Marvell Technology Stock: AI Growth Outlook vs Weak Price ActionMarvell Technology (NASDAQ: NASDAQ:MRVL ) posted stronger-than-expected Q3 earnings, delivering $0.76 EPS on $2.08B revenue, slightly beating analyst expectations. Despite the beat, shares slipped over 5% after-hours, largely due to market concern around short-term margins and spending tied to the company’s latest acquisition.

Management delivered upbeat guidance for Q4, forecasting $0.79 EPS at the midpoint with $2.20B revenue, both above Wall Street estimates. The company expects full-year revenue to grow above 40%, driven primarily by accelerating demand across AI datacenter infrastructure.

A major highlight is Marvell’s acquisition of Celestial AI, a photonics-focused startup positioned in the next wave of high-speed, low-power interconnects. The acquisition deepens Marvell’s footprint in AI compute and networking, a segment CEO Matt Murphy says is entering a “multi-year expansion cycle.” The company also noted that AI datacenter revenue growth for next year is now expected to exceed earlier projections, reinforcing Marvell’s positioning among key semiconductor names benefiting from hyperscale AI investment.

Still, investors appear cautious as broader semiconductor valuations stay elevated. While fundamentals point to strong growth into 2026, short-term stock weakness reflects concerns about execution risk, integration expenses, and near-term volatility across the AI chip supply chain.

TECHNICALS

MRVL remains in a broad uptrend, respecting a rising trendline from mid-2025. Price recently rejected resistance near $97, pulling back toward the $73 support zone, which aligns with the trendline. If this zone continues to hold, bulls maintain control with upside targets $127.

A breakdown below the trendline exposes $61 and $47 support levels. RSI remains neutral-bullish, supporting continuation if volume returns.

Trade ideas

Top winners in the stock marketRecently, the shares of Marvell Technology Inc (#Marvel), Dell Technologies Inc (#Dell), Uber Technologies Inc (#Uber), Coinbase Global Inc (#Coinbase) , and Palantir Technologies Inc (#Palantir) have risen amid increasing demand for products essential to artificial intelligence — chips, servers, and software.

Key triggers:

1. Strong industry news: companies producing chips and servers reported results above expectations and signaled further growth.

2. Uber’s launch of robotaxi services.

3. A surge in crypto activity at the end of November.

Five Growth Drivers :

#Marvel (+21.2%) — a surge following earnings and the acquisition of Celestial AI (developer of optical solutions for AI) for ~$3.25 billion, paired with an optimistic outlook for next year.

#Dell (+12.9%) — raised its guidance thanks to soaring demand for AI servers and a record number of confirmed orders.

#Uber (+8.5%) — shares gained after the launch of robotaxi services in Dallas in partnership with Avride, signaling a new stage of autonomous ride scaling.

#Coinbase (+7.1%) — a rebound in late November driven by increased crypto volatility and trading volumes (Coinbase profits from trading activity).

#Palantir (+7.2%) — supported by a strong Q4 outlook and continued demand for its AI platform; enthusiasm in the AI sector fueled additional momentum.

Strong fundamental drivers for #Marvel / #Dell (AI infrastructure) and #Palantir (contracts + commercial AI) create solid ground for the trend to continue. #Uber gains fresh momentum from robotaxi expansion, and #Coinbase stands to benefit further if elevated crypto activity and higher trading volumes persist.

FreshForex analysts see continued growth potential for #Marvel, #Dell, #Uber, #Coinbase, and #Palantir , supported by rising demand for AI solutions and digital infrastructure.

As long as no concrete industry issues arise (such as delays or cancellations of major AI-hardware orders, or chip supply disruptions), these stocks retain strong upward prospects.

Quant signals V3 Bearish Opportunity: MRVL Post-Earnings MRVL QuantSignals V3 – Earnings Trade Alert (2025-12-02)

Trade Direction: BUY PUTS (Bearish)

Confidence: 60% | Conviction: Medium

Recommended Strike: $87.00

Entry Range: $2.92

Target 1: $5.70 | Target 2: $8.55

Stop Loss: $1.43

Expiry: 2025-12-05 (3 days)

Position Size: 2% of portfolio (moderate conviction)

⚠️ Risk & Conflict Notes

Katy AI shows post-earnings bearish momentum from $92.72 → ~$86-88, despite composite guidance suggesting BUY CALLS.

High implied volatility (IV 169.7%) → rapid time decay; monitor closely.

Light volume & overbought stochastics (86.9) → market conviction weak, pullback likely.

Options flow: Extremely bearish, PCR 4.28, indicating heavy institutional put buying.

Moderate Risk Warning: Consider scaling in rather than full position due to medium confidence.

💡 Trade Insight

Combines Katy AI bearish timing with extreme options flow for an asymmetric opportunity.

Post-earnings, price movement is more predictable, reducing event risk.

Tight stop loss mitigates risk from IV crush.

MRVL - RSI Back Above 50, Eyes Fibonacci Targets at 99 and 112MRVL - CURRENT PRICE : 86.00 - 88.00

MRVL is showing early signs of bullish continuation after finding support near the 50-day EMA and rebounding with positive momentum. The price structure remains healthy as it trades above the EMA 50, suggesting the medium-term trend is still intact.

Key Technical Highlights :

1) Price Above EMA 50

The stock price is holding above the EMA 50, showing that the uptrend remains valid and buyers are still in control.

2) RSI Above 50 and Not Overbought

RSI has crossed back above the 50 level, confirming improving momentum while staying below overbought territory, leaving more room for upside.

3) MACD Structure

Although the MACD line is still below the signal line, both are positioned above the zero level, indicating the overall market tone remains positive with potential for a new bullish crossover.

Based on Fibonacci extension, potential upside targets are at :

1st Target: USD 99.00 (0.618 level)

2nd Target: USD 112.00 (1.000 level)

ENTRY PRICE : 86.00 - 89.00

FIRST TARGET : 99.00

SECOND TARGET : 112.00

SUPPORT : 80.50

MRVL: watching for bottom formation in coming monthsPrice continues to act in line with the trend structure outlined in the October update, starting a pullback after reaching the mid-term resistance zone and now reacting from the first level of support.

While a final push lower toward the 50-day MA remains possible in the near term, I’ll be watching for bottoming signs and the formation of a new base over the coming weeks and months.

Chart:

Previously:

• On downside potential (Aug 11):

Chart:

www.tradingview.com

• On support (Aug 25):

Chart:

www.tradingview.com

• On resistance zone (Oct 2):

Chart:

www.tradingview.com

• On pullback potential (Oct 10):

Chart:

See weekly review:

MRVL | Another Semi Run Coming | LONGMarvell Technology, Inc. engages in the design, development, and sale of integrated circuits. Its products include data processing units, security solutions, automotive, coherent DSP, DCI optical modules, ethernet controllers, ethernet PHYs, ethernet switches, linear driver, PAM DSP, transimpedance amplifiers, fibre channel, HDD, SSD controller, storage accelerators, ASIC, and Marvell government solutions. It operates through the following geographical segments: United States, Singapore, Israel, India, China, and Others. The company was founded by Wei Li Dai and Pantas Sutardja in 1995 and is headquartered in Wilmington, DE.

$MRVL pullback below $75 sets up new long to $100+MRVL is consolidating in an expanding triangle (bullish) chart formation however price action looks a bit extended here.

I think it's likely that we pullback from here into one of the support levels below, and then that will setup a fresh long up to the upper resistance levels on the chart.

Let's see how the idea plays out over the coming weeks.

Marvell - Marvelous comebackNASDAQ:MRVL price action has seen steady uptrend returning after closing above the US$80.00 psychological level. we expect MRVL to have a good run up 109 and 128 over the longer-term period. Momentum is rising across all short, mid, and long-term indicator. Prices to queue is at 79.75 and 75.00.

MRVLTechnical Overview

Current Price: Around $67.35

Major Uptrend Line: A long-term rising trendline from 2019 remains intact, supporting the broader bullish structure.

Key Support & Buy Zones

Primary Buy Zone: $63.34 – $61.44

This zone aligns with historical price congestion and the major uptrend support.

Secondary Buy Zone: $50.86 – $50.73

Deeper support from previous accumulation areas.

Stop Loss: A daily close below $46 would invalidate the bullish setup and signal potential trend reversal.

Resistance & Target Levels

Target 1: $92

Strong historical resistance; a break above this level could open the door for further upside.

Target 2: $127

The previous all-time high area and next major upside objective.

Trend & Momentum

Trend: Despite recent volatility, the long-term structure shows higher lows, indicating the primary trend is still up.

Momentum: The stock recently bounced from the buy zone near $63, suggesting buyers are active. Sustaining above $63 is key for the next bullish leg.

Trading Strategy Idea

Aggressive Entry: Accumulate near $63–61 with a stop below $46.

Conservative Entry: Wait for a clear break and daily close above $70 to confirm renewed momentum toward $92.

Summary:

Marvell Technology remains in a long-term uptrend with critical support at $63–61. Holding above this zone favors a move toward $92 and possibly $127, while a close below $46 would negate the bullish outlook.

Marvel. Short for now. Long Later.Marvel was a short idea for me at like $77. Now I am looking for lower and potential longs. I will only long in the box if we get there. Its the only sensible yearly and fib level that would justify a long term entry for me. I will wait and if we get there I am in. I create these charts way in advance so I have a plan when we get there. This is a very long term mindset.

I always get messages from mods to explain my trades. I often cant. It comes from almost 10 years of looking at charts. I know trend, levels and my proprietary fib pulls. My record shows for itself. I don't believe anyone should ever copy trade me. All my trades are long term holds and heat is expected in the near term.

MRVL Hidden Trend: Navigating the Silent DeclineMRVL Bear Flag Pattern

The MRVL chart indicates a bear flag formation, suggesting a continuation of the downtrend from its all-time high of $127.48 in January 2025. After hitting a low of $47.09 in April 2025, the stock consolidated between $47-$85. The recent breach below the sideways channel reflects the bear flag's flagpole, echoing the preceding downward trend.

Technical Indicators

The stock trades below its 50 DMA ($74.28) and 200 DMA ($83.13), reinforcing bearish sentiment. The daily RSI at 42 further underscores weakening momentum.

Trading Strategy

• Entry: $72-$70

• 1st Target : 100 DMA at $66.84, aligning with the 0.236 Fibonacci extension level at $66.30

• Next Targets : $63.28, $59.24, and $54.56

• Stop Loss : $80

Potential Downside

Should bearishness persist, the stock may revisit its 52-week low of $47.09, marking a significant support level.

MRVL Earnings Play--Don’t Miss Out

# 🚀 MRVL Earnings Play (8/28 AMC) 🚀

💎 **Moderate Bullish | 75% Conviction** 💎

🎯 **Trade Setup**

📊 Ticker: \ NASDAQ:MRVL

🔀 Direction: CALL 📈

🎯 Strike: 80.00

📅 Expiry: 2025-08-29

💵 Entry: 2.23 (ASK)

📦 Size: 1 contract (risk 💸 \$223)

🎯 Profit Target: 6.69 (200%)

🛑 Stop: 1.12 (-50%)

⏰ Timing: Pre-earnings close (8/28 AMC)

⚡️ **Why Bullish?**

* 🚀 AI/data-center sector tailwinds

* 📈 Heavy OTM call OI at \$78–85 (dealer hedging fuel)

* 🔥 Pre-earnings drift (+2.49% today)

* 📊 IV elevated but not extreme → room for upside

✅ **Execution Rule**: In before close, out within 2h post-earnings or at stop/target.

---

### 📌 Suggested TradingView Tags

\#MRVL #Marvell #EarningsPlay #OptionsTrading #CallOptions #WeeklyOptions #BullishSetup #MomentumTrading #TradeIdeas #StockMarket 🚀📊

MRVL $80 Call: Balanced Risk, High-Reward LEAP Trade!

## 💎 MRVL \$80 LEAP – Long-Term Semiconductor Bullish Play! (Sep 2026 Expiry) 💎

### 🔑 Market Summary

* 📊 **Momentum:** Weekly RSI shows short-term bullish recovery; monthly chart signals caution → mixed to moderately bullish

* ⚖️ **Options Flow:** Favorable volatility environment supports LEAP strategy

* 🏦 **Institutional Sentiment:** Mixed; some accumulation noted, but bearish long-term trend remains a caution

* 🌐 **Sector Context:** Semiconductor market recovery potential, but watch for broader bearish drivers

---

### 📈 Trade Setup

* 🟢 **Direction:** LONG CALL

* 🎯 **Strike:** \$80.00

* 💵 **Entry Price:** \~\$15.50

* 📅 **Expiry:** Sep 18, 2026 (\~13 months)

* 📊 **Size:** 1 contract

* ⏰ **Entry Timing:** Market open

* 📈 **Confidence Level:** 75%

---

### 💥 Risk & Reward

* 🏆 **Profit Target:** \$31.00 (100%+ potential upside; aggressive target \~\$46.00)

* 🛑 **Stop Loss:** \$10.50 (30–40% of entry price)

* ⚡ **Key Risks:** Bearish monthly momentum, semiconductor sector headwinds, potential bull trap

* 🔄 **Recommendation:** Enter cautiously, monitor weekly momentum for continuation signals

---

### 🔥 Hashtags for Viral Sharing

\#MRVLLEAP #MRVLOptions #Semiconductors #LongTermCall #LEAPs #BullishPlay #TradingViewAlerts #WallStreet

MRVL Massive 15-Years Symmetrical Breakout Targets AheadMarvell Technology (MRVL) has just completed a monumental breakout from a 15-years symmetrical triangle, a rare and powerful long-term accumulation structure. This type of macro consolidation typically precedes a major directional expansion, and in this case, the breakout confirmed bullish continuation.

Currently, MRVL is forming a rising channel structure, with price bouncing cleanly from the lower boundary confirming demand and the continuation phase of the macro move.

The 1:1 projection from the symmetrical triangle gives us a clear target trajectory, with the final leg potentially extending to $229, aligning perfectly with the upper boundary of the rising channel.

In the short to mid-term, the ideal buyback opportunity rests near $67.50, should the market retest previous breakout support or the lower boundary of the channel once more. This zone offers asymmetric risk-to-reward potential for long-term investors and swing traders alike.

Key Targets

📈 $67.50 – Buyback Opportunity Zone

📈 $229 – Rising Channel Top / 1:1 Expansion Target

A breakout this large is no coincidence, it’s backed by years of price compression and institutional positioning. Now is the time to watch closely.

📩 Drop your view in the comments and share your stock requests for quick analysis.

Only stock assets will be accepted under this post.

MRVL | Ichimoku Breakout Setup with Fractal and MACDMarvell Technology (MRVL) just printed a clean bullish breakout setup across multiple technical systems. Here's the breakdown:

Why This Setup Matters

Ichimoku Cloud: Price has decisively cleared the cloud with bullish Tenkan-Kijun alignment. The Senkou Span A is rising, and the cloud ahead is thin — suggesting low resistance and potential acceleration.

Fractal Support: Multiple upward fractals formed near the $73–$74 support zone, validating the base before the breakout. Price broke the most recent fractal high, triggering a potential continuation.

MACD Momentum: A bullish crossover just occurred, with the histogram flipping positive — a classic momentum confirmation following consolidation.

Trade Parameters

Entry: $76.02

Stop: $70.41 (below the recent flat Kijun and cloud base)

Target: $89.93 (R1 pivot zone and psychological resistance)

Risk:Reward Ratio: 2.48

Projected Move: +18.35%

Additional Confluence

The Kumo breakout occurred alongside a flat Kijun and a narrowing cloud — a textbook edge-to-trend signal.

Price structure has formed higher lows since June.

Potential for strong institutional interest heading into earnings.

Risk Notes

Watch for rejection around $78.50 (prior resistance zone).

The upcoming cloud twist is narrow — if the Tenkan turns flat, a short-term pullback could occur before continuation.

Let me know in the comments if you're watching MRVL or trading this breakout. I’ll post an update if we get confirmation above $78 with volume.

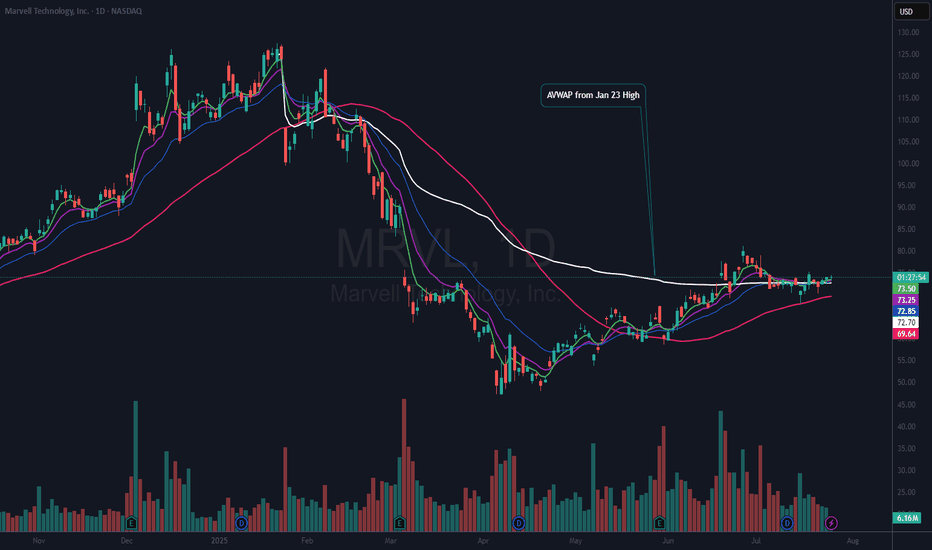

$MRVL Nice Risk Reward HereNASDAQ:MRVL is still basing so this could be quite an early trade. However, I did put on a ½ size position yesterday as it rose above the 21 EMA (blue). I like that it is over the AVWAP from the Jan 23rd all-time high (ATH). That means that by price and volume the majority of stockholders are at or near breakeven since that ATH. Which also tells me that there are not many sellers left and that the stock has a chance of entering a stage 2 uptrend.

My current stop will be based on a solid close below the 50 DMA (red). I want to add to my position “if” we can get a good follow-thru day above $75.26.

If you like this idea, please make it your own and follow “your” trading rules. Remember, it is your money at risk.

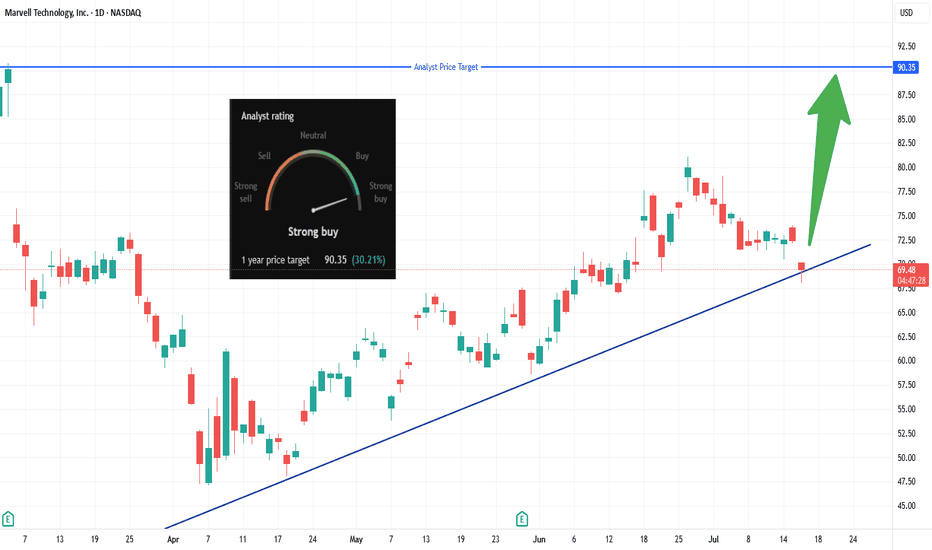

MRVL Long Breakout Setup, Eyes $90 Target!Looking to enter long on a clear breakout above $70.13 (today’s high).

• Entry: Above $70.13

• Stop-Loss: Below today’s low (~$68.50) to protect capital

• Target: $90.35 – per analyst consensus (~+30%)

✅ Why:

📈 Trendline bounce & momentum: Price holding strong above an ascending trendline from April suggests buyers are stepping in.

🏢 AI-chip catalyst: Marvell’s custom ASICs are gaining traction with Amazon, Microsoft, and Google—data-center demand is surging.

💰 Analyst confidence: Consensus is “Strong Buy” with average targets between $90–$94 (some as high as $133).

🧩 Market & Sector Tailwinds: AI chip stocks rallying; Marvell poised as lower-cost custom-chip alternative to Nvidia—and undervalued vs peers.

*** Be sure to follow us for more trade setups! ***