Apple’s $241 Bounce or Breakdown: Is This the Next Big Move?Apple’s stock price is moving down toward $241. This is an important zone. If Apple can stay above $241, it could jump up to $284. But if it falls below $241, the price might drop even more; maybe to $225 or even $200.

What do you think will happen next? Would you buy Apple if it drops to $241, or would you wait for a bigger move?

If you’re not sure what to do or have questions, ask me! Sometimes asking the right question gives you the answer you need to trade smarter. What’s your question about Apple right now?

Mindbloome Exchange

Trade Smarter Live Better

Trade ideas

Hello trader, for tomorrow, AAPL: 254.04 10/10/25One thing we should keep in mind is the stock's location. We could have a quick first bullish entry above 254.00/252.00 up to 258.00. It depends on where it is in the pre-market. If it is near the 258.00 pre-market zone, it could encounter rejection. We only enter bullish above 260.00/262.00.

Our bearish entry should be below 250.00/248.00. Stops should be above the VWAP if it is bearish, or below it if it is bullish.

AAPL LongThe broader market structure shows that AAPL recently transitioned from a bullish leg to a clear short-term bearish phase after a strong Break of Structure (BOS) at 259.24, which confirmed a shift in control from buyers to sellers. Price failed to make a new high after the last rally, and the subsequent drop formed a decisive lower low, reinforcing bearish intent. The Change of Character (CHoCH) sits lower at 251.04, and if price were to breach that level, it would signal deeper downside continuation and confirm that higher-timeframe buyers have lost momentum.

The supply zones between 254.5–258.5 show layered resistance, where price previously dropped sharply, suggesting aggressive selling pressure from institutional participants. These zones remain strong as price has not yet retested them after the initial rejection. The demand area around 252–251 is the most immediate zone of interest, as it was the origin of the last bullish impulse that temporarily interrupted the down move—buyers stepped in with some strength there, though the overall context still favors sellers. A deeper secondary demand around 250–249 aligns with the CHoCH, representing the last structural defense before a full breakdown.

Currently, price action within the marked region shows a corrective pullback after a strong impulsive decline. Price is hovering just above the 252 demand zone, and momentum is beginning to slow—suggesting short-term exhaustion from sellers. The most probable scenario is a small sweep into the 251.5–252 range to tap liquidity before a relief rally back toward 255–256, where the first supply zone awaits. If that rally occurs and fails to reclaim above 256.5, sellers are likely to re-enter and drive price back toward 251.

The trade bias for now is short-term bullish (counter-trend), expecting a corrective move upward, but within a larger bearish structure. The key invalidation for any bullish scenario would be a clean break below 250.90, which would confirm continuation to the downside.

Momentum currently favors sellers overall, but short-term candles are showing smaller bodies and lower wicks—signs of absorption from buyers around demand.

Apple: Rally Has a Bit More Room to RunApple’s upward momentum has clearly slowed at the $260.10 resistance level, though the stock has already come very close to this mark. As a result, we’re allowing for a bit more room for green wave to run in the near term, with the possibility that AAPL could slightly surpass the $260.10 level. However, a sustained breakout above this resistance is likely only after a pullback in wave . At the same time, there remains a 34% probability that the next peak will mark the end (or has already marked the end) of the corrective upward move in the beige wave alt.b . In this case, we would expect significant sell-offs, with a new corrective low for blue wave alt.(IV) forming between the two support levels at $212.94 and $168.

How Shipping, Freight, and Logistics Power Global Market Trading🌍 Introduction: The Invisible Engine Behind Global Trade

Every product that moves across borders — from a smartphone in New York to coffee beans in Paris — owes its journey to the vast and intricate world of shipping, freight, and logistics. These three elements form the invisible yet powerful engine that keeps the global market trading ecosystem running.

Behind every trade agreement, export figure, and import bill, lies a network of ships, trucks, planes, and warehouses. Without this system, the flow of goods would come to a standstill, crippling international economies. As globalization deepens, logistics isn’t just about moving products — it’s about synchronizing global supply chains, optimizing cost efficiency, and maintaining the balance of trade across continents.

In today’s dynamic market, logistics has evolved into a strategic weapon. Countries with superior shipping infrastructure and efficient freight management command a strong position in global trade. Let’s explore how these sectors intertwine to shape the global market’s future.

⚙️ 1. Understanding the Triad: Shipping, Freight, and Logistics

Before diving deeper, it’s essential to distinguish between these three interconnected terms:

Shipping: Refers to the actual physical transportation of goods from one location to another — typically over sea or air.

Freight: Represents the cargo itself or the cost of transporting it. Freight can move via air, land, or sea.

Logistics: A broader term encompassing the entire process — from procurement and storage to shipment, tracking, and delivery.

Together, they form a supply chain ecosystem that connects producers, suppliers, distributors, and consumers across continents.

🚢 2. The Backbone of Global Trade: Maritime Shipping

The shipping industry handles over 80% of global trade by volume. Massive container ships, each capable of carrying over 20,000 TEUs (Twenty-foot Equivalent Units), connect major trade hubs like Shanghai, Rotterdam, Dubai, and Los Angeles.

Why Shipping Dominates:

Cost Efficiency: Sea transport remains the most economical for bulk goods.

Scalability: Ships can carry massive loads, making them ideal for global trade.

Connectivity: Ports link multiple continents through trade routes like the Suez Canal, Panama Canal, and the Strait of Malacca.

Key Global Shipping Hubs:

Singapore: Known for its ultra-modern port infrastructure and strategic location.

China (Shanghai & Ningbo): The heart of global manufacturing and export.

Rotterdam (Netherlands): Europe’s largest port and logistics gateway.

Dubai (Jebel Ali): The Middle East’s most significant trade link.

Challenges in Modern Shipping:

Port Congestion: Especially during global disruptions like COVID-19.

Rising Fuel Costs: Impacting freight rates worldwide.

Environmental Regulations: The shift toward green shipping (LNG, electric, hydrogen-powered vessels).

✈️ 3. Freight Networks: The Arteries of the Global Market

Freight is the lifeblood of commerce. It moves raw materials to factories, finished products to retailers, and food to consumers. The freight sector spans multiple modes:

a) Sea Freight

Still the most widely used due to lower costs. However, it’s slower, making it less suitable for time-sensitive cargo.

b) Air Freight

Used for high-value, urgent, or perishable goods — electronics, pharmaceuticals, and luxury items.

Example: A smartphone assembled in China reaches the U.S. in under 48 hours via air freight.

c) Land Freight (Trucking & Rail)

Essential for last-mile connectivity and regional trade.

Rail Freight: Gaining importance through transcontinental networks like China-Europe Railway Express.

Truck Freight: Vital for connecting ports, airports, and inland destinations.

Freight Pricing Dynamics

Freight rates are influenced by:

Fuel prices (bunker fuel, aviation fuel)

Port handling charges

Supply-demand imbalances

Geopolitical tensions (e.g., Red Sea or Black Sea blockages)

Global crises (pandemics, wars, etc.)

For instance, during the 2021–22 period, container freight rates between Asia and the U.S. soared by over 300%, revealing how fragile and demand-sensitive freight economics are.

🏗️ 4. Logistics: The Brain of the Operation

If shipping is the muscle and freight is the blood, logistics is the brain coordinating every movement.

Modern logistics involves:

Supply chain planning

Inventory management

Warehousing and distribution

Real-time tracking systems

Customs and documentation handling

The Digital Transformation of Logistics

The logistics industry is undergoing a technological revolution:

IoT sensors track container temperature and location.

AI algorithms optimize routes and predict disruptions.

Blockchain ensures transparency and authenticity in transactions.

Drones and robotics accelerate warehouse operations.

Major Global Logistics Players

DHL (Germany) – Known for integrated logistics and global air freight.

Maersk Logistics (Denmark) – Evolved from a shipping company to an end-to-end logistics leader.

FedEx and UPS (USA) – Masters of express logistics.

DB Schenker, Kuehne + Nagel – Giants in multimodal transport and supply chain management.

📈 5. How Logistics Shapes Global Market Trading

The performance of logistics directly impacts global market trading trends, particularly in:

a) Trade Competitiveness

Efficient logistics reduce costs and delivery time, giving countries an edge.

For example, Vietnam and Bangladesh have become major textile exporters due to improving port and logistics infrastructure.

b) Stock Market Sensitivity

Shipping and logistics stocks often act as economic barometers.

When freight demand rises, it signals stronger global trade — often boosting related equities like Maersk, Cosco, or FedEx.

c) Commodity Flow and Pricing

Delays or disruptions in shipping (like the 2021 Suez Canal blockage) can skyrocket oil and commodity prices, shaking markets worldwide.

d) Currency and Inflation Effects

Rising freight costs translate into import inflation, affecting consumer prices and currency values.

🌐 6. The Emerging Trends Transforming the Industry

The next decade of shipping and logistics will be defined by technology, sustainability, and geopolitical realignment.

a) Green Shipping Revolution

To meet carbon-neutral goals, companies are investing in:

Biofuel and hydrogen vessels

Electric trucks and hybrid cargo ships

Port electrification and automation

b) Digital Freight Platforms

Startups and major logistics firms are digitizing operations. Platforms like Flexport, Freightos, and Maersk Spot allow real-time booking, rate comparison, and shipment tracking.

c) Regionalization of Supply Chains

The pandemic taught companies not to depend on single regions (like China). “China +1” strategies are leading to diversification into India, Vietnam, and Mexico.

d) Autonomous Transport

Self-driving trucks are being tested for long-haul logistics.

AI-powered ships are navigating test routes autonomously.

e) Cold Chain Expansion

As pharmaceutical and perishable goods trading grows, demand for temperature-controlled logistics (cold chain) is booming globally.

💥 7. Challenges Facing the Global Shipping and Logistics Sector

Despite its importance, the industry faces intense challenges:

Geopolitical Tensions: Trade wars and conflicts disrupt established routes (e.g., Russia-Ukraine, Red Sea tensions).

Fuel and Energy Volatility: Shipping heavily depends on bunker fuel; any spike raises freight costs globally.

Environmental Regulations: IMO 2020 sulfur caps and net-zero emission goals are increasing operational costs.

Port Infrastructure Gaps: Developing nations face bottlenecks due to outdated facilities.

Digital Divide: Smaller logistics players struggle to adopt advanced tech systems.

Labor Shortages: Shortage of truck drivers, dock workers, and technical staff affects global efficiency.

🧭 8. Future Outlook: The Next Wave of Global Logistics

By 2030, the logistics landscape will look very different:

Smart Ports: Automated cranes, AI scheduling, and blockchain customs.

Hyperloop & Drone Delivery: Faster, cleaner alternatives for intercity and last-mile logistics.

Decentralized Trade Routes: Africa and South America emerging as new freight corridors.

Resilient Supply Chains: Diversification and AI forecasting will reduce dependency on any single geography.

The integration of AI and blockchain will bring transparency and traceability to global supply chains, reducing fraud and inefficiencies. Meanwhile, green logistics will become a major investment theme, attracting ESG-focused capital.

💡 9. Investment & Trading Opportunities in the Sector

For traders and investors, shipping and logistics offer exciting opportunities:

Publicly Listed Giants: Maersk, Hapag-Lloyd, Evergreen Marine, FedEx, and UPS often move in sync with trade growth cycles.

Port Operators: DP World, Adani Ports, and Hutchison are key beneficiaries of rising trade volumes.

Logistics Tech Startups: AI-driven freight management firms are disrupting traditional models.

ETF Exposure: Funds like the Global X Shipping ETF allow investors to ride global logistics growth.

As e-commerce and manufacturing expand globally, logistics stocks could become the backbone of long-term investment portfolios.

🏁 Conclusion: The Flow That Never Stops

Global market trading is like a living organism — and shipping, freight, and logistics are its vital organs. Every container that moves, every parcel delivered, and every port expansion project fuels the heartbeat of the world economy.

As the 21st century progresses, this industry is not just about transportation anymore. It’s about technology, sustainability, and strategy. Those who master logistics control the rhythm of world trade.

From AI-managed ports to zero-emission ships, the next decade promises a revolution in how goods move across the planet — faster, cleaner, and smarter. In the grand theater of global markets, logistics remains the silent powerhouse that keeps the world connected and commerce alive.

AAPL at the Tipping Point

🧩 Overall Technical Analysis

Timeframe: Daily (1D)

Current Situation: Price is consolidating in a narrow sideways range between $252 and $259, after a strong bullish rally — a typical bullish continuation pattern.

50-day SMA: Around $233.6, acting as a strong dynamic support.

Medium-term Trend: Uptrend (higher highs and higher lows since mid-September).

Pattern: Rectangular consolidation after a sharp move up — potential bullish flag formation.

⚡ Short-Term Outlook (1–2 Weeks)

The price is compressing between $252–$259, like a spring ready to break.

Bullish Scenario (Higher Probability)

Confirmation: Break and close above $260

Target 1: $268

Target 2: $275

Stop Loss: Daily close below $252

Bearish Scenario (Lower Probability)

Confirmation: Break and close below $252

Target 1: $243

Target 2: Around the 50-day SMA (~$233–$234)

Stop Loss: Daily close back above $258

📈 Short-term Summary:

As long as price stays above $252, the short-term bias remains bullish.

🏆 Long-Term Outlook (1–3 Months)

Primary Trend: Still bullish, supported by the 50-day SMA.

Market Structure: Higher highs and higher lows — classic uptrend continuation.

Potential next leg up if the price breaks convincingly above $260.

Long-Term Targets:

Target 1: $280 (psychological resistance & previous high zone)

Target 2: $295 (Fibonacci 1.272 extension from recent swing)

Long-Term Stop Loss:

Below $233 (loss of the 50-day SMA and break of bullish structure)

💡 Key Insights:

Watch for increasing volume and RSI momentum for confirmation of a breakout.

Keep an eye on upcoming earnings and product news — Apple’s sentiment can shift quickly.

A high-volume breakout above $260 would provide a stronger confirmation for continuation.

AAPL Holding Firm Below Resistance. Watch $259 Breakout. Oct. 6Market Overview (15-Min Chart)

AAPL spent Friday consolidating after an early rebound from the $253.20 support zone. Price action has since formed a rising wedge structure — typically a signal of waning momentum — as the stock approaches the $259–$260 resistance zone.

The MACD histogram shows weakening bullish momentum, with histogram bars fading toward zero, suggesting buyers may be losing strength. However, the Stoch RSI is curling upward from the lower band, which can hint at a short-term continuation push if price holds the trendline above $256.50.

The structure implies equilibrium — bulls maintaining control above the intraday trendline, but bears waiting near resistance. The battle line for the next directional move is clearly set around $259.

GEX Confirmation (1H Chart Insight)

On the 1-hour Gamma Exposure (GEX) chart, the highest positive NET GEX / Call Resistance aligns right at $259–$260, confirming this as the critical level institutions are defending. If AAPL manages to break and sustain above this zone, gamma pressure could unwind, potentially sending price toward $263–$265, where the next Call Wall sits.

On the downside, Put Walls and support clusters are visible at $252–$247.50, marking the range where dealers are likely to absorb downside momentum. The IVR (19.1) and IVX avg (26.2) indicate compressed volatility, suggesting that once a breakout occurs, it could expand sharply.

Trade Scenarios for the Week (Oct. 6–11)

Bullish Case:

If AAPL reclaims $259 with strength, momentum could carry it toward $263.75 (measured move target) or $265, aligning with upper gamma resistance.

* Entry: Above 259 confirmation

* Target 1: 263.75

* Target 2: 265

* Stop-Loss: Below 256

Bearish Case:

If AAPL fails to hold $256 and breaks below the rising trendline, expect sellers to retest $253.20 and possibly $250, where the 2nd Call Wall transitions into a neutral gamma zone.

* Entry: Below 256

* Target 1: 253.2

* Target 2: 250

* Stop-Loss: Above 259

Option Insights

The current GEX landscape indicates a tight battle between gamma compression and breakout potential. With only 2.8% Call participation, there’s low bullish overextension — which can fuel a strong move once breakout volume enters.

For options traders, calls near 260–265 could be positioned for breakout confirmation, while puts near 255–250 can capture a wedge breakdown. The low IVR supports directional debit strategies early in the week.

My Thoughts

AAPL looks balanced but loaded — buyers defending the short-term uptrend, while major resistance aligns perfectly with gamma ceilings at $259–$260. This convergence of structure and sentiment often precedes a defining move.

A sustained breakout above $259 could quickly attract momentum traders and dealer hedging flows, pushing toward $263+. If price rejects again and slips below $256, the wedge breakdown may trigger a healthy pullback to reset momentum.

This is a pivotal setup — patient traders will wait for confirmation, not prediction.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own due diligence and manage risk responsibly before trading.

APPLE (AAPL) – BUY SETUP ANALYSIS | TARGET $280 | OCT 2025Current Price: $258.01

Trend: Uptrend channel (bullish)

The chart shows a rising parallel channel, and the price is currently trading near the upper region of the channel — suggesting possible short-term correction before resuming the uptrend.

🧭 Key Levels

Buy Entry Point: $223.34 – $223.68

This zone is highlighted as a strong demand/support area. Price may retrace to this zone before resuming upward.

Stop Loss: $211.44

Below this level, bullish structure would be invalidated.

Target Point: $280.74 – $280.80

This is the projected take-profit zone, aligning with the top of the channel extension.

🔍 Projection

Expected move:

Price might break below the current trend channel, retest the support zone around $223, and then bounce upward toward the $280 target.

This setup represents a buy-the-dip strategy inside a long-term uptrend.

⚠️ Risk Management

Risk-to-Reward Ratio ≈ 1:4, favorable setup.

Entry should only be considered if price confirms reversal signals (e.g., bullish candlestick patterns) near $223 support.

AAPL – Ready to Break Out Despite Macro NoiseMarkets are holding strong near all-time highs even amid the backdrop of a potential U.S. government shutdown. One standout name is Apple Inc. NASDAQ:AAPL , which has surged 32% since our last analysis. This rally confirms renewed momentum and continued investor confidence in large-cap tech.

Apple is in a strong uptrend, currently consolidating just below resistance. The structure is bullish, and a breakout seems likely. Any pullback toward support could offer a high-probability entry for trend followers.

🟩 Trade Setup

Entry Zone: $223 – $227 (support area)

Target Range: $237 – $259

Stop Loss: Close below $217

Watch price action near these levels and manage risk accordingly.

This 3-Step System Will Help You Understand TrendsMan yesterday i saw

something inside myself that i have never seen.

The power to hold back and be patient.

One thing is for sure patience

will always beat speed.

Yes speed works wonders.

But patience gives you faith and results.

While speed gives you only results.

Its okay to be the tortoise or the slow one.

Am very slow at learning stuff

But once i learn it,

man its like there is no going back

i become a freaking machine.

Learning the rocket booster strategy

is something that i want you to grab on to.

This strategy will save your butt.

This strategy will be your bread and butter.

Its freaking easy.

Its very easy Its done in 3 steps look at this

chart: NASDAQ:AAPL

1- The price should be above the 50 EMA

2- The Price should be above the 200 EMA

3- The price should gap up or trend up.

Remember this is a trending trading system.

Its not a reversal trading system.

Rocket boost this content to learn more.

Disclaimer: Trading is risky

please learn risk management and profit taking strategies.

Also feel free to use a simulation trading account

Make sure you trade trade above x10 Margin

AAPL Breaking Wedge? Key Gamma Levels to Watch for Oct 3 Intraday Technical Outlook (15m Chart)

Apple (AAPL) is currently trading near $256.7, consolidating inside a rising wedge formation. The short-term trendline support is being tested, while momentum indicators show early weakness:

* MACD: Bearish crossover with histogram fading, suggesting potential downside pressure.

* Stoch RSI: Cooling off from overbought levels, hinting at reduced buying momentum.

* Key Levels: Immediate intraday support sits near $257–256.5, with stronger downside zones at $255.5 and $254.2 if wedge support breaks. Resistance remains at $259.2–260.0, aligned with the upper wedge line.

Intraday takeaway: Price action is in a tightening range — a breakdown below $256.5 could invite fast downside scalps, while a bounce back above $259.2 opens room for a squeeze toward $260+.

Options Sentiment & GEX Outlook (1H Chart)

The 1-hour GEX map is showing well-defined institutional positioning:

* Gamma Walls:

* $260–262.5: Heavy call wall cluster, aligning as a gamma resistance zone.

* $257.5: Highest positive GEX level, acting as a magnet and resistance pivot.

* $252.5–250: Key put walls, serving as gamma support.

* Implications:

* If AAPL holds above $257.5, momentum traders could target the $260–262.5 gamma wall for short-dated calls.

* Failure to sustain above $257.5 risks a fade toward the $255–252 zone, favoring put spreads.

* Volatility Context: IVR sits around 19.7 (below average), which means option premiums are relatively cheap. This favors directional plays, but be mindful of quick moves as AAPL sits near a gamma pivot.

My Thoughts & Recommendation

For Oct 3 trading, I see AAPL in a make-or-break setup:

* Intraday (scalping/trading): Watch for a wedge break. A clean move below $256.5 favors a test of $255–254. On the upside, reclaiming $259.2 can accelerate momentum toward $260–262.5.

* Options trading (swing/0DTE): Calls make sense only above $257.5, aiming for the $260–262.5 wall. Otherwise, puts are more favorable if price rejects from $257.5 and drifts back into the $255 zone.

Overall bias: Neutral-to-bearish intraday unless $259+ is reclaimed.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research and manage risk before trading.

AAPLApple (AAPL) price is in a strong uptrend, there is a chance that the price will test the $261-$265 level. In this zone, if the price cannot break above $265, the short-term price is likely to go down, consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

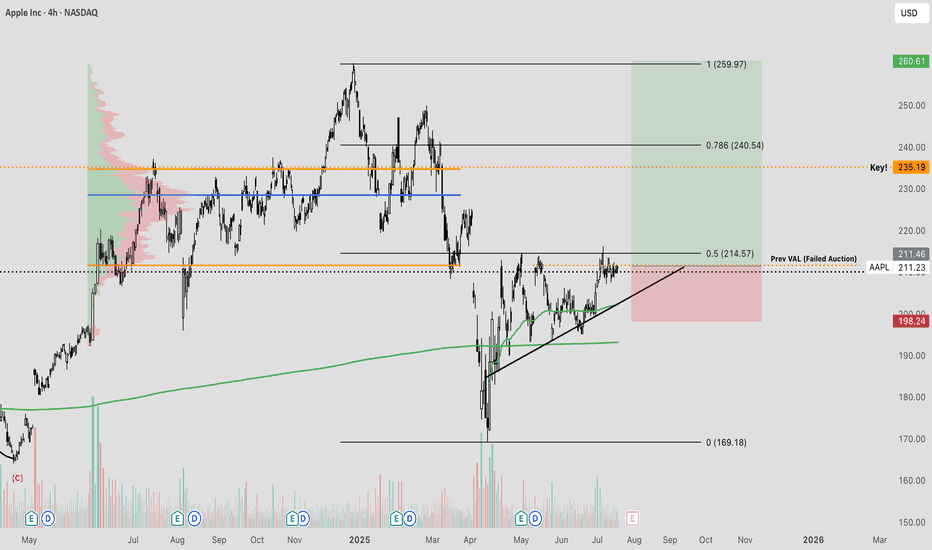

APPLE Lagging BehindApple remains a key component on my watchlist, having experienced a significant pullback amid recent market volatility driven by tariff-related macroeconomic tensions. A primary concern contributing to this weakness appears to be the company's delayed integration of AI technologies within its operating systems and hardware. There's a growing narrative among investors that Apple is beginning to resemble a legacy titan — respected but perhaps lagging behind in innovation.

That said, I believe Apple is actively developing AI capabilities behind the scenes, and any formal announcement or rollout could serve as a catalyst for a meaningful revaluation of the stock. Historically, Apple has demonstrated an ability to quietly build, then scale innovation at a massive level — and I suspect AI will be no different.

Interestingly, Apple has also exhibited characteristics of a defensive equity, often rallying even as broader global indices falter. This reinforces the notion that investors still view Apple as a relative safe haven. Given its valuation relative to long-term growth potential, Apple may be increasingly seen as an undervalued mega-cap poised for a strong rebound.

From a technical standpoint, we're beginning to see signs of accumulation, with buyers stepping in around key levels. The prior value area low around $211 has historically acted as a fair value zone. If price action successfully reclaims this level, auction market theory would imply a potential move back toward the upper end of the range — approximately $230 to $235.

Moreover, the current market structure is forming a constructive ascending pattern, with price pressing into higher zones. Should this structure hold and break through resistance, it could trigger accelerated upside momentum. This setup offers a compelling longer-term swing opportunity, particularly with clearly defined risk. The invalidation point lies just below the ascending trendline and the anchored VWAP from the lows — a key trend confirmation tool used to gauge average positioning of market participants.

All considered, this is a technically sound and fundamentally interesting level to consider an entry. Let’s see how this one unfolds.

Apple + The 3 Step Rocket Booster StrategyI know i said i would stop talking about

stocks but i thought about you..

Maybe you are still in the making it stage

Maybe you only have access to forex options

but remember if thats the case dont

trade above x4 margin

Especially if you are dealing with stock

options.

Its because of you i fought hard to

design the Rocket booster

strategy.

This is the strategy i started with

its beginner friendly and

very easy to understand

it has 3 steps. i think the reason it become

so popular is because its very simple

so here are the following 3 steps:

1-The price has to be above the 50 EMA

2-The price has to be above the 200 EMA

3-The price should gap up

The last step is very important for you

to understand because it filters out

the noise in the trading.

How?

Because it has to be trending upwards

on the week and the day to signal

a beginner friendly entry for you.

Look at NASDAQ:AAPL

you can clearly see that its gapped up.

Rocket boost this content to learn more.

Disclaimer: Trading is risky

please use a simulation trading account

before you trade with real money.

AAPL Oct. 1 – Coiling Below Resistance, Next Big Move Loading!Intraday View (15-Min Chart)

AAPL traded choppy with a clear descending trendline pressing price lower. It’s holding around $253–$254, but momentum is fading as MACD stays red and Stoch RSI remains weak.

* Support Levels: $253.11, $253.58, $254.43

* Resistance Levels: $255.19, $255.91

* Indicators: MACD firmly negative, showing sellers still in control. Stoch RSI hovering near lows, suggesting potential for a small bounce.

📌 Intraday Thought (Oct. 1): If $253 holds, AAPL could bounce back to $255+. A breakdown under $253 risks a slide toward $250. Scalpers can lean long on $253 support with tight stops, or fade into $255.9 resistance if price rejects.

Options & Swing View (1H + GEX)

Gamma exposure provides a wide setup:

* Upside: Heavy call walls at $257–$262.5, with a gamma cluster stretching toward $265–$270.

* Downside: Put support around $247.5–$242.5, deeper wall at $237.5.

This keeps AAPL boxed between $250–$257 in the short term. A break over $257 could trigger a push into $262–$265, while losing $250 risks deeper tests toward $247.

* Bullish Play (Oct. 1): Calls targeting $262.5–$265 if $257 breaks on volume.

* Bearish Hedge: Short puts toward $250 → $247.5 if support fails.

* Neutral Play: Iron condor between $247.5–$257 while AAPL consolidates.

My Thoughts (Oct. 1)

AAPL is stuck under a descending trendline, and momentum looks weak into the close. The $253 level is key—hold it and we could see a bounce back to $255+, but a break lower risks sliding toward $250. For options, I’d wait for a confirmed move through $257 breakout or $250 breakdown before sizing up.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.