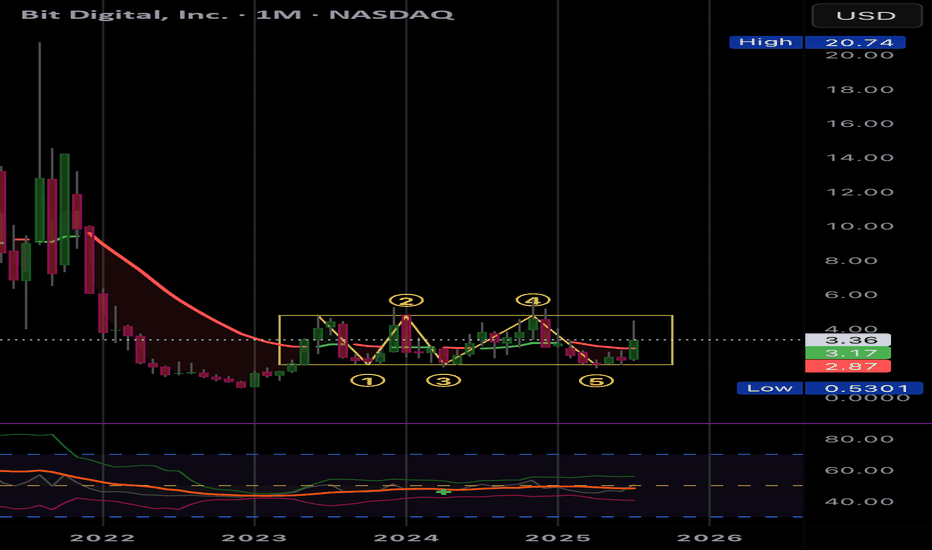

$BTBT long? Targeting $4+NASDAQ:BTBT just broke out of a falling wedge and looks strong here. I think over the next couple of weeks, we could potentially see a large move up to the $4.94 resistance.

If that level breaks, then we can see the higher resistance levels get tagged.

Let's see how it plays out.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.273 CHF

25.71 M CHF

98.13 M CHF

309.20 M

About Bit Digital, Inc.

Sector

CEO

Samir Tabar

Website

Headquarters

New York

Founded

2015

ISIN

KYG1144A1058

FIGI

BBG01SJ2K0Y2

Bit Digital, Inc. provides cloud services for customers such as artificial intelligence (“AI”) and machine learning (“ML”) developers. It operates through following segment: Digital Asset Mining, Cloud Services, Colocation Services, and ETH Staking. The Digital Asset Mining segment engages in mining activities. The Cloud Services segment provides computing services to support generative AI workstreams. The Colocation Services segment provides physical space, power and cooling within the data center facilities to customers. The Ethereum Staking segment includes service fee and reward-sharing fees to the service providers. The company was founded in November 2015 and is headquartered in New York, NY.

Related stocks

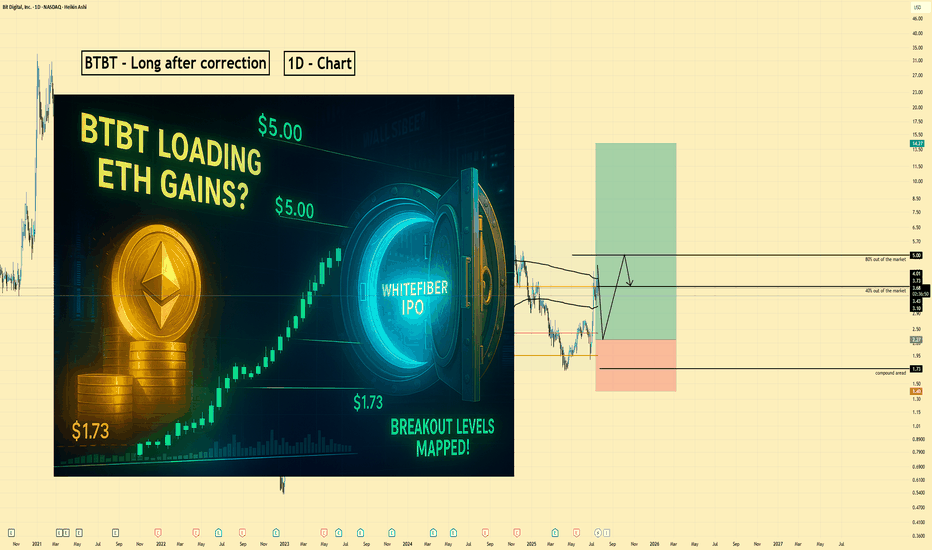

BTBT | Long | Ethereum Treasury Pivot with Capital Backing | (JuBTBT | Long | Ethereum Treasury Pivot with Capital Backing | (July 2025)

1️⃣ Short Insight Summary

Bit Digital (BTBT) is in the middle of a strategic transformation—shifting from Bitcoin mining to Ethereum treasury and staking. With heavy ETH accumulation, a pending HPC IPO, and strong cash reserve

BTBT is bottomed, severely undervalued Under SEED_TVCODER77_ETHBTCDATA:1B mcap, with over 27k ETH in holdings and some BTC as well.

Price correlates to ETH but is currently lagging, options contracts are free.

This seems like a super obvious play, its bounced off its bottom well and with ETH reverse and a positive crypto admin this s

Bit Digital Stock Chart Fibonacci Analysis 042925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 1.74/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where BTBT is featured.

Frequently Asked Questions

The current price of BTBT is 2.405 CHF — it has decreased by −4.34% in the past 24 hours. Watch Bit Digital, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Bit Digital, Inc. stocks are traded under the ticker BTBT.

We've gathered analysts' opinions on Bit Digital, Inc. future price: according to them, BTBT price has a max estimate of 5.65 CHF and a min estimate of 4.03 CHF. Watch BTBT chart and read a more detailed Bit Digital, Inc. stock forecast: see what analysts think of Bit Digital, Inc. and suggest that you do with its stocks.

BTBT reached its all-time high on Aug 7, 2025 with the price of 2.809 CHF, and its all-time low was 2.371 CHF and was reached on Jul 30, 2025. View more price dynamics on BTBT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BTBT stock is 4.53% volatile and has beta coefficient of 1.93. Track Bit Digital, Inc. stock price on the chart and check out the list of the most volatile stocks — is Bit Digital, Inc. there?

Today Bit Digital, Inc. has the market capitalization of 760.26 M, it has decreased by −0.06% over the last week.

Yes, you can track Bit Digital, Inc. financials in yearly and quarterly reports right on TradingView.

Bit Digital, Inc. is going to release the next earnings report on Dec 17, 2025. Keep track of upcoming events with our Earnings Calendar.

BTBT earnings for the last quarter are 0.06 CHF per share, whereas the estimation was −0.02 CHF resulting in a 423.07% surprise. The estimated earnings for the next quarter are 0.00 CHF per share. See more details about Bit Digital, Inc. earnings.

Bit Digital, Inc. revenue for the last quarter amounts to 20.36 M CHF, despite the estimated figure of 20.67 M CHF. In the next quarter, revenue is expected to reach 25.67 M CHF.

BTBT net income for the last quarter is 11.80 M CHF, while the quarter before that showed −51.09 M CHF of net income which accounts for 123.10% change. Track more Bit Digital, Inc. financial stats to get the full picture.

No, BTBT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 13, 2025, the company has 54 employees. See our rating of the largest employees — is Bit Digital, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Bit Digital, Inc. EBITDA is −8.83 M CHF, and current EBITDA margin is 6.45%. See more stats in Bit Digital, Inc. financial statements.

Like other stocks, BTBT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Bit Digital, Inc. stock right from TradingView charts — choose your broker and connect to your account.