WYR trade ideas

WYNN - 25.41% Potential Profit - Corridor BreakoutCorridor Breakout graduating from a 2-month correction period. Note that vaccine-related news might make or break this trade, this is why I keep the stop loss fairly tight. However, I feel positive given today's news and the upside could be massive.

Target price set at a new potential resistance line.

- 3-month uptrend followed by a 2 month correction period that might be over amid positive vaccine news

- RSI + Stoch well above 50

- MACD above Signal.

Suggested Entry $86.84

Suggested Stop Loss $84.59

Target price $110.86

Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss.

ABC Bullish Falling WedgeThis one is tough for me to post because it has been all over the place price wise!

This stock has had the flu for a long, long time.

My stop would be below 67.5 WYNN does not seem to be going lower than that

The chart is bullish from what I see. Break out is 74.5 but has been there and done that before, and did not break out

WYNN is also in a falling wedge. It has not broken the upper trend line of that wedge but seems to be trying. Falling wedges can be bullish if the stock breaks up and out of it

I did notice on Chartmill that there has been large player interest in hotels like HLT

It was hard to post targets 1. So Targets 2 are even harder, but are 160 to 185.5. Just seems hard to believe right now. I am having issues pressing the long button on this one..lol But with a clear break out over 74.5 or I may even look at buying this closer to the bottom trendline of falling wedge at 68 to 70ish. I will see what Monday brings. This one whare I may buy a small amount to begin with. But the flu can not last forever..or can it?

The only thing that never changes is Change

WYNN - Nearing Bottom of Short Term Channel - Potential BuyMoved though red cloud on the 1hr and 2hr - currently stuck in 3hr chop (in the cloud). When it escapes, look to first pink resistance above with green cloud support on right. We will see how 4hr and Daily react... Playing 90$ weekly calls. Good luck if you play!

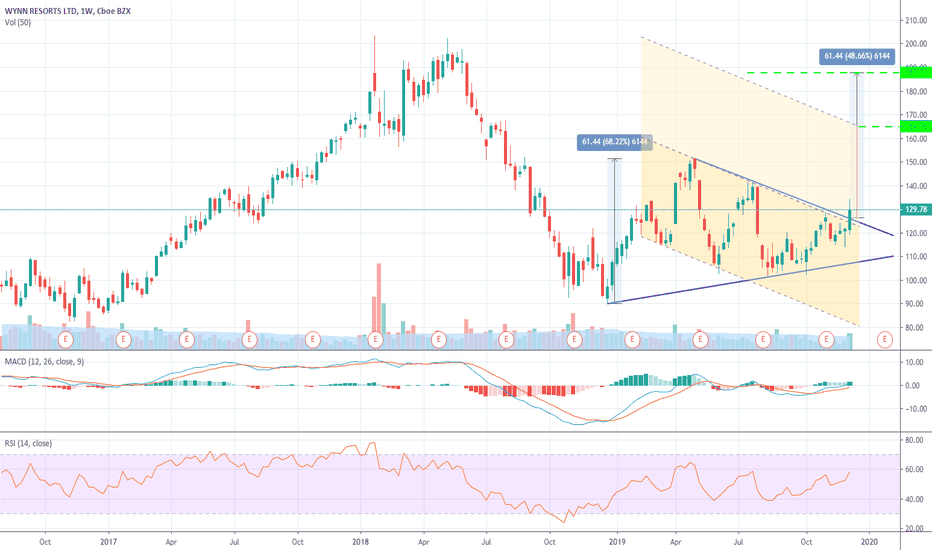

$WYNN weekly chart bullish breakout #stock #chart$WYNN stock price has bottomed in DEC'18 and then after the local top in APR'19 started to trade inside a symmetrical triangle and in the same time descend inside a parallel channel

Last week on the back of the US-China trade agreement and more important , on news that president Xi will visit Macau for 3 days and unveil a plan for further development and investment ( all is linked with the 20th anniversary of the return of Macau to China) stock price broke trough the descending line of both triangle and parallel channel and even more important CLOSE above both

MACD and RSI are both very supportive for further move upwards( RSI at only 58, keep in mind is a weekly chart, MACD just turning positive with histogram green for over a month)

Targets are :

T1 - lower top of the mirror parallel channel at around 165

T2 - calculated move from the breakout of the triangle at around 187.7

Good luck,

TA

all i do is WYNN baby!!!!!!!!!only champions are playing wynn right now.. this has 105 all over it.. buy now before u buy some else bags

no one is telling you to buy but me. because im a far superios intelligent being , yes even ur boss at goldman sachs or what ever bank ur currently emplyed

this takes out 86 non stop till 105