Micron Technology - New all time highs!💰Micron Technology ( NASDAQ:MU ) is heading for new highs:

🔎Analysis summary:

More than a decade ago, Micron Technology entered into a significant long term rising channel pattern. Recently, we witnessed an expected rally of about +120%, perfectly rejecting support. But with the current all time high retest, we will also see a bullish breakout in the near future.

📝Levels to watch:

$140

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

MU trade ideas

Micron Hit a Record High This Week. Here's What Its Chart SaysMicron Technology NASDAQ:MU hit an all-time intraday high this week as multiple analysts raised their price targets for the tech firm amid strong demand from AI-related companies for MU's high-bandwidth memory. What does technical and fundamental analysis say the Micron prepares to report earnings next week?

Let's see:

Micron's Fundamental Analysis

All of the GPUs and high-end chips destined for data centers and generative artificial intelligence need memory -- lots and lots of memory.

This has created shortages (and higher prices) for high-bandwidth, high-speed DRAM chips, and Micron is the only U.S.-based source for those. The company's top competitors for that high-end marketing are both South Korean firms, SK Hynix and Samsung Electronics.

When Micron reports fiscal Q4 earnings after the bell next Tuesday, Wall Street will be looking for the firm to report $2.86 of adjusted earnings per share on $11.1 billion of revenue.

That would crush the firm's own guidance, and also represent a 142.4% gain from the $1.18 in adjusted EPS that MU reported in the year-ago period. Revenue would also have grown some 43% from the $7.75 billion the company rang up in the same period last year.

And of the 21 sell-side analysts that I can find that cover MU, 20 have revised their earnings estimates for the period higher since the current quarter began. (One analyst lowered his forecast.)

This week, Vijay Rakesh of Mizuho Securities (rated at five stars out of a possible five by TipRanks) reiterated his "Buy" rating on MU while increasing his target price to $182 from $155.

A day earlier, CJ Muse of Cantor Fitzgerald and Timothy Acuri of UBS (both also rated at five stars by TipRanks) reiterated their own "Buy" ratings. Both also increased their target prices from an identical $155 to $185.

Micron's Technical Analysis

Now let's look at MU's chart going back to April 2024 and running through Tuesday afternoon:

Readers will note that MU recently broke out of a "cup-with-handle" pattern that it had been in from June through mid-August and that had a $128 pivot.

The stock does now appear to be extended from that, which might rattle a few investors (especially as MU heads into earnings).

Meanwhile, MU's Relative Strength Index (the gray line at the chart's top) is in a technically overbought state.

That said, the stock's daily Moving Average Convergence Divergence indicator (or "MACD," marked with black and gold lines and blue bars at the chart's bottom) is looking extremely bullish.

The histogram of the 9-day EMA (the blue bars) is now well above zero, as are both the 12-day Exponential Moving Average (or "EMA," marked with a black line) and the 26-day EMA (the gold line). The 12-day EMA is pulling away from the 26-day line. All of that is very bullish technically.

MU did, in fact, crash through its previous all-time high of June 2024 (marked with a heavy black line) on Thursday.

That level (about $157) was the pivot for the bulls that has now been triggered technically. (That's where all of those elevated target prices from the above-mentioned analysts came from.)

The downside pivot? It's a long way down at Micron's 50-day EMA (marked with a blue line at $121.50 in the chart above).

All in, I would not be surprised if MU remains volatile heading into and coming out of next week's earnings report.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle was long MU at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

The Analyst Ratings feature comes from TipRanks, an independent third party. The accuracy, completeness, or reliability cannot be guaranteed and should not be relied upon as a primary basis for any investment decision. The target prices are intended for informational purposes only, not recommendations, and are also not guarantees of future results.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

MU eyes on $132-134: Key Resistance about to break for new ATH? MU has been recovering nicely after our last trade call.

Looks ready to break key Resistance at $132.18-134.25

Looking for a Break-n-Retest to start next leg to new ATH.

.

Previous Analysis that caught the EXACT BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

Micron: AI Memory Powerhouse Amid #AI and #TechnologyMicron: Undervalued AI Memory Powerhouse Amid #AI and #Technology Trends Explosion? $175 Target in Sight?

Micron (MU) shares hit a new 52-week high of $158.28 today, up 1.2% amid surging AI data center demand and institutional buying, with the stock soaring 86.8% YTD on memory chip tailwinds.

As Q4 fiscal 2025 earnings loom on September 23—projecting 58% EPS jump to $1.29 on $8.7B revenue—analysts have hiked targets to $175, implying 10%+ upside. Just as #AI racks up 17K mentions and #technology trends with 46K on X today (fueled by AI video generators and chip hype), Micron's HBM3E tech for Nvidia GPUs positions it as the undervalued play in the $200B+ semiconductor memory market.

But with forward P/E at 12x, is MU set to ride the AI wave higher, or will supply gluts cap the rally? Let's unpack the fundamentals, SWOT, charts, and setups for September 17, 2025.

Fundamental Analysis

Micron's resurgence is driven by AI hyperscaler demand for high-bandwidth memory (HBM), with Q2 fiscal 2025 revenue hitting $9.3B (up 93% YoY) and data center sales doubling to $2.2B.

Analysts forecast 2025 revenue of $38.5B (up 50% YoY), as HBM capacity ramps to 250K wafers amid #AI trends exploding on social media. Trading at 18% below fair value per DCF, MU's undervaluation shines with gross margins rebounding to 37%—but cyclical DRAM risks could flare if PC demand softens.

- **Positive:**

- AI boom ties into today's #technology hype, with HBM3E sales projected at $2.5B in FY2025; institutional stakes rising signal confidence.

- Q2 EPS beat of $1.18 (vs. $1.00 est.) and $1.6B FCF undervalues the stock at 12x forward earnings vs. sector 25x.

- Broader trends in edge AI and automotive chips position MU for 20%+ CAGR, amplified by #AI video generator virality.

- **Negative:**

- Inventory overhang from prior cycles could pressure pricing, clashing with #technology optimism if China trade tensions escalate.

- High capex ($8B annually) strains balance sheet if AI adoption slows amid economic jitters.

SWOT Analysis

**Strengths:** Leadership in DRAM/NAND with 20%+ market share; AI-optimized HBM tech generates 50%+ gross margins, amplified by #AI relevance in data centers.

**Weaknesses:** Cyclical exposure to consumer electronics; $7.8B net debt limits agility in a volatile #technology market.

**Opportunities:** HBM ramp to meet Nvidia/AMD demand unlocks $5B+ revenue; undervalued at 12x P/E amid 58% EPS growth and #AI boom on X.

**Threats:** Supply chain disruptions from geopolitics; competition from Samsung/SK Hynix capitalizing on #technology trends.

Technical Analysis

On the daily chart, MU is in a parabolic uptrend, breaking 52-week highs after consolidating above $140 support, with volume exploding on AI news and mirroring #AI volatility spikes. The weekly shows a cup-and-handle breakout from summer lows, now accelerating higher. Current price: $158.28, with VWAP at $156 as intraday pivot.

Key indicators:

- **RSI (14-day):** At 74, overbought but fueled by momentum—watch for consolidation amid #technology surges. 📈

- **MACD:** Bullish crossover with surging histogram, confirming AI-driven acceleration; minimal divergence. ⚠️

- **Moving Averages:** Price crushing 21-day EMA ($145) and 50-day SMA ($130), golden cross locked in.

Support/Resistance: Key support at $150 (recent breakout and 50-day SMA), resistance at $165 (Fib extension) and $175 (analyst target). Patterns/Momentum: Cup-and-handle targets $200; strong buy signals. 🟢 Bullish signals: Volume on earnings hype. 🔴 Bearish risks: Overbought RSI could pull back 5-8% on profit-taking.

Scenarios and Risk Management

- **Bullish Scenario:** Smash $165 on earnings beat or #AI catalyst targets $175 short-term, then $200 by year-end. Buy dips to $150 for entries tied to tech trends.

- **Bearish Scenario:** Breach $150 eyes $140 (200-day EMA); supply news amid #technology fade could retrace 10%.

- **Neutral/Goldilocks:** Range-bound $150–$165 if data mixed and #AI cools, ideal for straddles pre-earnings.

Risk Tips: Set stops 3% below support ($145.50) to tame volatility. Risk 1-2% per trade. Diversify with NVDA or SMH to hedge semi correlations.

Conclusion/Outlook

Overall, a bullish bias if MU holds $150, supercharged by today's #AI and #technology trends, cementing its undervalued status with 40%+ upside on memory demand. But watch September 23 earnings for confirmation—this fits September's chip rotation amid viral AI hype. What’s your take? Bullish on MU amid #AI chip trends or fading the rip? Share in the comments!

$MU a chart I don't likeSo, as I have been trying my hand at stock with Technical Analysis, it's definitely harder than I thought. I definitely do not like these charts for the simple reason that they all have Huge Gaps in them with new all-time highs. No real resistance and no real support. With all the Perma bulls in the market chatter, and market manipulation by Market Movers and News Update it's hard to gauge where to put your money. What a good entry point is. Like in what I describe in my AMEX:SPY report. You will see let's say a reverse cup and handle and you think ok this should have a reversal but Trump and his Perma bull following will just say yea no economy is great we are doing great, and the Markets just follow. Now your Put entry is down. Market is crying for a correction. AI investors and CEO'S are ignoring the AI bubble. While I see that there should be a gap down, there is still a potential that current price will bounce off the current support and break through to $700. But in this market, you just never know. I need to save enough money so I can get into crypto I would most likely perform better on there.

THIS IS NOT FINANCIAL ADVICE, AS ALWAYS ITS MY OPINION BE SAFE.

Micron(MU) Ceiling: A Technical Thesis for a Short PositionThis trade is a strategic short on Micron Technology (MU), grounded in a technical analysis thesis of price rejection at a significant trendline resistance. The core premise is that the strong upward momentum has exhausted itself as the price has encountered a formidable ceiling, signaling an imminent corrective move. The trade is designed to capitalize on the anticipated retracement to a key underlying support level.

The price of MU has been on a strong ascent, but this rally has recently culminated in a critical inflection point. As shown by the red arrow on the chart, the price has failed to convincingly break above a major resistance trendline, which has been respected over a long-term horizon. This rejection is a high-probability bearish signal, indicating a shift in market control from buyers to sellers.

Trade Idea:

Entry Signal: The short position is initiated at the point of rejection, precisely where the red arrow is located.

Exit Strategy: The primary profit target is set at the strong support level, marked by the green support line.

MU hitting $200?Micron technology could be hitting $200 due to an uptrend and a upcomign earnings date. Higher highs, higher lows, which indicates a strong bullish uptrend, and the breakout from 130 followed by a massive volume is also indicating a bullish uptrend. The price is ridign the upper bollinger band, indicating strong momentum.

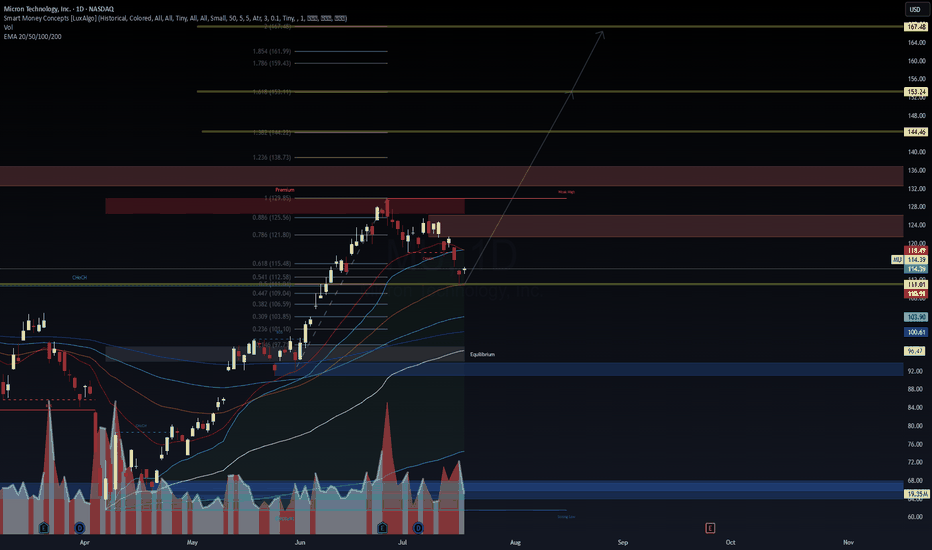

MU - SMC Premium Zone Rejection | Targeting Equilibrium Before E📉 MU - SMC Premium Zone Rejection | Targeting Equilibrium Before Expansion

🔍 WaverVanir DSS Framework | SMC x Fibonacci x Liquidity

We just observed rejection from the Premium zone and 0.886 Fibonacci retracement near $129.85, aligning with prior weak high liquidity. Price has shown signs of distribution, with a likely retracement to the Equilibrium zone ($98–$103) before any bullish continuation.

🧠 Key Observations:

ChoCH confirmed post-run to premium → Expect redistribution

Price rejected 0.886 (122.06) and weak high near 129

Strong EMA confluence forming around 110–103 range

Equilibrium zone and volume spike near $98–$103 offers valid demand

Long-term target remains open toward Fib extension @ $146.10, but only after deeper retrace

📉 Short Bias Until $103–$98 Demand Zone

🔁 Then flip long if bullish confirmation appears

📊 VolanX Market View:

Structure: Breaker → ChoCH → Premium Rejection

Bias: Retracement → Reaccumulation

Tools Used: Smart Money Concepts, Fib, Volume, EMA stack, Liquidity zones

🧠 Built using the WaverVanir DSS, designed to navigate institutional flows and macro-infused setups. We’re tracking this sequence closely across cycles.

📅 Chart Date: July 14, 2025

📍 Asset: NASDAQ:MU (Micron Technology Inc.)

💬 Follow @WaverVanir for macro-aware, alpha-focused setups.

📈 Disclaimer: Not financial advice. Educational content only.

#SMC #OptionsFlow #FibLevels #LiquidityZones #WaverVanir #VolanX #TradingView #MU #Micron #TechStocks #InstitutionalTrading #VolumeProfile #ChoCH #Equilibrium #SmartMoney

$MU – Preparing for Institutional Flow Reversal?📈 NASDAQ:MU – Preparing for Institutional Flow Reversal?

Micron ( NASDAQ:MU ) is at a crucial confluence zone, holding just above the 0.618 retracement ($115.48) after a CHoCH breakdown. With EMAs (20/50/100/200) aligning under price, the technical setup hints at an early-stage liquidity grab before potential expansion.

🔹 Technical Outlook

Current price: $114.39

CHoCH confirmed near premium zone ($129–$138)

Rejection from 0.886 Fibonacci zone ($125.56)

Holding above major EMAs (Support: $110.91 / $111.01)

Volume spike suggests accumulation at equilibrium ($100–$103)

🔹 VolanX DSS Probability Scenarios

LSTM-GRU model predicts price recovery toward $135–$140 by late August

Short-term risk zones: $108.67 stop loss (weekly), upside target $124.69

1W Neural Forecast: +5.9% upside bias, confidence skewed toward recovery

VaR (99%): -8.68% max drawdown exposure

🔹 Macro & Risk Consideration

Semiconductor cyclicals are catching tailwinds from AI infrastructure demand

Risk: High beta and earnings volatility; monitor inflation & Fed communication

Volatility: 52.4% annualized – risk remains elevated

🔹 Strategic Play (Not Financial Advice)

Entry Zone: $111–$114 (support + VWAP alignment)

SL: $108.67 (below weekly structure)

TP Zones: $124.69, $138.73, $153.24 (Fib levels)

💡 “We don’t trade the price, we trade the narrative. Follow the Smart Money—ride the VolanX Protocol.”

#Micron NASDAQ:MU #TradingView #SMC #LSTM #AITrading #SmartMoney #TechStocks #Fibonacci #OptionsFlow #VolanX #WaverVanir #MarketIntel #InstitutionalTrading #ProbabilityBasedTrading

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report next week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2025-10-17,

for a premium of approximately $9.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MU - POTENTIAL 52-WEEK HIGHMU - CURRENT PRICE : 118.89

The share price rises almost 111% from the bottom of 07 April 2025 to the high of 26 June 2025. Then the stock starts to pullback. It retraces at Fibonacci golden ratio of 38.2%. Last Friday the stock rises and closed as a bullish LONG WHITE CANDLE with high volume - indicating strong buying interest from investors/traders.

This bullish scenario is also supported by some other indicators such as :

1) Price above 50-days EMA

2) Price closes above ICHIMOKU CLOUD (KUMO)

3) RSI reading at 58.95 (above 50 considered bullish)

4) Price is trading near 52-week high level

With all the evidence mentioned above, now may considered as a buying opportunity. 1st target should be one- or two-dollar below the actual 52-week high resistance level.

ENTRY PRICE : 115 - 119

TARGET : 128 and 135

SUPPORT : 108

MU LEAP Alert: $165 Call Poised for Multi-Month Run!

🚀 **MU LEAP ALERT – \$165 CALL**

**Target:** 200% Premium 💎 | **Stop:** \$16.25 🛑 | **Entry:** \$25.00 ⏰

💡 **Thesis:**

* AI + Memory Cycle Recovery 🔋💻

* Weekly RSI \~77 → Strong momentum 📈

* Low VIX (\~15) → Perfect for long-term LEAPs 🌟

* Institutional volume spike supports upside 🔥

🎯 **Trade Details:**

* **Instrument:** MU

* **Direction:** CALL (LONG)

* **Strike:** \$165

* **Expiry:** 2026-09-18

* **Entry Price:** \$25.00

* **Profit Target:** \$75 (200% Gain)

* **Stop Loss:** \$16.25 (35%)

* **Size:** 1 Contract

* **Confidence:** 75% ✅

* **Entry Timing:** Market Open ⏱️

⚠️ **Risks / Notes:**

* Overbought RSI → potential pullback ⚡

* Sector correlation → weakness can affect MU 🏭

* Weekly monitor & partial profit-taking recommended 🪙

💥 **Action Plan:**

1️⃣ Buy at open \$25.00 (or use limit at ask)

2️⃣ Partial exit at +100% premium

3️⃣ Trail remainder toward +200% target

4️⃣ Exit if weekly closes < \$147

🔥 **High-Conviction, Long-Term Bullish Play!**

\#MU #LEAP #OptionsTrading #AI #TechStocks

Micron Technology Inc (MU) – Breakout AlertWe’re currently seeing a breakout setup forming on MU. A confirmation on the next candle would strengthen this move, potentially paving the way for further momentum.

Using technicals, the target price of $145 comes from the Fibonacci expansion. Specifically, it aligns with the 61.8% level from the most recent move up, making it the first key Fibonacci target to watch.

If price action holds, I’m anticipating a swing toward $145. Patience and confirmation are key here. Let’s see how the next session unfolds.

Micron Technology Moving HigherAs you can see, MU has been in an uptrend for a little while now. It broke above a key trendline, consolidated for a bit, then broke even higher last Friday and confirmed with a full candle close above yesterday. I can see MU going to the top orange line which is a long-term weekly trend line in the mid $180's.

Micron (MU) Trade Plan | Resistance, Pullback & Thief Setup📊 Micron Technology (MU) | Thief Plan Swing/Day Trading Setup

⚡ Why This Plan?

Micron Technology (MU) has been showing strong momentum in 2025, driven by AI demand, DRAM revenue growth, and favorable fundamentals. The Thief Plan Strategy (layering entries + tactical exits) is designed to adapt to both swing & day trading setups, balancing technical signals with fundamental catalysts.

🎯 Thief Technical Trading Plan

Strategy: Hull Moving Average Pullback ➝ Bullish Bias

Entry Method (Layering Style): Multiple buy limit layers

$122.00

$124.00

$126.00

$128.00

(You may increase/decrease layers based on your own plan & risk)

Stop Loss: Thief SL reference @ $115.00

Adjust based on your own risk tolerance & style.

Target Zone: $146.00 (resistance barricade / overbought trap zone — best to “escape” before exhaustion).

⚠️ Note: These levels are educational references. Manage your own SL/TP — trade at your own risk.

📈 Fundamental & Sentiment Insights

52-Week Range: $61.54 – $131.41

Market Cap: $147.02B

YTD Performance: +50.4% 🚀

Investor Sentiment:

Analyst Consensus: Moderate Buy 🟢

21 Buy | 5 Hold | 1 Sell | 2 Strong Buy

Avg. PT: $147.54 (+12.3% Upside)

Institutional Ownership: 80.84%

Fear & Greed Index: 39/100 → Fear 😨

Earnings & Growth:

Q3 FY2025 EPS: $1.91 (Beat by $0.34)

Revenue Growth YoY: +58.2%

DRAM Revenue: +51% YoY (AI-driven)

Net Margin: 18.41%

Debt-to-Equity: 0.30 (healthy)

Dividend Yield: 0.4%

🌍 Macro & Market Drivers

AI Boom: HBM demand projected at $10B run-rate.

Data Center DRAM: +63% YoY expected in Q4 FY2025.

US CHIPS Act & Tariffs: Long-term tailwinds for domestic semiconductor players.

Competition: Samsung & SK Hynix applying pressure on margins.

🐂 Bullish vs 🐻 Bearish Outlook

Bullish Case (Long):

AI/Data Center demand ➝ strong revenue trajectory.

Valuation attractive (PE 23.6x vs peers 32x).

Analyst PTs reach as high as $200.

Bearish Case (Risk):

Memory market cyclicality ➝ volatile pricing.

Fear & Greed shows low confidence (39/100).

DCF suggests stock could be overvalued short-term.

📌 Summary

Outlook: Neutral ➝ Bullish short-term (AI strength offsets macro fear).

Catalyst: Q4 FY2025 Earnings (Sept 23, 2025).

Risk: Moderate (High Beta 1.47).

🔗 Related Assets to Watch

NASDAQ:NVDA - AI semiconductor sentiment indicator

NASDAQ:AMD - Semiconductor sector momentum

NASDAQ:SOXX - Semiconductor ETF for sector strength

NASDAQ:SMH - Alternative semiconductor ETF

NASDAQ:WDC - Memory sector correlation

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#MU #Micron #Stocks #SwingTrade #DayTrading #ThiefPlan #Semiconductors #AI #TechStocks #TradingView

MU $135 Call Swing – Momentum + Low VIX Edge!

🚀 **MU Swing Alert! \$135 Call Play 💎📈**

💡 **Momentum + Low VIX → Short-Term Bullish Swing Opportunity!**

**Trade Snapshot:**

* **Instrument:** MU

* **Strategy:** Buy Call (single-leg, naked)

* **Strike:** \$135

* **Expiry:** 2025-09-19 (12-day swing)

* **Entry Price:** \$2.97 (ask at open)

* **Profit Targets:** \$4.46 (+50%) initial, \$5.94+ (+100%) secondary

* **Stop Loss:** \$1.79 (\~40% of premium)

* **Size:** 1 contract

* **Confidence:** 70%

**Rationale:**

* 🔹 Daily RSI 71.4 → bullish momentum

* 🔹 Multi-timeframe positive returns → short-term upside probability

* 🔹 Low VIX → favorable for momentum swing trades

* 🔹 Preferred strike \$135 balances leverage & probability

**Key Notes:**

* Entry at market open; consider slight limit inside ask if desired

* Tight stop & defined profit targets to manage risk

* Max hold: exit by 2025-09-17 unless momentum confirms continuation

* Watch for low volume → could reduce move reliability

📊 **Summary:** Models converge on \$135 call as the optimal swing trade with 12-day horizon. Favorable technicals + low VIX + manageable risk make this a high-probability momentum play.

Smart Money Flow into $MU Calls – Earnings Week Opportunity

# 🚀 MU Earnings Play (Aug 31 – Sep 5) 🚀

💎 **Moderate Bullish | 65% Conviction** 💎

🎯 **Trade Setup**

📊 **Ticker**: \ NASDAQ:MU

🔀 **Direction**: CALL 📈

🎯 **Strike**: \$125.00

📅 **Expiry**: 2025-09-05

💵 **Entry**: 0.68 (ASK)

📦 **Size**: 1 contract (risk 💸 \$68)

🛑 **Stop**: 0.34 (−50%)

🎯 **Target**: 1.36 (+100%)

⏰ **Timing**: Market open 8/31 → exit by 9/4 (Thu)

⚡ **Why Bullish?**

* 📈 RSI strong on weekly (68.7); neutral daily (52.3) → upside potential

* 🔥 Options flow: C/P ratio 1.23, heavy \$124–125 call action

* 🧘 Low VIX (\~15) → cheap premium, low gamma risk

* 🤖 Consensus from 5 AI models = **Moderate Bullish**

✅ **Plan**: Buy ONLY if MU holds above **\$120** w/ healthy opening volume. Cut fast if <\$120.

---

### 📌 Suggested Tags

\#MU #Micron #EarningsPlay #OptionsTrading #CallOptions #WeeklyOptions #BullishSetup #MomentumTrading #TradeIdeas #StockMarket 🚀📊

$MU — Cup & Handle Breakout WatchNASDAQ:MU — Cup & Handle Breakout Watch

Broke the downtrend of the handle within a larger cup & handle base

All major MAs (21/50/200) are tight and stacked, creating a launchpad

Resistance at 128.60 (handle high) → breakout trigger

Volume lighter on pullback, constructive for setup

RS Rating 86, strong earnings acceleration (+208% EPS last qtr, +37% sales), funds adding

Trade Plan:

– Entry on breakout through $128.60 w/ volume

– Stop under handle low (~$118)

– Target zone $133–135 initial, room higher if momentum carries

Classic CAN SLIM setup aligning technical + fundamental strength.

#Cupandhandle #TechnicalAnalysis #SwingTrading