HIVE / 4hNASDAQ:HIVE surged 9.6% intraday in an impulsive move, likely representing the third wave of an extension within Wave v(circled).

The developing extension in Minute fifth wave further strengthens the outlook for continued upside in Minor Wave 5, completing the final leg of the Leading Diagonal in Intermediate Wave (1).

📈 Wave Analysis

Since April 9, HIVE has been advancing in a five-wave overlapping structure, forming a Leading Diagonal in Intermediate Wave (1). This well-defined pattern likely represents the initial phase of a larger impulsive uptrend at the Primary degree.

Within this developing diagonal, a final advance of approximately 7% remains in play , unfolding as Minute Wave ⓥ of Minor Wave 5. This move is expected to complete the projected overall advance of about 42%.

🎯 The technical target remains intact near 2.80.

#CryptoStocks #HIVE #BTCMining #BitcoinMining #BTC #AI #HPC

NASDAQ:HIVE CRYPTOCAP:BTC GETTEX:HPC NYSE:AI MARKETSCOM:BITCOIN

HIVE trade ideas

HIVE / 4hNASDAQ:HIVE rose 8% intraday in an impulsive rise, extending Wave ⓥ slightly beyond its projected target. This move likely marked the final advance, registering an extreme high at 3.03. Minor Wave 5 — the last leg of the Leading Diagonal in Intermediate Wave (1) — now appears complete.

📈 🎬 Wave Analysis

Since April 9, NASDAQ:HIVE has formed a Leading Diagonal in Intermediate Wave (1), which should now be complete. This well-defined pattern likely marks the initial phase of a larger impulsive|underlying uptrend at the Primary degree.

📉📈🎬 Trend Analysis

A confirming pullback is expected to signal the trend change into Intermediate Wave (2) — a corrective phase likely unfolding toward key retracement levels over the coming months. This would precede an impulsive Intermediate Wave (3) within the broader underlying uptrend.

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC #BitcoinMining

NASDAQ:HIVE $Crypto $Stocks CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

HIVE / 4hAs anticipated in the prior analyses, NASDAQ:HIVE has declined by 14.5% after peaking at 3.07 in late August, completing the Leading Diagonal as Intermediate Wave (1) .

Wave Analysis

📈🎬 The Leading Diagonal in Intermediate Wave (1), as a potentially bullish and well-structured pattern, strengthens the case for an underlying Primary degree uptrend. An impulsive Wave (3) is anticipated in the coming months.

Trend Analysis

📉🎬 The trend reversal at the Intermediate degree is now confirmed.

A Minor Wave A is now unfolding toward the Fib retracement level of 0.382.

The entire correction in Intermediate Wave (2), which might be unfolding as an A–B–C sequence downward, is likely to continue into late October.

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC #BitcoinMining

NASDAQ:HIVE CRYPTOCAP:BTC BITSTAMP:BTCUSD NYSE:AI GETTEX:HPC

HIVE / 4hNASDAQ:HIVE continued its rise with a 4% intraday gain, further extending Minute Wave ⓥ. This move likely marks the final advance, registering an extreme high at 3.07. Minor Wave 5 — the final leg of the Leading Diagonal in Intermediate Wave (1) — now appears complete.

📈 🎬 Wave Analysis

Since April 9, NASDAQ:HIVE has formed a Leading Diagonal in Intermediate Wave (1), which should now be complete. This well-formed pattern likely marks the initial phase of a larger impulsive|underlying uptrend at the Primary degree.

📉📈 🎬 Trend Analysis

A confirming pullback is expected to signal the trend change into Intermediate Wave (2) — a corrective phase likely unfolding toward key retracement levels over the coming months. This would precede an impulsive Intermediate Wave (3) within the broader underlying uptrend.

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC #BitcoinMining #AI #HPC

NASDAQ:HIVE NYSE:AI GETTEX:HPC CRYPTOCAP:BTC BITSTAMP:BTCUSD

HIVE / 4hAs anticipated, NASDAQ:HIVE rose another 8% today in an impulsive surge, extending Wave ⓥ. This final advance appears to be approaching its extreme high , completing Minor Wave 5 as the last leg of the Leading Diagonal in Intermediate Wave (1).

📈 Wave Analysis

Since April 9, NASDAQ:HIVE has been advancing in a five-wave overlapping structure, forming a Leading Diagonal in Intermediate Wave (1). This well-defined pattern likely marks the initial phase of a larger impulsive uptrend at the Primary degree.

Within this leading diagonal, the final advance is now nearing completion, unfolding as Minute Wave ⓥ of Minor Wave 5. This impulsive leg is expected to complete the projected overall advance of approximately 50%.

🎯 The final target lies near 2.94.

NASDAQ:HIVE CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN $BitcoinMining $BTCMining

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC #BitcoinMining

HIVE / 4hAccording to the prior analysis (pinned in the profile on X), NASDAQ:HIVE surged 10% intraday in an impulsive rise and closed with an 8% gain above the Minor Wave 3 extreme high at 2.50 — confirming the leading diagonal in Intermediate Wave (1) as a valid structure. This breakout further reinforces the outlook for continued upside in Minor Wave 5, unfolding as the final advance of Intermediate Wave (1).

📈 Wave Analysis >> Since April 9, NASDAQ:HIVE has been advancing in a five-wave overlapping structure, forming a leading diagonal in Intermediate Wave (1). This well-formed pattern likely marks the early phase of a larger Primary-degree impulsive uptrend. Within this developing diagonal, an estimated 11% final advance remains in play in Minute Wave ⓥ of Minor Wave 5 — approaching the completion of the projected advance, which could total approximately 42%.

🎯 The technical target remains intact near 2.80.

NASDAQ:HIVE CRYPTOCAP:BTC GETTEX:HPC NYSE:AI MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

#CryptoStocks #HIVE #BTCMining #BitcoinMining #BTC #AI #HPC

HIVE? Crazy ideaWe had a greater flag stemming from 2023, and when we broke below it signaled lack of faith the market had in this company. Today we are shooting underneath into a new channel, hoping to align with what will be seen as a drawdown before stock pumps.

-----------------------------------------------

Fastforward today; balance sheet is clean

good exahash rate

positive outlook

one of the top BTC treasury holdings

non american (if thats a plus to you)

-----------------------------------------------

Currently I own 3000 shares of this stock and am selling covered calls to 3 dollars, converting the premium and theta into more shares.

My impression from the charts in front of me

Slow climb to 3 dollars prior to September earnings call

After we will see this ticker start to follow and trend along with BTC.

I hope to see growth in this company's holdings of BTC and I do not expect them to shed any more at this current time.

HIVE / 4hNASDAQ:HIVE continued to hold above the midline of its projected advance today, reinforcing bullish momentum within the current wave structure. A breakout above 2.50 would complete the leading diagonal as Intermediate Wave (1), potentially confirming the start of a broader bullish uptrend.

📈 Wave Analysis >> Since April 9, HIVE has been advancing in a five-wave overlapping structure, forming a leading diagonal in Intermediate Wave (1). This well-formed pattern likely marks the early phase of a larger Primary-degree impulsive move to the upside. Within this developing structure, Minor Wave 5 is currently in progress and approximately halfway through its projected advance, with the total move potentially reaching ~42%. With roughly 17% of that upside still in play, 🎯 the technical target lies near 2.80.

#CryptoStocks #HIVE #BTCMining #BitcoinMining #BTC #AI #HPC

NASDAQ:HIVE CRYPTOCAP:BTC GETTEX:HPC BITSTAMP:BTCUSD NYSE:AI MARKETSCOM:BITCOIN $BitcoinMining

HIVE / 4hNASDAQ:HIVE held above the midline of its projected advance today, reinforcing bullish momentum within the current wave structure. A surge above 2.50 would mark the structural completion of the leading diagonal as Intermediate Wave (1), potentially initiating a broader bullish uptrend.

📈 Wave Analysis >> Since April 9, NASDAQ:HIVE has been advancing in a five-wave overlapping structure, forming a leading diagonal in Intermediate Wave (1). This well-formed pattern likely marks the early phase of a larger Primary-degree impulsive move to the upside. Within this developing structure, Minor Wave 5 is currently in progress and approximately halfway through its projected advance, with the total move potentially reaching ~42%. With roughly 17% of that upside still in play, 🎯 the technical target lies near 2.80 .

#CryptoStocks #HIVE #BTCMining #BitcoinMining #BTC #AI #HPC

NASDAQ:HIVE CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

HIVE / 4hNASDAQ:HIVE surged 6.76% today, as anticipated — reinforcing confidence in the validity of the current wave structure. Only 19% of the projected advance in Minor Wave 5 remains, with the leading diagonal as Intermediate wave (1), nearing completion as a potential initiating leg of a broader bullish uptrend.

📈🎬 Wave Analysis >> Since April 9, NASDAQ:HIVE has been advancing in a five-wave overlapping structure, forming a Leading Diagonal in Intermediate Wave (1). This pattern likely marks the beginning of a larger Primary-degree impulsive move to the upside.

Within this developing structure, Minor Wave 5 is currently in progress and approximately halfway through its projected advance, with the total move potentially reaching ~42% . With roughly 19% of that upside still in play,

🎯 the technical target lies near 2.80 .

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC #AI #HPC

NASDAQ:HIVE CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

HIVE / 4hNASDAQ:HIVE rose by 3.7% today, as anticipated. Price volatility pushed slightly higher and held above the boundary of the Leading Diagonal—reinforcing confidence in the pattern’s validity.

Wave Analysis >> Since April 9, NASDAQ:HIVE has been advancing in a five-wave overlapping pattern, likely forming a Leading Diagonal as Intermediate wave (1). This structure marks the origin of a larger Primary-degree impulsive move to the upside.

Within this bullish formation, wave 5 appears to be in its early stages, potentially targeting a total advance of approximately 40%. With around 24% of that move still in play, the technical target lies near $2.77. This level aligns with key Fibonacci extensions and resistance zones, supporting a long-term bullish outlook— provided the lower boundary of the diagonal structure remains intact.

NASDAQ:HIVE CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC

HIVE / 4hNASDAQ:HIVE has been advancing since April 9 in a five-wave overlapping pattern, which appears to be forming a Leading Diagonal as Intermediate wave (1) of a larger Primary-degree impulsive structure to the upside.

Within this bullish formation, wave 5 is likely in its early stages, potentially targeting a ~40% total advance. With approximately 29% of this move still in play, the technical target lies near the $2.77 level. This aligns with key Fibonacci extensions and resistance zones, reinforcing the bullish outlook—provided the lower boundary of the diagonal structure holds.

NASDAQ:HIVE CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC

HIVE / 4hNASDAQ:HIVE has been advancing since April 9 in a five-wave overlapping sequence, unfolding as a Leading Diagonal in Intermediate wave (1).

Within this bullish structure, wave 5 may now be in the early stages of a potential 40% rise, with a technical target near 2.77.

NASDAQ:HIVE CRYPTOCAP:BTC MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC

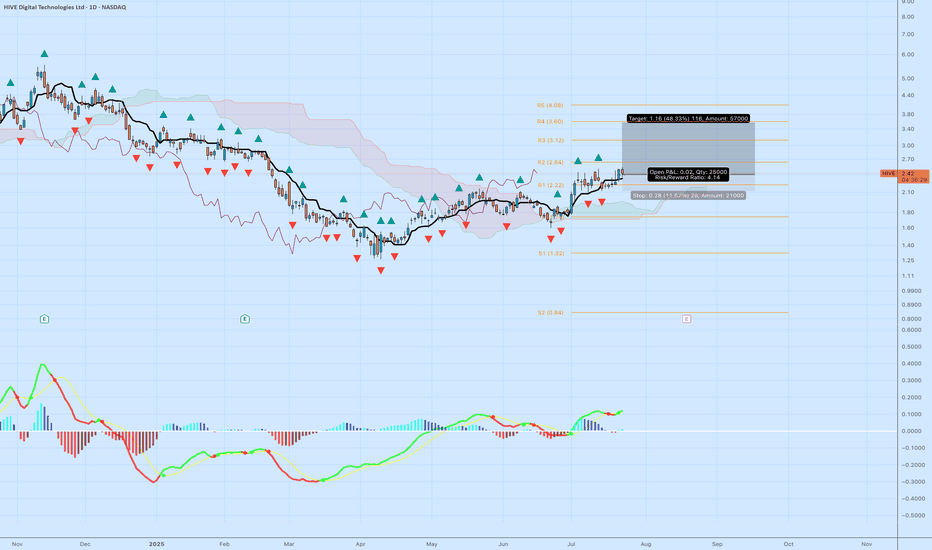

HIVE – Bullish Breakout Above Cloud with MACD and Fractal HIVE Digital Technologies ( NASDAQ:HIVE ) is showing a textbook trend reversal after months of basing. Price action has cleared the Ichimoku cloud with conviction, printing a bullish MACD signal and confirming structure with repeated fractal support.

Setup Breakdown:

Price above cloud and holding above R1 pivot (2.22)

Bullish MACD crossover with rising histogram and momentum curve

Multiple bullish fractals printed from the consolidation base

Entry off the breakout with clean support structure below

Target near R3 at 3.12 offers 48%+ upside with defined risk

Trade Details:

• Entry: $2.42

• Stop: $2.14

• Target: $3.58

• Risk/Reward: 4.14

• Quantity: 25,000 shares

This breakout lines up with broader crypto strength and interest in blockchain infrastructure. HIVE is well-positioned as a data center and digital asset play with rising institutional attention.

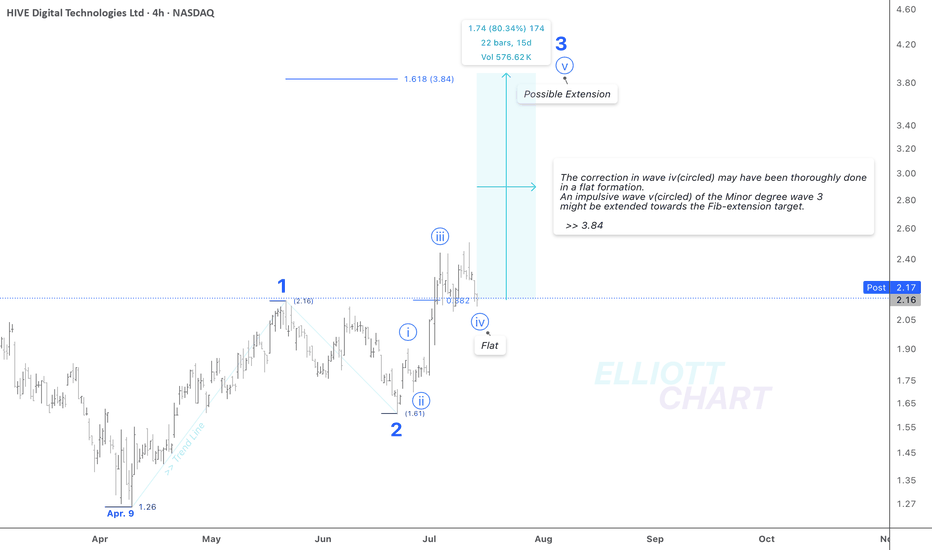

HIVE / 4hAccording to the prior analysis, NASDAQ:HIVE may have developed a sequence of Minor degree waves since April 9, in which both waves 1 and 2 were completed, and impulsive wave 3 remains in progress.

Wave Analysis >> After an anticipated flat correction of wave iv (circled), the following impulsive wave v(circled) of Minor degree wave 3 might extend by 80% towards the Fib-extension target >> 3.84

NASDAQ:HIVE CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC

HIVE / 4hAccording to the prior analysis, NASDAQ:HIVE may have developed a sequence of Minor degree waves, in which the waves of 1 and 2 both were completed, and impulse 3 has remained in progress.

Wave Analysis >> The correction in wave iv (circled) may have been thoroughly done in a flat formation. An impulsive wave v(circled) of the Minor degree wave 3 might be extended towards the Fib-extension target >> 3.84

NASDAQ:HIVE CRYPTOCAP:BTC MARKETSCOM:BITCOIN

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC

$HIVE / 4hAs depicted in the 4h-frame above, NASDAQ:HIVE may have developed a sequence of Minor degree waves upward >> 1, 2, and an impulse 3, which remains in progress, since April 9.

Wave Analysis >> After completion of the ongoing correction in wave iv(circled), an impulsive wave v(circled) of the Minor degree wave 3 might be to 80% extended towards the Fib-extension target >> 3.84.

#CryptoStocks #HIVE #BTCMining #Bitcoin #BTC

NASDAQ:HIVE CRYPTOCAP:BTC MARKETSCOM:BITCOIN

HIVE – Trade Setup - short pain for long gainz Short term risks for long term gainzzz

3h,4h and daily charts indicate heavy oversold conditions which make this a good opppr for the contrarian play, to target $3 levels for a 30% upside.

However we need to reclaim key levels of support first….

🔹 **Trade Direction:** Short (Bearish)

🔹 **Entry:** ~$2.05

🔹 **Stop Loss:** $2.25 (above recent resistance)

🔹 **Target 1:** $1.85 (previous demand zone)

🔹 **Target 2:** $1.60 (key psychological level)

📊 **Probability & Justification:**

- **Momentum:** Strong bearish momentum with lower highs and lower lows.

- **Indicators:** Oversold conditions on stochastic RSI but no bullish divergence yet.

- **Moving Averages:** Price below 50 & 200 EMA, confirming a downtrend.

- **Volume Profile:** Increasing sell pressure suggests further downside.

⚠️ **Risk Considerations:**

- Oversold bounce possible; manage risk accordingly.

- Potential support at $1.85 – monitor reaction before holding further.

📉 **Bias:** Bearish unless price reclaims $2.25+ with volume.

$HIVE Short Term Swing FormationsNASDAQ:HIVE in a critical spot to watch to determine market direction after significant period of consolidation.

Looking for break below blue trendline to invalidate.

Looking for convincing vol to break $4.20-$4.70 resistance and test of purple trendline for breakout.

You see head and shoulders breakdown, I see quick $$Algo vs. head and shoulders smackdown -- who's gonna win? (said in my most bobastic sounding voice) To be honest, both COULD be right. I can win short term and the breakdown could be real.

Uptrend line from the May low is still intact and I always listen to my algo on the miners because the wins are usually fat compared to others, plus it has already corrected 40% and Bitcoin hasn't. While the miners are always leveraged plays on bitcoin in both directions, 40% seems extreme to me.

I traded it during the March-May 50% correction and made money then, so entering after a 40% drop already happened makes this a much higher probability trade. I may cut it loose early if I can get a big win before the end of the day on Monday, though.

Per my usual strategy, as long as the position is open, I'll add to my position at the close on any day it still rates as a “buy” and I will use FPC (first profitable close) to exit any lot on the day it closes at any profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.