ONEOK, Inc. (OKE)Company Overview

ONEOK, Inc. is one of the largest U.S. operators of midstream energy infrastructure, with assets spanning natural gas gathering, transportation, processing, and storage, as well as oil and petroleum product pipelines and storage. Founded in 1906, the company is headquartered in Tul

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.080 CHF

2.76 B CHF

19.65 B CHF

628.56 M

About ONEOK, Inc.

Sector

Industry

CEO

Pierce H. Norton

Website

Headquarters

Tulsa

Founded

1906

ISIN

US6826801036

FIGI

BBG00LVF2128

ONEOK, Inc. engages in gathering, processing, fractionating, transporting, storing and marketing of natural gas. It operates through the following segments: Natural Gas Gathering and Processing, Natural Gas Liquids and Natural Gas Pipelines. The Natural Gas Gathering and Processing segment offers midstream services to producers in North Dakota, Montana, Wyoming, Kansas and Oklahoma. The Natural Gas Liquids segment owns and operates facilities that gather, fractionate, treat and distribute NGLs and store NGL products, in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region, which includes the Williston, Powder River and DJ Basins, where it provides midstream services to producers of NGLs and deliver those products to the two market centers, one in the Mid-Continent in Conway, Kansas and the other in the Gulf Coast in Mont Belvieu, Texas. The Natural Gas Pipelines segment provides transportation and storage services to end users. The company was founded in 1906 and is headquartered in Tulsa, OK.

Related stocks

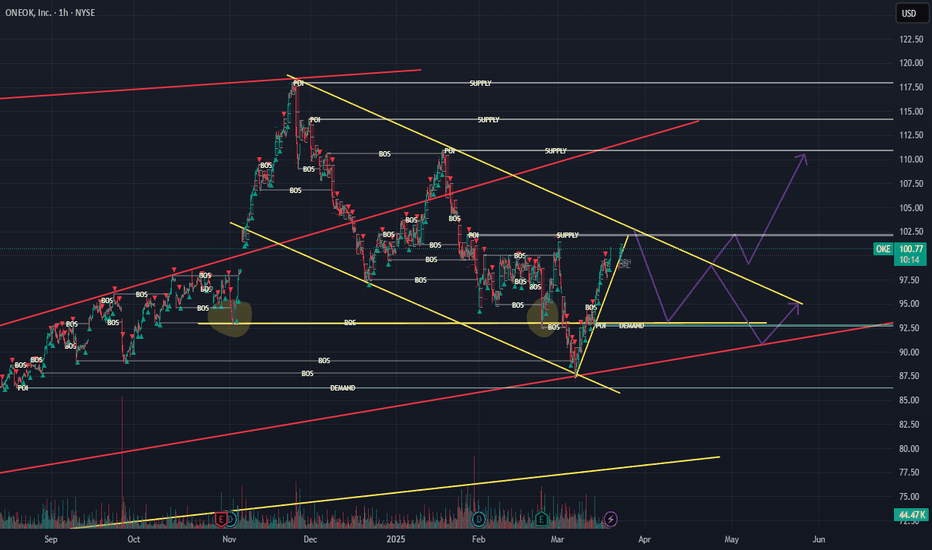

OKE Recovery in ProgressThe news cycle pushed the stock much lower than anticipated but seems to have recovered. Moving forward we can expect 2 scenarios with the stock price retesting long term trendlines or a continued rally fueled by increasing gas prices and Fed interest rate cuts.

The chart shows, in my opinion, 2 p

$OKE demonstrates solid long-term technical strength Technical Analysis

As of February 28, 2025, ONEOK Inc. (NYSE: OKE) is trading at $100.39. The stock has shown a bullish trend in the long term, while the short-term trend appears bearish. Key support levels are identified at $95.81 and $93.97, with resistance around $102.90.

The Relative Strengt

OKE: testing support?A price action below 69.00 supports a bearish trend direction.

Expect further downside potential for a break below 68.00.

The downside target price is set at 66.00 (just below its 50% Fibonacci retracement level).

The stop-loss price is set at 72.00.

Testing major support (see the black dotted trend

ONEOK STOCK ANALYSISONEOK, Inc. engages in gathering, processing, fractionating, transporting, storing and marketing of natural gas. It operates through the following segments: Natural Gas Gathering and Processing, Natural Gas Liquids and Natural Gas Pipelines. The Natural Gas Gathering and Processing segment offers mi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ENLC4107236

EnLink Midstream Partners, L.P. 5.6% 01-APR-2044Yield to maturity

6.52%

Maturity date

Apr 1, 2044

ENLC4492787

EnLink Midstream Partners, L.P. 5.45% 01-JUN-2047Yield to maturity

6.40%

Maturity date

Jun 1, 2047

See all ONK bonds

Curated watchlists where ONK is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of ONK is 73.218 CHF — it has decreased by −18.84% in the past 24 hours. Watch ONEOK, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange ONEOK, Inc. stocks are traded under the ticker ONK.

We've gathered analysts' opinions on ONEOK, Inc. future price: according to them, ONK price has a max estimate of 91.26 CHF and a min estimate of 65.64 CHF. Watch ONK chart and read a more detailed ONEOK, Inc. stock forecast: see what analysts think of ONEOK, Inc. and suggest that you do with its stocks.

ONK stock is 23.22% volatile and has beta coefficient of 1.04. Track ONEOK, Inc. stock price on the chart and check out the list of the most volatile stocks — is ONEOK, Inc. there?

Today ONEOK, Inc. has the market capitalization of 37.25 B, it has increased by 9.64% over the last week.

Yes, you can track ONEOK, Inc. financials in yearly and quarterly reports right on TradingView.

ONEOK, Inc. is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

ONK earnings for the last quarter are 1.06 CHF per share, whereas the estimation was 1.06 CHF resulting in a 0.56% surprise. The estimated earnings for the next quarter are 1.18 CHF per share. See more details about ONEOK, Inc. earnings.

ONEOK, Inc. revenue for the last quarter amounts to 6.26 B CHF, despite the estimated figure of 6.10 B CHF. In the next quarter, revenue is expected to reach 6.40 B CHF.

ONK net income for the last quarter is 667.25 M CHF, while the quarter before that showed 563.02 M CHF of net income which accounts for 18.51% change. Track more ONEOK, Inc. financial stats to get the full picture.

Yes, ONK dividends are paid quarterly. The last dividend per share was 0.83 CHF. As of today, Dividend Yield (TTM)% is 5.52%. Tracking ONEOK, Inc. dividends might help you take more informed decisions.

ONEOK, Inc. dividend yield was 3.94% in 2024, and payout ratio reached 76.55%. The year before the numbers were 5.44% and 69.76% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 28, 2025, the company has 5.18 K employees. See our rating of the largest employees — is ONEOK, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ONEOK, Inc. EBITDA is 5.43 B CHF, and current EBITDA margin is 28.45%. See more stats in ONEOK, Inc. financial statements.

Like other stocks, ONK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ONEOK, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ONEOK, Inc. technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ONEOK, Inc. stock shows the strong sell signal. See more of ONEOK, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.