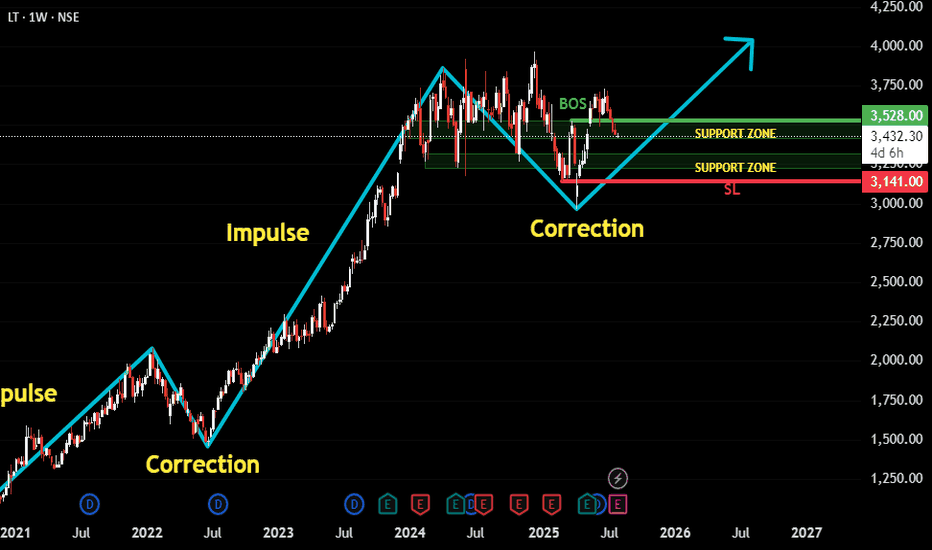

LT Weekly Breakout In this stock we clearly see the Channel pattern is formed and Ready for Breakout , Wait for candle Close in 1D with good volume , then we can see very good move up to 15% nearly .

As now nifty is given Breakout from 1D Channel pattern and in Market Breadth 1D has given breakout and in weekly marke

Larsen & Toubro Limited Shs Sponsored Global Depositary Receipt Repr 1 Sh Reg-S

No trades

Key facts today

Larsen & Toubro (LT) reported FY 2025 revenue of Rs 255,734.45 Crore, up from Rs 221,112.91 Crore in FY 2024, with a net profit of Rs 17,687.39 Crore.

Larsen & Toubro plans to expand into real estate, semiconductors, green energy, and data centers from FY26-31, while enhancing its core engineering, procurement, and construction operations.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.340 EUR

1.64 B EUR

27.93 B EUR

About Larsen & Toubro Limited

Sector

Industry

CEO

Sekharipuram Narayan Subrahmanyan

Website

Headquarters

Mumbai

Founded

2007

ISIN

USY5217N1183

FIGI

BBG000M3N5Q3

Larsen & Toubro Ltd. is an investment holding company, which engages in technology, engineering, construction, manufacturing, and financial activities. It operates through the following business segments: Infrastructure, Hydrocarbon, Power, Heavy Engineering, Defence Engineering, IT and Technology Services, Financial Services, Development Projects, and Others. The Infrastructure segment is composed of engineering and construction of buildings and factories, transportation infrastructure, heavy civil infrastructure, power transmission and distribution and water and renewable energy projects. The Hydrocarbon segment provides engineering procurement, construction and commissioning solutions for the global oil and gas Industry from front-end design through detailed engineering, modular fabrication, procurement, project management, construction, installation and commissioning. The Power segment includes turnkey solutions for coal-based and gas-based thermal power plants including power generation equipment with associated systems and balance-of-plant packages. The Heavy Engineering segment manufactures and distributes custom designed, engineered critical equipment and systems to core sector industries like fertiliser, refinery, petrochemical, chemical, oil and gas, thermal and nuclear power, aerospace and defence. The Defence Engineering segment refers to the design, development, and serial production and through life-support of equipment, systems and platforms for Defence and Aerospace sectors; and design, construction, and repair of defense vessels. The IT and Technology Services segment represents global IT services, digital solutions, and engineering and research and development. The Financial Services segment deals with the provision of retail finance, wholesale finance, and investment management services. The Development Projects segment refers to the roads and transmission projects, the Hyderabad Metro Rail project, and power development projects. The Others segment encompasses realty, smart world, and communication projects, marketing and servicing of construction and mining machinery and parts thereof and manufacture, sale of rubber processing machinery and digital platforms. The company was founded by Henning Holck-Larsen and Soren Kristian Toubro in 1938 and is headquartered in Mumbai, India.

Related stocks

L&T1️⃣ Multi-Timeframe (MTF) Analysis

TF Trend Proximal Distal Avg

HTF (Yearly/Half-Yearly/Qtrly) Strong UP 2585 2244 2415

MTF (Monthly/Weekly/Daily) Strong UP 3255 3080 3168

ITF (240/180/60 min) Strong UP 3430 3405 3418

🔹 This alignment means all major timeframes are in demand zones and trending UP.

LT Following Classic Impulse-Correction Rhythm.This is a trend-following setup on LT (Larsen & Toubro) where we’ve observed a clear repeating pattern of Impulse → Correction → Impulse. The recent price action suggests that the latest correction has matured, and the structure now hints at a potential next impulse wave beginning.

Here’s the thoug

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

95KTL39

Kudgi Transmission Limited 9.5% 25-APR-2039Yield to maturity

—

Maturity date

Apr 25, 2039

658LTMRH26

L&T Metro Rail (Hyderabad) Ltd. 6.58% 30-APR-2026Yield to maturity

—

Maturity date

Apr 30, 2026

95KTL34

Kudgi Transmission Limited 9.5% 25-APR-2034Yield to maturity

—

Maturity date

Apr 25, 2034

914KTL29

Kudgi Transmission Limited 9.14% 25-APR-2029Yield to maturity

—

Maturity date

Apr 25, 2029

95KTL33

Kudgi Transmission Limited 9.5% 25-APR-2033Yield to maturity

—

Maturity date

Apr 25, 2033

95KTL36

Kudgi Transmission Limited 9.5% 25-APR-2036Yield to maturity

—

Maturity date

Apr 25, 2036

88KTL27

Kudgi Transmission Limited 8.8% 25-APR-2027Yield to maturity

—

Maturity date

Apr 25, 2027

88KTL26

Kudgi Transmission Limited 8.8% 25-APR-2026Yield to maturity

—

Maturity date

Apr 25, 2026

914KTL30

Kudgi Transmission Limited 9.14% 25-APR-2030Yield to maturity

—

Maturity date

Apr 25, 2030

668LTMRH27

L&T Metro Rail (Hyderabad) Ltd. 6.68% 30-APR-2027Yield to maturity

—

Maturity date

Apr 30, 2027

914KTL31

Kudgi Transmission Limited 9.14% 25-APR-2031Yield to maturity

—

Maturity date

Apr 25, 2031

See all LTO bonds

Curated watchlists where LTO is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks