Lucid: post-split impulse and a chance for a new rangeLucid stock has absorbed the post-split selloff and is now showing signs of recovery. On the daily chart, price has moved out of the descending channel and consolidated above 19.50. The bullish scenario points to a first target at 27.00, where strong resistance is located. A breakout there could pave the way toward 48.00–49.00, marking a potential mid-term trend reversal.

EMAs are starting to turn upward, while volume is picking up, signaling increased buying interest. The key support lies in the 18.00–19.00 zone. As long as this area holds, the bullish case remains valid.

From a fundamental perspective, Lucid benefits from strong EV sector demand and continued backing from major investors in Saudi Arabia. Production challenges and high costs remain risks, but overall EV market growth provides optimism.

CH2A trade ideas

Bullish Trade Plan – LCIDBullish Trade Plan – LCID

The market has already cleared sell-side liquidity and shown a strong reaction from the lows, confirming bullish intent.

Structure: Price has shifted upward after taking liquidity below, signaling strength.

Bias: Until the market reaches buy-side liquidity, deeper downside movement is less likely.

Resistance Zone: There is only one notable resistance where price may create a short pullback. If the pullback fails to push lower, then no significant resistance remains above.

Outlook: The target remains on the buy-side liquidity, and the market is expected to continue its bullish move until that level is taken.

“Lucid’s Chart Isn’t Bearish – It’s Collapsing”1️⃣ Date & Time

Date: 3rd September 2025

Time: 12:45 AM IST

2️⃣ Fundamental News

Lucid executed a 1-for-10 reverse split on September 2nd.

Vehicle delivery guidance cut sharply → 18k–20k units vs initial lofty targets.

Analysts downgraded outlook; majority remain bearish.

⚡ Movement today aligns with structure, not news.

3️⃣ Public Sentiment & Human Behaviour

Retail Psychology: Panic exits after reverse split, many trapped at higher levels.

Institutional Strategy: No accumulation — every bounce used as exit liquidity.

Social Signal: Headlines spin the SUV launch as bullish, but real structure shows deep collapse.

4️⃣ Current Structure

Macro

Resistance: $20–22 → locked.

Support: $16 → $14 anchor.

Stage: Macro Collapse, no rescue gates open.

Micro

Resistance: $17.50–18.00.

Support: $16.20 → $15.80.

Behaviour: Controlled pullbacks, failed rescues, micro collapse intact.

5️⃣ Projection

Primary Path (70%): Drift toward $15.80–16.20, extension possible to $14.

Alternate Path (20%): Weak bounce to $18.00, rejection likely.

Low Path (10%): Rescue breakout above $20, only with strong institutional catalyst.

6️⃣ Pullback Levels

Shallow: $17.20

Medium: $18.00

Deep: $20.00 (unlikely rescue barrier)

7️⃣ Final View

Bias: Bearish.

Lucid remains in both Macro & Micro Collapse. Until $20+ is reclaimed with strength, downside path toward $15–$16 range dominates.

8️⃣ Essence

“Lucid’s chart is not in distress — it is in collapse. Every bounce is a distribution, every pullback an illusion. Path points only lower until a new structure is born.”

9️⃣ Disclaimer

⚠️ This analysis is shared for educational and research purposes only. It is not financial advice, trading advice, or an investment recommendation. Market decisions are entirely your own responsibility.

LUCID short interest high maybe is opportunity like GameStopLucid (LCID) is currently facing heavy selling pressure, but let’s be clear: this is not just normal selling. The stock has a short interest of around 29–30%, which is very high compared to most companies.

👉 Big funds betting against LCID include JPMorgan, Jane Street, Wolverine, Bank of America, and others. They are trying to profit from pushing the price lower.

But history has shown us a different story before — GameStop was also one of the most shorted stocks, and retail investors flipped the script by holding and buying gradually.

Yes, Lucid is going through a tough period right now (factories, expansion, high costs), but this is exactly the phase Tesla and BYD went through before success.

📈 I believe the real beginning of Lucid’s success will start around 2026–2028, as production scales and demand stabilizes.

💎🙌 The question is: do we let the shorts win, or do we hold and create another success story?

My view: This is a chance for gradual accumulation (buying in stages) at these levels.

LCIDUSDT Ending Diagonal Near Strong DemandLucid Group continues its broader bearish move but now approaches a critical juncture with a well defined ending diagonal formation, often signaling trend exhaustion. Price action is nearing a historically strong demand zone, increasing the probability of a sharp reaction.

The trading plan is clear patiently accumulate within the projected buy zone as outlined on the chart, with focus on tracking price movement along the mapped reversal path. The setup presents a potential high reward-to-risk opportunity targeting the main sell-off resistance area, where major decisions will be reassessed.

Watch price closely as the ending diagonal matures. A strong bullish reaction could mark the start of a mid-term reversal phase.

📍 Drop your stock requests in the comments for quick technical updates only US stock assets will be analyzed under this post.

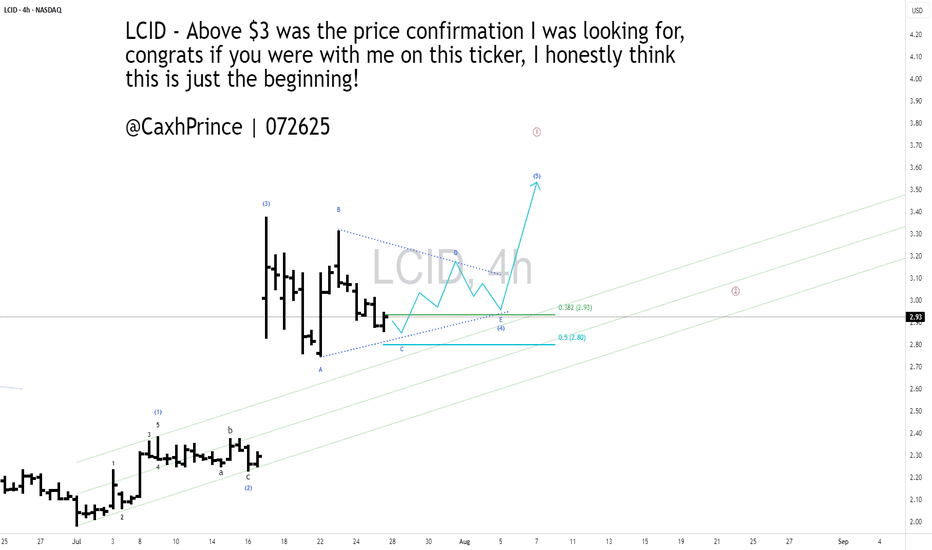

#LCID - 4HR [ A potential bullish view]Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

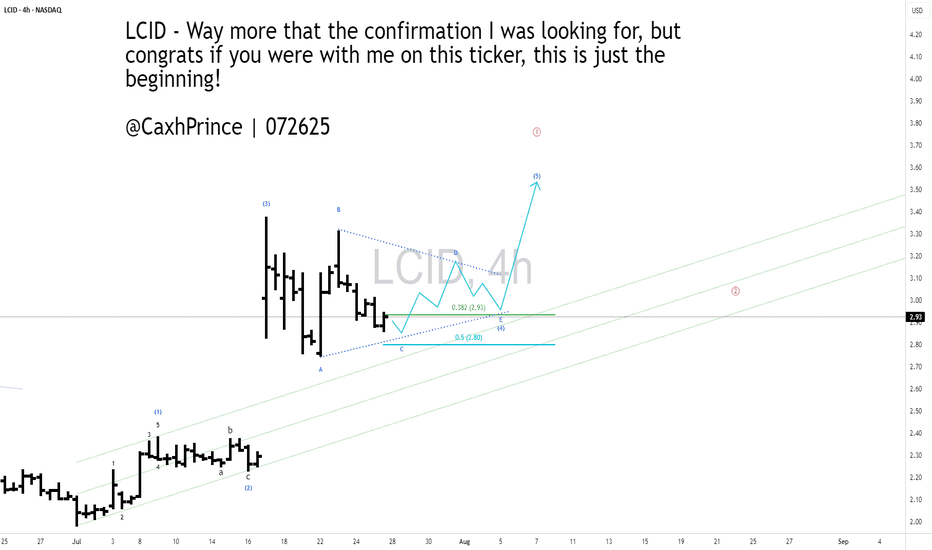

A 4HR Bullish view on #Lucid Motors ($LCID)Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

My thoughts on LCID-4HRLucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

Time for Lucid Group Inc. (LCID) – Short-Term Bullish --3.50 USDLucid Group Inc. (LCID) on the 4-hour chart is showing a moderately bullish structure, suggesting potential for continued short-term upside. After a period of consolidation and base-building, the price has broken above key moving averages (MA5, MA10, and MA30), which are now turning upward and beginning to act as dynamic support. This shift indicates improving technical sentiment. The nearest resistance is around the $3.08 level — a zone defined by previous swing highs. A confirmed breakout above this level could pave the way toward the next target around $3.50, which represents both a psychological threshold and a former supply zone.

Supporting this bullish outlook, momentum indicators (likely WaveTrend or Stochastic RSI) are signaling continued upside pressure without yet showing strong overbought conditions. However, caution is warranted: if the price gets rejected at the $3.08 resistance, a pullback toward the $2.70–$2.75 support area is possible. Holding that support would be crucial for maintaining the current higher-low structure. Overall, the technical setup favors a move toward $3.50, but it requires follow-through from buyers at key resistance levels.

Potential TP : 3.50 USD

LUCID going to benefit from recent policy changes Lucid is positioned to enjoy a short-term uplift from the policy change due to its EV-only model and lower volume compared to peers. However, its longer-term success depends on execution—scaling manufacturing, launching key new models, and moving toward profitability in a future without subsidies.

High probability bullish setup #lcidMultiple confluences are suggesting a potential bullish reversal:

A- Price is forming lower highs, while MACD is showing higher lows → bullish divergence

B- MACD crossover is forming, indicating strengthening momentum

C- Bollinger Bands are narrowing, suggesting a potential breakout

D- Support level is holding, confirmed by increased volume, indicating buyer interest

NASDAQ:LCID

Disclaimer: This is not financial advice. The information provided is for educational and informational purposes only. Trading stocks and other financial instruments involves significant risk and may not be suitable for all investors. Always do your own research and consult with a licensed financial advisor before making any trading decisions. Past performance is not indicative of future results.

Buy Idea for Lucid Group (LCID) • Current Price: $2.15

• Support level: $1.99

• Resistance level: $2.42 / $2.85

• Indicators:

• Bollinger Bands show a potential reversal from the lower band.

• MACD and momentum indicators are still weak but may show signs of convergence soon.

• Volume is picking up, which may support a short-term move.

Plan:

• Consider gradual buying around $2.15, with a tight stop-loss at $1.99 to limit downside risk.

• Initial target: $2.42, second target: $2.85.

⚠️ Note: This is a short-term technical idea based on the 4-hour chart. Always adjust your position size and risk level accordingly.

$LCID Future Growth Investors may adopt a bullish stance on Lucid Group Inc. (NASDAQ: LCID) due to substantial insider buying, particularly by the Public Investment Fund (PIF) of Saudi Arabia. In October 2024, PIF purchased approximately 396 million shares at $2.59 each, totaling over $1 billion. This significant acquisition increased PIF's holdings to more than 2.2 billion shares, representing a majority stake in the company .

Such large-scale insider purchases are often interpreted as a strong vote of confidence in a company's future prospects. PIF's continued investment suggests optimism about Lucid's strategic direction, including its expansion into the electric SUV market with the upcoming Gravity model and recent acquisitions aimed at enhancing production capabilities .

While other insiders have engaged in stock sales, these are relatively minor compared to PIF's investments. For instance, in August 2024, Eric Bach, Lucid's SVP of Product and Chief Engineer, sold approximately 90,000 shares for $282,000 . Overall, the scale of PIF's purchases indicates a bullish outlook on Lucid's long-term potential.

Sources: Insider Ownership and Buys (Public Investment Fund - PIF):

➤ SimplyWall.St - LCID Insider Ownership

➤ SEC Form 4 Data for LCID Insiders

Recent Insider Sale by Eric Bach (SVP of Product):

➤ SEC Form 4 - Eric Bach Insider Transaction

Lucid's Financial and Strategic Overview:

➤ Finviz - LCID Financial Overview & News

Safe Entry ZoneCurrently stock in down movement.

Has Two significate support level 1h Green Zone (most propaply will respected) and 4h Green Zone (Strongest Support Level) price targeting is the 1h Red Zone (Take Profit Line where you can secure profit) then for long term we got two P.High(Previous Hign) Lines which acts as Strong Resistance Levels MUST Be Respected and Watch-out for any selling Pressure to secure profit.

Note: Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

LCID - PULLBACK & ZOOMGood Morning,

LCID is showing some decent, DECENT Julien, bullish potential. Currently in a bullish wave form with some room to move up. Volume overall is good and the stock position healthy. If it can fully complete its bullish wave we could see some gains up to the 4.20$. We could expect a corrective wave after that action and if all supports hold another nice bullish run.

ENJOY!

LUCID showing possible move!I was looking at LUCID on the weekly chart. Its been on a downtrend since its IPO Merge with CCIV. Momentum indicators have been showing Divergence for more then 2 years. An it looks like Direction could be changing soon to the upside. If it doesn't rejects the RSI trendline it could breakout, An the MacD is also looking bullish as well an close to crossing the zero line. An with short interest at 29.54% it could be a interesting play if price picks up Momentum.

LCID upMVP system

Momentum: upward trend

Volume: significant increase

Price: looks like poss rounded bottom

The R/R here is pretty sweet. I want to play this - I’m watching for a possible dip below support w a recovery back above. The volume here is what interests me. If it does pop up, it could be impressive.

Thank you.