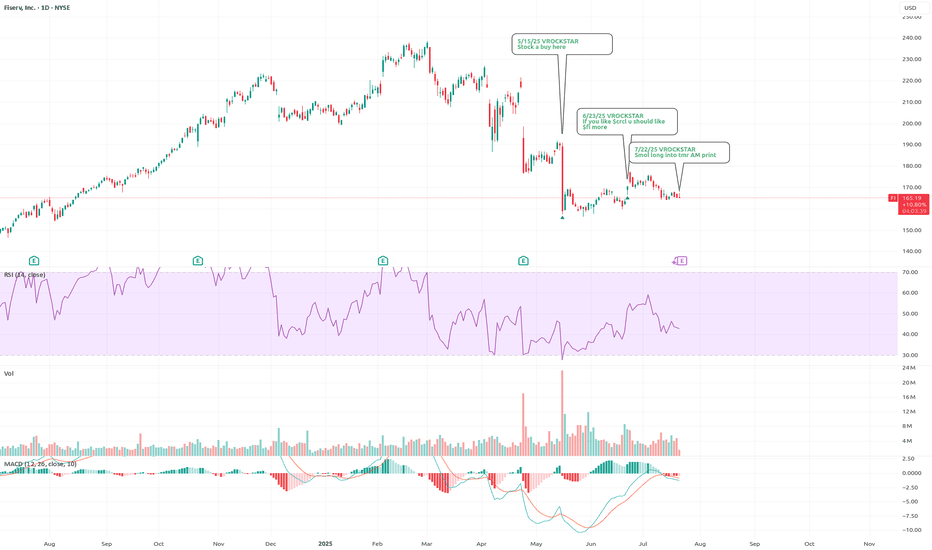

$FI Technical Outlook: Gradual Recovery with Key Support LevelsFI is currently moving slowly after a sharp decline triggered by ER. Technically, the stock appears to be well-supported by the MA20 and the 38.2% Fibonacci retracement level.

Despite the sluggish pace, the chart suggests a potential uptrend. In the first phase, I anticipate a move toward the $140

Key facts today

A class action lawsuit has been filed against Fiserv, Inc. on behalf of investors who allegedly suffered losses due to securities fraud occurring between July 24, 2024, and July 22, 2025.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.780 CHF

2.84 B CHF

18.58 B CHF

539.32 M

About Fiserv, Inc.

Sector

CEO

Michael P. Lyons

Website

Headquarters

Milwaukee

Founded

1984

ISIN

US3377381088

FIGI

BBG006TLPX35

Fiserv, Inc. engages in the provision of financial services technology. It operates through the Merchant and Financial segments. The Merchant segment offers commerce-enabling products and services including merchant acquiring and digital commerce and mobile payment services, and security and fraud protection, stored-value, and pay-by-bank solutions to companies of all sizes. The Financial segment provides products and services such as processing of customer loan and deposit accounts, digital payments, and card transactions to financial institutions and corporate and public sector clients. The company was founded by Leslie M. Muma and George D. Dalton on July 31, 1984 and is headquartered in Milwaukee, WI.

Related stocks

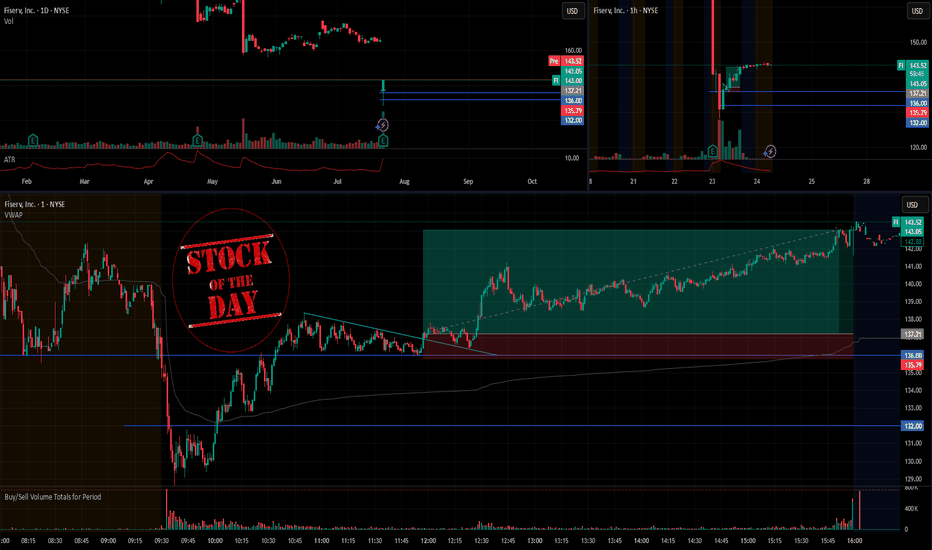

Stock Of The Day / 07.23.25 / FI07.23.2025 / NYSE:FI

Fundamentals. The earnings report exceeded expectations.

Technical analysis.

Daily chart: Downtrend

Premarket: Gap Down on increased volume. We mark the premarket low of 136.0

Trading session: The price did not continue the downward movement and formed an uptrend

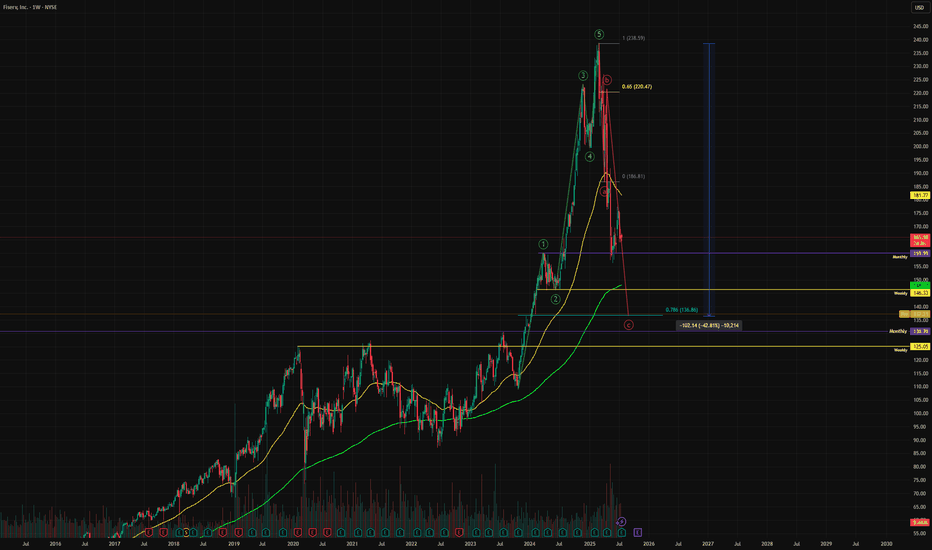

Fiserv Falling Knife TradeLooks like Fiserv is entering an area of interest. I will SLOWLY start an accumulation here between $125 - $136 for my first buy and looking to lower levels to add more aggressively.

A vicious ABC correction and we are currently sitting on on the 0.786 Fib. If this fails to hold, we have a monthly

7/22/25 - $fi - Smol long into tmr AM print7/22/25 :: VROCKSTAR :: NYSE:FI

Smol long into tmr AM print

- sub 20x PE and 2x peg (pf adj. for debt) is reasonable for mkt leader

- like the stable coin angle, think they really talk this up... as i've written about previously

- v "consumer" exposed (similar to how i wrote about NYSE:DECK ). i

FiservInsiders have sold $239 Million shares on MAY 29TH. We expect price to rally from these lows to visit the 50% Fib levels. This is a contrarian play as 4,024 Puts are in play which means more Bears are betting on a drop. This means a lot of Stop Loss orders are prime above the $170 level. This will b

6/23/25 - $fi - If you like $crcl u should like $fi more6/23/25 :: VROCKSTAR :: NYSE:FI

If you like NYSE:CRCL u should like NYSE:FI more

- all banks will have their own stable coins

- but for a player like FI what makes their launch so unique is that it can/ will likely be used for much more txn volume than any given bank based on their payments r

$FI bounce coming off 30% ATH drawdown $170 targetHello, NYSE:FI Fiserv evidently got hammered to the downside the last month and last few months the name is down 30% from it's all time high from March 2025 and last month and change it is down 25% or so after downgrades. I have been watching the name the last week or so and I was looking for a dr

DCA into $FI- NYSE:FI is big recognizable brand in Point of Sales. You might have seen clover handheld machines.

- I believe fundamentals on this blue chip company is getting cheap. I'm not going all in but have started DCA into this name.

- If it falls further 20-30 or even 40% I will be happy to DCA furt

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FISV5864177

Fiserv, Inc. 5.15% 12-AUG-2034Yield to maturity

—

Maturity date

Aug 12, 2034

FISV5548630

Fiserv, Inc. 5.45% 02-MAR-2028Yield to maturity

—

Maturity date

Mar 2, 2028

FISV5634579

Fiserv, Inc. 5.375% 21-AUG-2028Yield to maturity

—

Maturity date

Aug 21, 2028

FISV5634796

Fiserv, Inc. 5.625% 21-AUG-2033Yield to maturity

—

Maturity date

Aug 21, 2033

FISV4986756

Fiserv, Inc. 2.65% 01-JUN-2030Yield to maturity

—

Maturity date

Jun 1, 2030

FISV4845277

Fiserv, Inc. 3.2% 01-JUL-2026Yield to maturity

—

Maturity date

Jul 1, 2026

FISV5548631

Fiserv, Inc. 5.6% 02-MAR-2033Yield to maturity

—

Maturity date

Mar 2, 2033

FISV5761679

Fiserv, Inc. 5.45% 15-MAR-2034Yield to maturity

—

Maturity date

Mar 15, 2034

FISV5761677

Fiserv, Inc. 5.15% 15-MAR-2027Yield to maturity

—

Maturity date

Mar 15, 2027

FISV4986740

Fiserv, Inc. 2.25% 01-JUN-2027Yield to maturity

—

Maturity date

Jun 1, 2027

FISV4845279

Fiserv, Inc. 4.4% 01-JUL-2049Yield to maturity

—

Maturity date

Jul 1, 2049

See all FIV bonds

Curated watchlists where FIV is featured.

Frequently Asked Questions

The current price of FIV is 112.512 CHF — it has decreased by −1.86% in the past 24 hours. Watch Fiserv, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Fiserv, Inc. stocks are traded under the ticker FIV.

We've gathered analysts' opinions on Fiserv, Inc. future price: according to them, FIV price has a max estimate of 196.90 CHF and a min estimate of 100.87 CHF. Watch FIV chart and read a more detailed Fiserv, Inc. stock forecast: see what analysts think of Fiserv, Inc. and suggest that you do with its stocks.

FIV stock is 1.99% volatile and has beta coefficient of 0.38. Track Fiserv, Inc. stock price on the chart and check out the list of the most volatile stocks — is Fiserv, Inc. there?

Today Fiserv, Inc. has the market capitalization of 59.83 B, it has decreased by −15.97% over the last week.

Yes, you can track Fiserv, Inc. financials in yearly and quarterly reports right on TradingView.

Fiserv, Inc. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

FIV earnings for the last quarter are 1.96 CHF per share, whereas the estimation was 1.93 CHF resulting in a 1.44% surprise. The estimated earnings for the next quarter are 2.14 CHF per share. See more details about Fiserv, Inc. earnings.

Fiserv, Inc. revenue for the last quarter amounts to 4.12 B CHF, despite the estimated figure of 4.12 B CHF. In the next quarter, revenue is expected to reach 4.32 B CHF.

FIV net income for the last quarter is 814.03 M CHF, while the quarter before that showed 753.34 M CHF of net income which accounts for 8.06% change. Track more Fiserv, Inc. financial stats to get the full picture.

No, FIV doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 3, 2025, the company has 38 K employees. See our rating of the largest employees — is Fiserv, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Fiserv, Inc. EBITDA is 7.58 B CHF, and current EBITDA margin is 43.86%. See more stats in Fiserv, Inc. financial statements.

Like other stocks, FIV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Fiserv, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Fiserv, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Fiserv, Inc. stock shows the strong sell signal. See more of Fiserv, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.