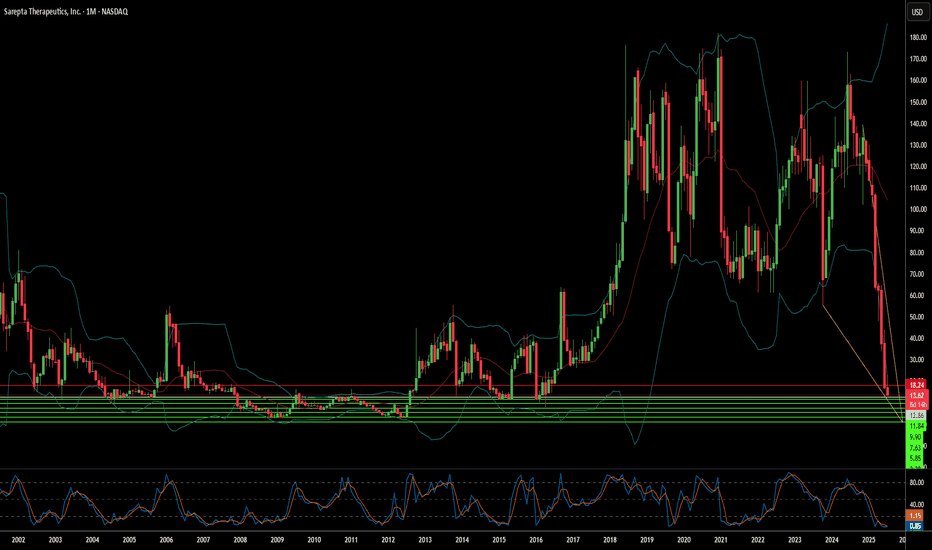

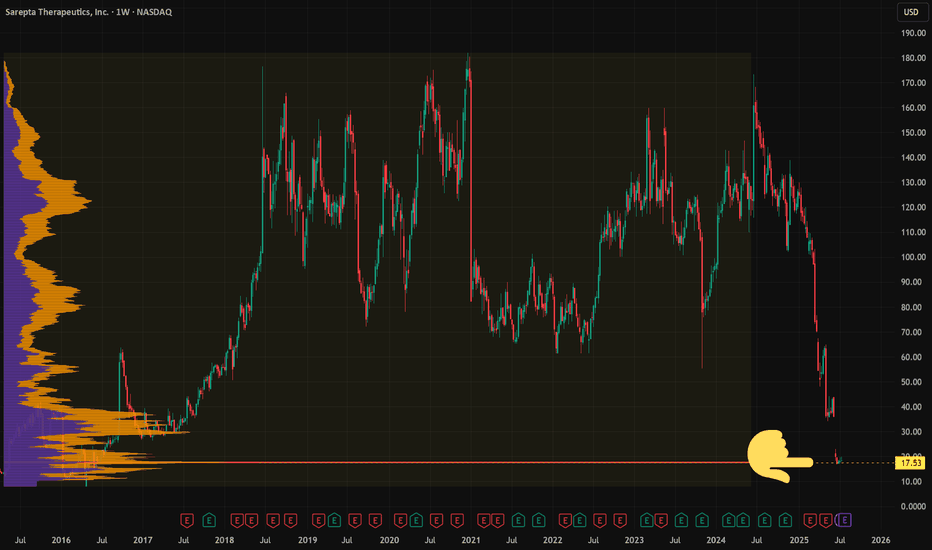

$SPRT: potential start of new swing moveNASDAQ:SRPT continues to follow the bullish trend structure outlined in the September and October updates. Today’s move may be completing the pullback phase and initiating a new upleg toward the 27+ resistance area.

Chart:

Previously:

On follow-through (Oct 2): www.tradingview.com

• On bull

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.175 CHF

213.64 M CHF

1.73 B CHF

99.15 M

About Sarepta Therapeutics, Inc.

Sector

Industry

CEO

Douglas S. Ingram

Website

Headquarters

Cambridge

Founded

1980

ISIN

US8036071004

FIGI

BBG00LVGD035

Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company, which is engaged in the discovery and development of therapeutics for the treatment of rare diseases. The company was founded on July 22, 1980, and is headquartered in Cambridge, MA.

Related stocks

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety

I'm scared of this stock and I'm buyingWall St. has already written the obituary on NASDAQ:SRPT —but that’s exactly why I’m stepping in.

Back in 2020 (link below) I traded a setup from a Spike at 50% Retracement up to its prior ATH near $170, cashed out, dodged the drug-trial IV grenade. I saw 50% of market cap evaporate in a gap. S

SRPT LongSarepta Therapeutics

Focused on the development of precision genetic medicines to treat rare neuromuscular

and central nervous system diseases

investorrelations.sarepta.com

Major leader in treatment

- Duchenne muscular dystrophy (Duchenne) and limb-girdle muscular dystrophies (LGMDs)

- Explore pe

SRPT Sarepta Therapeutics Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SRPT Sarepta Therapeuticsprior to the earnings report this week,

I would consider purchasing the 120usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $9.30.

If these options prove to be profitable prior t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SRPT6155802

Sarepta Therapeutics, Inc. 4.875% 01-SEP-2030Yield to maturity

—

Maturity date

Sep 1, 2030

SRPT5657414

Sarepta Therapeutics, Inc. 1.25% 15-SEP-2027Yield to maturity

—

Maturity date

Sep 15, 2027

See all AB3A bonds

Curated watchlists where AB3A is featured.

Frequently Asked Questions

The current price of AB3A is 15.005 CHF — it has increased by 25.66% in the past 24 hours. Watch Sarepta Therapeutics, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Sarepta Therapeutics, Inc. stocks are traded under the ticker AB3A.

We've gathered analysts' opinions on Sarepta Therapeutics, Inc. future price: according to them, AB3A price has a max estimate of 36.26 CHF and a min estimate of 4.03 CHF. Watch AB3A chart and read a more detailed Sarepta Therapeutics, Inc. stock forecast: see what analysts think of Sarepta Therapeutics, Inc. and suggest that you do with its stocks.

AB3A reached its all-time high on Jun 24, 2024 with the price of 145.362 CHF, and its all-time low was 10.021 CHF and was reached on Jul 24, 2025. View more price dynamics on AB3A chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AB3A stock is 20.42% volatile and has beta coefficient of 1.15. Track Sarepta Therapeutics, Inc. stock price on the chart and check out the list of the most volatile stocks — is Sarepta Therapeutics, Inc. there?

Today Sarepta Therapeutics, Inc. has the market capitalization of 1.38 B, it has decreased by −21.82% over the last week.

Yes, you can track Sarepta Therapeutics, Inc. financials in yearly and quarterly reports right on TradingView.

Sarepta Therapeutics, Inc. is going to release the next earnings report on Mar 3, 2026. Keep track of upcoming events with our Earnings Calendar.

AB3A earnings for the last quarter are −1.43 CHF per share, whereas the estimation was −0.58 CHF resulting in a −147.60% surprise. The estimated earnings for the next quarter are −1.08 CHF per share. See more details about Sarepta Therapeutics, Inc. earnings.

Sarepta Therapeutics, Inc. revenue for the last quarter amounts to 318.09 M CHF, despite the estimated figure of 267.43 M CHF. In the next quarter, revenue is expected to reach 303.88 M CHF.

AB3A net income for the last quarter is −143.33 M CHF, while the quarter before that showed 156.21 M CHF of net income which accounts for −191.75% change. Track more Sarepta Therapeutics, Inc. financial stats to get the full picture.

No, AB3A doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Nov 20, 2025, the company has 1.37 K employees. See our rating of the largest employees — is Sarepta Therapeutics, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Sarepta Therapeutics, Inc. EBITDA is −16.79 M CHF, and current EBITDA margin is 14.30%. See more stats in Sarepta Therapeutics, Inc. financial statements.

Like other stocks, AB3A shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Sarepta Therapeutics, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Sarepta Therapeutics, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Sarepta Therapeutics, Inc. stock shows the sell signal. See more of Sarepta Therapeutics, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.