9/16/25 - $ionq - max short, gl 2 all9/16/25 :: VROCKSTAR :: NYSE:IONQ

max short, gl 2 all

- doesn't have a useful product

- continues to acquire companies by diluting you

- mgmt is dumping shares while unethically (at best) pumping their own shares on live TV

- no cash flow for 5 years

- all i can say is... been there... done that...

- gl to all.

- stock is probably worth $10-15 at most.

- trade it, have fun. but owing it here is financial suicide. don't tell yourself "nobody understands" unless you can look yourself in the mirror and honestly tell yourself "i do". let's be real - even the CEO knows this thing is headed way. way. lower.

V

Trade ideas

Why IonQ (IONQ) Could Be the NVDA of Quantum ComputingIf you haven`t bought IONQ before the rally:

Now you need to know that IonQ isn’t just another speculative quantum stock — The company is building a robust ecosystem around its best‑in‑class trapped‑ion architecture and targeting fault‑tolerant, networked quantum systems. With record bookings, major acquisitions, and a strong balance sheet, IonQ could emerge as the NVIDIA equivalent for quantum infrastructure.

Key Bullish Arguments

1) Superior Quantum Tech – Trapped‑Ion Advantage

IonQ’s trapped-ion processors boast 99.9% two-qubit fidelity, demonstrating higher accuracy and scalability than superconducting alternatives

These systems also operate at room temperature, meaning simpler deployment and lower costs

2) Ecosystem Strategy & Acquisitions

The $1.08B acquisition of Oxford Ionics (expected close in 2025) expands IonQ’s qubit control tech, pushing toward planned 80,000 logical‑qubit systems by decade’s end

Combined with ID Quantique and Lightsynq, IonQ is building a full-stack quantum and networking offering

3) Strong Revenue Growth & Cash Runway

Revenue soared from $22M in 2023 to $43.1M in 2024, with bookings of $95.6M

. Q1 2025 saw $7.6M revenue and EPS –$0.14, beating expectations; cash reserves near $697M provide years of runway

4) Real Commercial Deployments

IonQ sold its Forte Enterprise quantum system to EPB ($22M deal) for hybrid compute and networking, marking real-world commercial applications

5) AI & Quantum Synergy

Involvement in NVIDIA’s Quantum Day and hybrid quantum‑classical AI demos (e.g., blood pump simulation with Ansys, ~12 % faster) indicates strategic synergy and positions IonQ as a critical piece in the future AI stack

Recent Catalysts:

Texas Quantum Initiative passes – positions IonQ at forefront of U.S. state-backed innovation

Oxford Ionics acquisition pending – major expansion in qubit scale & tech

Barron’s analyst buys – industry analysts see long-term potential; IonQ among top quantum picks

Broader quantum optimism – McKinsey & Morgan Stanley forecasts highlight synergy between quantum and AI, benefiting IonQ

IONQ — trend breakout and growth potentialIonQ shares have consolidated above the 47–50 zone and successfully broke the trendline, opening the way for further upside. The first target is set around 120, and if buying pressure continues, the price could extend toward 200. Key support levels are at 47–48 and 36, providing attractive accumulation zones.

From a fundamental perspective, the quantum computing sector is gaining momentum, and IonQ remains one of its leading players. Increasing demand for innovative technologies may support the continuation of the bullish trend in the medium term.

A stock you buy and forget — the longer you hold, the more you earn.

IONQ 's Ascending Triangle Breakout!IONQ has completed a prolonged consolidation phase, forming a textbook ascending triangle with a flat resistance ceiling at $48 and steadily rising higher lows. This structure represents clear accumulation pressure, with buyers consistently stepping in at higher price points.

Breakout Confirmation:

The stock has now broken above the $48 resistance with a surge in volume, validating the bullish breakout. This is a strong technical signal that the next leg higher has begun, rather than a false move.

Target Zones:

Measured move target (triangle projection): $80–82

Intermediate resistance: $98–109 (psychological and technical zones)

Extended target: $130–135 (171% projection, aligning with long-term triangle objective)

Risk Management:

The $48 breakout zone now acts as a critical support level. A sustained close below would negate the bullish breakout and suggest a failed pattern. As long as price remains above $48, momentum favors higher levels.

Volume & Momentum:

The recent volume spike at breakout confirms institutional participation. This is crucial, as breakouts from long consolidations often trigger strong trending moves when backed by volume.

Macro/Sector Context:

IONQ remains a flagship in quantum computing. The sector continues to benefit from rising AI + high-performance computing investments, making IONQ a key proxy for investor sentiment in the space. A breakout here could attract even more capital inflows into quantum plays.

✅ Conclusion:

IONQ’s breakout above $48 confirms the end of its consolidation and the start of a new bullish cycle. With well-defined support and multiple upside targets ( $80 → $100+ → $130), the risk/reward profile remains highly favorable. As long as the breakout level holds, the chart supports a multi-leg rally with significant upside potential.

IONQ long (early alert)IONQ weekly: tight range for almost two months. Have a feeling last week's candle was a reversal. Nothing is perfect on this, yet: the hammer reversal candle is red, MACD is not constructive, RSI and Williams% are both MEH. But I think today's AMD/IBM announcement will revalidate quantum plays. If IONQ can take out the volume shelf around 41ish, another 10% move (+) higher is likely. Looks like limited downside in the pattern...

IonQ - Bullish break above likelyNYSE:IONQ is likely to break to the upside as the stock has broken out of the corrective descending channel/flag and resistance gap has been tested multiple times and it is likely to be weaken. Momentum is flat over the long-term but mid-term stochastic and 23-period ROC has risen. Target is looking at 65.00

IonQ (IONQ) — Quantum Leader Targeting 8,000 Logical QubitsCompany Overview:

IonQ, Inc. NYSE:IONQ is a quantum computing pioneer using trapped-ion technology to solve problems beyond the reach of classical systems, offering investors exposure to the fast-growing quantum sector.

Key Catalysts:

Quantum communications expansion: Strategic acquisitions (e.g., Capella Space) and investments in quantum networking aim to build a future quantum internet.

Talent & execution strength: High-profile hires like Dr. Marco Pistoia (ex-JPMorgan) and Dr. Rick Muller (ex-IARPA) enhance R&D capabilities.

Long-term roadmap: Goal of 8,000 logical qubits by 2030, a milestone that could cement its competitive edge and drive adoption of practical quantum applications.

Investment Outlook:

Bullish above: $35.00–$36.00

Upside target: $80.00–$82.00, supported by tech milestones, strategic expansion, and top-tier talent.

#IONQ #QuantumComputing #Innovation #AI #QuantumInternet #Investing #TechGrowth

IonQ Inc. (IONQ), NYSE, (W)- cup-like structureThe stock is forming a rounding base (cup-like structure) after a corrective phase.

Price is consolidating below the major resistance zone at $48.66.

A breakout above this zone can trigger strong upward momentum.

Key Levels

Support Levels:

$42.35 (immediate pivot)

$36.05 (major support, must hold)

Resistance / Target Levels:

$48.66 (immediate breakout level)

$54.96

$61.26

$67.57

Volume Analysis

Volumes spiked on earlier rallies (May–June 2025), showing institutional interest.

Current consolidation shows low-to-medium volumes → suggests preparation for a breakout.

Bias : Bullish on breakout — IonQ is building a base below $48.66. A confirmed breakout could take it into the $55–67 zone in the medium term.

⚠️ Disclaimer: This chart is for educational purposes only.

Regulatory Note: We are an independent development team. Our services are not registered or licensed by any regulatory body in India, the U.S., the U.K., or any global financial authority. Please consult a licensed advisor before making trading decisions

9/4/25 - $ionq - the HFSP stock9/4/25 :: VROCKSTAR :: NYSE:IONQ

the HFSP stock

- in a world where owning co's growing deep DD's and earning better than LT rates FCF growing at this rate and sub 30x PE is hard enough

- enter... $IONQ... everyone's favorite qwandem stonk

- i present to you 12B of enterprise value

- what do you get behind that lovely qwandum curtain of shame?

- 40x sales in 2027

- but they're profitable right, Bob?

- acktshually... (know your meme)

- it burns *only* a couple hundred million bucks of cash

- mm k

- well. anything's possible in your head. but there's an imagination and then there's reality. HFSP buying this. your favorite X personality won't tell you the truth, but that's why you have V.

sincerely yours asking you to take another look and make sure you know exactly why you own this besides "chart" and "gonna do X". have a real thesis. if you don't know your edge, you don't have an edge. remember that.

V

IONQ - Where we are ? Will continue to Trend?Hello Everyone,

My second re-analysis for today is IONQ Quantum.

You can access / see my previous anaylsis here:

As you can see in the Chart , support level was worked again and it got in back insede the Trend channel. This level is important and if this level is broken then we can see 32-33 .

If it achive to break 41.60 and stay above this level , i beleive that new target is 48.

Next week i will watch if it can stay in the trend channel or not then i will increase my positions.

My feeling is trend is still UP and it will continue pricing in Trend Channel. But of course you need to manage risk and watch the support level.

Actually i am investing Quantum computing stocks for future and i am not fully interesting fluctuations, this is my strategy and i am ready to take this Risk.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday to all.

IONQ Pullback Play !📉

📌 Setup: Rising wedge near resistance — potential reversal short opportunity.

📍 Entry: Short below $44.20 (break below yellow support & trendline).

🛑 Stop-Loss: $45.66 (above recent high / wedge top).

🎯 Target 1 (T1): $43.15 – first support zone.

🎯 Target 2 (T2): $42.61 – deeper support if selling accelerates.

IONQ Earnings Call Play – High-Risk, High-Reward Setup

## 🚀 IONQ Earnings Call Play – High-Risk, High-Reward Setup (Aug 6)

**Quantum Alert: Will IonQ Surprise After Amazon Stake News?**

### 💡 Core Thesis:

Despite weak historical execution, **analysts are turning bullish** on IONQ ahead of earnings—backed by **strong sector sentiment, elevated options activity, and macro tailwinds** in tech.

---

### 🧠 Earnings Breakdown

| Metric | Status | Insight |

| -------------------- | ------------ | ----------------------------------------- |

| 📉 Revenue Growth | -0.2% | Flat growth in a high-expectation sector. |

| 🔥 Gross Margin | 50.7% | Solid base for future profitability. |

| ❌ Surprise Avg. | -38% | Historical underperformance. |

| 💬 Analyst Consensus | ⭐ Strong Buy | Amazon’s recent stake boosts sentiment. |

🧮 **Fundamental Score**: 5/10

⚠️ Weak execution vs. strong institutional interest.

---

### 🔍 Options Flow Snapshot

* 💥 **Bullish Divergence** on Calls (especially \$45.00 strike)

* 📈 Elevated IV (Rank 0.75)

* 🔀 High OI on both calls/puts suggests hedged anticipation

* 📊 Expected Move: \~8%

📊 **Options Flow Score**: 7/10

🚨 Smart money leaning **bullish**, but cautious.

---

### 📈 Technical Landscape

* 💤 Low volume pre-earnings

* 🧍 Hovering near support (\~\$40)

* 🚧 Resistance: \$43.55

* ⚠️ No strong trend detected

📉 **Technical Score**: 4/10

🧊 Cold tape, needs a catalyst to ignite.

---

### 🌐 Macro & Sector Context

* 💡 Quantum computing getting big headlines

* 🛒 Tech rotation underway

* 💰 Government & institutional support growing

🌍 **Macro Score**: 7/10

📢 Sector momentum can carry IONQ, if earnings surprise.

---

### 🔐 Trade Setup (Options Play)

| 🎯 Strategy | Long Call |

| --------------- | --------- |

| 📌 Strike | \$45.00 |

| 📆 Expiry | Aug 08 |

| 💵 Entry | \$0.98 |

| 🏁 Target | \$2.94 |

| 🛑 Stop Loss | \$0.49 |

| ⚖️ Risk\:Reward | 1:3 |

| 📈 Confidence | 66% |

📊 **Expected Move**: ±8.0%

📈 **IV Rank**: 0.75

🕰 **Timing**: Enter before close on Aug 6

📆 **Earnings Report**: Aug 6 (AMC)

---

### 📉 Exit Strategy:

* 🎯 **Profit Target**: \$2.94

* 🛑 **Stop Loss**: \$0.49

* ⏱ **Time Exit**: Close position within 2 hours post-earnings if no movement

---

### ⚠️ Bottom Line:

> **This is a speculative, high-volatility earnings trade** with asymmetric upside potential. Analyst upgrades and the Amazon effect provide tailwinds—but historical miss rate is real. Trade small, trade smart.

Safe Entry IONQGreen Zone is Safe Entry.

Stop loss below Green Zone (or blue line both are supports with 200MA below too).

Red Zone is Sell.

Note: each line(E.g. blue lines) acts as Strong Support/Resistance.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

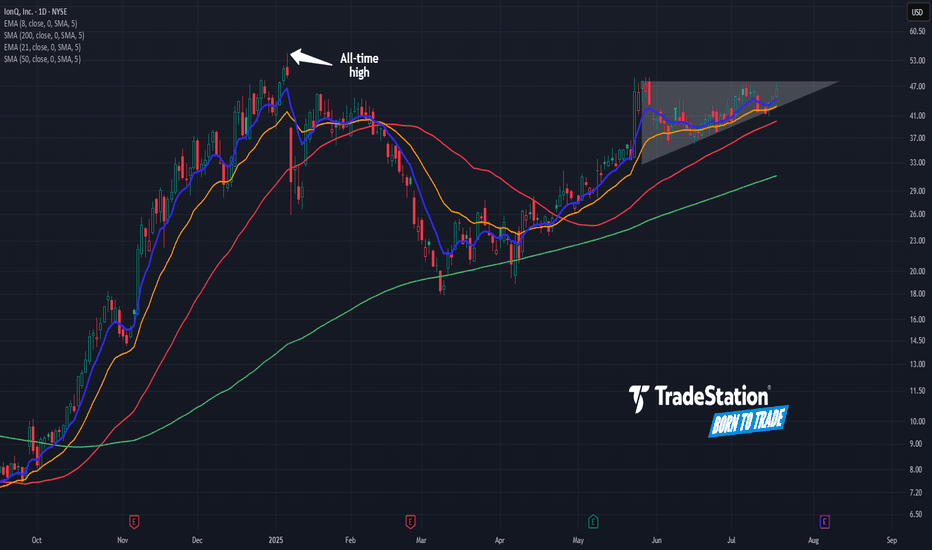

IonQ: Potential Continuation Pattern IonQ had a big surge in late 2024, and now some traders may see potential for continuation to the upside.

The first pattern on today’s chart is May 27's closing price of $48.04. IONQ has made a series of higher lows while remaining below that level, which may be viewed as a bullish ascending triangle.

Second, prices are near the all-time high of $54.74 in January. Could the stock be coiling for a move into new territory?

Third, IONQ is above its rising 50- and 200-day simple moving averages. That may be consistent with a longer-term uptrend.

Fourth, the 8-day exponential moving average (EMA) is above the 21-day EMA. That may be consistent with a short-term uptrend.

Next, IONQ is a fast-growing player in the emerging field of quantum computing. Given the overall focus on technology and increased competition with China, some investors may view the stock as a means to participate in the trend.

Finally, IONQ is an active underlier in the options market. (It’s averaged about 100,000 contracts per session over the last month, according to TradeStation data.) That may help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

NSE IONQ - Are we ready for a breakout?The corrective phase is complete and an impulse move appears likely. A strong buy above the A-B-C channel could target levels around 30 - 37 - 45 or higher. Good entry is possible above 26. However, if conditions worsen, further corrections may ensue.

I will update further information soon.

$IONQ – Breakout Watch at $48 After Months of ConsolidationNYSE:IONQ has been basing since January, quietly marinating under the $48 level — and now we’re approaching the trigger zone. Technically, it’s a great setup. But context is everything.

🔹 The Setup

Multi-month base under $48 — a breakout above that level could release serious energy.

The structure is clean, and the volume profile is tightening — signs that something is brewing.

🔹 My Concerns (Let’s Keep It Real):

Price action has been weak — this stock hasn’t traded clean lately.

Late-cycle behavior: Even A+ setups have been failing lately — breakouts aren’t sticking like they should.

Market conditions matter: I need to see risk-on confirmation from NASDAQ:QQQ , AMEX:IWM , CRYPTOCAP:BTC , and crypto names before trusting this breakout.

🔹 My Trade Plan:

1️⃣ No Anticipation Here: Only trading this on A+ intraday setup — strong volume, clean trigger through $48.

2️⃣ Risk Control: Tight stop — can’t give it room in this tape.

3️⃣ Market Check: I want to see risk-on flows:

✅ NASDAQ:QQQ strong

✅ AMEX:IWM green

✅ CRYPTOCAP:BTC & crypto names moving

✅ Speculative names showing juice

Why I’m Watching It Anyway:

Long base = stored energy

If the market flips risk-on and NYSE:IONQ catches a bid, this could move fast

But patience is key — not every setup needs to be taken

IONQ | Price PredictionI bought NYSE:IONQ last year for $7 because of the "Fair Price" algorithm. But I sold it already for $41. Based on the my platform's feature "Price Predictions" we still have the key level "Bullish" and even "Extra", which is risky one.

IONQ still has a lot of interest, but to be honest I see some red flags. But... I don't know the future. Hope that levels will help you a lot!

Safe Entry Zone IONQStock Movement Up.

1H Green Zone is Safe Entry Zone.

Blue Lines Are Previous Highs Consider As Good Resistances.

Red Zone is Strongest Resistance.

Watch out for any selling pressure and reversal candles at these Resistances to Secure Profit

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 1H TF when Marubozu/PinBar Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

Safe Entry Zone IONQQuantum Stocks currently forever ranging free money.

Since Green Zone been re-tested its weaker now but it consider to be good entry Zone for now.

We Only Wait for Buyers to Step-in because its weaker zone now not like first time.

Take Profit Lines is where you secure your profit.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

IONQ - what can it do for you?Don't ask me what I can do for you. What can you do for me? A ticker like IONQ can set you free if you buy and let it be.

We will be in fresh all-time highs soon, and this next part of the chart is called "inverse right leg" of the overall "inverse head and shoulder". The inverse right leg is always the longest bullish run you get with any chart shape. It comes after the inverse right shoulder, which propels the price upward. There are technical targets, but with such a short chart history, it's hard to tell how high it can go.

Stick around and find out. My people already have targets.

Beautiful textbook breakout by IONQIONQ has become quite the stock with a personality recently. Massive percentage swings from key level to key level occur regularly and fast. The stock seems to rush to its most logical target with no time to spare. I've personally been watching this stock very closely since the CEO hype breakout after jumping ship from QBTS. I've seen beautiful head and shoulders plays on this stock, as well as flawless pennant breakouts and liquidity sweeps. Let's hope the dark cloud of world war and insider selling doesnt punish this stock too hard.. happy trading folks. My target for this stock is $44