NRGD trade ideas

FNGU ChannelThis is the FNGU ETF at the 4 hour. It's a 3x leveraged ETF for mainly big tech. Well, FATMANG stocks make up over 40% of the NQ - possibly more by now.

This is one of my favorite ETFs to swing trade and scalp. The channels are aligned with the NQ channel that I published. FNGU found support at the middle of its channel... just like NQ. I am not sure how far this bounce will be.

NQ can make great gains, but the weak breadth makes rallies hard to sustain.

This is why I am waiting for the NQ to reach a major support. As you can see with FNGU, you can lose a lot in one day. If you wait until major support, you can serious bank the big bounces. The last big bounce increased the FNGU by over 60% within 2 weeks.

I am not a financial advisor. However, I would not recommend holding this ETF for long periods of time. 1-5 trading sessions at most. If you want to mitigate your risk, just scalp it.

NRGU - Big Oil Index X3 Leverage ETN All,

I traded this from $1.50 to $3.00. So if you don't trade ETFs or ETNs then I would not suggest buying these. These are EXTREMELY sensitive to the market. It will swing fast and hard and you have to have market stop losses. With news of re opening and it being O&G personally I can see it going up.

Economy - Oil and Gas: Reopening = bullish (fast)

Economy - Oil and Gas: Negative or bad oil news = bearish (fast)

A Great ETF to own Apple, Tesla and AmazonRecently, I notice Amazon is overvalue. Massive hiring during this season is normal because they layoff too much delivery force after Christmas. Amazon also ended their relationship with Fedex and start doing more in house delivery fleet. Amazon lost a $10 Billion dollars contract with DoD and try to take it away from Microsoft, I don't think Microsoft will be willing to go down that easy and handed a $10 billion dollar contact to Amazon. So, I believe the money that flood into Amazon stock will crash really soon. Overall, Amazon is a good company.

I am looking to buy into a dip on this ETF.

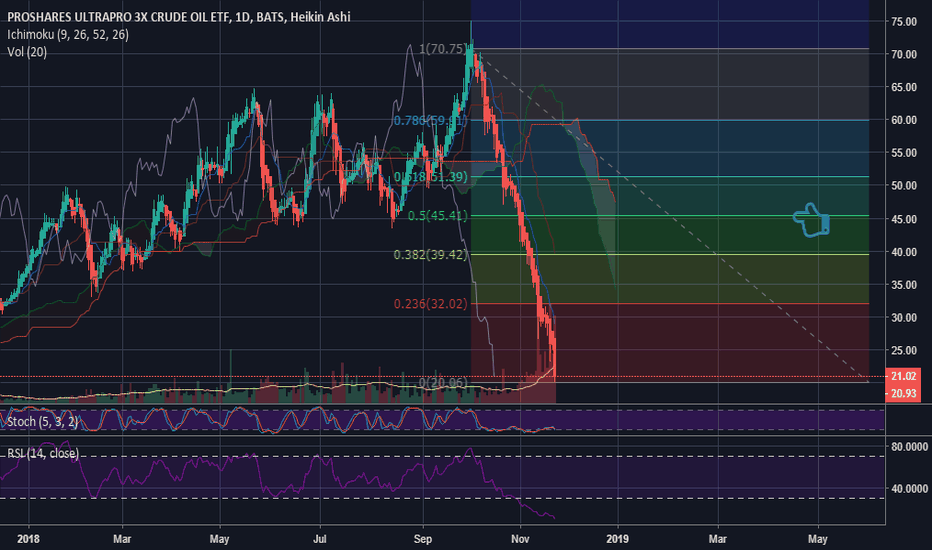

OILU LONG SET UP OILU ULTRAPRO 3X CRUDE OIL ETF

ENTRY 1 1.20

ENTRY 2 1.00

SL 0.13

TP.1 $8.00

TP.2 18.20

TP.3 28.20

TP.4 36.00

TP.5 48.00

act.webull.com

Your free stock is waiting for you! Join Robinhood and we'll both get a stock like Apple, Ford, or Facebook for free. Sign up with my link. join.robinhood.com

FANG+ Stocks: Buoyed in 2020 by Solid Earnings and Low RatesFor those who have followed my ideas over the past several months at-least, know that I remained bullish not only in the entire stock market on a broad basis, but US Tech was one of my top picks for continued growth which has deemed correct. I went on to say that 2020 will be a better year from peak to peak growth over the broader markets than 2019 which for now, is correct.

In-fact, even compared to "experts" across the lamestream media, I was one of the very few that actually believe 2020 would be a better year for the broader market than 2019 and not only has this deemed correct, but it will remain correct.

FNGU represents one of the best leveraged funds in the entire market and significantly better than the popular TQQQ, and even superior to the other popular 3x ETF TECL.

The companies the stock follows are diversified in a 10% weighted classification which is reset quarter by quarter. In 2020 I view all 10 of these boasting significant and continued growth.

- Tesla (My TP: 1000+)

- Nvidia (My TP: 350)

- Alibaba (My TP: 275-300; if Chinese GDP rebounds in Q2 then 400+)

- Bidu (My TP: 175-200; if Chinese GDP rebounds in Q2 then 250+)

- Twitter (My TP: 45)

- Facebook (My TP: 250-275)

- Apple (My TP: 375-400)

- Amazon (My TP: 2800-3200)

- Netflix (My TP: 425-450)

- Google (My TP: 1600+)

Of those listed above, Tesla, Nvidia, Apple and Amazon all have posted historic earnings; Netflix and Google posted decent earnings; Alibaba and Bidu continue to be remarkably undervalued given the current state of the virus, however, this will change by Q2 or Q3 of 2020; and Twitter and Facebook will likely rebound and show signs of strength as the year progresses.

In the long-run, Nvidia will be a dominant force in the AI market; BIDU and BABA will likely go on some sort of parabolic run to 3-4x their current stock value and Tesla will become a world dominant force in the EV and battery market. While normally 3:1 ETFs hold an inherent risk, given the diversification in this fund, one can capitalize on significant growth appreciation by investing into this ETF.

By the end of 2020 FNGU could and will likely triple in numerical value from current price (~100/share) buoyed ahead by decent earnings growth and likely the Fed lowering rates at-least twice in 2020.

An important technical note: once the SPX gets closer to 4000, investors should reduce their exposure to high risk ETFs as 4000 represents the peak of the longitudinal channel on EW theory. Investors should also reduce risk closer to late 2020 (October-ish) if the Democrats (particularly Bernie Sanders) have an elevated risk of winning the election based on polls.

- zSplit

Yep its Disgusting but Big Names will Surge Again in 2020Hypothesis: low interest rates; stable-ish economic data; accommodating Fed; Trump hyping Phase 2/3/4 trade deal and more QE will lead big tech names surging again in 2020 and part of 2021. With the trade 'war' at-least neutralized, this will help keep these big names more stable than what we saw in 2019 and lead the broader market higher.

FNGU includes: Amazon, Google, Tesla, Netflix, Apple, Baba, Nvidea, Facebook, Bidu and Twitter. Not in this fund, but semis (i.e. AMD) and Microsoft will have a good year once again.

From the above list, as painful as it is, I am bullish on all these names (fundamentally and technically via charts), except for Google and Twitter where I am neutral to slightly bullish. I expect Amazon, Facebook and Apple to surge 20-30%, with 30-40% gains on the top Chinese players like Baba and Bidu.

The dark-horse this year will be Facebook where I could see it perhaps gaining 30 or 40% in 2020. Amazon will also have a very good year.

If you haven't realized it by now, we are certainly in a big bubble, especially in technology (again, like in 2000) AND it will continue into 2020; if Trump wins again which is likely, it will continue into 2021 before coming to an end BIG time somewhere in, near or at 2022 (Elliot Wave theory).

- zSplit

OILU and general crude run-upI like this ETF for 4 Reasons

1) The coldest months of the year are about to begin and the demand for heating should be strong until at least February

2) At $21 it still has a lot of wiggle room compared to its 52 week high of $36

3) OPEC and Russia have announced production cuts

4) Positive trade deal news is positive Energy news.

I'm expecting some major action going into the new year, tell me what you think!

Short-term Trade: OILU / USOIL Extremely Favorable Risk-RewardI don’t believe OILU will stay at the $14 level for very long and conservatively speaking I’d say a 50% swing higher is likely.

Depending on your strategy, you could cap your loss at 2% or whatever your risk tolerance is and then go in full on a breakout. Personally, I’d buy half or a third now and hold. If prices fall, potentially up to 7% or so, I’d accumulate more and once the breakout happens go in full.

FNGD: Hidden 3x Inverse No One Knows AboutThis is one of my favourite inverse leveraged funds that I prefer over the popular SQQQ . Why? This stock includes many trade-prone / recession-prone stocks in 10% equal weight comparisons: Netflix, Baba, Bidu, Tesla, Apple, Facebook, Twitter, Google, Amazon and Nivdea.

With the trade war and a recession and antitrust going around, these big giants will be hit hard over the next several months - more than traditional tech players.

The only other sector that may-be hit harder will be the semi's. However, I see semis with a rollover faster, but with the giants rolling over for longer.

This is not a well-known leveraged fund but is one of the best and is incredibly cheap right now.

My major target is at-least 50.00 by Q1 2020.

- zSplit

USOIL 2 Week ForecastThe selling won’t be finished until we reach $50-$47 USOIL.

A selloff to $51 USOIL coincides with about $32 OILD

If we go below that, towards 50, towards 47, we could see $35+ OILD.

For those of you who happen to see this, I’m legitimately curious, how many of you saw this selloff in USOIL coming at $66??

What I’m doing:

Buy: anything below $28 really. 26 is good, 24 might not come but I’m gonna try for it. Sell or hold at $32, buy back/buy more on pullback to 27$, sell full @ $35+.

This is not investment advice, do your own due diligence.

OIL LONG IDEAI've been watching OIL for a while now. I think the time is now to get on board. Keeping it simple. The cycle timing is right. The MACD is above zero, the PSAR is positive and the long term trend line is broken. Putin meets with OPEC today I believe. I am buying OILU instead of GUSH because the markets keep selling off, which could drag GUSH down despite improving oil prices.