🔹 Stock: BBAI (NYSE)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Symmetrical Triangle Breakout

🚀 Trade Plan:

✅ Entry Zone: $8.70 - $8.80 (Breakout Confirmation)

✅ Stop-Loss (SL): $7.93 (Below Key Support)

🎯 Take Profit Targets:

📌 TP1: $9.57 (First Resistance)

📌 TP2: $10.65 (Extended Target)

📊 Risk-Reward Ratio Calculation:

📉 Risk (Stop-Loss Distance):

$8.71 - $7.93 = $0.78

📈 Reward to TP1:

$9.57 - $8.71 = $0.86

💰 Risk-Reward Ratio to TP1: 1:1.10

📈 Reward to TP2:

$10.65 - $8.71 = $1.94

💰 Risk-Reward Ratio to TP2: 1:2.48

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: Price holding above $8.80 with strong volume.

📌 Pattern Formation: Symmetrical Triangle Breakout, signaling potential continuation.

📊 Key Support & Resistance Levels:

🟢 $7.93 (Support / SL Level)

🟢 $8.71 (Breakout Zone)

🟢 $9.57 (First Profit Target / Resistance)

🟢 $10.65 (Final Target for Momentum Extension)

🚀 Momentum Shift Expected:

If the price holds above $8.80, an upside rally towards $9.57 and $10.65 is likely.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure strong buying volume above $8.80 before entering.

📈 Trailing Stop Strategy: If the price reaches TP1 ($9.57), move SL to $8.80 to protect profits.

💰 Partial Profit Booking Strategy:

✔ Take 50% at $9.57, let the rest run to $10.65.

✔ Adjust Stop-Loss to Break-even ($8.80) after TP1 is hit.

⚠️ Fake Breakout Risk:

If the price fails to hold above $8.70, be cautious and avoid entering early.

🚀 Final Thoughts:

✔ Bullish Breakout Setup – If price sustains above $8.80, a strong move is expected.

✔ Momentum Shift Possible – Volume increase will confirm the trend.

✔ Favorable Risk-Reward Ratio – 1:1.10 to TP1, 1:2.48 to TP2.

💡 Stick to the trade plan, manage risk, and trade smart! 🚀🏆

🔗 #StockMarket #BBAI #TradingSetup #TechnicalAnalysis #BreakoutTrade #DayTrading #MarketTrends #ProfittoPath