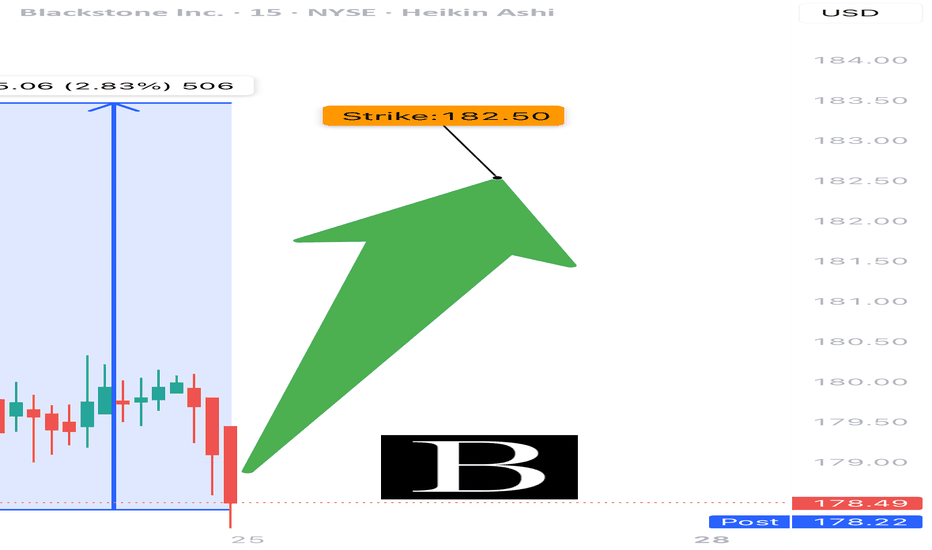

BX : First Attempt at Silent StockBlackstone has now decided to invest in Europe.

The stock is technically above the 50 and 200 period moving averages.

After leveling the trend line, an increase in volume was also observed.

In that case, holding a short-medium term or opening a long position with a reasonable risk/reward ratio in a

Key facts today

Blackstone's Legence plans an IPO targeting a $3 billion valuation, offering 26 million shares priced at $25-$29. Blackstone will retain 74% voting power post-IPO, listing on Nasdaq as 'LGN'.

Blackstone invested in Anthropic's $13 billion Series F funding round, contributing to the company's valuation rise to $183 billion.

Blackstone has acquired the Centre d'Affaires, a prime office building in central Paris, for about 700 million euros ($819 million) from German investor Union Investments.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.940 CHF

2.52 B CHF

11.32 B CHF

727.65 M

About Blackstone Inc.

Sector

Industry

CEO

Stephen Allen Schwarzman

Website

Headquarters

New York

Founded

1985

ISIN

US09260D1072

FIGI

BBG007FJHBD9

Blackstone, Inc. engages in the provision of investment and fund management services. It operates through the following segments: Real Estate, Private Equity, Credit and Insurance, and Hedge Fund Solutions. The Real Estate segment includes management of opportunistic real estate funds, Core+ real estate funds, high-yield real estate debt funds, and liquid real estate debt funds. The Private Equity segment consists of management of flagship corporate private equity funds, sector and geographically focused corporate private equity funds, core private equity funds, an opportunistic investment platform, a secondary fund of funds business, infrastructure-focused funds, a life sciences investment platform, a growth equity investment platform, a multi-asset investment program for eligible high net worth investors and a capital markets services business. The Credit and Insurance segment refers to Blackstone Credit, which is organized into two overarching strategies: private credit which includes mezzanine direct lending funds, private placement strategies, stressed and distressed strategies and energy strategies, and liquid credit which consists of CLOs, closed-ended funds, open ended funds and separately managed accounts. In addition, the segment includes an insurer-focused platform, an asset-based finance platform, and publicly traded master limited partnership investment platform. The Hedge Fund Solutions segment focuses on Blackstone Alternative Asset Management, which manages a broad range of commingled and customized hedge fund of fund solutions. It also includes a GP Stakes business and investment platforms that invest directly, as well as investment platforms that seed new hedge fund businesses and create alternative solutions through daily liquidity products. The company was founded by Stephen Allen Schwarzman in 1985 and is headquartered in New York, NY.

Related stocks

BX EARNINGS TRADE (07/24)

🚨 BX EARNINGS TRADE (07/24) 🚨

💼 Blackstone drops earnings after close — setup looks 🔥 bullish

🧠 Key Insights:

• 📉 TTM Revenue: -8.2%, but Q2 bounce back = $764M profit

• 💰 Margins: Strong → 45.3% operating, 20.6% net

• 📈 RSI: 73.88 = HOT momentum

• 🧠 AUM: $1.2 Trillion = 🐘 heavyweight

• 🔥 Options

BX Long Trade Setup!📊

⏱️ Timeframe:

30-minute chart

📍 Technical Highlights:

Bullish pennant breakout forming after a strong uptrend (continuation pattern ✅)

Breakout area: Around $163 (red resistance)

Support held near $162 zone (white/yellow lines)

🎯 Targets:

TP1: $164.15

TP2: $165.05

(Both resistance levels mar

Blackstone Leads the Revival of IPOs in Spain Blackstone Leads the Revival of IPOs in Spain with Cirsa and HIP

Ion Jauregui – Analyst at ActivTrades

Blackstone, the world’s largest investment fund, has strongly reactivated the IPO market in Spain with two of its most prominent portfolio companies: Cirsa, a gaming industry giant, and Hotel In

Catalonia Drives Away Residential Real Estate CapitalBy Ion Jauregui – Analyst at ActivTrades

Rental market regulations in Catalonia are triggering a real capital flight among major international funds. Following Patrizia’s moves, Blackstone and Azora have also begun divesting from the region’s rental housing market, prioritizing unit-by-unit proper

Black Stone Stock Chart Fibonacci Analysis 050925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 129/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

What is a war chest and lessons we can learn from Blackstone...In case you haven't heard, NYSE:BX is hogging over $100 billion of dry powder that is ready for deployment at the snap of a finger. Now, just because we cant get our hands on hundreds of billions of dollars doesn't mean that we shouldn't have a war chest of our own.

Why a war chest is a must hav

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BX5337775

Blackstone Private Credit Fund 4.0% 15-JAN-2029Yield to maturity

—

Maturity date

Jan 15, 2029

BX5480342

Blackstone Private Credit Fund 7.05% 29-SEP-2025Yield to maturity

—

Maturity date

Sep 29, 2025

BX4546377

Blackstone Holdings Finance Co. LLC 4.0% 02-OCT-2047Yield to maturity

—

Maturity date

Oct 2, 2047

3VRA

Blackstone Property Partners Europe Holdings SARL 1.0% 20-OCT-2026 2021-20.10.26 REG SYield to maturity

—

Maturity date

Oct 20, 2026

BX5705233

Blackstone Private Credit Fund 7.3% 27-NOV-2028Yield to maturity

—

Maturity date

Nov 27, 2028

BSRF5953318

Blackstone Reg Finance Co. LLC 5.0% 06-DEC-2034Yield to maturity

—

Maturity date

Dec 6, 2034

BX3898272

Blackstone Holdings Finance Co. LLC 6.25% 15-AUG-2042Yield to maturity

—

Maturity date

Aug 15, 2042

BX5901551

Blackstone Private Credit Fund 5.25% 01-APR-2030Yield to maturity

—

Maturity date

Apr 1, 2030

BX5049997

Blackstone Holdings Finance Co. LLC 1.6% 30-MAR-2031Yield to maturity

—

Maturity date

Mar 30, 2031

BX5497421

Blackstone Holdings Finance Co. LLC 6.2% 22-APR-2033Yield to maturity

—

Maturity date

Apr 22, 2033

BX5940206

Blackstone Private Credit Fund 7.3% 27-NOV-2028Yield to maturity

—

Maturity date

Nov 27, 2028

See all BBN1 bonds

Curated watchlists where BBN1 is featured.

Frequently Asked Questions

The current price of BBN1 is 136.919 CHF — it has increased by 16.64% in the past 24 hours. Watch Blackstone Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Blackstone Inc. stocks are traded under the ticker BBN1.

BBN1 stock has risen by 16.64% compared to the previous week, the month change is a 16.64% rise, over the last year Blackstone Inc. has showed a 10.16% increase.

We've gathered analysts' opinions on Blackstone Inc. future price: according to them, BBN1 price has a max estimate of 174.03 CHF and a min estimate of 109.27 CHF. Watch BBN1 chart and read a more detailed Blackstone Inc. stock forecast: see what analysts think of Blackstone Inc. and suggest that you do with its stocks.

BBN1 reached its all-time high on Dec 16, 2024 with the price of 168.056 CHF, and its all-time low was 0 CHF and was reached on Jun 25, 2021. View more price dynamics on BBN1 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BBN1 stock is 14.27% volatile and has beta coefficient of 1.33. Track Blackstone Inc. stock price on the chart and check out the list of the most volatile stocks — is Blackstone Inc. there?

Today Blackstone Inc. has the market capitalization of 169.40 B, it has increased by 0.83% over the last week.

Yes, you can track Blackstone Inc. financials in yearly and quarterly reports right on TradingView.

Blackstone Inc. is going to release the next earnings report on Oct 16, 2025. Keep track of upcoming events with our Earnings Calendar.

BBN1 earnings for the last quarter are 0.96 CHF per share, whereas the estimation was 0.87 CHF resulting in a 10.26% surprise. The estimated earnings for the next quarter are 0.99 CHF per share. See more details about Blackstone Inc. earnings.

Blackstone Inc. revenue for the last quarter amounts to 2.44 B CHF, despite the estimated figure of 2.21 B CHF. In the next quarter, revenue is expected to reach 2.59 B CHF.

BBN1 net income for the last quarter is 606.35 M CHF, while the quarter before that showed 544.30 M CHF of net income which accounts for 11.40% change. Track more Blackstone Inc. financial stats to get the full picture.

Yes, BBN1 dividends are paid quarterly. The last dividend per share was 0.83 CHF. As of today, Dividend Yield (TTM)% is 2.49%. Tracking Blackstone Inc. dividends might help you take more informed decisions.

Blackstone Inc. dividend yield was 2.00% in 2024, and payout ratio reached 95.26%. The year before the numbers were 2.54% and 180.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 3, 2025, the company has 4.89 K employees. See our rating of the largest employees — is Blackstone Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Blackstone Inc. EBITDA is 5.76 B CHF, and current EBITDA margin is 56.69%. See more stats in Blackstone Inc. financial statements.

Like other stocks, BBN1 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Blackstone Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Blackstone Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Blackstone Inc. stock shows the buy signal. See more of Blackstone Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.